Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

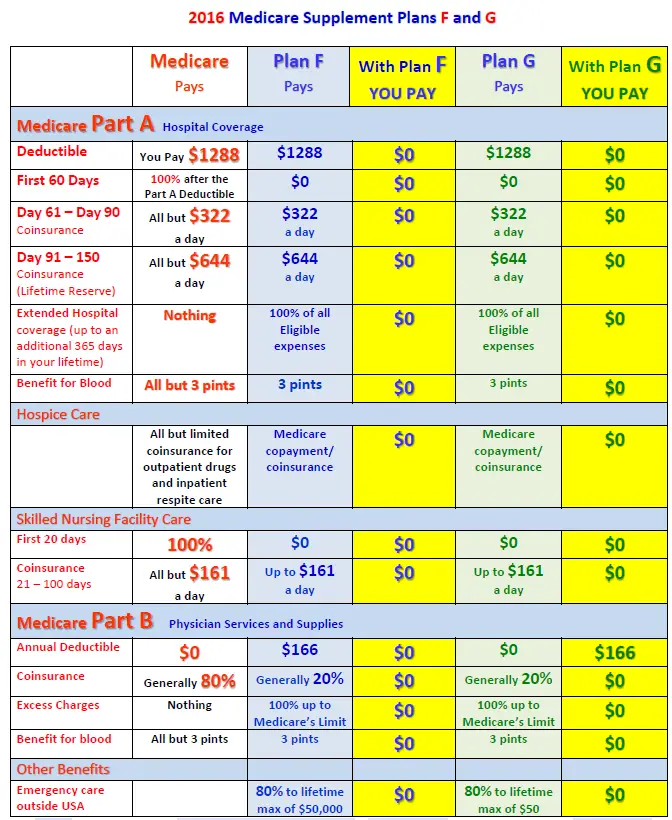

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

The Big Differences Between Medicare Plan F And Medicare Advantage Plans

Medicare Plan F is not a Medicare Advantage plan, which replaced your Medicare Part A and B benefits with private insurance. A Plan F supplement works alongside your Original Medicare. Many people ask Are Medicare Supplement Plans Worth It?, because they appear to cost more. The answer is most definitely, yes, they are worth every penny.

On the surface, Medicare Advantage plans look great. The monthly premiums are low and most plans offer additional benefits, including prescriptions, dental, vision, and more. But, the catch is that you pay more when you use services. In fact, the Kaiser Family Foundation conducted a study and found that most people with a Medicare Advantage plan pay more for a hospital inpatient stay, not less.

Also, unlike most Medigap plans, Medicare Advantage plans do not cover you when you travel. Youre covered for emergencies inside the United States and its territories, but you and not covered at all for foreign travel. With most Medigap plans, including Plan F, you are covered up to the limits of the policy.

Prescription drug coverage is not offered through Medicare Plan F but it is available as a stand-alone Medicare Part D plan. Basic prescription drug plans start at around $20 per month in most areas.

What Is Medicare Part F

by David Bynon, March 12, 2021

The federal Medicare programMedicare is a federal health insurance program for people ages 65 and older and people with certain disabilities…. is a series of lettered health insurance programs available to people, age 65 and older, and certain adults with qualifying disabilities. Medicare Part A and Medicare Part B is provided directly by the government, whereas Medicare Part CMedicare Part C is Medicare’s private health plan option. Also known as Medicare Advantage, Medicare Part C plans are a type of Medicare health plan offered by companies that contract with Medicare to provide all… , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ….) and Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… are provided through private insurance companies authorized to sell these plans.

If you qualify for Medicare and don’t know where to start

Don’t Miss: Must I Take Medicare At 65

Plan G Medicare Rates Are Lower

You see, most savvy seniors have already figured out that Plan G Medicare premiumsA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. … are lower than Plan F, and that cost difference adds up to more than the Part B deductible . So, for these seniors, a Medigap Plan G policy is better than Plan F because they save money.

Heres another thing that savvy seniors have figured out. On the surface, it may appear that all youre saving is a few dollars over the amount of the Part B deductible, but it can add up to much, much more. You see, many healthy people without chronic health conditions that require regular doctor visits go years with nothing more than an annual checkup. Because preventative care visits are free , many healthy seniors never pay the annual Part B deductible, so their Plan G policy keeps adding up the savings for them. Thats what makes Medicare Plan G the best for these people.

What Is A High

The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits. For 2019, the deductible for the high-deductible Plan F is set at $2,300. If you want to switch from a high-deductible plan back to the standard Plan F, you may need to undergo a medical exam for underwriting.

A high-deductible Medicare Plan F policy could be useful if you are healthier and do not think you’ll need many medical services. However, you should carefully evaluate your own medical situation before committing to the high-deductible plan, as you would be responsible for the entire $2,300 if you incurred a large medical cost.

For example, say you needed to get a colonoscopy, which can cost up to $3,500. Under a standard Medicare parts A and B plan with Medigap Plan F, the first 80% of that bill would be paid for by Medicare Part B. The remaining 20% would be covered by Plan F. You would end up paying nothing in medical expenses under this scenario, but you would pay the monthly premium of $140, which adds up to $1,680 per year.

In this scenario, you would save $500 if you have the high- deductible policy. However, this assumes you have only one medical expense during the year. For most older adults, this would not be the case. You should carefully evaluate your expected medical expenses for the year before selecting the high-deductible version of Medigap Plan F.

Also Check: Does Kaiser Medicare Cover Dental

Is There An Alternative To Plan F

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesnt cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so thats a good alternative to Plan F.

Best In Price Comparison: Aarp

AARP

-

Information for most plans is available on one PDF document for easy comparison

-

Customer-focused, with educational materials available on the site and for download

-

Quickly able to access personalized estimates

-

Monthly cost estimates broken down by age, gender, smoking status, location, and plan type

-

Not many extras or additional bonuses

-

Travel has $250 deductible, and then the plan pays 80%, while many other providers pay 100%

AARP is nothing if not detailed. Before you even get to personalized estimates, AARP makes sure you know what youll get for your money, and that you have an effective, comprehensive understanding of what each plan offers. Since it gives you such a comprehensive understanding up front, you may not even need to enter your information. If you know that you can find similar coverage for less money, or that another provider has more benefits, youll be able to tell from a cursory glance through the document, and all you need to enter is your ZIP code.

Make sure you consider all aspects of your personal situation and how it may impact your premiums and deductibles. The older you are when you enroll, the more prices can go up.

You May Like: Does Medicare Pay For A Rollator

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

What Is Not Covered By Medigap Plan F In Florida

Medicare Supplement plans like Plan F in Florida do not cover anything that is not covered as Medicare benefits under Medicare Part A and Part B, such as dental work, visual aids like glasses, or prescription drug plans. However, beneficiaries of Medigap Plan F and other Medicare Supplement plans can enroll in separate stand-alone Medicare Part D, which has prescription drug benefits, or after they compare the plans, they can purchase separate policies with dental, vision, and prescription drug coverage. These supplemental Medigap plans also do not cover your Medicare Part B premium.

You May Like: Is Aarp Medicare Part D

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Plan F Availability Review

85 percent of insurance companies that sold Medicare Supplement Insurance plans offer Plan F as part of their selection.2 This is the largest percentage of any Medigap plan.

Additionally, there is a high-deductible version of Plan F that can offer consumers another option. High-deductible Plan F allows plan members to pay a smaller monthly premium in exchange for an annual deductible for covered services.

You May Like: Is Rollator Walker Covered By Medicare

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

We give Plan F from each of the following Medicare Supplement carriers an A+ rating based on the companys reputation and financial strength:

| 80% | 80% |

The out-of-pocket Original Medicare costs covered by Plan F include:

The first eight items on the above list are covered by Medicare Plan F at 100 percent. The final item, foreign travel emergency care, is covered at 80 percent .

Plan F benefits rating: With cost coverage offered in all nine Medigap benefits areas, Medicare Plan F earns an A+ review in terms of its coverage.

Medicare Supplement Insurance Plan F benefits are standardized by the federal government. That means the basic out-of-pocket Medicare costs covered by Plan F sold in New York will be the same as Plan F sold in California.

Plus, Medicare Supplement Insurance plans are required by law to be accepted anywhere that Original Medicare is accepted. This means that if your doctor, hospital or other health care provider accepts Medicare, they will accept your Medigap Plan F.

There are no other network restrictions regarding where you can use your Medicare Supplement plan.

Plan F Coverage Of Medicare Part B Expenses

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

Plan F covers Medicare Part B approved services at the doctors office, such as:

- Medicare Part B coinsurance and copayment

- Medicare approved doctors office fees

- Part B deductible

- Medicare Part B excess charges

- Other Medicare-approved expenses associated with Part B coverage

Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges .

Read Also: Does Medicare Cover Home Health Care After Surgery

How Much Does Medicare Plan F Cost In 2022

The average cost of Medigap Plan F is around $130-$230 per month. There are many factors that impact the premium price.

These include your location, gender, age, tobacco use, and more. However, it could be more or less depending on your zip code as well as other factors.

A major factor that influences your monthly Medicare Supplement premium rates is the plan you select. With more benefits come higher monthly premiums. Thus, since Plan F offers the most comprehensive benefits, premium prices tend to be higher.

When Should You Enroll In A Medigap Policy

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting things like your age, gender, area of the country, and previous health conditions when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.5

Your state may have additional rules regarding open enrollment so check to be sure.

Read Also: Can You Get Medicare If You Live Outside The Us

Does Medigap Plan F In Florida Cover Prescription Drugs

As mentioned above, Medicare Plan F in Florida does not cover prescription drugs. These Medicare Supplement plans only cover services and charges that are covered benefits of Original Medicare , which does not cover prescription drugs. However, beneficiaries of Medicare and Medigap plans can purchase a separate Medicare Part D drug plan that does cover prescription drugs. It is important to keep in mind when enrolling in Original Medicare, if a Part D policy is not purchased and the beneficiary purchases one, later on, they may be charged a penalty fee.

How Policies Are Priced

One difference in premiums can arise from how they are “rated.” If you know this, it may help you anticipate what may or may not happen to your premium down the road.

Some policies are “community rated,” which means everyone who buys a particular plan pays the same rate regardless of their age.

Others are based on “attained age,” which means the rate you get at purchase is based on your age and will increase as you get older. Still others use “issue age”: The rate won’t change as you age, but it’s based on your age at the time you purchase the policy .

Premiums also may go up from year to year due to other factors, such as inflation and insurer increases.

It’s worth choosing an insurance company that has a good track record, Gavino said.

“Sometimes new carriers come into the market and have really low rates to entice people but then after a year of claims under their belt, they may have to raise rates significantly,” Gavino said. “I’ve seen it a lot.”

You May Like: Do I Need Medicare If I Have Tricare

Decide Between A Regular Plan F And High

Choose the plan that makes the most sense for you financially. Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,370 for 2021, before it will pay toward out-of-pocket costs.

Do You Really Need Medicare Supplemental Insurance

Dont just focus on the premium cost of a Supplemental Medicare plan. The least expensive plan may not offer all of the gap coverage you expect. Before deciding on a plan simply because of the average cost of supplemental Medicare insurance, make sure you are comparing the benefits each plan offers, too.

Read Also: How Do I Join Medicare

What Happened To Plan C And Plan F In 2020

Some Medicare beneficiaries commonly ask, Is Medicare Supplement Insurance Plan F ending?

The answer is that Plan F, as well as Plan C, are not ending. Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020.

If you already had Plan C or Plan F before 2020, you will be able to keep your plan. If you became eligible for Medicare before 2020, you may still be able to buy either Plan C or Plan F if either is available where you live.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.