The Big Differences Between Medicare Plan F And Medicare Advantage Plans

Medicare Plan F is not a Medicare Advantage plan, which replaced your Medicare Part A and B benefits with private insurance. A Plan F supplement works alongside your Original Medicare. Many people ask Are Medicare Supplement Plans Worth It?, because they appear to cost more. The answer is most definitely, yes, they are worth every penny.

On the surface, Medicare Advantage plans look great. The monthly premiums are low and most plans offer additional benefits, including prescriptions, dental, vision, and more. But, the catch is that you pay more when you use services. In fact, the Kaiser Family Foundation conducted a study and found that most people with a Medicare Advantage plan pay more for a hospital inpatient stay, not less.

Also, unlike most Medigap plans, Medicare Advantage plans do not cover you when you travel. Youre covered for emergencies inside the United States and its territories, but you and not covered at all for foreign travel. With most Medigap plans, including Plan F, you are covered up to the limits of the policy.

Prescription drug coverage is not offered through Medicare Plan F but it is available as a stand-alone Medicare Part D plan. Basic prescription drug plans start at around $20 per month in most areas.

Blue Shield Plan F & G Extra Includes Vision & Hearing Coverage

VISION: 1 eye exam every 12 months Eyeglass frame every 24 months Single, bifocal, trifocal, Aphakic, lenticular monofocal, or multifocalContact lenses every 12 months Hard one pair. Soft up to a three- to six-month supply for each eye based on lenses selected.

HEARING Air Services: Hearing aid exam every 12 months. 2 hearing aids per 12 months.Vista Hearing Aids, models 610 or 810. Up to two hearing aids per 12 months.$499 for Vista 610 model and $799 for Vista 810 model.

Over the Counter Items from CVS items are available through the mail-order catalog, OTC Brochure

- Foreign Travel $50,000 benefit, plan pays 80% for emergency care only, you pay 20%.

- SilverSneakers Gym membership.

- Plan G Extra details:

$25 per month discount

ARE YOU NEW TO MEDICARE? If so, Blue Shield will discount your Medicare Supplement premium by $25 per month for the first 12 months you are on your Blue Shield Medicare Supplement Plan .

Most Popular Medicare Supplement Plans: F, G, N

- Plan F = 100% coverage.

- Plan G = $233 deductible, then 100% coverage.

- Plan N = $233 deductible, then $20 copay for outpatient visits.

- All three provide 100% coverage for Inpatient Hospital services.

PRODUCT OFFERINGS:

- Medicare Advantage

- Medicare Part D Rx Prescription Plans

- Dental

If you sign up for Easy$Pay you save $3 per month. This service automatically pays your monthly payment from your checking or savings account.

- Medicare Supplement Companies: AnthemHealth Net AetnaUnitedHealthcare

What Does Medicare Supplement Insurance Plan F Cover

Medicare Supplement Plan F covers costs that Medicare doesnt cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

Specifically, this includes costs for Medicare Part A and Part B like:

- Copayments

- Coinsurance

- Deductibles

In addition to the deductibles and copayments, Medicare Plan F also covers things like hospice care coinsurance, skilled nursing facility coinsurance, up to three pints of blood, and foreign travel emergency care.

Read Also: How Do I Cancel Medicare Part A

What Is The Average Cost Of Medicare Supplement Insurance Plan F

by Christian Worstell | Published December 16, 2020 | Reviewed by John Krahnert

Medicare Supplement Insurance Plan F offers the most benefits of any of the 10 standardized Medigap plans available in most states.

Some Medicare beneficiaries might assume that Plan F is also the most expensive, but an examination of the average cost of Medigap plans reveals otherwise.

Who Should Enroll In Medicare Plan F Or Why Should Someone Enroll In Plan F

If you would like to deal with as few out-of-pocket healthcare costs as possible while enrolled in Original Medicare, Plan F probably is the Medicare Supplement policy for you.

Plan F also may be the best MedSup policy for you if youre the kind of person who likes covering all the bases, so to speak. Combined with Medicare Parts A and B, MedSup Plan F offers all the coverage you could want or need as you age.

Read Also: How To Sign Up For Medicare Part B Online

Mutual Of Omaha Medicare Supplement Plan F Benefits And Coverage

Generally speaking, Mutual of Omaha Medigap Plan F pays for all of the Medicare Part A and Part B deductibles, coinsurance costs, and copayments. It covers:

- All of the Part A hospitalization deductibles for up to 425 days of hospitalization

- All of the Medicare Part A deductible for skilled nursing facility care up to 100 days

- All of the Medicare Part A coinsurance and copayments for hospice care

- All of the costs of the first 3 pints of blood per year

- All of the yearly Medicare Part B deductible

- All of the 20% Medicare Part B coinsurance costs for doctors office visits and routine medical care

- All of the Medicare Part B excess charges

- 80% of costs incurred for emergency medical health care required during a foreign travel emergency, up to $50,000

Thus, as long as a beneficiary pays the monthly Medicare Part B premium and the Mutual of Omaha Medigap Plan F monthly premium, there will be no out-of-pocket costs for medical expenses and care, which is why it is generally considered to be the best Medicare Supplement insurance plan available for people who enjoy the benefits of Original Medicare.

How Much Does Medicare Supplement Plan F Cost

If you are enrolled in Medigap Plan F, you are responsible for the following costs:

- Monthly premium. Each Medigap plan has its own monthly premium. This cost will vary depending on the plan you choose and company you purchase your plan through.

- Yearly deductible. While Medigap Plan F itself does not have a yearly deductible, both Medicare Part A and Part B do. However, unlike some of the other options offered, Medigap Plan F covers 100 percent of the Part A and Part B deductibles.

- Copayments and coinsurance. With Medigap Plan F, all your Part A and Part B copayments and coinsurance are completely covered, resulting in an almost $0 out-of-pocket costs for medical or hospital services.

You May Like: Does Humana Medicare Cover Incontinence Supplies

When Can I Enroll In Medicare Plan F

You can sign up for a Medicare Supplement plan at any time, as long as you are eligible. Although, the best time to sign up for Plan F is during your one-time Medigap Open Enrollment Period. If you apply outside of this window or do not have guaranteed issue rights, youll need to answer underwriting eligibility questions and wait for application approval.

Will Plan F Rates Go Up In 2022

Each year, Medigap plans are subject to rate increases. The pricing method used partially determines this, as well as your age when you enroll.

When choosing a plan, researching rate increase histories is beneficial. On average over the past five years, Plan F rate increases have been between 3% and 6%.

Ask your agent what the rate increase history is for the carriers with which you are considering enrollment. Youll want to research carrier reviews before making a choice.

Recommended Reading: What Is Medicare Premium Assistance

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

How Much Does A Medicare Supplement Plan Cost

Perhaps you are considering supplementing your Medicare Part A and Part B coverage with other insurance that can help you pay out-of-pocket Medicare costs. It may be a good idea to learn about Medicare Supplement plans and how much they cost.

Find affordable Medicare plans in your area

Medicare Supplement plans are designed to work alongside Part A and Part B and to help pay out-of-pocket costs, which may include deductibles, copayments, and coinsurance, for example. Medicare Supplement insurance coverage for these expenses varies by plan type.

If you enroll in a Medicare Supplement plan, you will typically pay the insurance company a monthly premium in exchange for coverage. How much a Medicare Supplement plan will cost may depend on factors such as:

- The plan you select

- The insurance company you choose to provide your Medicare Supplement plan

- The time period when you apply for a Medicare Supplement plan

Read Also: Does Medicare Pay For In Home Hospice Care

Whats Going On With Medicare Supplement Plan F

As of January 1, 2020, people newly eligible for Medicare wont be able to buy Medicare Supplement Plan F. As part of the Medicare Access and CHIP Re-authorization Act of 2015, you may not be able to buy a Medicare Supplement insurance plan that may cover the Part B deductible if you became eligible for Medicare January 1, 2020 or later. This includes Medicare Supplement Plan C, Medicare Supplement Plan F, and the Medicare Supplement High Deductible Plan F. The standard Medicare Part B annual deductible is $203 in 2021.

If you bought a Medicare Supplement Plan F before January 2020, you can generally keep your coverage. Existing Medicare Supplement Plan F policies cannot be cancelled by an insurance company unless you fail to pay your premiums, you gave false information on your application, or the insurance company goes bankrupt.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

How To Find Out Which Medicare Plan Is Best

The best way to find out which type of plan may be best for your situation is to work with an experienced broker like us who offers all of the plans with the top companies in your area.

We can offer unbiased advice and find the best plan to fit your needs. And it wont cost you any more to use our services prices are the same as buying directly from the insurance company.

If you have questions on any of the plans, then give us a Call at 783-5901 or Email us at Our service is 100% FREE and were happy to help you.

Also Check: Is Mutual Of Omaha A Good Medicare Supplement Company

Factors Affecting Medicare Supplement Plan Pricing

To fully understand how these factors may affect your Medicare Supplement plan cost, lets examine each factor separately.

The type of Medicare Supplement plan you choose can influence your cost for coverage.

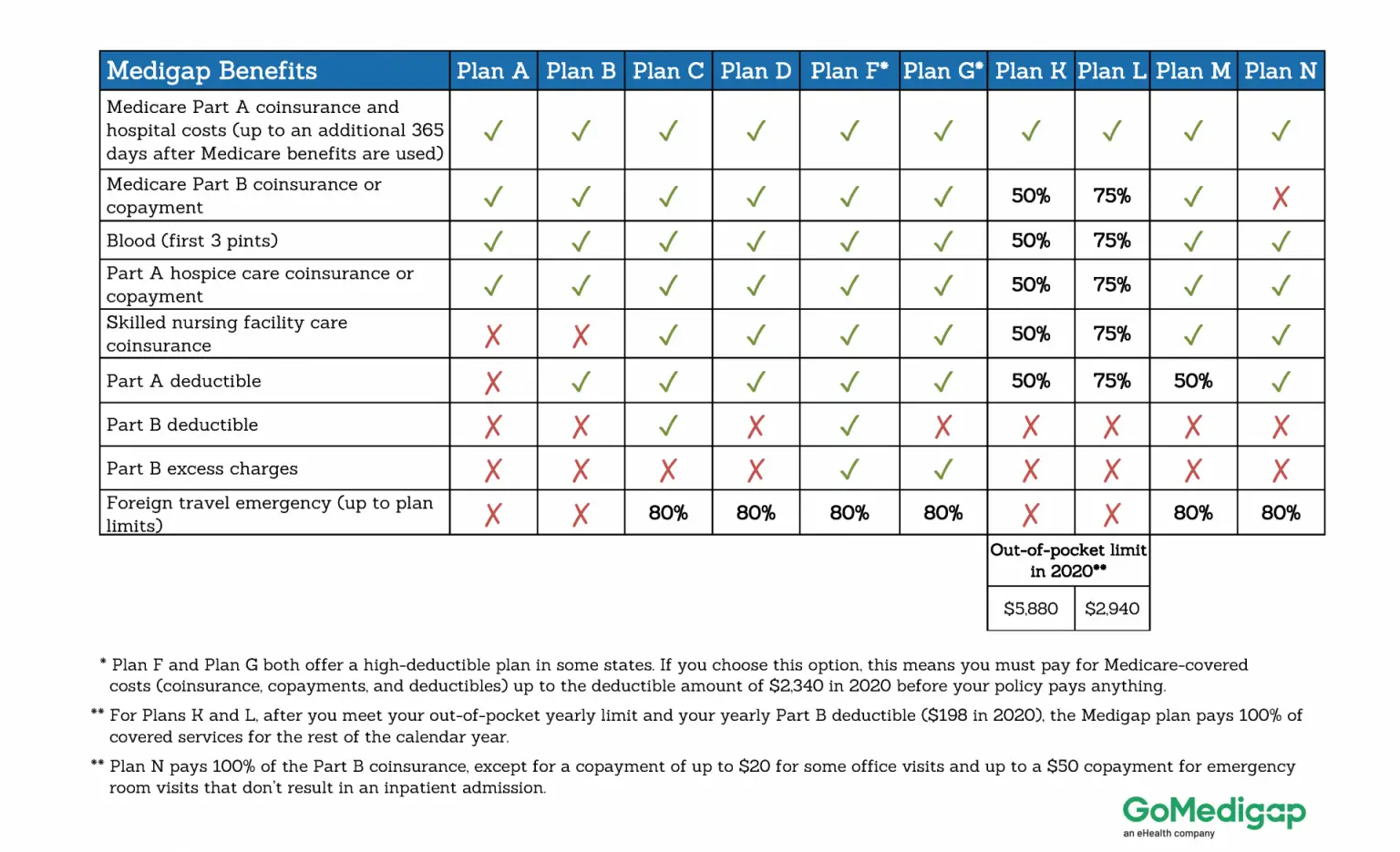

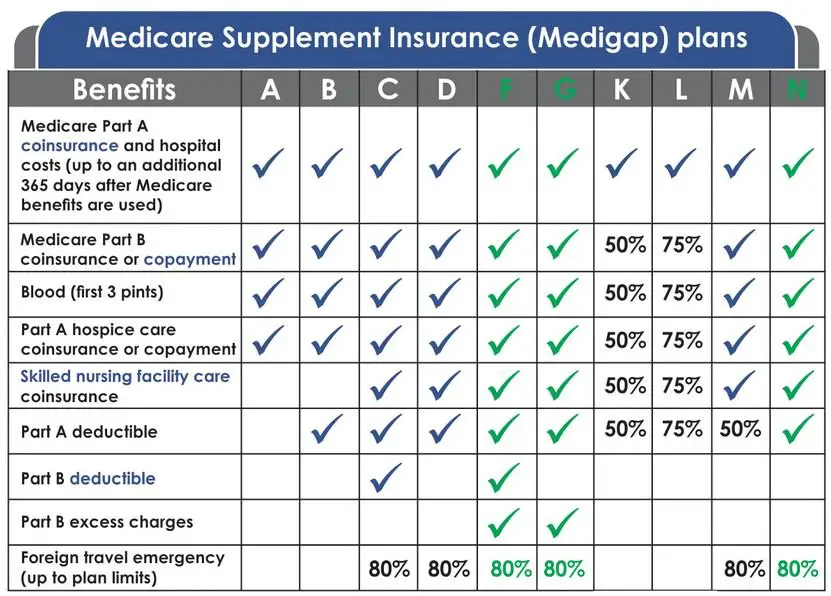

Unlike Medicare, which is sponsored by the federal government, Medicare Supplement plans are offered by private insurance companies. In 47 states, there are up to 10 standardized Medicare Supplement plans available. With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized Medicare Supplement plan types, Medicare Supplement benefit plans are labeled with alphabetic letters for easy reference.

All the standardized Medicare Supplement plans share some basic benefits. Aside from the first benefit listed below, not all plans cover these benefits at 100%. Basic benefits include:

- Medicare Part A coinsurance and coverage for hospital services

- Medicare Part B coinsurance or copayment

- Blood transfusions

- Hospice care coinsurance or copayment

Insurance companies offering Medicare Supplement plans set their own premiums. This means that if you want to apply for Medicare Supplement Plan L, for example, the monthly premium you will pay may vary significantly between one insurance company and another even though they are offering identical standard benefits . Premiums may vary among states as well.

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington D.C., and Wisconsin.

High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, and Wyoming.

Enrolling in Medicare Supplement Plan F is easy, and if you also need to plan for the prescription drug plan, it offers many that rate four stars or higher on the Medicare 5-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.

Also Check: What Is Uhc Medicare Advantage

What Are The Costs Associated With Plan F

Plan F costs will vary, depending on the county you live in and the insurance companies that sell Medicare Supplement insurance in your location.

For beneficiaries who dont mind paying for out-of-pocket costs up front, there is also a high deductible Plan F option. This is a variation on the standard Plan F that requires beneficiaries to pay all out-of-pocket expenses up to the deductible, which is $2,370 in 2021. After meeting the deductible, the plan begins to pay for Medicare-covered costs.

Keep in mind that the high-deductible Plan F option doesnt vary from the standard Plan F when it comes to basic benefits. Instead, the high-deductible Plan F may have lower premium costs than the standard Plan F this is offset by the fact that your out-of-pocket costs may be higher until youve reached the deductible.

Can I Enroll In Medicare Part F If Im Enrolled In Medicare Part C Or Medicare Advantage

If you have a Medicare Part C or Medicare Advantage plan, you cant have a MedSup plan, too.

If you have Original Medicare plus a MedSup plan and youd like to switch to a Medicare Advantage plan that offers the same or similar coverage, you can do that. Drop the MedSup plan before you do so, though, as it won’t pay out after you enroll in Medicare Advantage.

Recommended Reading: Does Medicare Pay For Custom Foot Orthotics

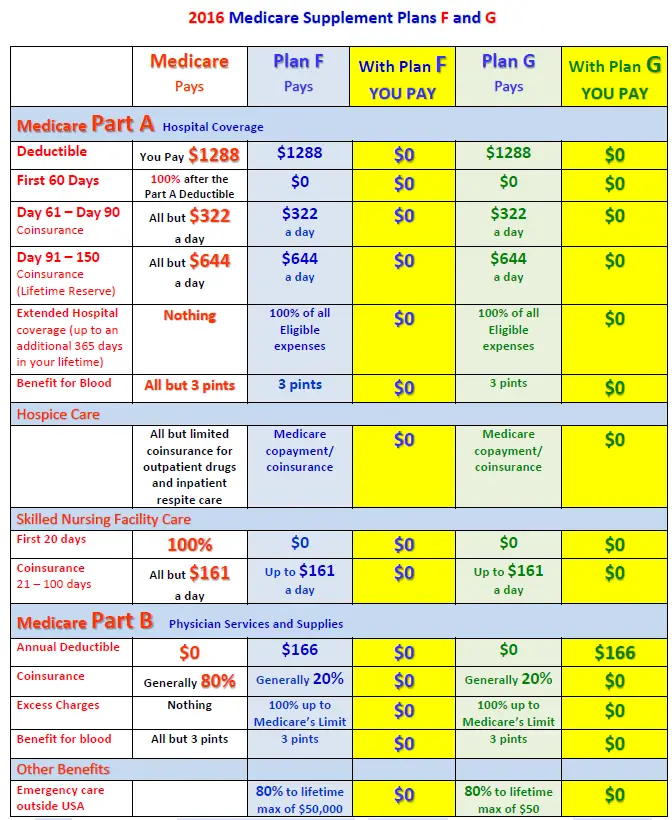

What Benefits Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, youll need to pay your Part B deductible , yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F. Even though it has similar coverage, Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible . Once you pay the Part B deductible, the coverage is the same for both plans.

So Is Plan F Worth The Price

For some, its easier to budget a set amount of cash per month for a Plan F premium and the peace-of-mind of having no other out-of-pocket healthcare expenses. The need to pay $183 before a Medigap plan takes over can create a strain on a tight budget.

However, the yearly savings of a Plan G over a Plan F may be enough to warrant paying the Part B deductible . Even so, a Plan G member will still come out ahead by the end of the year.

Also Check: Is Aetna Medicare Good Insurance

Get Help From A Medicare Specialist

Medigap plans are nuanced when it comes to pricing. For example, not everyone understands that there is only one Medigap Enrollment Period in your lifetime, not an annual one like other Medicare plans. Signing up late can cause your rates to go up based on preexisting conditions. Your local State Health Insurance Assistance Program or State Insurance Department can help you with issues like this. You can also ask your broker for details.

When Can I Enroll In A Medicare Supplement Plan F Plan

You should be able to buy a Part F plan whenever you want if youre enrolled in Medicare Part A and Part B in some form or fashion. Or you should be able to buy it whenever you want as long as:

- Youre not under the age of 65.

- You dont have Medicare coverage due to a disability or end-stage renal disease.

- You became eligible for Medicare before the start of 2020.

That said, the best time to buy MedSup Plan F or any other MedSup plan is during Medicare open enrollment.

If you wait until that after that period ends, you may have a harder time getting Plan F and you may have to pay more for it. Why? Because youll likely need to answer a number of questions about your medical history before an insurance company will sell you a plan. And your answers to those questions could cause an insurer to refuse MedSup coverage or to charge you an arm and a leg for it.

Also Check: How Can A Provider Check Medicare Eligibility