Coverage For Cardiac Catheterization

Medicare also covers minimally invasive heart disease treatments that may be a viable alternative to open heart surgery. These laparoscopic surgeries use small incisions and with the surgeon using tubes and small instruments to repair the blockages.

These procedures are collectively called cardiac catheterization because they involve catheters inserted into the affected heart arteries.

Cardiac Catheterization Alternatives to Open Heart Surgery

- Angioplasty

- Balloon angioplasty uses a catheter to place a medical balloon into the blocked artery. The balloon is inflated, it opens the narrowed artery and improves blood flow. This procedure does not always result in long-term improvement.

- Stents

- Similar to an angioplasty, a metal stent is inserted into the blocked artery. It is expanded, opening the blockage and holding the artery open for years or decades. This procedure can cause blood clots, which are often treated with prescription blood thinners.

Typically, cardiac catheterization is covered by Medicare Part B medical insurance. You are responsible for your Part B deductible. After that, Medicare pays 80 percent, and you pay 20 percent of the costs.

Medicare Part A hospital insurance covers the procedure if youre admitted to a hospital and remain an inpatient through at least two midnights in a row during which the procedure is performed.

Committee Findings And Conclusions

The committee utilized the extensive review of literature provided by the panel of background paper authors, four experts in dental research. The committee also benefited from a two-day public workshop featuring many guest speakers and attended by members of the public with expertise in dental research and hospital-based dental practice . Unfortunately, little systematic research is available to assess the prevention and management of the oral-medical problems examined in this chapter. Standards of practice for these problems have been developed, often on the basis of plausible biological reasoning but without much evidence from well-controlled clinical trials. The committeeâs findings, as discussed in this chapter, are summarized briefly below. Its conclusions about Medicare coverage follow.

Using Your Dental Insurance Couldnt Be Easier:

Choose a licensed dentist practicing in North Carolina

Make an appointment

Show your Blue Cross NC member ID card at the dentistâs office

Though most dentist offices will file a claim for you, if they donât offer that service, you will need to file the claim.

How do I file a dental claim?

Participating providers will file the claim on your behalf. If your dentist office does not file claims, you should pay the dentist in full and submit your claim to Blue Cross NC for reimbursement. Complete a dental claim form and mail it to us within 180 days from the date of your service.

Mail the completed claim form to:

Blue Cross and Blue Shield of North CarolinaDental Claims Unit

Will I get credit for my prior dental coverage?

Yes, Blue Cross NC may waive or reduce any applicable dental waiting period by the number of month of prior dental coverage. Proof of prior dental coverage with less than 63 days lapse in coverage is required.

Dental Blue for Individuals is not part of the covered health insurance benefits of any Blue Cross NC plans. Dental Blue for Individuals must be purchased separately.

You May Like: What Medicare Supplement Plans Cover Hearing Aids

Supplementary Health Care Benefits

Supplementary benefits are different from medical benefits. These services are provided by health care practitioners other than physicians or midwives. Learn about the range of supplementary health care benefits covered under MSP for eligible individuals. Read more to find out if you are eligible for assistance with the cost of these benefits.

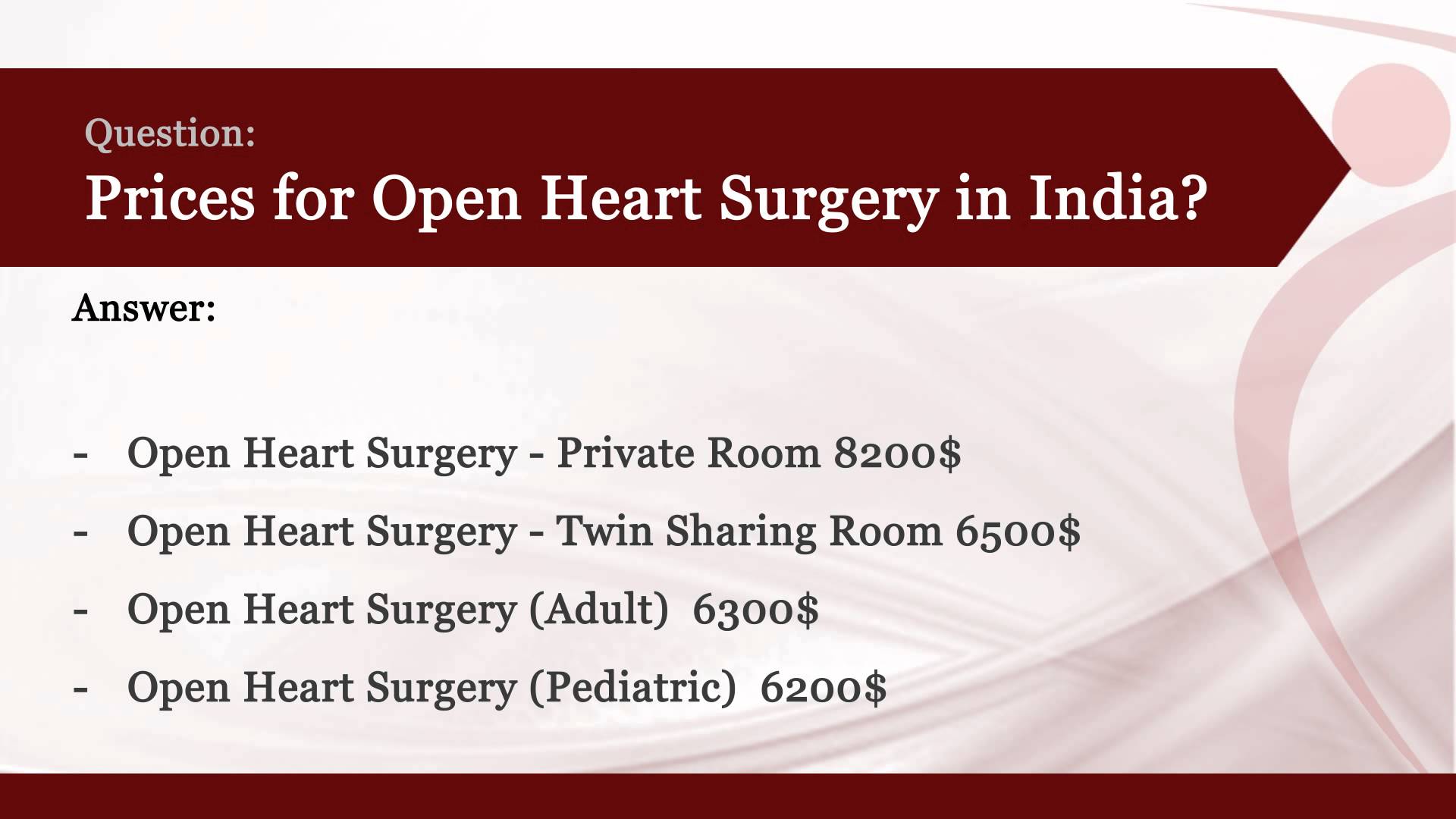

How To Pay For Surgery Costs

There are numerous creative ways to cover the costs of surgery.

Borrowing from Retirement Savings Its not what were taught, but know that your 401k or 403b retirement plans could allow you to take a loan against the funds you already have saved without a penalty. Most plans will allow you to withdraw 50% of your vested balance for healthcare expenses.

Payment Plans They are commonly offered when surgery is routinely paid for by the patient instead of an insurance company. Sometimes, its a formal agreement for monthly payments. It could be a loan that involves the hospital or surgeon in the financial arrangements. Especially in the case of an unplanned or emergency surgery, hospitals are usually happy to establish a payment plan with willing patients. Monthly payments are more attractive than NO payments. And they should keep the debt from appearing on your credit report as a negative account.

Medical Crowdfunding This has become a routine process in recent years such as a GoFundMe that is powered by donors and its particularly effective for medical needs. You can start a campaign or one can be started for you.

Using The Nest Egg Spending your life savings on surgery is definitely not ideal. But if the surgery improves your quality of life, it could be money well spent.

Shop Around Hospitals and doctors charge different rates. If youre not tied down to a network, it pays to comparison shop, just like you would do at a store.

10 Minute Read

Recommended Reading: Does Social Security Disability Qualify You For Medicare

The Technology Used During Surgery

Traditional cataract surgery involves making a very small incision on the cornea to remove the cataract. A laser then breaks up the cataract so it can be suctioned out and removed.

Laser cataract surgery, which is typically more expensive, uses a laser to create the initial incision instead, reducing certain risks and improving the visual outcome of cataract surgery.

Beware Of Patient Convenience Items

My surgery date was November 6, 2017. I thought this adventure was totally in the past when, surprise! On June 29, 2018 I received a bill for an unpaid balance of $123.50 for Patient Convenience Items. Internet research tells me that these are services like comb, toothbrush, toothpaste, shampoo, slippers and such amenities.

I called the hospital Customer Service number and after a very long wait got to talk with a representative. She informed me that the Royal Oak hospital had automatically billed me $3.75 per day for phone and $5.75 per day for TV. As it happens, I used my cell phone for all outside phone calls and I didnt watch TV . When I explained all that, I was overjoyed at the result: the rep entered an allowance that canceled the charges!

OK, I could have afforded this charge, which was minuscule compared with the total bill. However, since I didnt use the services, I didnt feel guilty about escaping this cost.

I asked what I should do when I enter the hospital again. She suggested telling them up front if I dont want these services and having them make a note in my records. That way, if I receive a bill 7 months later, Im in a better position to request that the charges be reversed.

Read Also: Why Is My First Medicare Bill So High

What If You Dont Have Insurance

The best advice, of course, is to get insurance if you dont have it. Thats easier said than done, though, particularly if youve had a heart attack and the doctor says that you need immediate cardiac surgery. Its unlikely that youll be able to enroll in a health care plan while youre being wheeled from the ER into the operating room.

However, if you suffer from recurring chest pain or have been diagnosed with coronary artery disease and you dont have health insurance its still possible to sign up for coverage before you potentially need surgery. The Affordable Care Act guarantees that you cant be turned down because of an existing condition. So patients with heart disease are now able to buy insurance coverage before their disease progresses to the point when they need a coronary artery bypass graft or other expensive procedure.

If you have to have surgery without insurance, many hospitals give patients who pay in cash a 30-35 percent discount. But even with a 35 percent discount, you could still end up being responsible for $80,000 or more in medical bills.

In order to reduce the cost of surgery, make sure to shop around. Fees will differ between facilities, surgeons, anesthesiologists, and pharmacies, even if theyre within the same region. Be sure to ask for a complete cost breakdown for your procedure or medications before choosing which providers youll use.

Medicare And Heart Surgery

Although it is a common procedure used to treat coronary heart disease, angioplasty has its limitations. The procedure is ideal when few blood vessels are affected, but in the case of more extensive disease, a more invasive approach may provide better long-term results.

In this case, you might be considered as a candidate for coronary artery bypass surgery , more commonly known as open heart surgery.

Every year the Centers for Medicare and Medicaid Services releases a list of surgical procedures that, regardless of the number of days you are hospitalized, will be automatically approved for inpatient care. In this case, Part A covers your procedure irrespective of the 2-Midnight Rule. CABG is covered on the inpatient-only list.

Many surgeries are not on the inpatient only list and are categorized as outpatient procedures, even if you stay in the hospital overnight or longer. In those cases, Part B will be billed. As an example, many pacemaker placement surgeries are considered outpatient procedures.

Being admitted as an inpatient is important not only because it keeps your out of pocket costs down but because it determines whether Medicare will pay for your care in a rehabilitation facility after you leave the hospital.

You need to be admitted as an inpatient for three consecutive days if you want Part A to pick up the costs for your stay in a rehabilitation facility.

Read Also: What Is Centers For Medicare And Medicaid Services

Does Medicare Advantage Cover Cardiovascular Disease

Advantage plans must cover at least as good as Medicare. Yet, restrictions like doctor networks come along with this plan type.

But, many Advantage plans include extra benefits. For example, an Advantage plan could consist of a gym membership.

These plans must cover Cardiovascular screenings 100%, the same as Medicare. But, youll have a bill for diagnostic care and treatments.

Each company and plan is different depending on your location. Plus, the plans change each year during the Annual Enrollment Period.

But, if you dont qualify or the cost is too high, there may be a Medicare Advantage Special Needs Plan for Chronic Heart Conditions. Some locations dont have this option, but if your area does, its worth considering.

Minimally Invasive Heart Procedure For Aortic Stenosis Delivers Cost Savings Over Time

A common perception that minimally invasive surgery to repair aortic stenosis is more expensive for hospitals than open heart surgery may be painting an incomplete and inaccurate picture, says a recently released Canadian research paper.

The study, Breaking Down the Silos: Transcatheter Aortic Valve Implant Versus Open Heart Surgery, conducted a budget impact analysis of therapeutic alternatives for the treatment of high-risk severe symptomatic aortic stenosis patients comparing minimally invasive Transcatheter Aortic Valve Implant to Surgical Aortic Valve Replacement .

It found the overall cost of a hospital treating an aortic stenosis patient over the course of a fiscal year is marginally less when they receive TAVI because patients are generally required to spend less time in hospital and experience fewer adverse events like life-threatening bleeding, atrial fibrillation, stroke and cardiac arrest with the minimally invasive procedure than when they undergo open heart surgery.

My findings indicate that TAVI is more expensive up front for the procedure itself, but it becomes slightly less expensive than open heart surgery when you consider the patients healthcare a year out, says study author Hamid Sadri, Director of Health Outcomes, Research and Technology at Medtronic. Hospitals may benefit more if they look at the cost of therapy over one year rather than the common practice of going procedure by procedure.

You May Like: What Causes Left Sided Heart Failure

Recommended Reading: Is Sonobello Covered By Medicare

What Is The Cost Of Having Wisdom Teeth Removed

For many people, the root of the issue of wisdom tooth removal can come down to money. According to Costhelper.com, a simple wisdom tooth extraction using local anesthetic costs $75 to $200, or $300 to $800 for all four. By comparison, removing an impacted tooth, a more involved procedure, can cost $225 to $600.

Surgical Procedures Not Covered Under Medicare

A surgery must be considered medically necessary to qualify for Medicare coverage. Investigational procedures arent covered.

Medicare generally wont cover cosmetic surgery either, but there are a few exceptions.

Medicare may cover cosmetic surgery if it repairs an accidental injury or improves the function of a malformed body part.

Cosmetic Procedures Covered by Medicare

- Surgery to treat severe burns

- Surgery to repair the face after a serious car accident

- Therapeutic surgery that coincidentally serves a cosmetic purpose

For example, rhinoplasty to correct a malformed nasal passage and chronic breathing issues can simultaneously improve the appearance of your nose. Or a procedure that removes excessive eye skin to improve vision may also make your eyelids appear less droopy.

Its important to note that Medicare covers breast reconstruction procedures following a mastectomy or lumpectomy, as it doesnt consider these procedures to be cosmetic surgeries.

Don’t Miss: When Does Medicare Part D Start

What The Total Doesnt Include:

- Insurance premiums. This is the monthly fee you have to pay just to keep your insurance active. You may also be responsible for your annual deductible and will have to pay any applicable co-payments until you reach your out-of-pocket maximum. Those charges are on top of your monthly insurance premiums.

- Physical therapy after the operation. After bypass surgery, most patients need physical therapy to learn how to move properly without harming the incision. They also must learn exercises that will assist in recovery. Physical therapy can cost between $50 and $350 an hour and might not be covered by insurance.

- Additional medications you might need. These could include blood-thinning medication to prevent blood clots , beta-blocker medication to slow your heart rate , statins to lower your cholesterol , and an ACE inhibitor to control your blood pressure and prevent heart failure .

- Lost wages.

- Additional miscellaneous expenses like caregiving, travel and anything else you might have to pay as a result of having bypass surgery.

How To Get Medicare Coverage For Prostate Specific Antigen Testing

By testing for prostate cancer early on, you can better your chances of treating the disease. Remember that early detection is fundamental. Our team of Medicare experts can help answer your coverage questions about PSA tests. You never want to overpay for a plan thats not a perfect fit for you. Let us help compare policies and prices for you. Its as easy as calling the number above or filling out an online rate form.

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Also Check: Is Medicare Enrollment Required At Age 65

Does Medicare Cover Heart Monitoring And Testing

Medicare will cover critical testing. Part B will cover a Cardiovascular blood screen test every five years. The blood screen will include cholesterol, lipids, and triglyceride levels.

If your doctor accepts Medicare, you wont pay for this screen. Sometimes, your doctor wants more screens than Medicare will cover. When Medicare doesnt cover a test, youll pay the bill.

How To Estimate Your Surgery Cost With Medicare

Talking to your doctor and health care team about costs prior to surgery is a good way to avoid surprise billing.

Make sure to ask your doctor, surgeon or other health care provider what kind of care or services you may need after your procedure along with a cost estimate.

Questions to Ask Your Doctor Prior to Surgery

- Is this procedure covered by Medicare?

- Which hospitals or ambulatory surgical centers do you work with when you perform this type of procedure?

- Which facility is the best place for me to get this surgery?

- Does the facility you recommend participate in Medicare?

- Do I need permission before my operation?

While its always a good idea to get an estimate in advance for non-emergency surgery, its important to understand that estimates can be wrong. For example, if you need other unexpected services, your costs may be higher.

According to Kaiser Health News, hospital estimates are often inaccurate and there is no legal obligation that they be correct.

Even if your bill ends up higher than expected, having an estimate is useful. It can help you make the argument with your provider and Medicare that you shouldnt be charged more than you expected.

You May Like: Does Medicare Pay For Hearing Evaluation

What Are The Costs With Cardiovascular Disease If I Have A Medicare Supplement Plan

So, lets say you have Medigap Plan G, which is super easy to understand. With this plan, youll pay the premium and the Part B deductible.

An ambulance falls under Part B benefits, so if you didnt meet the deductible, youd pay it here. Then, when you go to the hospital, the plan will pay all your coinsurances and Part A deductible.

The difference between Medigap and Medicare Advantage is significant savings. As long as you keep paying your monthly premium, you can count on Medigap to be there for you when you need it.