B Premium Can Be Limited By Social Security Cola But That Wasnt An Issue For Most Beneficiaries In 2020 Or 2021

In 2021, most enrollees pay $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 and in 2019 . But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

Read Also: Silverdale Social Security Office

What If My Premium Payment Is Late

If your First Bill payment is late, you’ll get a Second Bill. Your Second Bill will include both past amounts and next month’s premium. If you dont pay the total amount due by the 25th of the month, you’ll get a Delinquent Bill. If you get a Delinquent Bill and you dont pay your total amount due by the 25th of the month, youll lose your Medicare coverage.

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while it’s easy to argue that seniors will still come out ahead financially, let’s also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes won’t take seniors’ entire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. That’s a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.

Don’t Miss: Which Cpap Machines Are Covered By Medicare

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $170.10 in 2022. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2022 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

Also Check: How To Apply For Medicare Advantage

These Are The Situations That Can Diminish Your Benefits

Some 65 million Americans receive Social Security retirement benefits each month, according to the Social Security Administration . The average monthly benefit for all retired workers in 2022 is estimated to be $1,657a sum that represents the primary source of income for some of them.

Even if youve saved funds in a 401, an individual retirement account , or another qualified retirement plan, if youre banking on Social Security to supplement that, then you may be in for a shock once your first payment arrives. If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

Medicare Advantage Premiums And Social Security Benefits

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

Medicare Advantage premiums vary in price just like other private insurance plans. This means that there is no way to say how much you will pay without getting a quote.

To have your Medicare Advantage monthly premium deducted from your Social Security benefit, you have to contact the Social Security Administration. Otherwise, you will have to pay the premium directly to your insurance company.

You May Like: What Is A Medicare Supplement Plan N

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Read Also: How To Update Address With Social Security

Medicare Part B Premiums For Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 .65

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premiumâMedicaid will typically pay low-income beneficiaries Medicare Part B premiumâthe costs of low-income beneficiaries rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.

Also Check: How Can I Check My Social Security Status

Read Also: How To Get A Wheelchair From Medicare

Are My Medicare Premiums Tax Deductible

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

The IRS has set that limit at 7.5 percent of your adjusted gross income . Your AGI is the money you make after taxes are taken out of each paycheck.

The IRS allows you to deduct any out-of-pocket healthcare expenses, including premiums, that are more than 7.5 percent of your AGI.

So, if you have an AGI of $50,000, you could deduct healthcare expenses after youve paid $3,750 in medical expenses. Depending on your premiums and other healthcare spending, you might not reach this number.

If your spending is less than 7.5 percent of your AGI, you cant deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Keep careful track of your out-of-pocket medical expenses throughout the year so you can make the proper deductions at tax time.

You can pay your Medicare bills online or by mail if they arent automatically deducted. You wont pay an added fee for parts A, B, or D, based on your payment method.

There are several ways to pay:

Six: Calculate Social Security And Medicare Deductions

You must withhold FICA taxes from employee paychecks.

Be sure you are using the correct amount of gross pay for this calculation. This article on Social Security wages explains what wages to take out for this calculation.

The calculation for FICA withholding is simple.

| FICA Taxes – Who Pays What? | |

|---|---|

| FICA Taxes | Employee Pays |

| 0.9% on gross pay over $200,000 | 0% |

Withhold half of the total from the employee’s paycheck.

For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% for a total of $114.75.

Be careful not to deduct too much Social Security tax from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social Security Administration.

You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year. The additional tax is 0.9% of the gross pay based on the employee’s W-4 status. No additional tax is due from the employer.

Most states impose income taxes on employee salaries and wages. You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority.

Your responsibilities as an employer for deducting, paying, and reporting these taxes are discussed in this article.

You May Like: What Are The Guidelines For Medicare

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $142,800 is subject to the Social Security tax for 2021. Since $142,800 divided by $6,885 is 20.7, this threshold is reached after the 21st paycheck.

For the first 20 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining four pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,537.40 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employees take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,074.80 to Social Security and $4,791.96 to Medicare.

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The holds harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the holds harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the holds harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

Read Also: Can I Get Glasses With Medicare

Medicare Part B Premiums To Rise 145% In 2022 With Premiums For Highest

Medicare Part B Premiums for the highest earners will top $14,000 a year in 2022.

getty

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2022, and the base premium increases 14.5% from $148.50 a month in 2021 to $170.10 a month in 2022. That $21.60 monthly increase compares to a $3.90 monthly increase last year. Meanwhile income-related surcharges for high earners have been bumped up again too. The wealthiest senior couples will be paying nearly $14,000 a year in Medicare Part B premiums. Part B covers doctors and outpatient services.

The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. Last year, Congress kept the increases in the Part B premiums and the deductible in check with caps as part of a short-term budget bill. So far, no such luck this year.

The CMS announcement comes after last months Social Security Administrations COLA announcement: a 5.9% cost of living adjustment for 2022, compared to the 1.3% cost of living adjustment for 2021. The average Social Security benefit for a retired worker will rise in 2022 by $92 a month to $1,657 in 2022, while the average benefit for a retired couple will grow $154 a month to $2,753.

The income-related premium surcharges apply to Part D premiums for drug coverage too.

Medicare Part B Premium surcharges for high-income individuals

CMS

Further Reading:

Does Social Security Automatically Deduct Medicare

Can I have my Medicare premiums deducted from my Social Security payments? In fact, if you are signed up for both Social Security and Medicare Part B the portion of Medicare that provides standard health insurance the Social Security Administration will automatically deduct the premium from your monthly benefit.

Recommended Reading: Where Do I Get A Medicare Card

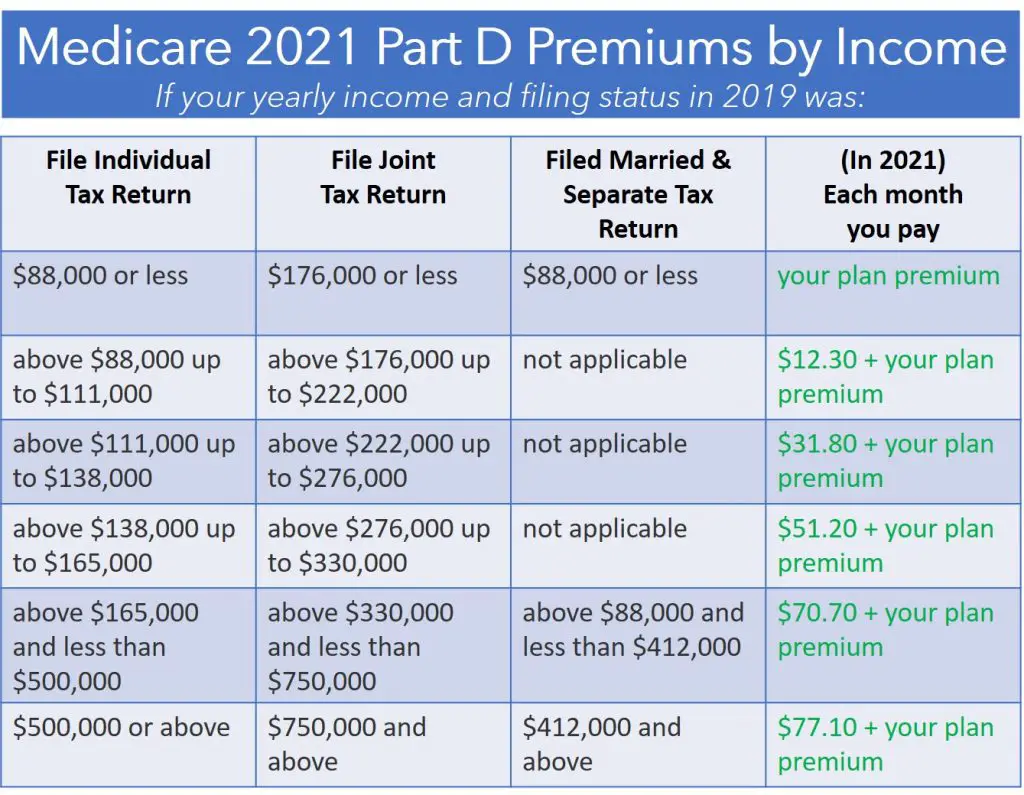

What Is Part D

If you are what Medicare calls a high earner, , youll have to pay the Medicare Income-Related Monthly Adjustment Amount, or IRMAA. Youll have to pay this whether youre in a stand-alone drug plan, or enrolled in a MA plan.

Social Security will let you know if you have to pay Part D-IRMAA based on your income. This can change from year to year.

Note that this isnt part of your plans premium, and you wouldnt pay this to your plan. Most people have it removed from their Social Security check, or youll receive a bill from Medicare or the RRB.

If your filing status and yearly joining income in 2020 falls under one of the following, see how much youll pay each month in 2022.

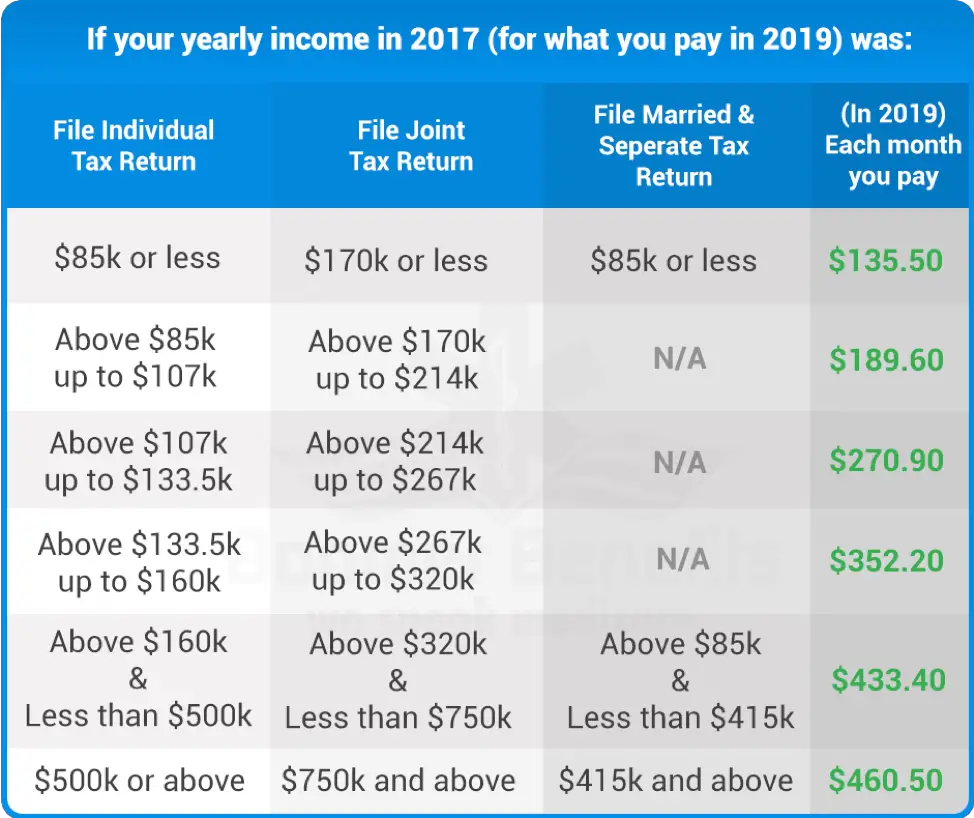

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

You May Like: Does Part B Medicare Cover Dental