Why Choose A Medicare Supplement Plan

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isnt an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

Medicare Supplement insurance plans work with Original Medicare, Part A, and Part B. They pay costs that Original Medicare doesnt.

Medicare Advantage is different. It replaces original Medicare and might be similar to the health insurance you had before you enrolled in Medicare. Because you are no longer in the federal system, the plans have differences. Reading and asking questions about those differences before you sign up is important.

Cost of supplemental plans vary

While the basic benefits are the same for every Medicare Supplement policy, costs vary widely, and some companies offer additional benefits that might make choosing their plans attractive to you.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

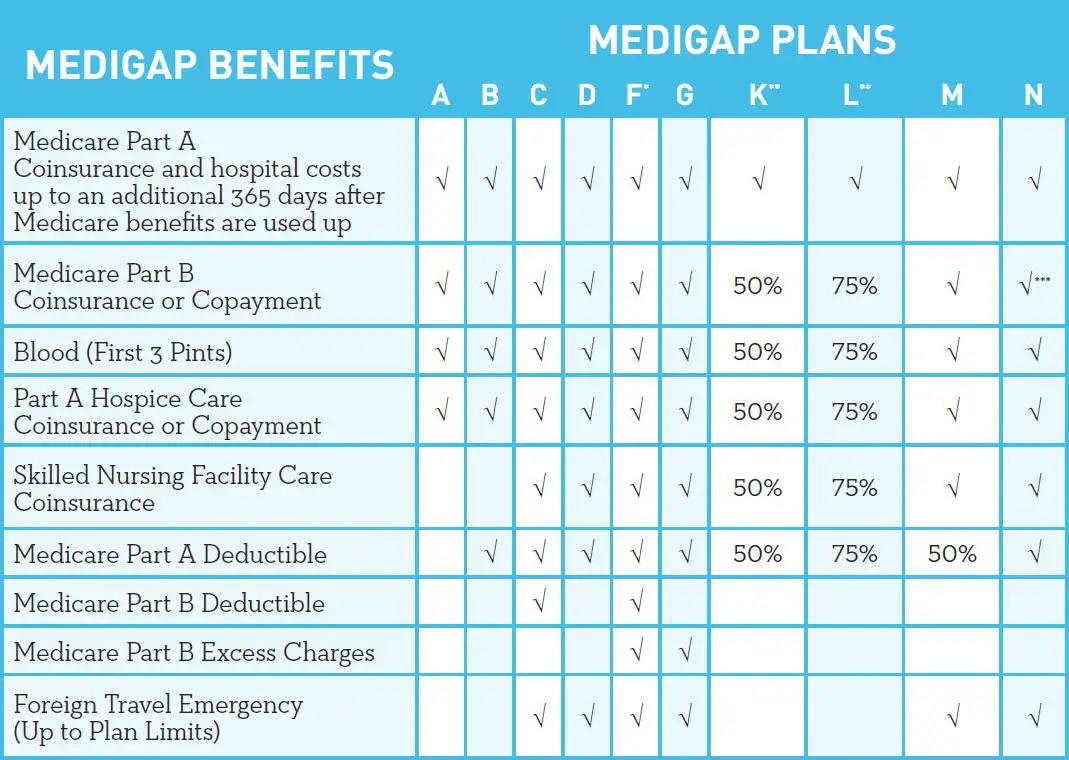

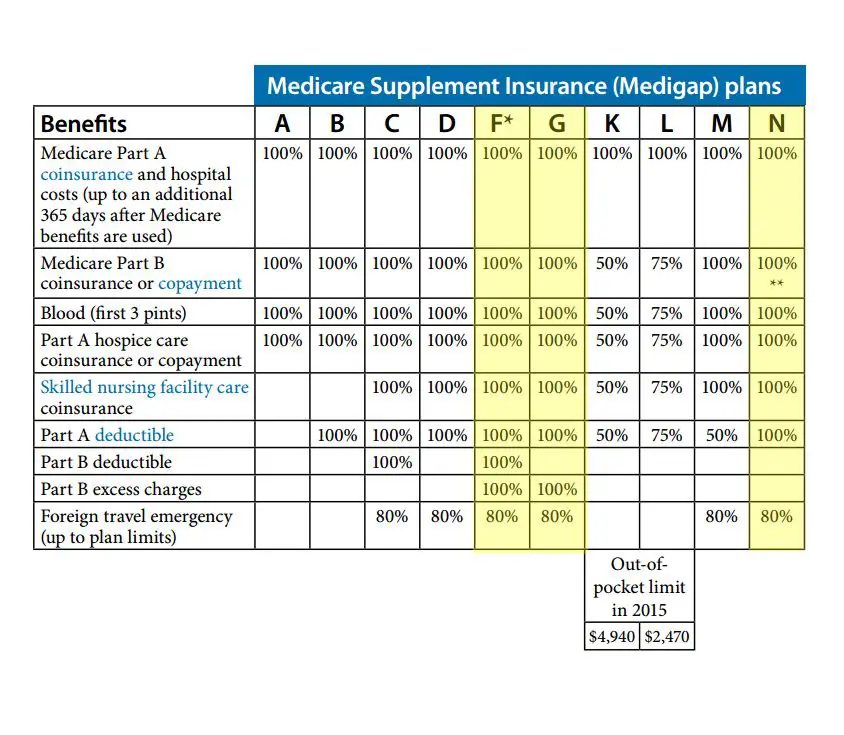

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

What Are The Best Medicare Supplement Plans Available In 2021

Find out how to choose the right Medicare Supplement plan for you.

Everyday Health may earn a portion of revenue from purchases of featured products.

Knowing how much money to set aside for your healthcare expenses can seem daunting without proper preparation and research. Medicare doesnt meet every coverage need for many people, but there are options available to fill those gaps. Depending on your health and budget needs, enrolling in a Medicare Supplement plan could be a viable option.

Also Check: What Is The Medicare Expansion

When Should I Enroll In A Medicare Supplement Plan

The best time to enroll in a Medicare Supplement plan is during your six-month Open Medigap Enrollment Period. This time period begins during the first month that you are eligible for Medicare and enrolled in Part B. During this specific time frame, you are guaranteed the right to enroll in any Medicare Supplement plan that you would like, without the risk of increased premiums.

However, after this six-month window closes, there is no guarantee that you will be able to obtain coverage under a Medicare Supplement plan. This is because after your Open Medigap Enrollment Period ends, insurance companies have the right to utilize a process called medical underwriting to raise your premiums or even deny you coverage based on preexisting health conditions.

Other Coverage You Have

Although 65 is the traditional retirement age, plenty of people are still employed at that age and continue to work for years. If you are covered by an insurance plan from your employer or by a plan from your spouses employer, its a good idea to speak with the administrator of that plan to see how enrolling in Medicare will affect your coverage under it. If you have a secondary insurance policy already, you might not need Medigap or a Medicare Advantage plan.

Recommended Reading: Does Medicare Offer Dental Plans

Best Medicare Supplement Companies

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for its Medicare Supplement plans. It’s important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

- Medigap plans offered: A, F, G, N and high-deductible F

- Average cost of Plan G: $179

Cigna, like UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna plans are widely available, and Cigna stands out for its high-deductible Plan F, which is an affordable way to protect yourself if you need expensive medical care. Cigna’s Medicare Supplement plans are generally priced higher than plans from some other companies, but using the company’s household premium discount can help you to get a better deal. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

How To Choose The Best Medicare Supplement Plan For You In 2021

As you research which Medigap plan is the best fit for you in 2021, here are some points to consider:

Because there are so many options and people’s individual circumstances differ greatly, what is right for one person may not work for you. However, there are a few generalities we can discuss.

Below are a few scenarios you may find yourself in when choosing your Medicare Supplement plan, and what information you need to know for each:

SCENARIO ONE: If you have high Part A fees

Part A has three categories associated with it. These are:

- Part A coinsurance

- Part A hospice care coinsurance or copayment

- Part A deductible

If you have Original Medicare and are frequently using your Part A coverage but not your Part B coverage, a plan that covers these categories would work best for you. Every plan listed above covers 100% of these categories, except for plans A, M, L and K.

SCENARIO TWO: If you have high Part B fees

There are three categories for supplement plans that cover Part B fees. These are:

- Part B deductible

- Part B coinsurance or copayment

- The Part B excess charge

Recommended Reading: Are Dental Implants Covered By Medicare

Top 10 Best Medicare Supplement Insurance Companies

These top 10 insurance companies offer Medicare Supplement Insurance in most states. Our review explores each company and the plans they offer so that you can compare plans and find the best coverage for your needs.

Note: If you’re looking for the best Medicare Advantage insurance companies, check out our review of the best Medicare Advantage plans and companies of 2022.

Ranking the top 10 Medicare Supplement Insurance companies can be difficult for two reasons.

- First, Medicare Supplement plans also called Medigap offer benefits that are standardized in every state except for Massachusetts, Minnesota and Wisconsin. This means each companys plans pay for the same out-of-pocket Medicare costs as the same types of Medigap plans sold by other companies.

- Second, Medicare Supplement plan prices and plan selection can fluctuate from one company to another and from one location to the next, so the top company in one city or state might be different from the top company in another location.

One great way to find the best Medicare Supplement Insurance companies that offer plans where you live is to compare plans for free online, with no obligation to enroll, using an independent source.

With all that said, weve compiled a list below of 10 Medicare Supplement Insurance companies that all meet the following criteria:

- Serve a high number of beneficiaries

- Sell plans in most states

- Offer a diverse selection of plans

Whats notable: Cigna has been in business since 1792.

Types Of Medicare Supplement Plans

Medicare Parts A and B have significant out-of-pocket costs. These costs include:

Part A deductible. Inpatient hospital stays have a deductible for each benefit period. A benefit period starts when a hospital or skilled nursing facility admits you. It ends when you havent needed inpatient care for 60 consecutive days. This means you can have multiple benefit periods each year. The deductible for each benefit period is $1,408 in 2020.

Part B deductible and coinsurance. You must pay the 1st $198 of Part B covered services each year. After you meet your deductible, youre responsible for 20% of the Medicare-approved amount for Part B services.

Medicare Supplement plans help with most of these costs. Medicare has standardized each plan. This means that a Medicare Supplement Plan G covers the same services no matter which company you purchase it from. Not every company offers every plan, but all companies that sell Medicare Supplements offer Plan A.

Heres an overview of what each plan covers:

Plan A: covers 100% of your Part A coinsurance, your Part B coinsurance and the 1st 3 pints of blood if you need a transfusion.

Plan B: covers everything Plan A covers. It also covers your Part A deductible.

Plan C: covers everything Plans A and B cover. It also covers your Part B deductible and 80% of your costs if theres an emergency while traveling overseas .

Plan G: covers everything Plan F does. The only difference is that it does not cover your Part B deductible.

Read Also: How Much Does Medicare Cost Me

What Is The Cost Of Supplemental Health Insurance For Seniors

The average cost of supplemental health insurance for seniors will depend on where you live, the health insurance company, type of plan, and benefit level you select. While these amounts will vary greatly, we can still give you an idea what you may spend. These average monthly premium price can range from $150 to $200.1

Comparing Medigap Insurance Companies By Rate Increases

Look, we can tell you who we think the best Medigap insurance companies are, but until you actually compare rates and rate increase, youll never know for sure. As you are probably aware, all lettered Medigap plans offer the exact same benefits, regardless of the insurance company standing behind the policy. Thats because Medicare supplement plans are standardized

Heres a fact. An Aetna Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services…. may cost less in San Diego, California than the same plan from Mutual of Omaha, but in Tampa, Florida Mutual of Omahas rates could be better. You simply wont know until you get a free Medicare Supplement Rate Analysis.

Getting the rate increase history is important because it will show you, in back and white, what you can expect from each insurance carrier. The last thing you want is to jump into an insurance pool with a low initial rate and rapid rate increases down the road. Stable rates are best, even if the initial rate is slightly more.

Recommended Reading: Do Medicare Advantage Plans Cover Dentures

What Does Medicare Supplement Insurance Cost

The primary goal of a Medicare Supplement insurance plan is to help cover some of the out-of-pocket costs of Original Medicare . As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly.

Best For Special Needs: Cigna

Cigna

-

Only available in 23 states

-

Dental coverage only available with some plans

We chose Cigna as best for special needs because of their personalized plan offerings. While other Medicare Advantage Plans limit coverage to individuals with special health conditions or care needs, Cigna offers special needs plans that include access to a wider range of specialists, along with regular health assessment .

Depending on your health care needs, Cigna offers an increased range of services, whether that is more intensive treatments, personalized care treatments, or more individual specialist attention.

Based on a review of Cignas Model of Care, the National Committee for Quality Assurance has approved Cigna to operate as a Special Needs Plan through 2021.

Cigna offers a health risk assessment that can be used to develop personalized care plans with Cigna Medicare Advantage Plan enrollees and their primary care doctor. The HRA also helps match each enrollee with the health and wellness services that best fit their needs.

Originally founded in 1792 as the Insurance Company of North America, Cigna is now an American worldwide health services organization. They have a full range of plans with premiums ranging from $0 to over $100 each month, depending on your needs and location.

Read Also: Is Dental Care Included In Medicare

Pay Less Now And More As You Go With Plan N

Medigap Plan N premiums are the lowest of the top Medigap plans in 2022.

This plan is a top choice for those who:

- Are looking for a relatively low monthly premium

- Are okay with small copayments

- Are not concerned about excess charges

This plan requires you to pay small copayments when you receive certain services, such as $20 at the doctor and $50 for an emergency visit. However, if you visit one of your local urgent care facilities, you wont have any copays.

This particular plan doesnt cover the excess charges. However, Part B excess charges are prohibited in the following states: Connecticut, New York, Ohio, Massachusetts, Minnesota, Vermont, Rhode Island, and Pennsylvania. If youre comfortable with a few copayments in exchange for a lower premium, this could be the plan for you.

Even though Plan N isnt as popular as other letter plans, its one of the Medigap plans we enroll our clients in the most. The reason this plan makes this list is due to its lower premiums. The reason the monthly premiums are lower is because of the copays. In exchange for a lower monthly premium, you agree to pay a $20 copay at the doctors office and a $50 copay at the emergency room.

Mutual Of Omaha Medicare Supplement

Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur. They have a lot of experience, offer discounts for things like being a non-smoker, and they are available in most states.

What we like: They offer international travel coverage with some of their plans. Theyve been working with Medicare since 1966, so they know what theyre doing. Their international coverage option is great for active seniors.

Flaws: Some of their high end plans are pretty expensive. Also, they do not offer plans C and D.

Also Check: Where To Send Medicare Payments

Do I Need A Medicare Supplemental Insurance Plan

It depends on your coverage. Medicare supplemental insurance plans are standardized insurance add-ons regulated by the federal government and issued through private insurance companies. Individual insurance companies set their own premiums for each Medigap option they offer. Medicare supplemental insurance options are labeled with letters A through L.

Each plan includes a list of benefits that every insurance company must offer. That means that no matter which company you purchase your Medigap policy from, you will always have the same coverages and inclusions. This is true for all Medicare enrollees except those who live in Massachusetts, Minnesota or Wisconsin because coverages in these states vary from the standard list of inclusions.

Take a look at whats covered under each Medicare supplemental plan that you can currently purchase.

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

You May Like: Why Is My First Medicare Bill So High

Best Cheap Medicare Supplement Plan: Plan K

If you are interested in the cheapest Medigap policy that still provides some coverage on top of Original Medicare, you may want to look into Plan K.

Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible. Many other Medigap plans, such as Plan G, provide full reimbursements for these types of health care.

This is crucial to consider if you need health insurance coverage for skilled nursing. In this case, if you were to get Plan K, only 50% of such costs would be covered.

On the other hand, your monthly premiums with Plan K will be much cheaper. Policyholders can expect to pay about $77 per month, making it the best Medicare Supplement plan for low-income seniors.

What Coverage Is Included Under Medicare Supplement Plan K

Those looking for a lower cost Medicare Supplement plan might consider Plan K, which offers more basic coverage in exchange for lower premiums. Plan K will cover 100 percent of Part A coinsurance, as well as 50 percent of the following benefits:

- Medicare Part B coinsurance or copayments

- First 3 pints of blood

- Part A hospice care coinsurance or copayments

- Care delivered at a skilled nursing facility

- Part A deductible

Plan K is also one of two Medicare Supplement plans that includes an annual out-of-pocket limit, which can help enrollees better predict and plan for their expected costs for the year. In 2021, Plan Ks limit is set at $6,220.

You May Like: How To Make Medicare My Primary Insurance