How To Apply For Medicare

The good news is if youre already receiving benefits from Social Security or the Railroad Retirement Board, you dont have to apply for Medicare. Youll automatically be signed up for Medicare parts A and B as you near your 65th birthday.

If youre not automatically enrolled, youll need to apply for original Medicare and any additional coverage you want.

When Can You Add A Medicare Supplement Plan

You can sign up for a plan during your open enrollment period. This period lasts six months and begins the first day of the month in which you are 65 or older* and enrolled in Original Medicare Part B. You must also be signed up for Original Medicare Part A. During this open enrollment period, carriers cannot ask about medical conditions*. If you apply outside the open enrollment period, insurance companies can ask about health conditions* and acceptance is not guaranteed.

*Note: Not all states allow health underwriting and some states offer plan to those under age 65 who are eligible for Medicare due to reasons other than age.

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Don’t Miss: What Is Better Original Medicare Or Medicare Advantage

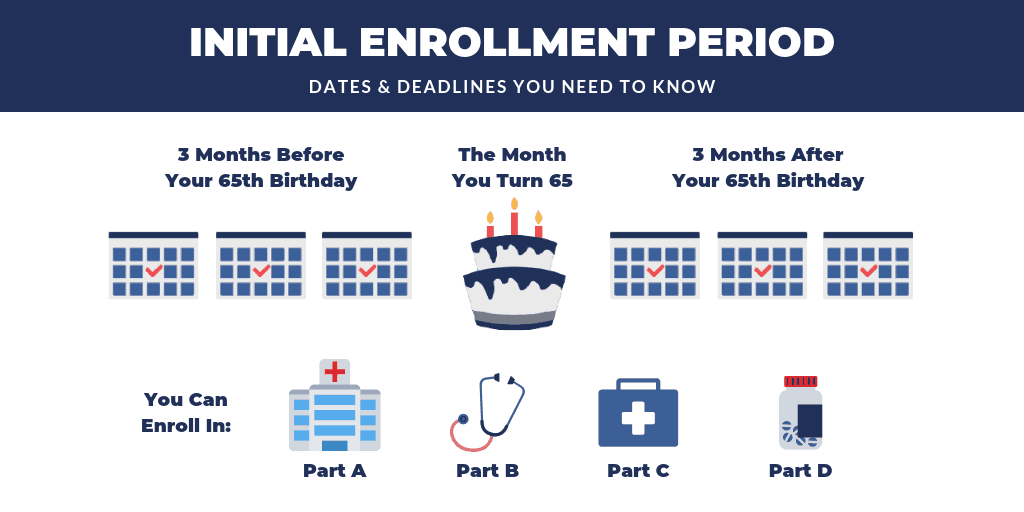

During Your Initial Enrollment Period

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.

Do You Have To Sign Up For Medicare

Many people look forward to the day when they finally can sign up for Medicare. But not everyone feels that way.

A Money Talks News reader named Reuben sent me this question:

Stacy, is every American at age 65 required to sign up for Medicare? Please advise.

This is an important question for anyone approaching 65. And in truth, it breaks down into two smaller questions:

Don’t Miss: When Do My Medicare Benefits Start

Turning 65 What You Need To Know About Signing Up For Medicare

The first of the 78 million baby boomers turned 65 on January 1, 2011, and some 10,000 boomers a day will reportedly reach that milestone between now and 2030. If you are about to turn 65, then it is time to think about Medicare. You become eligible for Medicare at age 65, and delaying your enrollment can result in penalties, so it is important to act right away.

There are a number of different options to consider when signing up for Medicare. Medicare consists of four major programs: Part A covers hospital stays, Part B covers physician fees, Part C permits Medicare beneficiaries to receive their medical care from among a number of delivery options, and Part D covers prescription medications. In addition, Medigap policies offer additional coverage to individuals enrolled in Parts A and B.

Local Elder Law Attorneys in Your City

City, State

Medicare enrollment begins three months before your 65th birthday and continues for 7 months. If you are currently receiving Social Security benefits, you don’t need to do anything. You will be automatically enrolled in Medicare Parts A and B effective the month you turn 65. If you do not receive Social Security benefits, then you will need to sign up for Medicare by calling the Social Security Administration at 800-772-1213 or online at . It is best to do it as early as possible so your coverage begins as soon as you turn 65.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: Does Medicare Cover Depends For Incontinence

Example : Your Employer Is Contributing To Your Group Health Insurance Plan

If you donât have to pay for your group health insurance premium, most of the time you will be better off staying where you are until you retire and come off the group.

Some other factors you might consider would be how high your deductible is, your coinsurance percentage, and your copays. You might also consider your health. If youâre really healthy and only go to the doctor for an annual or semi-annual exam, youâre not particularly concerned with a higher deductible.

However, if you have a major illness or have had a history of being in and out of the hospital, a higher deductible can be a bit overwhelming, and you may decide to switch to Medicare for its very low deductible.

Note: Medicare on its own only covers about 80% of your Medicare-approved expenses. We always recommend adding a Medicare Supplement, which covers the remaining 20%.

If You Missed Enrolling Your Initial Or General Enrollment Period

If a group health plan covers you through your or your spouses employer or union, you can sign up for Medicare Part A or Part B anytime.

If your employment or group health plan ends, you have an eight-month Special Enrollment Period to sign up for Part A and Part B without facing a late enrollment penalty. Keep in mind that retiree health plans and COBRA dont qualify you for a Special Enrollment Period when that coverage ends.

Read Also: How To Reorder Medicare Card

Penalty Fees For Late Enrollment

Medicare charges penalty fees for those who do not enroll in their Initial Enrollment Period, or they do not qualify for an exception due to employer insurance or other coverage.

Unless a person qualifies for a special exception, they will pay a monthly premium that is 10% higher for every 12-month period they were eligible for Medicare but did not sign up.

A person can qualify for a Medicare plan before 65 years of age if they meet certain criteria:

- They have end stage renal disease and need dialysis or are on the kidney transplant list.

- They have amyotrophic lateral sclerosis .

- Their doctor confirms that they have a disability.

An estimated 6.2 million people qualify for Medicare because they are disabled, according to the Medicaid and CHIP Payment and Access Commission. However, significantly fewer people use these benefits.

A doctor may declare a disability for people due to several types of medical conditions, including:

- Intellectual or developmental disabilities: These might include Down syndrome, cerebral palsy, or autism.

- Physical conditions: Traumatic brain injury, severe back injuries, or quadriplegia qualify as disabilities.

- Severe behavioral or psychological disorders: People with bipolar disorder or schizophrenia can qualify for Medicare early.

A doctor must submit paperwork to Medicare, declaring that a person has a disability. The individual may have a waiting period before they qualify for full Medicare benefits.

Consider Whether You Need Medicare Supplement Insurance

You might already know that Medicare doesnt pay 100% of approved charges. For example, Medicare Part B coverage pays 80% of covered medical costs after you meet the annual deductible. That means youre responsible for the remaining 20% and for paying your deductible.

Thats why many people who choose Original Medicare also buy Medicare Supplement Insurance, often called a Medigap policy, to help pay for some or all of these gaps in benefits. Private insurance companies sell these policies. They help pay for other costs, including coinsurance and copays.

You May Like: How Much Is A Colonoscopy With Medicare

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you can’t reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So it’s understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, it’s important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason you’re delaying is that you are still working and you’re covered by the employer’s health plan. If that’s the case, you’ll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

What Happens If You Dont Sign Up

Under Medicare rules, its the day you actually leave active employment, not the day your COBRA or retiree benefits end, that matters. After you leave your job, you have an eight-month special enrollment period to and a Medigap plan, if you choose one. Miss it, and you could be without coverage for many months.

Suppose you quit work in September and you dont sign up for Medicare. In April, your retiree or COBRA plan realizes youre eligible for Medicare and stops paying claims.

Youve missed your special enrollment period, so you wont be able to enroll in Medicare until the next General Enrollment Period that runs from January 1st to March 31st. Your coverage wont begin until the following July, leaving you without health insurance for many months.

In addition, you will likely pay Medicare late enrollment penalties with your Part B and Part D premiums.

Recommended Reading: Do I Need To Sign Up For Medicare Part B

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Youre Still Employed And Pass On Part B

If youre happy with the coverage your employer offers, you may think you dont need to enroll in Medicare. But individuals who work for a small employer should enroll in Part B because that will be their primary insurance coverage.

Employees of large companies do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

*The threshold for being considered a large employer is 100 employees when an individual qualifies for Medicare based on a disability.

Don’t Miss: Can You Get Medicare If You Work Full Time

When Do I Get My Medicare Card

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application. However, waiting times can be up to 90 days. If you are automatically enrolled in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

If the employer does require you to enroll in Medicare, then Medicare automatically becomes primary and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan only pays for services that it covers but Medicare doesnt. Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage.

Its therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability. If so, find out exactly how the employer plan will fit in with Medicare. If not, ask for that decision in writing.

Note that in this situation, signing up for Medicare Part B when you also have employer insurance will not jeopardize your chances of buying Medigap supplemental insurance after the employment ends. When Medicare is primary to the employer plan, you have the right to buy Medigap with full federal protections if you do so within 63 days of the employer coverage ending.

Read Also: Does Medicare Supplement Cover Drugs

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

What Happens If I Miss My Iep

If you dont enroll in Medicare when youre first eligible, you can still sign up later, but you may end up paying a late penalty for Medicare Part B and/or D. Here are your other enrollment options:

- There is a Medicare General Enrollment Period , from Jan. 1 March 31 every year.

- There is a Special Enrollment Period, but there are restrictions and you must qualify to be eligible.

For more specific insights, check out our article about all Medicare enrollment periods.

Also Check: How Much Does Medicare Cover For Hip Replacement

Enrollment Windows Are Limited

If you’re thinking about delaying your enrollment in Medicare, keep in mind that there are enrollment windows that apply. After your initial enrollment window ends, you can only sign up for Medicare Part A and B during the general annual enrollment period from January 1March 31, with coverage effective July 1.

And you can sign up for Part D during the annual enrollment period from October 15December 7, with coverage effective January 1 of the coming year.

So if you delay your enrollment, you could be paying higher premiums when you eventually do enroll, and you’ll have to wait until an open enrollment period in order to have access to coverage. If you’re only enrolled in Part A, for example, and you get diagnosed with a serious illness in April, you’ll have to wait until the following January to have Part D coverage, and until the following Julymore than a year in the futureto have Part B coverage.

Keep all of this in mind when you’re deciding whether to enroll in the parts of Medicare that have premiums.