How Medicare Advantage Ppo Plans Work

Medicare Advantage is a bundled alternative to Original Medicare and is sold by private health insurance companies contracted with the federal government. Medicare Advantage plans include all the Medicare Part A and Part B benefits, usually prescription drug coverage , and often additional benefits like some coverage for dental and hearing care.

With a Medicare Advantage PPO plan, you can get affordable care from a network of doctors and hospitals. These medical providers and facilities have contracted with the plan to provide services for specific prices.

PPO plans also allow you to seek out-of-network care. That means you can see any doctor or visit any hospital you want, but youll pay more for covered services outside the provider network. In addition, unlike Medicare HMO plans, PPO plans dont require you to choose a primary care physician or get referrals before seeing a specialist.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

When Can I Enroll In A Medicare Advantage Plan

You can join a Medicare Advantage Plan during the following periods.

- Initial enrollment period: You can enroll in a Medicare Advantage plan the month that you become eligible for original Medicare coverage. In most cases, this is when you turn 65.

- Open enrollment period:From Oct. 15 to Dec. 7 each year, you can join, switch or drop a Medicare Advantage plan. If you enroll during this period, your coverage will begin on January 1st of the next year so long as your application is processed before Dec. 7.

If you have a current Medicare Advantage plan and you want to switch to a different plan or to original Medicare coverage, you can do so from Jan. 1 to March 31 each year.

Recommended Reading: Does Medicare Cover Acupuncture Services

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

| TTY 711, 24/7

Unlike some other types of Medicare Advantage health plans, a PPO generally does not require you to utilize a primary care doctor, nor do you need a referral to visit a specialist.

What Is Not Covered

The plan that a person selects can opt to deny coverage for health services that are not deemed medically necessary by Medicare.

If a person is unsure if their plan covers a particular service, it is best to call the provider before receiving the treatment.

People with a PPO plan usually have prescription medication coverage.

However, it is important to note that every PPO plan is different and may offer different coverage.

Many prescription drugs have a copay. The copay amount will usually be less for a generic drug than for a particular brand. It could be a percentage of the total or a set dollar amount.

The medication may also need prior authorization from the provider before they pay for it.

Don’t Miss: Does Medicare Cover Home Health Care Costs

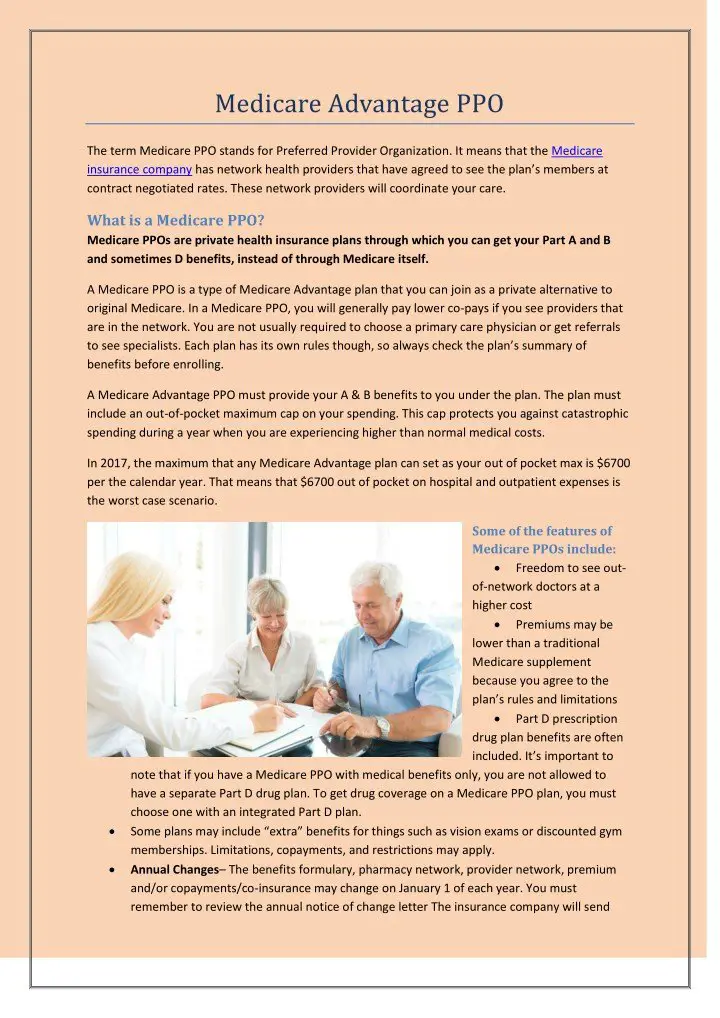

Understanding Medicare Advantage Ppo Coverage And Benefits

Learn about Medicare Advantage PPO plans, what they do and do not cover, average costs, when to enroll, and more.

Medicare Advantage PPO is a subset of Medicare Advantage or Medicare Part Chealth insurance. Offered by private insurance firms, PPO plans work within a network of doctors, hospitals, and other providers. If you see a doctor within the network, your plan will likely cover the visit in whole or in part. If you see an out-of-network doctor, you will have to pay out-of-pocket costs.

How Medicare Ppos Work

PPOs have the same requirements as other Medicare Advantage plans they must provide seniors with the same benefits, rights, and protections as Original Medicare. Most PPOs offer extra benefits, such as vision and hearing care but these services may cost extra.

PPO Plans have network health care providers and hospitals nationwide, making them a good option for kupuna who visit their family on the mainland or travel regularly . Members do pay less if they seek care from in-network doctors and hospitals and pay more if they use doctors, hospitals, and providers outside of the network. Check with a Medicare Agent for individual plan details.

Can I join a Medicare PPO?

In order to qualify for a Medicare PPO Plan, you must already be enrolled in Medicare Parts A and B. In most cases, you will continue paying your Medicare Part B premium. Some PPOs charge an additional premium, on top of your Part B premium. One reason that a plan would charge an additional premium is if it includes prescription drug coverage and other additional services.

On a Medicare PPO do I have to get care within the PPO network?

Its important to know whether you would need to receive health care from within the PPO network or whether you would have the freedom to choose your health care provider and hospital. Because there are preferred providers in a Medicare PPO, it is more cost efficient to receive in-network care but it is not a requirement.

Will I need to get a referral to see a specialist?

Also Check: Do Medicare Supplements Cover Pre Existing Conditions

Do Medicare Ppos Use A Network Of Providers

Similar to an HMO plan, a PPO plan has a network of health care providers. You can see any Medicare-approved health care provider you wish, but it’s cheaper for you to stay within the policys network and use a preferred doctor, hospital or medical facility.

There are two types of PPO plans.

- A local PPO plan has a small network of providers serving one or more counties, or partial counties.

- A regional PPO serves an entire region and has a large network of providers in order to better meet the needs of beneficiaries in rural areas.

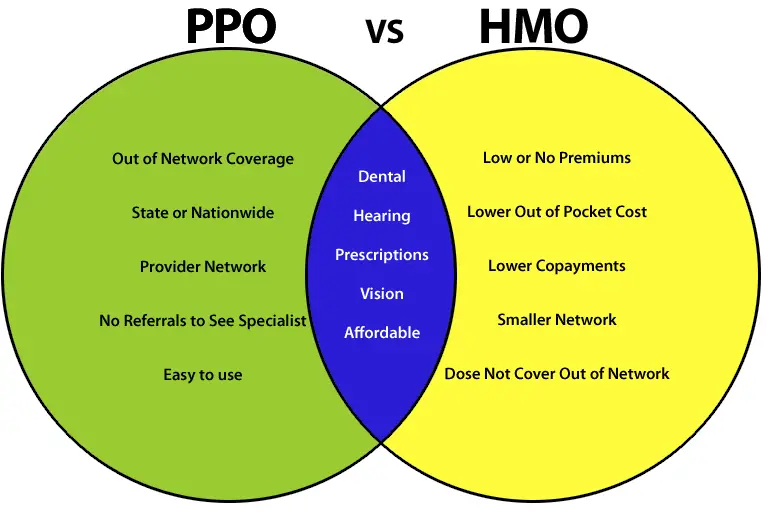

There are several differences between a Medicare PPO and HMO plan. With a PPO:

- You typically coordinate your own care

- You aren’t required to have a primary care physician

- You can usually see a specialist without a referral

- You can use the services of an out-of-network provider, although it may cost you more

Medicare Advantage Hmo Vs Ppo: Which Is Better

There’s no right choice for everyone. Instead, Medicare Advantage beneficiaries should review the terms of specific plans available in their area. HMOs typically have lower monthly premiums, though fewer clinicians will be covered. This can be a problem if you are selective about your doctors or a doctor you like is not in-network.

PPOs generally offer a wider variety of clinician choices, but you may pay a higher monthly premium. And if you choose to seek care out-of-network, you’ll pay more.

Don’t Miss: Will Medicare Pay For Electric Scooter

What Is Medicare Ppo / What Is Medicare Hmo

PPOs and HMOs come into play in Medicare when you are using Medicare Part C aka Medicare Advantage Plans.

Medicare Advantage Plans are alternative plans offered by private insurance companies to take the place of Original Medicare. They often include drug coverage or Part D coverage . They are approved by the Federal Government and cover everything that Original Medicare covers. In addition, they often offer benefits and services beyond what Medicare offers such as dental, vision and hearing benefits.

So then, what is a Medicare Advantage PPO plan or HMO plan?

Medicare Advantage plans are often HMO, PPO, or PFFS plans. When you are choosing a Medicare Advantage Plan, you will need to consider everything we discussed about HMOs and PPOs as they will apply to these private insurance plans and how they set-up their provider networks.

Who Can Get A Ppo

PPOs are available to anyone of any age who wants more flexibility and freedom in choosing your health care providers, pharmacies, and specialists.

This allows you to have more control over the type and quality of health care that you receive without having this dictated by someone else within the government or from a managed health system like HMOs.

For anyone looking for a higher degree of choice that will also work as gap insurance, supplemental insurance, and Medicare Part C insurance once you are 65 years of age or older, a PPO may be right for you.

Enter your zip below for a free Medicare quotes comparison!

Also Check: How Much Does Medicare Pay For Dialysis Transport

Medicare Ppo Plans And Provider Network Rules

Every Medicare PPO plan has a provider network. However, these plans also offer coverage for out-of-network care. In addition, PPO plan members may see specialists without a referral.

Medicare PPO plans may charge a monthly premium and a deductible. Members usually pay a copayment for covered health care services, after meeting any deductible.

While Medicare PPO plans may cover out-of-network care, plan members usually pay more than they would for the same service from a network provider.

Where Can I Sign Up For Medicare Ppo Plans

Like all types of Medicare Advantage plans, Medicare PPOs are sold by private insurance companies. The availability and selection of plans will vary from one area to another.

Get in touch with a licensed insurance agent who can provide information on Medicare PPO plans that may be available in your area. A licensed agent can also help you review the costs and benefits of each available plan where you live and help guide you through the enrollment process. Call 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week to speak with an agent.

1 Kaiser Foundation. Medicare Advantage Plans, by Plan Type. Retrieved from https://www.kff.org/medicare/state-indicator/plans-by-plan-type/?currentTimeframe=0& sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D.2 Kaiser Foundation. Medicare Advantage Total Enrollment, by Plan Type. Retrieved from https://www.kff.org/medicare/state-indicator/total-enrollment-by-plan-type/?currentTimeframe=0& sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D.3 MedicareAdvantage.coms internal analysis of CMS 2018 Medicare Advantage Landscape Source Files. May 2018.4 Kaiser Foundation. . Retrieved from https://www.kff.org/medicare/issue-brief/medicare-advantage-2017-spotlight-enrollment-market-update.

About the author

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Where you’ve seen coverage of Christian’s research and reports:

You May Like: Can A 60 Year Old Get Medicare

Benefits Available With A Ppo Plan

You have all the benefits from Medicare Part A and Part B , including:

- Inpatient hospital and skilled nursing facility care

- Home health care

- Medically necessary outpatient care

- Preventive care

Most PPO plans offer additional benefits that Medicare doesnt cover, like routine hearing, dental, and vision exams. You may have to pay an additional premium to get more comprehensive coverage. For instance, your PPO plan may cover routine dental exams, but you pay more for services like root canals or dentures. Many plans will offer prescription drug coverage. If you choose a plan that doesnt, you cannot purchase a standalone Part D plan.

| Advantages of a Medicare PPO Plan | Disadvantages of a Medicare PPO Plan |

|

|

Claims In Medicare Advantage Ppo Vs Medigap

A Medicare Advantage PPO Plan could deny your claim. With original Medicare and a Medicare Supplement Plan, there is no arguing with the insurance company. If Medicare pays its portion, the Medicare Supplement Plan MUST also pay its portion. If Medicare says it wont pay for your service, then your Medigap plan wont cover it either. Its that simple.

Don’t Miss: What Are The Parts Of Medicare

The Main Difference: Using The Plans Provider Network

Medicare HMO and PPO plans differ mainly in the rules each has about using the plans provider network. In general, Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs do.

A provider network is a list of doctors, hospitals and other health care providers under contract with a health plan. Providers in a network agree to accept the plans payment terms for covered services, which helps plans manage costs. As a result, plans are able to share the savings with plan members through low out-of-pocket costs.

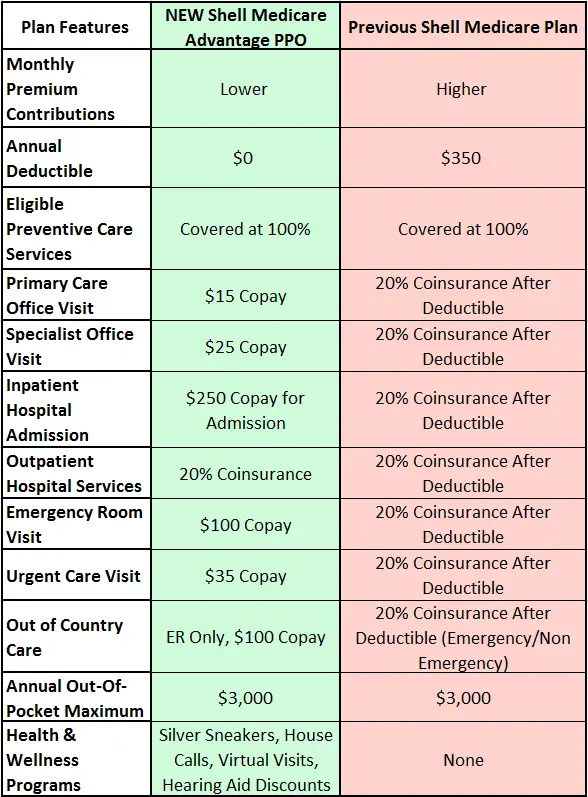

See the table below for how Medicare HMO plans and Medicare PPO plans set rules around provider networks.

Medicare HMO Must use network providers for covered services Network primary care provider coordinates care Referral needed for specialist care

Varies by plan

What’s A Medicare Hmo

Health maintenance organizations of today aren’t like the HMOs of the past. Some HMOs have a point of service option as well.

Most HMOs provide care through a network of doctors, hospitals and other medical professionals that you must use to be covered for your care. With an HMO-POS you can go outside of the network for care, but you’ll pay more.

- You’ll need to choose a primary care physician to coordinate all your care.

- You typically don’t need a referral to see a specialist, but your doctor can sometimes help you get in to see one more quickly.

- You’ll need to work with your doctor to get prior authorization before you get some services. If you don’t get prior authorization, some services may not be covered.

- The HMO and POS portions of the plan have separate deductibles. Care you receive in-network through the HMO has a different deductible than care you receive out-of-network through the POS. The two deductibles cannot be combined – they must be reached separately.

Recommended Reading: Will Medicare Pay For In Home Physical Therapy

A Word About Government Health Care

There have been many efforts by politicians and President Obama to integrate a plan for medical services that would work with all people. The problem is that its not true.

No one system or method works for everyone. There is never a cookie-cutter solution for your health care needs.

Every situation and health condition is unique, and the needs of individuals are just too unique to group it all into one plan.

Medicare Advantage Ppo Vs Hmo Plans: What’s The Difference

Medicare Advantage offers Medicare through a private insurer. Sometimes called Medicare Part C, these all-in-one plans often provide services original Medicare does not, such as vision and dental insurance and prescription drug coverage.

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Recommended Reading: What Is The Best Medicare Advantage Plan In Washington State

Humana Group Medicare Advantage Ppo Enhanced Plan

State Health Plan Medicare retirees have several options for health plan coverage. One of these options is the Humana Group Medicare Advantage PPO Enhanced Plan *, which includes Medicare prescription drug coverage and a premium for subscribers.

* The Humana Group Medicare Advantage Plans have a benefit value equivalent to a 90/10 plan.

Below are resources for members enrolled in the Humana Enhanced Medicare Advantage Plan.

Advantages Of Medicare Part C

- More convenient premium: Medicare Part C combines the benefits of Part A and Part B coverage into a single convenient payment. This can make it easier to manage your healthcare costs and ensure that your premiums are always paid on schedule.

- Enhanced benefits: Many Medicare Part C plan providers include Part D coverage rolled into its premiums, which is not included on the original Medicare. Insurance providers may also choose to extend additional benefits to Part C plan holders that are not included in Medicare parts A or B. Some examples of additional benefits may include dental care needs and hearing exams.

- Streamlined medical care: Because many Medicare Part C providers offer all of their required medical services within a single network, your healthcare providers can actively communicate with one another regarding your treatment. This can help you avoid unnecessary complications and delays for example, interactions between medications provided by 2 different medical care professionals.

- May save you more money: Most Medicare Part C plans include $0 monthly premiums and low to no deductibles. They also often limit the total amount of money youll need to pay out-of-pocket for the services you receive in a single year. This may save you money on your health needs when compared to what youd pay for original Medicare.

Recommended Reading: How Do I Apply For Medicare In Missouri

You May Like: Is Stem Cell Treatment Covered By Medicare

Renewability In Medigap Vs Medicare Advantage Ppo

Medicare Advantage PPO plans can change every year. If they increase the co-pays, premiums, or change their terms to something you dont like, you dont have any recourse except to change plans. Although Medicare Supplement Plans automatically renew each year, , if you dont get one when you are healthy, or within 6 months of your Part B effective date, you might not qualify for one.

Medigap plans can discriminate against you if you have health issues. Even if they accept you into their plan, you might have a six-month waiting period for the insurance company to cover pre-existing conditions.

Some states, such as California, have different rules on this, but most states dont give you the opportunity to change plans if you have pre-existing medical conditions.

Keep in mind that the Medigap insurance company can, however, increase your premium.

However, if the insurance company drops the plan, youll be able to get a Medigap plan using the Guaranteed Issue rules. Good luck finding an agent or broker to assist you with this change though, because most insurance companies wont pay an agent or broker for using these rules to help you enroll. Most brokers and agents dont want to take on the liability of helping you if they arent getting paid. And they cannot accept a fee from you to assist you with the change.