Other Financial Aid Options

If none of the above apply to your situationor if the assistance they provide simply isnt enoughdont give up hope just yet. In addition to the possibilities listed above, there are other resources available which can help you pay for a loved ones cremation and other end-of-life expenses.

- If your loved one is, or was, in hospice care, see if you can talk to a hospice social worker. They will likely be able to connect you with valuable resources that can help you get the financial support you need.

- Be sure to check your local coroners office to see if your family might qualify for burial assistance.

- Private financial aid programs can offer support as welljust take care to do thorough research before choosing one to ensure that their service is high-quality and trustworthy.

- Dont forget to check whether your loved one had a Payable on Death account or life insurance plan. Depending on how much they set aside, it may be enough to cover part or all of their funeral costs.

- You can also set up a memorial fund in your loved ones name through a bank or online crowdfunding platform to seek further assistance from friends and family members.

All of the above can play an integral role in keeping end-of-life costs manageable. However, theres one more thing you can do that will make a huge difference: choosing an affordable direct cremation service.

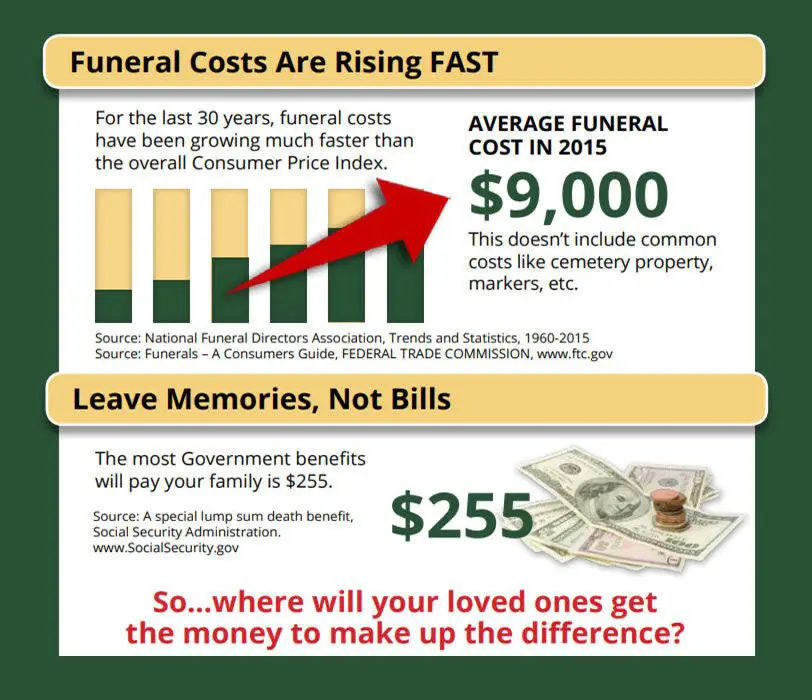

What Can Social Security Funeral Benefits Be Used For

Though the survivor funeral grant is earmarked for assistance with funeral costs, it arrives as a single payment of cash and may be spent on anything the assignee wishes. When the grant was first enacted, in 1935, the real value of $255 was close to $2,500 in 2020 dollars. This made it an adequate support for nearly all working Americans funeral expenses. After nearly nine decades of inflation, the Social Security Administration continues to pay out the original amount, without any adjustment, in what has become an anachronism that rarely covers the full cost of funeral expenses.

Fortunately, many states offer extra help with funeral and burial expenses. The state of Illinois, for example, pays a similar one-time benefit of up to $1,103 for the funeral of a low-income resident. Other states, and even some cities or counties have similar programs. In addition to these benefits, almost every state allows free donation of bodies to medical science. These donations are respectfully handled and studied for the advancement of science, after which they are cremated at no cost.

Will Medicare Help Cover Funeral Costs

Bottom line: No, Medicare doesnt cover funeral expenses.

Original Medicare covers hospital and medical expenses, but not funeral costs.

Likewise, a beneficiary who is enrolled in a Medicare Advantage plan, a Medicare Part D prescription drug plan or a Medicare Supplement plan will not receive funeral or bereavement coverage from their Medicare plan.

Recommended Reading: Does Medicare Cover While Traveling Abroad

Horse And Carriage Funeral

A horse and carriage funeral is arguably the most elegant type of funeral service possible. This style of funeral is a sophisticated and unforgettable event for everyone in attendance. With final expense insurance, this is not out of reach. You ought to be remembered the way you want to be remembered, and as one of your final decisions, you ought to have a funeral thats done just the way you want it. You may have had to compromise what you wanted throughout your life due to financial concerns, but that wont happen this time. For small premium costs, you can have a final expense policy that covers the service you want.

How You Can Make This Happen

These services are locally offered, so it is best to search for available companies providing this service in your area. From there, you can make arrangements, ranging from which horse you would like, to the type of carriage , and even decor options such as the drapes on the horses. Once you complete the application process, you are well on your way to a funeral service that no one will ever forget. The horse may travel from the church to the burial site, funeral home to church, or the funeral home to the burial site.

One factor to keep in mind is the cost. The rate is typically hourly, and additional charges may come into effect after surpassing a certain mileage.

People Who May Be Interested

Protect Your Personal Information From Marketers

Senior citizens often receive mail that asks for personal information in exchange for details about life insurance, funeral expense benefits, or supplemental Medicare benefits. Once seniors provide their information, they are sometimes flooded with mailed solicitations or hounded by sales calls.

The mailings will typically ask you to fill out a postage-paid card with your name and date of birth and promise to provide free information about the benefits available to you.

The organizations that send these mailings are not affiliated with the government. They sell your personal information to insurance companies that then use it to try to sell you life, burial, or supplemental Medicare insurance.

These companiescalled lead generatorssometimes send mailings that look like they may be from government agencies. They feature headings like New 2018 Government Benefit Update for Minnesota Citizens,IMPORTANT LETTER OF NOTIFICATION, or Medicare Open Enrollment Qualification Request Card.

One mailing pressures seniors to return the card to see if they qualify for a Final Expense Insurance Program that may pay 100 percent of final expenses or as much as $25,000.

Another mailing asks seniors to provide their personal information to see if they qualify for a NEW state- regulated life insurance program that would pay up to $50,000. The mailing also claims that those who return the card may receive a no-cost dental, vision, and hearing discount plan.

Read Also: Will Medicare Help Pay For Hearing Aids

Cost Breakdown Of Funeral Services

The average funeral cost breakdown varies by state, services rendered, and extras included. According to the 2021 NFDA Cremation & Burial Report, burial rates are projected to be around 36% and cremation, 58%, for the year. Based on historic rates and future projections, burial rates are expected to continue to decrease and cremation rates increase, with as much as 78% choosing cremation by 2040.

What You Should Know About A Veterans Funeral Beforehand

Just because someone served in the military doesnt make them an automatic candidate for a burial plot in a VA National Cemetery. More specifically, no VA benefits exist for someone who was dishonorably discharged not the place of burial nor the VA financial assistance. In short, if you were dishonorably discharged, you get nothing.

The Veterans Funeral options available to you

A major part of planning a veterans funeral is where it will take place. You can either opt for a private cemetery or, you could choose a burial site in one of the 135 VA National Cemeteries. If you choose to be buried in a National Cemetery, you may not get in the one of your choice. However, your preference is taken into consideration.

A burial in a VA National Cemetery offers unique services. One is the opening and closing of the grave. Its a common practice and it is required for underground burial as well as entombment for above ground. The veterans grave is always cared for from that moment forward. It will always be maintained and never deteriorate into an unkempt burial site.

The veteran may also get a free headstone marker. However, this could be an additional charge if the veteran is buried in a private cemetery.

Applying for burial in a VA National Cemetery

Assuming you meet the requirements of burial allowance, you can submit an application in which you provide the following:

Once you have done this, you can submit and then wait until your spot in a VA National Cemetery is confirmed.

Read Also: Does Medicare Pay For Dental Cleaning

Does Medicare Or Medicaid Cover Funeral Expenses

Although Medicare and Medicaid programs do not have provisions for funeral and burial expenses, there are other options to consider when preparing for these expenses.

- Setting up a trust. Dual-eligibles who wish to maintain their needs-based coverage may be required to hold their funeral or burial savings in a special trust. Some trusts may operate like a bank account, while others may have more complex rules governing their use. Certain funeral homes may only accept payments from specific types of trust funds.

- Purchasing a policy for burial insurance. Insurance plans that cover the cost of a funeral and burial may charge monthly premiums or require significant down payments and recurring payments throughout the year. The benefits may not count against needs-based eligibility rules.

- Social Security benefits. Upon a Social Security recipients death, a surviving spouse or child may receive a one-time lump sum payment that can be used to help offset the costs of the funeral and burial. The exact amount is established by the Social Security Administration.

The Differences Between Medicare and Medicaid

Those who qualify for both programs, also known as dual-eligibles, usually have any expenses not covered by Medicare paid for through Medicaids system. However, neither program covers funeral or burial expenses.

Savings Exemption from Asset Limits

Options for Funeral Expense Coverage

Related articles:

Irrevocable Funeral Trusts Impact On Medicaid Eligibility

Aside from care needs, Medicaid considers three areas related to the applicants finances:

- Monthly income

- Countable assets

- Asset transfers as far back as 60 months preceding their application date

Generally speaking, in 2019, the applicants monthly income cannot exceed $2,313. The value of their countable assets cannot exceed $2,000. . Applicants must not have made any asset transfers within the previous 60 months. . Applicants with income and / or assets over the limit mentioned above, or who have violated the look-back period, are typically denied Medicaid coverage. And families are left to pay the significant cost of nursing home or other care expenses out-of-pocket.

Purchasing an irrevocable funeral trust allows an applicant to pay in advance for an expensive item for which they or their family will have to pay for eventually. And by doing so, they reduce their countable assets and can qualify for Medicaid. An irrevocable funeral trust, because it is a trust and irrevocable, is not counted as an asset by Medicaid. Nor does its purchase violate the 60-month asset transfer rule , or in California, the 30-month asset transfer rule.

Not all funeral trusts are considered to be Medicaid exempt assets.

Note that a different trust exists to help individuals whose income exceeds the Medicaid limit. Read about Qualifying Income Trusts here. Some states also allow applicants to qualify through a medically needy pathway.

Read Also: How Can I Find Out If I Have Medicare

Am I Eligible For A Medical Savings Account

The eligibility criteria for a Medicare Medical Savings Account includes:

- Youre eligible for Medicare

- You do not have End-Stage Renal Disease

- You do not have other health insurance

If you are currently enrolled in Original Medicare, you may have to wait until the Medicare Annual Election Period to sign up for a Medicare Medical Savings account .

The Medicare AEP lasts from every year.

Learn more about Medicare MSA plans and the Medicare Advantage plans that are available near you by speaking with a licensed insurance agent.

Does The Va Cover Burial Costs

The Department of Veterans Affairs is a U.S. Government agency that handles programs benefiting veterans and their family members.

It offers education opportunities, rehabilitation services, home loan guarantees, pensions, and health care (including nursing homes, clinics, and medical centers.

Thankfully, there is good news on this front:

The VA provides a generous burial allowance to those elgible, covering burial, funeral, and transportation costs!

The eligibility criteria are detailed, so instead of describing them here, well refer you to the official Veterans Burial Allowance page.

Also Check: Is Trump Trying To Get Rid Of Medicare

Does Medicare Cover Funeral Expenses In 2021

By Rikin Shah | Licensed Life & Health Insurance Agent

If youre here, you probably know that a funeral isnt cheap these days.

According to the National Funeral Directors Association, once you add up all funeral service expenses and burial costs, you will have to shell out between $5,000 and $15,000.

As much as we might want to provide the best final arrangements for our loved ones, the reality is that many people have to make compromises given how unaffordable a traditional funeral is these days.

For such a basic need as easing the death of loved ones, it makes sense to ask whether the government, specifically the federal Medicare program, might offer some help.

Does Medicare Cover Final Expenses

Medicare itself will not cover any final or funeral costs. Medicare is a federal healthcare program that provides coverage for inpatient and outpatient costs only while you are living. However, you may choose while enrolled in Medicare to participate in a Medical Savings Account. With this program, you choose a plan that deposits funds into a special account that you can use only toward qualifying medical expenses. This can save you on out-of-pocket costs. If you die with funds in your account, these funds will be released to your designated beneficiary if your designated beneficiary is someone other than your spouse. In this case, those taxable funds may then be used toward any funeral expenses. If your spouse is your beneficiary, it will become their MSA upon your death.

Don’t Miss: How Do You Qualify For Medicare In Texas

Check Your Existing Insurance Coverage

Lead generators try to scare you into thinking that you may not have enough money to pay your final expenses or that Medicare wont pay your medical bills. A lot of people already have life or supplemental Medicare insurance policies. You can review the coverage you already have through Medicare by calling MEDICARE 633-4227) or visiting the Medicare website at www.mymedicare.gov.

Know Your Funeral Rights Before You Begin

As we age, its perfectly natural to begin thinking about final arrangements. One important part of making final arrangements is making sure you understand and have made preparations for your funeral costs.

Before you begin, its important to know you have specific rights when it comes to funerals. The Federal Trade Commission first introduced the Funeral Rule in 1984 to prevent funeral homes from pressuring people into buying goods and services they didnt need or want. It was also intended to help protect consumers from being overcharged for the items they did want.

The Funeral Rule gives you the right to:

- Buy only goods and services you want.

- Be offered pricing information by phone.

- Be provided with an itemized statement of all goods and services.

- See a list of casket prices.

- Be offered a price list for outer burial containers.

- Be provided with a written statement prior to making any payments.

- Select an alternative container for cremation.

- Provide your own casket or urn.

Also Check: Is Eye Care Covered Under Medicare

State & Local Resources

Some states offer assistance programs for families who do not have the means to pay for funeral expenses for a loved one. When available, benefit amounts vary and are typically reserved for individuals without the means to pay for a loved ones funeral. In almost all cases, both state and local funds available to help with funeral costs are given at the local level. In all cases, you must apply and be approved for benefits.

Medicaid Funeral And Death Benefits

Medicaid is a government insurance program. It provides medical coverage for people of all ages who do not have enough resources to pay for health care. Qualifying for Medicaid does not guarantee that the federal government will cover any of your funeral expenses.

Medicaid resources are administered by the states. Since state government programs tend to vary when the leadership changes, its difficult to have a complete list of states that offer funeral assistance. To find out the support you may be eligible to receive, search your states name + Medicaid funeral expense.

Even if there are no state-wide programs to help pay for your loved ones funeral, there may be resources at the county or municipal level.

You may also receive assistance from other charitable organizations or local religious groups.

Keep reading to learn about some of the benefits you may be eligible to receive to assist you in paying for a funeral. Also, discover your best resource for finding programs to help with your financial obligations.

You May Like: Does Medicare Cover Nursing Home Care

Who Can Apply For Funeral And Burial Payment Assistance

If a person lived in Massachusetts at the time of their death and there are not enough resources to pay for the funeral and burial costs, you can apply for payment assistance. You might be able to get help paying for up to $1,100 of the cost. There are rules that apply, which you can learn about on this page.

Does Life Insurance Cover Funeral Costs

Any life insurance policy can be used to help cover funeral costs . Life insurance is one of the most efficient and trusted ways to cover the cost of final expenses. In particular, final expense insurance is specifically designed to help cover any end-of-life expenses such as medical bills or burial costs.

Commonly referred to as burial insurance or funeral insurance, final expense insurance is especially popular with seniors because of its focus on protecting surviving loved ones from experiencing a financial burden when they pass .

When it comes to final expense insurance, theres no one-size-fits-all policy. Each family is unique and has different concerns for their loved ones. As the leader in final expense life insurance, no one understands this more than Lincoln Heritage Life Insurance Company®. For over 55 years, weve helped protect policyholder families from paying high prices as average funeral costs and other expenses have continued to rise.

Funeral Advantage gives families the cash insurance benefit they need within 24 hours of claim approval and assists with price shopping funeral costs. Funeral Advantage is designed to protect your loved ones from emotional overspending by helping them understand the pricing options available to them. We helped save policyholder families thousands of dollars last year alone.

Recommended Reading: Does Medicare Cover Inspire Sleep Apnea Treatment