What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas’ Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

Medicare Eligibility By Disability

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefitsthree months before youre eligible for coverage.

The Cost Of Medicare At 60

If Medicare at 60 becomes a reality, there are financial concerns that the country must address. Those who age in are eligible for Medicare Part A premium-free if they paid in while working for at least 40 quarters .

The tax money goes to the Hospital Insurance Trust Fund. This fund pays for Medicare Part A, which is premium-free for most.

Get A Free Quote

Find the most affordable Medicare Plan in your area

A significant concern is that the HI Trust Fund is at risk of insolvency. There might not be sufficient revenue to cover Part A premiums in just a few years. The original prediction for when this would happen was 2026, but the pandemic is an additional strain on the fund and is speeding up the timeline.

The HI Trust Fund will need to be well-funded if Medicare at 60 becomes law. This is because millions of new citizens would become eligible for Medicare. Thus, the need to fund the healthcare program would increase.

Also Check: Can You Have Two Medicare Advantage Plans

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

When Should I Sign Up For Medicare

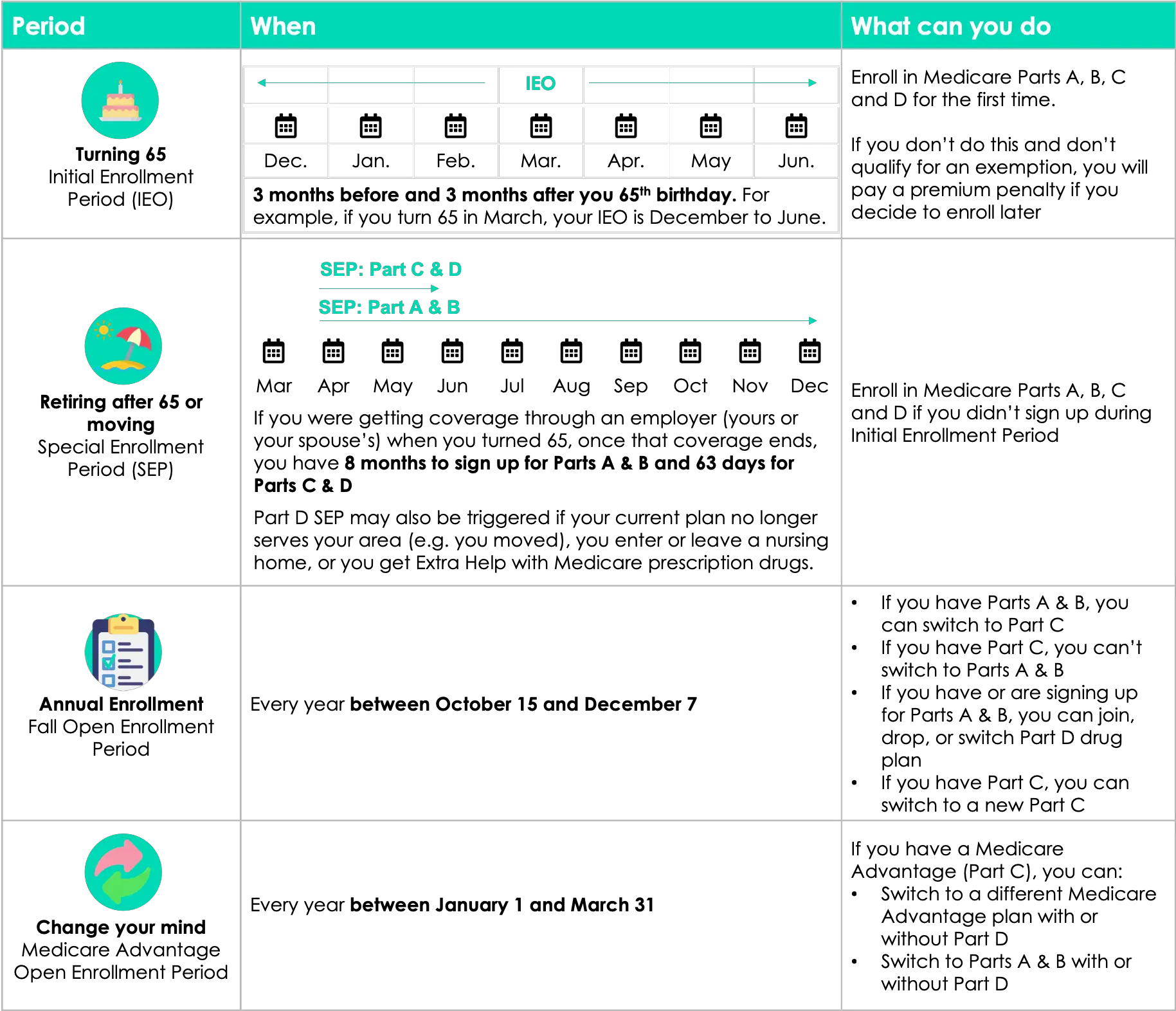

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

You May Like: Can You Have A Health Savings Account With Medicare

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Who Qualifies For Premium

For members who are interested in premium-free Medicare Part A coverage, those who are age 65 will qualify if they meet the following:

- Already receive retirement benefits from Social Security or Railroad Retirement Board

- Eligible to receive Social Security or Railroad benefits but havenât filed for them

- A member or their spouse were Medicare-covered employed through the government

And for members who are under 65 the eligibility requirements are:

- Received Social Security or Railroad Retirement Board disability for 24 months

- Person who has End-Stage Renal Disease and meets determined requirements

In addition, you must also pay the Part B premium each month. The standard premium is $170.10 in 2022.

Please keep in mind that individuals with a higher income may have to pay more for their Part B premium. Be aware that if you donât sign up for Medicare Part B when you first become eligible, you may have to pay a 10% penalty for each full 12-month period you could have had Part B but didnât sign up .

Also Check: How Much Is The Average Medicare Advantage Plan

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. You can qualify for Medicare Part A and Medicare Part B by:

- Being age 65 or older

- Living with a qualifying disability

- Living with certain health conditions, like end-stage renal disease or amyotrophic lateral sclerosis

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

Recommended Reading: What Is A P10 Number For Medicare

If I Retire At 62 Is That My Medicare Eligibility Age

Summary:

No, you donât qualify for Medicare until age 65 unless youâre eligible due to disability, as weâll explain below. For most people, Medicare coverage starts at age 65.

But this may be good news for you: in some cases, when one spouse turns 62, the other spouse whoâs âMedicare ageâ might qualify for premium-free Medicare Part A even if he or she hasnât worked. More on this below.

Retirees And Those Still Working

If you paid into a retirement system that didnt withhold Social Security or Medicare premiums, youre probably still eligible for Medicareeither through your retirement system or through your spouse. To receive full Medicare coverage at 65, you must have earned enough credits to be eligible for Social Security.

Each $1,470 you earn annually equals one credit, but you can only earn a maximum of four credits each year. You will receive Social Security benefits at retirement if you have earned 40 credits10 years of work if you earned at least $5,880 in each of those years. If you continue to work beyond age 65, things get a bit more complicated. You will have to file for Medicare, but you may be able to keep your companys health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Theres a lot to consider that makes it prudent to talk to a person knowledgeable in Medicare about your specific choices. This could be your Human Resources department or a Medicare representative.

If you continue to work beyond 65, theres a lot to consider that makes it prudent to talk to a Medicare expert about your choices.

You May Like: Does Medicare Cover Air Evac

Will I Get Medicare At 62 If I Retire Then

No. Even if your spouse is eligible for Medicare when you retire at 62 , youâre not eligible unless you qualify by disability.

if you retire before age 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you might want to visit healthcare.gov, or your state insurance agency on your stateâs official website, to learn about your options.

What Is Covered Under Medicare Part C

Medicare Part C plans provide all of the same benefits as Original Medicare. Most Medicare Advantage plans also offer prescription drug benefits, which Original Medicare doesn’t cover.

Some Medicare Advantage plans may also offer a number of additional benefits that can include coverage for things like:

Read Also: Does Medicare Cover Transportation To Dialysis

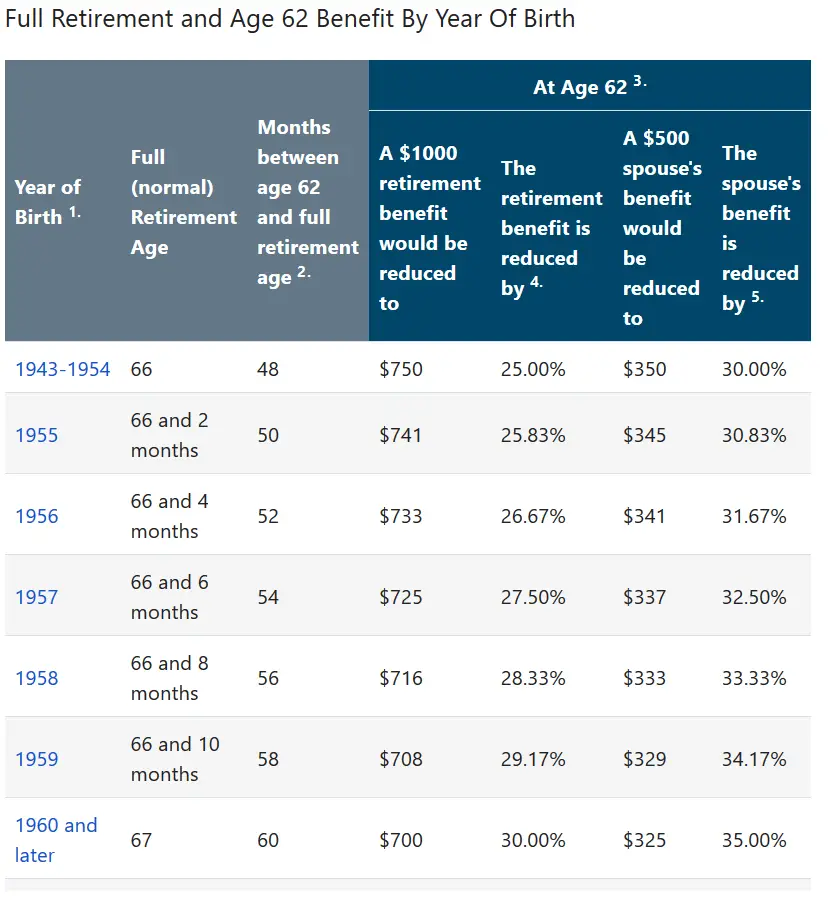

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

Are You Turning 65

You should sign-up for Medicare benefits a few months before you turn 65 to avoid a break in coverage. You’re eligible to enroll in Medicare Part B at age 65 even if you are not eligible for Medicare Part A.

- Sign up for Part B when first eligible to avoid a late enrollment penalty.

- If your sponsor is on active duty, you may delay Part B enrollment without penalty.

- Get started with Medicare

If you didn’t sign up for Medicare Part B when you first became eligible, or you dropped it, you can sign up during Medicare’s general enrollment period . You may have to pay a Medicare Part B Late Enrollment PenaltyYour monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it..

Also Check: How Much Does Medicare Pay For A Doctors Office Visit

What To Do If The Bill Doesnt Pass

To pass Congress, the bill would need full support from all of the Democratic members. Since that seems unlikely, its best to make some plans to find savings for yourself.

If youve got bills piling up these days, health care or otherwise, you may want to consider a lower-interest debt consolidation loan to help get you out of debt easier and sooner.

As for your health-care costs, it will take a little while for you to see the impact of the new subsidies. Make sure youre not overpaying for this crucial coverage by shopping around for the best rate.

And while youre shopping for insurance, why not keep the savings rolling? By looking around for a cheaper policy, you could potentially cut your homeowners insurance bill by $1,000 this year.

Even if the government doesnt pass a change qualifying you for Medicare coverage, with the savings above, you can make your own changes to the status quo, improve your health care coverage and lower your monthly bills.

Also Check: Can I Change From Medicare Supplement To Medicare Advantage

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Read Also: What’s The Number For Medicare

Does Medicare Automatically Send You A Card

Once you’re signed up for Medicare, we’ll mail you your Medicare card in your welcome packet. You can also log into your secure Medicare account to print your official Medicare card. I didn’t get my Medicare card in the mail. View the Medicare card if you get benefits from the Railroad Retirement Board.

How To Apply For Medicare Part A And Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If youve been receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

If you have ALS or Lou Gehrigs disease, youre automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

Some people will need to sign up for Medicare themselves. If you have end-stage renal disease , and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 . If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 , Monday through Friday, 9 AM to 3:30 PM, to speak to an RRB representative.

Read Also: Does Medicare Pay For Ensure

What Is The Earliest Age You Can Get Medicare

Due to there being circumstances where someone can enroll in Medicare due to a disability, there is no minimum age to enrolling in Medicare with a disability. However, you must have been receiving Social Security Disability Benefits for at least two years.

The only circumstance where this two-year limit can be waived is if you are diagnosed with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis. However, if you do not receive Social Security disability or are not diagnosed with one of the qualifying illnesses, you will need to wait until you are 65 to enroll in Original Medicare.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Also Check: Can You Apply For Medicare Part B Online