Medicare Part B: Medical Coverage

Medicare Part B covers outpatient services, doctors fees, preventative services, and the cost of using medical equipment. Some people, such as those who are enrolled for Social Security, are automatically enrolled in Part B. Others have to enroll online.

Premiums

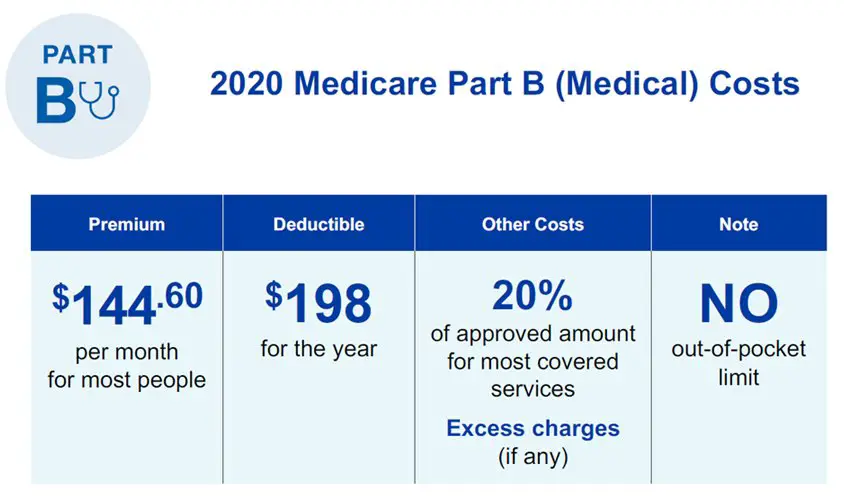

Individuals who earn less than $88,000 per year or couples who file jointly and earn less than $176,000 per year pay the standard premium of $148.50. Those with higher incomes are tiered into different premium levels by their income.

Deductible

For 2021, the standard deductible for Part B costs $203. If you receive benefits through Social Security, the Railroad Retirement Board, or the Office of Personnel Management, your premium is automatically deducted from your benefits.

Copays and Coinsurance

Medicare works with doctors offices to set standardized prices that they will pay for services. After youve paid the deductible, Medicare will cover 80% of these medical expenses, while youll be expected to cover the remaining 20% of the approved amount.

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

How Much Does Medicare Cost In 2022

- Part A: Most people can get Medicare Part A for a zero-dollar premium.

- Part B: Medicare Part B has a standard monthly premium of $170.10 in 2022.1

- Part C: Medicare Part C has an average monthly premium of $19 in 2022.2

- Part D: Medicare Part D stand-alone plans are projected to have an average monthly premium of $33.3

There are four different parts of Medicare labeled A and B , C , and D . Each comes with its own set of expenses.

Lets take a closer look with a detailed breakdown of the costs associated with each part of Medicare.

Don’t Miss: Do You Automatically Get Medicare When You Turn 65

How Much Are Medicare Part C Costs Increasing

According to the Kaiser Family Foundation, full Medicare Advantage enrollment increased by around 2.4 million beneficiaries between 2020 and 2021. Medicare Advantage plans are purchased through private health insurance companies, so any increase in costs varies from plan to plan in 2022.

Its best to check with your provider for updates on your Medicare Advantage premium pricing. In September, CMS will release final information on the 2022 premium and cost distribution for Medicare Advantage and Part D. plans for 2022.

How Much Does Medicare Part B Cost In 2022

The premium for Medicare Part B in 2022 is $170.10 per month. You may pay less if youâre receiving Social Security benefits. You also may pay more â up to $578.30 â depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $233 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

Read Also: Does Medicare Cover Cataract Surgery And Implants

Tips On How To Pay Medicare Premiums

- Make sure to pay both your Part B and Part C premiums on time so you wont lose coverage. Automatic deductions are the best way to avoid missing a payment.

- Make sure both Medicare and your Part C provider have your current mailing address for bill delivery .

- Dont miss more than three months of Medicare Part B payments. Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made.

- Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

Also Check: How Much Does Ss Deduct For Medicare

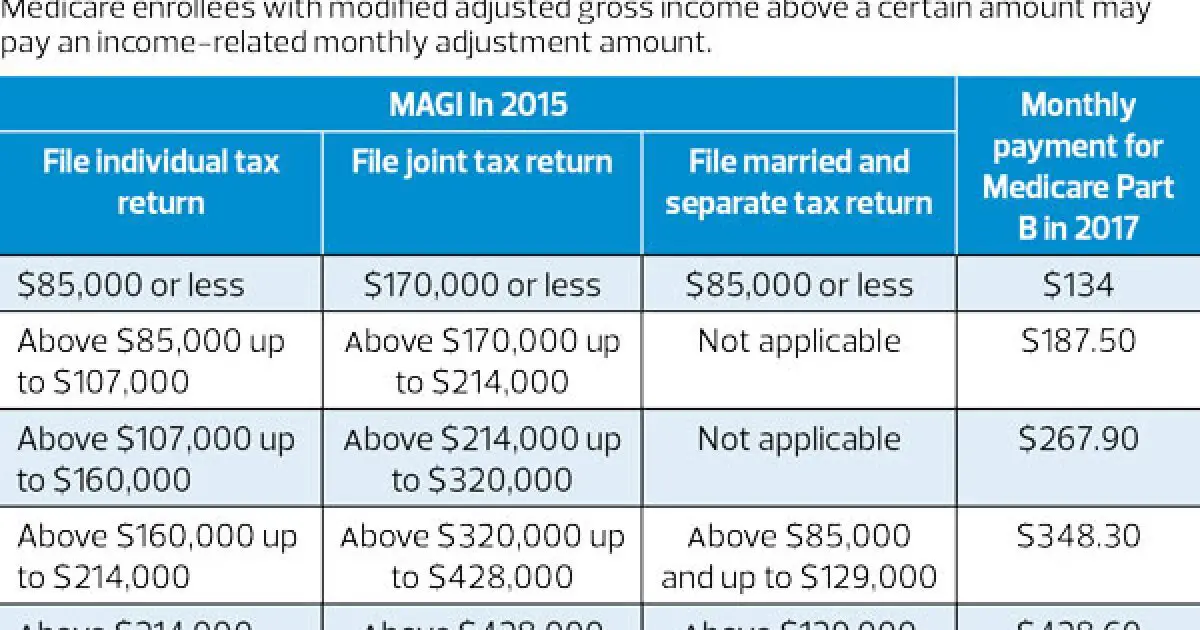

How Does Income Impact Medicare Costs

When you become eligible for Medicare and look at how much to budget for your annual health care costs, youll need to also factor in your tax-reported income. Medicare has set income limits for people filing individual tax returns, joint tax returns and individuals who are married or living with their spouse at any time during the year and file separate tax returns. These limits are then used to determine adjusted costs for Medicare Part B and Part D premiums.

Depending on how much you make, you may have to pay an income-related monthly adjustment amount for Part B and Part D. This amount and the income limits Medicare set can both change every year.

In 2022, people with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums.

Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

Paying Medicare Premiums In 2022

As youre learned in this article, not all Medicare premiums are alike. And neither are the ways in which they can be paid.

If a premium is owed for Medicare Part A, a monthly bill is typically sent to the beneficiary.

If you receive Social Security benefits, you can generally have your Part B, Medicare Advantage, Part D or Medicare Supplement Insurance premiums deducted directly from your Social Security check. Those who do not receive Social Security benefits are directly billed for their premiums.

Payment arrangements may include mailing a check, an electronic transfer from a bank account or charging a credit or debit card.

Don’t Miss: Can You Switch Back To Medicare From Medicare Advantage

Paying For Medicare Premiums Tips: Your Hsa And Employer Health Plan

From the above, you can see you may face higher costs for Medicare than you originally thought. Thats why you should consider two things a health savings account plan and if you have employer health coverage.

If you have an HSA and must get Medicare at age 65, the good news is that you can use your HSA funds to pay for Medicare costs including Part B and Part D premiums. Your HSA also can help with other costs, and you can learn more about how Medicare and HSAs work here.

How Much Does Medicare Part A Cost

Medicare Part A usually doesnt require a monthly premium payment if you or your spouse paid Medicare taxes while working. If you have to purchase Medicare Part A, it can cost up to $499 per month.4

What it is: Medicare Part A provides coverage for hospital services and care. This includes expenses for care received during stays in hospitals, skilled nursing facilities, hospice or home health care facilities.

Recommended Reading: Are Hospital Beds Covered By Medicare

Additional Costs To Know

There are some additional things to know about the costs associated with a Medicare Supplement Insurance plan.

- Two plans, Plan F and Plan G, have a high-deductible option available in some areas. The high-deductible version of these plans has a lower monthly premium than the standard version in exchange for a deductible. The plans coverage does not begin until the deductible has been satisfied. The deductible for these plans in 2021 is $2,370 for the year.

- Two plans, Plan K and Plan L, feature an annual out-of-pocket limit. Once the beneficiary has reached the out-of-pocket limit for covered services, the plan pays 100% of the cost of covered care for the remainder of the year. The 2021 out-of-pocket limits are $6,220 for Plan K and $3,110 for Plan L.

- While Plan N covers 100% of the cost of the Medicare Part B coinsurance, the plan requires a copayment of up to $20 for certain office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

A Costs If You Have Original Medicare:

Home health care

- $0 for home health care services.

- 20% of the Medicare-approved amount for Durable medical equipment .

Hospice care

- $0 for hospice care.

- You may need to pay a copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while youre at home. In the rare case, your drug isnt covered by the hospice benefit, your hospice provider should contact your Medicare drug plan to see if its covered under Medicare prescription drug coverage

- You may need to pay 5% of the Medicare-approved amount for inpatient respite care.

- Medicare doesnt cover room and board when you get hospice care in your home or another facility where you live .

Hospital inpatient stay

- $1,408 deductible for each benefit period.

- Days 160: $0 coinsurance for each benefit period.

- Days 6190: $352 coinsurance per day of each benefit period.

- Days 91 and beyond: $704 coinsurance per each lifetime reserve day after day 90 for each benefit period .

- Beyond lifetime reserve days : all costs.

Mental health inpatient stay

Skilled nursing facility stay

- Days 120: $0 for each benefit period.

- Days 21100: $176 coinsurance per day of each benefit period.

- Days 101 and beyond: all costs.

You May Like: Does Medicare Cover A1c Test

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

Part A premium based on credits earned

Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

Part B premium based on annual income

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60. The amounts are reevaluated by Medicare annually and may change from year to year. Any amount charged above the standard premium is known as an income-related monthly adjustment amount .

Related articles:

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industry in general, including provisions for preventive care. In 2020, the ACA closed the Medicare donut hole however, that doesnt mean prescription drug coverage is free. Beneficiaries are still responsible for various costs.

But one of the major changes specific to Medicare Part C plans is that insurers are not allowed to charge plan members more than what Original Medicare would charge for certain services, such as chemotherapy. This could affect costs, depending on your plan. Only five factors can determine your monthly premium rates: age, location, tobacco use, individual vs. family enrollment, and plan category.

Also Check: When Does Permission To Contact Expire Medicare

So If I Have To Pay For Medicare Which Medicare Coverage Is Ideal For Me

Your ideal Medicare coverage depends on your exact healthcare needs and requirements. However, Medicare Advantage plans are usually a convenient, comprehensive option when it comes to Medicare-backed health insurance.

At MedicareInsurance.com, our licensed agents can help you research and compare Medicare Advantage plans that may be available in your area today. Give us a call or contact us online today to get started!

D Late Enrollment Penalty

A late enrollment penalty is a number added to your monthly Medicare Part D if you dont cover Part D or Medicare Advantage for 63 or more continuous days. The cost of the late enrollment penalty depends on the time spent without Part D or recognizable prescription drug coverage. For each month without Medicare Part D coverage, 1% of nationwide base beneficiaries will be rounded up to the next $0.10 and added to their monthly premium.

Don’t Miss: Is My Medicare Number My Social Security Number

Medicare Advantage Plans Costs And Coverage

Medicare Advantage plans, is an all-in-one alternative to Original Medicare. These plans are administered by private insurance companies approved by the federal government.

Medicare Advantage bundled plans include Part A and Part B and usually have Part D drug coverage. Plans may also include other extra benefits such as vision and dental.

What Medicare Advantage Covers

- All the services covered by Original Medicare.

- Vision, hearing and dental are usually included.

- Emergency and urgent medical care is always covered.

- Most plans offer some form of prescription drug coverage.

Since Medicare Advantage plans are provided through private insurers, there are no fixed premiums, deductibles or coinsurance. Instead, they vary from plan to plan. You first must have Original Medicare before you can buy a Medicare Advantage plan.

The companies that administer the plans decide what to charge for premiums, deductibles and coinsurance once a year. Medicare does not have a hand in determining the costs. Changes take effect on Jan. 1 of the following year.

Cost-Determining Factors of Medicare Advantage PlansDon’t Leave Your Health to Chance

Medicare Part A Costs And Coverage

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care and hospice care. Long-term care is not covered under Part A.

If you receive Social Security for at least four months before your 65th birthday, you will be automatically enrolled in Part A and Part B. If you dont receive Social Security before turning 65, youll need to sign up with Social Security to receive coverage.

What Medicare Part A Covers

- Inpatient care

- Home health care

- Skilled nursing facility care

Part A charges no monthly premium to anyone who paid Medicare taxes through their employer for at least ten years. Those who havent worked that long have to pay premiums for Part A coverage. Most beneficiaries do not have to pay the premium.

2022 Medicare Part A Out-of-Pocket Costs and Increases

| Income Level for Individual Taxpayer | Income Level for Joint Tax Filers | Monthly Medicare Part B Premium |

|---|---|---|

| $91,000 or less |

Also Check: How To Sign Up For Medicare And Tricare For Life

Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2022 Medicare Part D enrollee would have pay for a premium.1

| Annual 2020 Income |

| Plan premium + $77.90 |

How Did Medicare Supplement Insurance Change In 2022

Medicare Supplement Insurance, or Medigap, helps pay for certain Part A and Part B out-of-pocket expenses, such as deductibles, coinsurance and copayment.

As of 2020, Medigap Plan C and Plan F will no longer be sold to new Medicare beneficiaries.

If you became eligible for Medicare before January 1, 2020, you may still be able to buy Medigap Plan F or Plan C if either is available where you live. If you already have either plan, you can keep it.

Read Also: How Old To Be Covered By Medicare

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.