What Will Medicare Part B Cost

Medicare Part B requires a monthly premium,4 which will be automatically deducted from any benefit youre receiving from Social Security, the Railroad Retirement Board or the Office of Personnel Management. Otherwise, youll get a bill.

Youll generally pay a standard premium amount unless your modified adjusted gross income is over a certain amount. For this calculation, Medicare uses your IRS tax return from two years prior to identify whether youre a higher-income beneficiary. If you are, youll pay an income-related monthly adjustment amount . Heres how it works.

If your yearly income in 2019 was:

| File taxes as an individual | File taxes as married filing jointly | File taxes as married, filing separately | Youll pay each month in 2021* |

| $88,000 or less | |||

| $504.90 |

In addition to your monthly premiums, Medicare Part B has a deductible of $203 in 2021. Once you hit your deductible during the year, youll usually be responsible for 20% of Medicare charges for all Part B services .

Although the costs above are standard, if you dont enroll in Part B when youre first eligible and you didnt have a valid reason to delay enrollment your premium may go up 10% for each 12-month period you couldve had it .5 In most cases, youll pay this late enrollment penalty for as long as you have Part B, so dont miss your window.

When Can You Sign Up Outside Of The Initial And General Enrollment Periods

You could qualify for a Special Enrollment Period and avoid the penalty for enrolling late. SEPs are typically granted if you or your spouse are still working when you turn 65 and you have group health insurance through an employer or union.

In that case, youre allowed to enroll in Part B at any time you have qualified group health coverage and youve turned 65. Once you no longer have coverage, you can enroll during the eight-month SEP period that starts the month after you lose the job or the coverage, whichever comes first.

When Can You Sign Up

Like Medicare Part A, typical Medicare Part B enrollment comes with a seven-month Initial Enrollment Period for signup. This includes the three months before and after the month you turn 65, plus the month of your birthday. Hence, if you turn 65 in April, your Initial Enrollment Period stretches from January through July.8

If you arent automatically enrolled, you can sign up for Part B any time during your Initial Enrollment Period. But if you wait until the month you turn 65 , your Part B coverage will be delayed.

If you miss your initial signup and you arent eligible for a Special Enrollment Period , you can enroll in Part B during the General Enrollment Period, between January 1 and March 31 each year. There are a variety of reasons you might get a SEP, including losing employer health coverage or moving back to the U.S. after living in another country.

You May Like: What Preventive Care Is Covered By Medicare

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

When Should You Apply For Medicare If You Have Employer Health Coverage

Most people should sign up for Medicare Part A when theyre first eligible because it rarely costs anything. But some people delay enrolling in Part B because they dont want to pay the monthly premium. The decision usually depends on the type of health coverage you already have.

You can put off enrolling in Part B at age 65 if you have group health coverage through your or your spouses job and the employer has at least 20 employees.6 Youll be able to enroll with no penalty during the Special Enrollment Period that follows the end of your employers insurance. You can also choose to enroll in Part B while still insured and pay the premium.

If your employer has fewer than 20 employees, you should apply for Part A and Part B as soon as youre eligible.7

Be sure to talk to your employers benefits administrator about how signing up for Medicare will affect your coverage or Health Savings Account .8 You cannot contribute to an HSA if you have Medicare Part A. Your administrator can help you time the beginning and end of your coverage through work and your new health insurance so theres no gap in your coverage.

When your group coverage is ending, youll need to complete documentation and submit it to your Social Security office. If you have questions, ask Social Security.

Don’t Miss: What Is The Penalty For Not Enrolling In Medicare

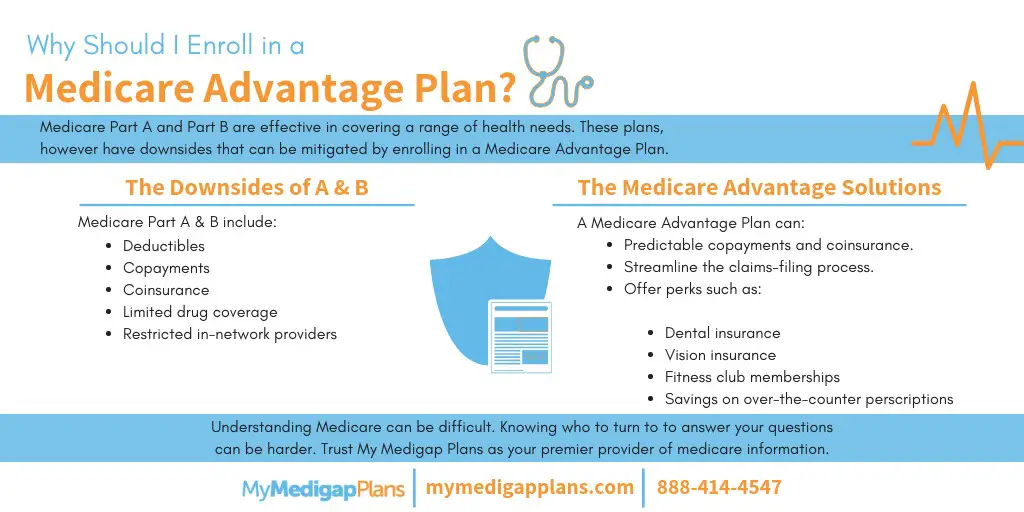

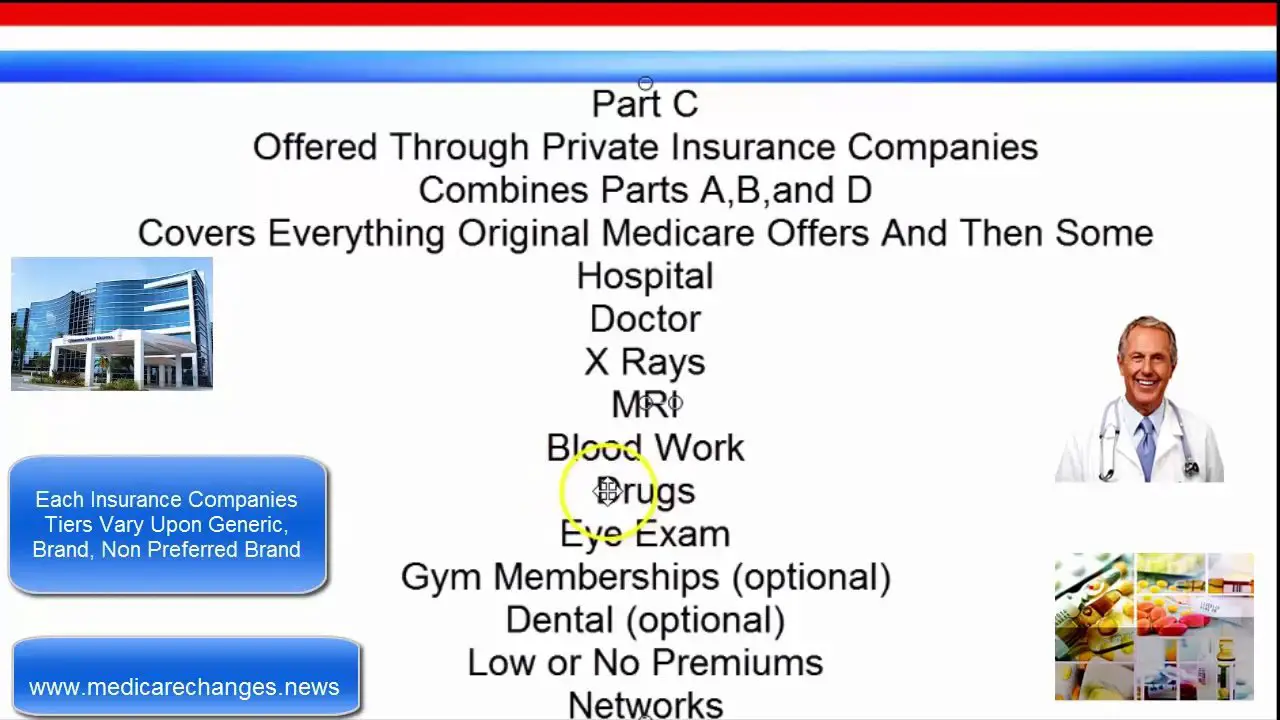

Enrolling In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare, can select an advantage plan 3-month before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Medicare is one thing you dont want to procrastinate on. Many people change plans during the Annual Enrollment Period if you make a change during this period, your policy will begin on January 1st of the following year.

Also Check: Does Medicare Cover The Cost Of Cataract Surgery

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, November 12, 2021

designer491 / Alamy Stock Photo

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $71.40 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Other Medicare Charges Also Rising

The annual Part B deductible will rise $30 next year to $233, up from this year’s $203.

For Medicare Part A, which covers hospitalization and some nursing home and home health care services, the inpatient deductible that patients must pay for each hospital admission will increase by $72 in 2022 to $1,556, up from $1,484 this year. Almost all Medicare beneficiaries pay no Part A premium. Only people who have not worked long enough to pay their share of Medicare taxes are liable for Part A premiums.

Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. During this period, beneficiaries can review their coverage and decide whether to make changes.

Dena Bunis covers Medicare, health care, health policy and Congress. She also writes the Medicare Made Easy column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for the Orange County Register and as a health policy and workplace writer for Newsday.

More on Medicare

Note: We are currently in the process of replacing our commenting service, so it may take a few days for previous comments to appear. Login or register on AARP.org to join the conversation.

Featured AARP Member Benefits

You May Like: Can You Get Medicare If You Work Full Time

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

I Turn 65 In A Few Months When Should I Sign Up For Medicare

En español | If you already receive Social Security benefits, Social Security will automatically sign you up for Medicare Part A and Part B though you can decline Part B enrollment if you want to. Otherwise, you need to apply for Medicare. The best time to do that depends entirely on your own situation. Broadly, there are two options:

You May Like: What Age Can You Get Medicare Part B

How Much Is The Medicare Part A Coinsurance For 2021

The Part A deductible covers the enrollees first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage during that same benefit period, theres a daily coinsurance charge. For 2021, its $371 per day for the 61st through 90th day of inpatient care . The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

Medicare Special Enrollment Period

Special situations may come up that give you the chance to sign up for or change your Medicare plan outside of your Initial Enrollment Period or the Annual Enrollment Period.

There are several special cases that make you eligible for a Special Enrollment Period.

Here are some common situations:

- You move: If you move to an address outside your plans service area, into a nursing home, or you have different plan options at your new address, youll be able to apply for a new plan.

- You want to switch to a 5-star Medicare plan: Every year, Medicare evaluates plans based on a 5-star rating system. Medicare considers these plans excellent. You can make the switch once to a 5-star plan anytime from Dec. 8 through Nov. 30 if one is available in your area.

- You lose your current coverage: This applies if you or your spouse will retire or change to a job that doesnt offer coverage. It doesnt apply if your insurance company cancels your coverage because you didnt pay your monthly premiums.

- Your plan changes its contract with Medicare: Enrollment in a plan depends on the plans contract with Medicare, and for various reasons these contracts could change.

Your new coverage begins on the first day of the month after you sign up.

Also Check: Does Medicare Cover Handicap Ramps

Coordinating Start Dates For Medicare Advantage Or Drug Coverage And Medicare

Same as above. Once you learn your Original Medicare effective date, youll want to apply for Medicare Advantage prior to that date, so that you have the coverage you desire.

- If you have delayed Part B, your start date will be different from above, as will your Medicare Advantage and Medigap effective dates

- If you are enrolled in Medicare Advantage and want to switch to Medigap,

- If you are enrolled in Medigap and Switch to Medicare Advantage,

- Dont forget to coordinate your Part D drug plan enrollment with your Original Medicare

Related Articles:

How To Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Don’t Miss: Is My Spouse Covered Under My Medicare

When And How To Apply For Medicare

Learn about Medicare enrollment periods and how to sign up for all the coverage you need.

Youre about to get Medicare! Thats great news because the program helps pay for your health care costs and brings peace of mind. But learning how Medicare works and how to apply can be overwhelming. This article breaks down the key Medicare enrollment periods, how they work, and helps you plan for your big enrollment day.

After The Open Enrollment Period Ends

However, after the Open Enrollment Period ends, that is no longer the case. Instead, you will pay higher premiums and could even be rejected from enrolling in some plans.

Medicare coverage does not start at the same time for everyone. While the Initial Enrollment Period is the best time to sign up for Original Medicare, a Medicare Advantage plan, Medicare Part D, or a Medicare Supplement plan, its not the only time to do so.

The key to meeting your enrollment deadlines is knowing well in advance the exact coverage you want to sign up for.

Recommended Reading: What Is A Medicare Discount Card

Medicare Initial Enrollment Period

Your first chance to enroll in Medicare is around age 65 when you have a seven-month window to apply. During the Medicare Initial Enrollment Period, you can enroll in Original Medicare Parts A and B. You can look at plans or sign up at any time during the three months before, the month of, and the three months after your 65th birthday. Need coverage the month you turn 65? Sign up in the three-month window before your birthday.

Take a deeper dive in our related article about all-things Medicare Initial Enrollment Period.

During Your Initial Enrollment Period

This lasts for seven months, of which the fourth one is the month in which you turn 65. For example, if your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

To avoid late penalties and delayed coverage, you need to sign up for Medicare during your IEP in these circumstances:

- You have no other health insurance

- You have health insurance that you bought yourself

- You have retiree benefits from a former employer

- You have COBRA coverage that extends the insurance you or your spouse received from an employer while working

- You have veterans benefits from the Department of Veterans Affairs health system

- Youre in a nonmarital domestic relationship with someone of the same or opposite sex and you are covered by his or her employer insurance

If you enroll during the first three months of your IEP, your Medicare coverage begins on the first day of the month you turn 65 . If you sign up during the fourth month, coverage begins on the first day of the following month. But if you leave it until the fifth, sixth or seventh month, coverage will be delayed by two or three months. For example, if your birthday is in June and you sign up in September , coverage will not begin until Dec. 1.

You May Like: Does Medicare Cover Home Sleep Apnea Test

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

Medicare General Enrollment Period

If you dont sign up for Medicare Part A and/or Part B when youre eligible, you can apply for Medicare for the first time using the General Enrollment Period from Jan. 1 through March 31 every year. Coverage begins July 1.

This enrollment period is only available to people who didnt sign up during their Initial Enrollment Period and who arent eligible for a Special Enrollment Period.

Note: You may have to pay a higher premium for Part A and/or Part B due to late enrollment.

Recommended Reading: Does Medicare Pay For Prep