How Do Medicare Advantage Plans Work

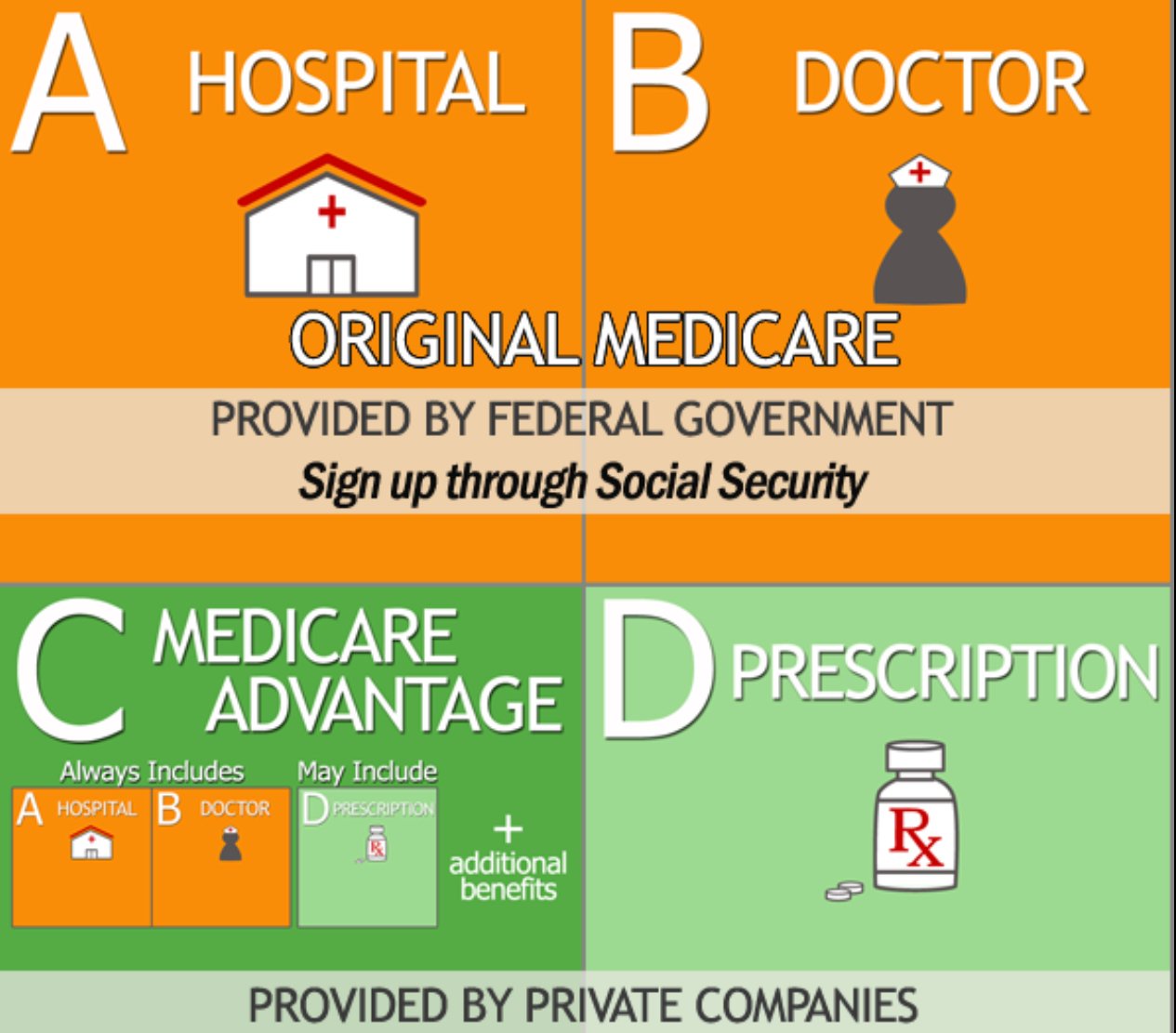

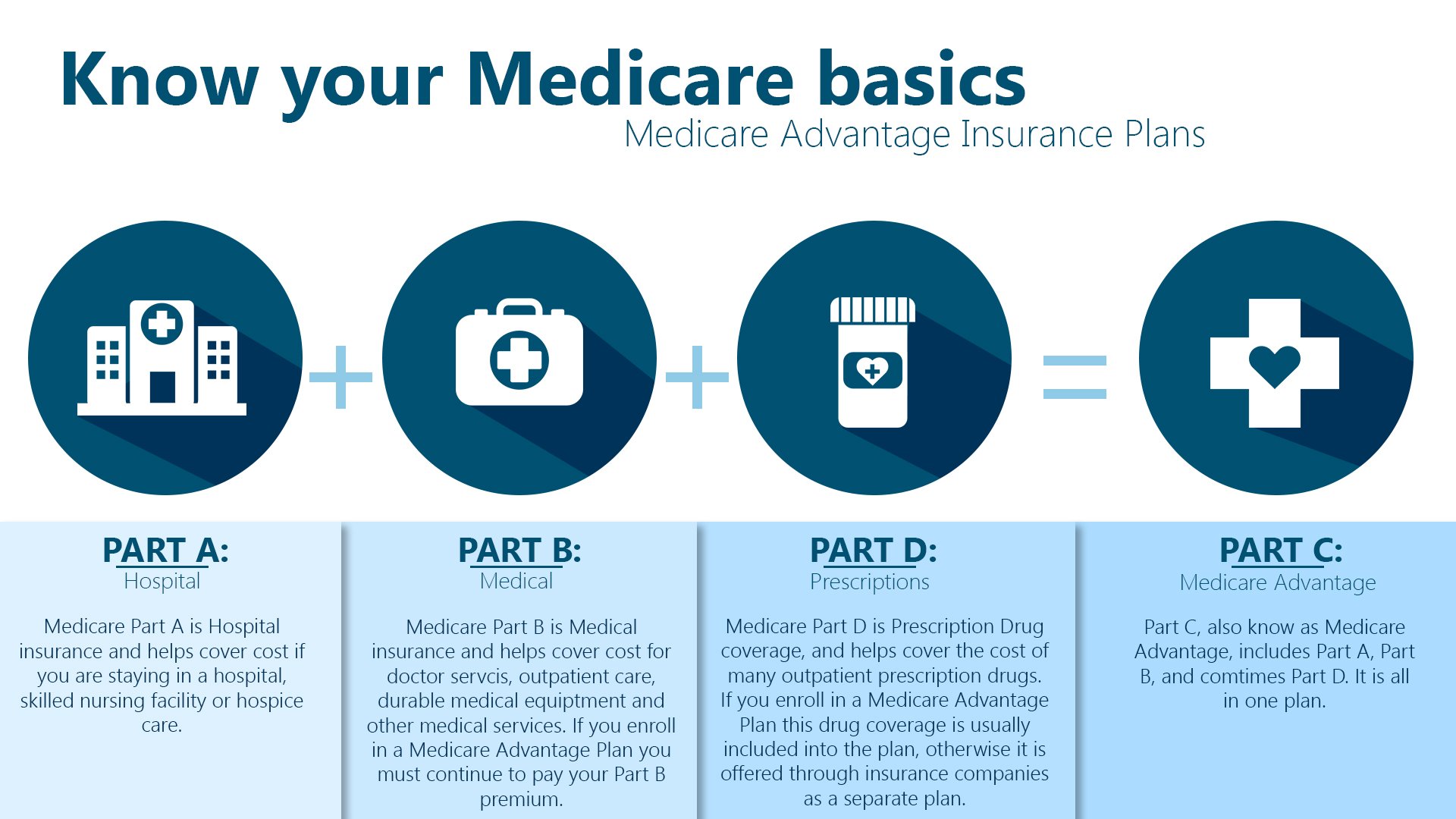

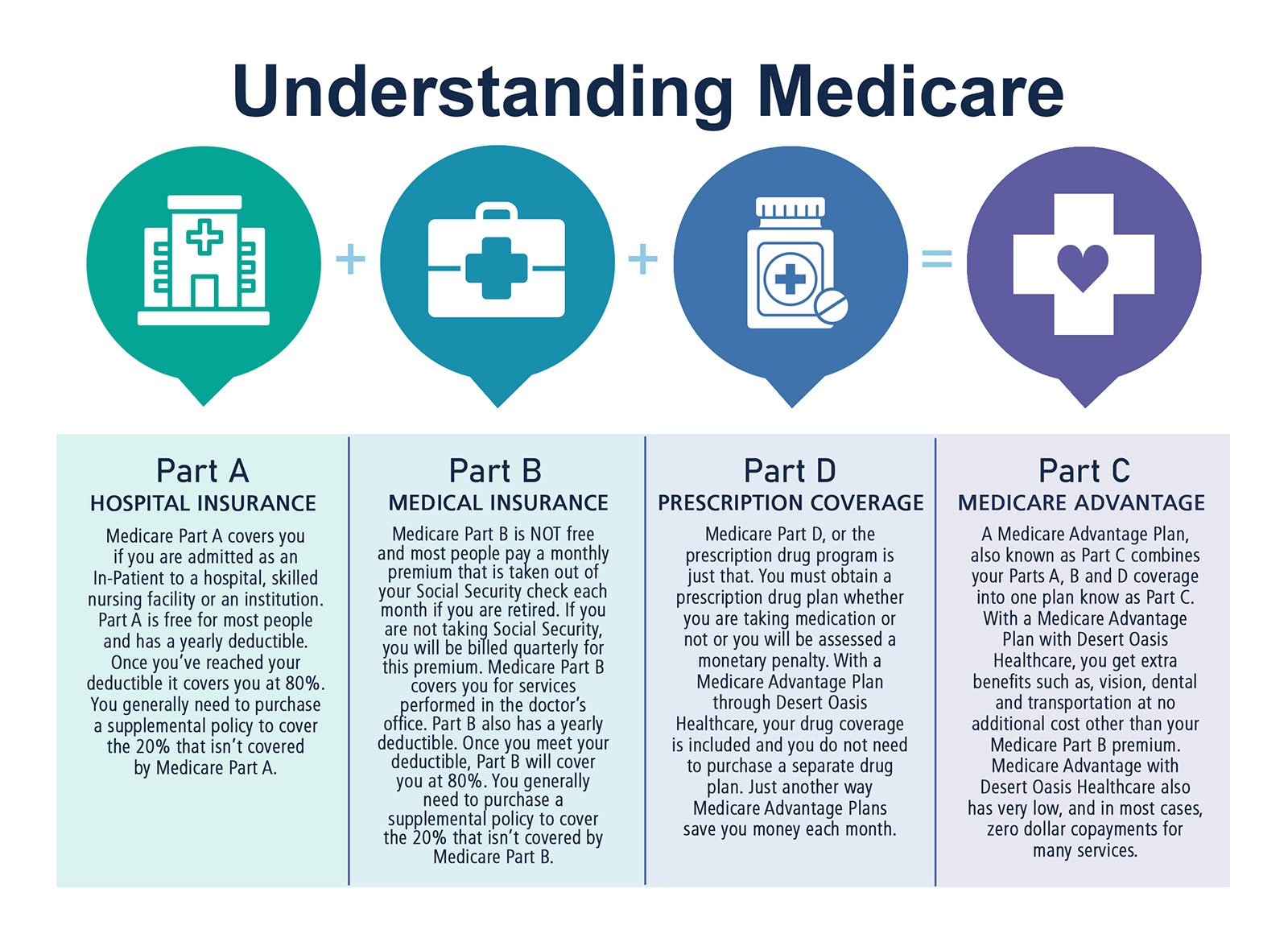

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

What Is The Advantage Of A Medicare Part C Plan

Federal law requires Medicare Part C plans to provide, at a minimum, all the same services provided by Original Medicare Parts A and B. Examples of these services are:

- Inpatient hospital stays and treatments.

- A limited number of days in a skilled nursing facility.

- Inpatient rehabilitation.

- A limited number of days of home health care.

- Outpatient doctors visits.

- Laboratory tests, including blood tests and X-rays.

- Limited mental health services.

- Emergency care, including ambulance transportation.

- Preventive care.

What Is Medicare Part C Special Enrollment Period

Certain life events trigger special enrollment periods when you can switch from one Part C plan to another or sign up for Medicare Part C coverage for the first time. There are several life events that count as SEPs for Medicare Advantage. Many of these SEPs also apply to Medicare Part D prescription drug plans. Some of these SEPs include:

- Plan not renewing or reducing its service area: You can enroll in another MA plan starting December 8 and ending the last day of February.

- Medicare ending the plans contract: You can switch to another MA plan starting the 2 months before the contract terminates and ending 1 full month after the contract terminates.

- Losing eligibility for Medicaid: If you receive a notice that you will no longer be eligible for Medicaid benefits for the current plan year, you will have 2 full months after receiving the notice to join an MA plan. If you will not be eligible for Medicaid the following year, you can enroll in an MA plan between January 1 and March 31 .

- Living in a Part C or Part D service area with an overall 5-star quality rating: You can join an MA plan with an overall 5-star quality rating one time between December 8 and November 30.

Recommended Reading: Does Plan N Cover Medicare Deductible

Find A $0 Premium Medicare Advantage Plan Today

2 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/issue-brief/medicare-advantage-2022-spotlight-first-look.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

What Does Medicare Part C Cover

All Medicare Advantage plans include the same standard benefits as Original Medicare.

Most Medicare Advantage plans also provide prescription drug coverage.

Some Part C plans may also cover benefits such as:

Some Medicare Advantage plans may also cover services such as non-emergency medical transportation, home health care and home modifications such as bathroom grab bars.

Some types of plans restrict your coverage to in-network health care providers.

More info: What does Medicare Part C cover?

Read Also: What Is Step Therapy In Medicare

How Much Does Medicare Part C Cost

If you enroll in a Medicare Advantage plan, you may have to pay some or all of the following expenses:

Some Medicare Advantage plans feature $0 premiums, though $0 premium plans aren’t available in all locations.

54 percent of all Medicare Advantage plans that include prescription drug coverage feature a $0 premium, and 98 percent of Medicare Advantage beneficiaries who have a plan that includes drug coverage are enrolled in a $0 premium plan.1

In the video below, Medicare expert John Barkett explains that Medicare Advantage premiums dropped by around 14 percent in 2020.

What Types Of Medicare Advantage Plans Are Available

There are various kinds of Medicare Advantage plans, such as HMO, PPO, and Private Fee-for-Service plans. HMOs and PPOs each have certain characteristics, whether they are part of a Medicare plan or part of a regular health plan.

For example, an HMO plan typically comes with lower costs but requires you to see providers within a network and get referrals before you see a specialist. A PPO plan typically costs more, but offers more flexible options for seeing providers and may not require any referrals to see specialists.

Read Also: Do You Have Dental With Medicare

What Is The Annual Election Period

The annual election period is the interval in which Medicare beneficiaries can make changes to their coverage. It is also called the annual enrollment period or Medicare open enrollment.

The AEP dates run from October 15 through December 7. During this time, people can change between Original Medicare and Medicare Advantage plans, or between the various Medicare Advantage plans.

Individuals may also change from one Medicare Part D plan to another or enroll in a Part D plan if they did not do so when they were first eligible.

Plans Provide Additional Coverage

Part C plans frequently include benefits in addition to what Original Medicare offers. This can include more preventive care, auxiliary health care services and discount programs. As a part of their unified coverage, most plans also include prescription drug coverage, adding in the benefits that would normally be offered through a separate Part D plan.

| Medical service |

|---|

Cost-sharing benefits on top of Part A and B

Recommended Reading: How To Qualify For Free Medicare

What Does Medicare Advantage Pay For

Part C providers are required by law to offer all of the benefits enrollees would otherwise have with Original Medicare Parts A and B. All of the same inpatient and outpatient services are included in any Part C package, though insurers may offer extra services some seniors are willing to shop for.

Services not covered by Original Medicare include routine dental and vision benefits, hearing aid services and routine foot care. Some MA plans do offer some or all of these services, though they may potentially charge a higher monthly premium or larger coinsurance/copays.

Beneficiaries’ Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries’ choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans’ mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans’ availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .

You May Like: Can You Cancel Medicare Part B

Changes To Medicare Advantage Under Obamacare

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

There was also an initial drop in the number of Medicare Advantage plans being offered. An Avalere Health analysis found a 5 percent drop in the availability of Medicare Advantage plans. In addition, the variety of plan types also dropped, with more Medicare Advantage providers offering only HMO policies instead of PPO, PFFS and Special Needs Plans.

For the 2020 enrollment season, Medicare Advantage customers saw an increase in plan options nationwide, with a total of over 5,000 Advantage plans on the market according to state data that we analyzed from the Centers for Medicare and Medicaid Services.

The donut hole, which is a coverage gap in Medicare, has also been eliminated thanks to measures put into place under the Affordable Care Act. Now, once you reach your drug plans initial coverage limit , youll pay 25 percent of the cost of your medications until you reach the catastrophic limit on the other side.

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

Also Check: Which Insulin Pumps Are Covered By Medicare

Medicare Advantage Plans Must Spend At Least 85% Of Premiums On Medical Costs

The ACA added new medical loss ratio requirements for commercial insurers offering plans in the individual, small group, and large group markets. It also added similar requirements for Medicare Advantage plans, although they took effect three years later, in January 2014.

Medicare Advantage plans must have MLRs of at least 85%, which is the same as the requirement for plans issued to employers in the large group market. That means 85% of their revenue must be used for patient care and quality improvements, and their administrative costs, including profits and salaries, cant exceed 15% of their revenue . The specifics of the calculations are laid out in this HHS regulation from 2013, with the calculation details starting on page 31288.

In the individual, small-group, and large-group health insurance markets, insurers that fail to meet the MLR requirements must send rebates to policyholders . But for Medicare Advantage plans, the rebates must be sent to the Centers for Medicare and Medicaid Services instead.

If a Medicare Advantage plan fails to meet the MLR requirement for three consecutive years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the MLR requirements for five consecutive years, the Medicare Advantage contract will be terminated altogether.

The federal government has ordered several plans to suspend enrollment in 2022 coverage due to a failure to meet the MRL requirements.

What Does A Medicare Advantage Plan Cost

Depending on your Medicare Advantage plan, the costs you pay out-of-pocket can vary:

- You may pay a deductible, a certain amount you must meet before your plan begins to pay.

- There may be copays for doctor visitsthis is a flat fee usually due at the time of the visit.

- You may have to pay a share for lab services and medical equipment.

- You will pay a monthly plan premium if there is one.

- You will continue to pay the Original Medicare Part B monthly premium, as well.

- Additional coinsurance or copays if you see providers outside your plan network.

To help control your costs, make sure you understand the terms of your plan and the out-of-pocket costs you may be required to pay.

Recommended Reading: How To Get Dental And Vision Coverage With Medicare

What Is Medicare Part C Coverage For Outpatient Care

Under Original Medicare, outpatient care is generally covered by Medicare Part B. Outpatient care includes medically necessary services and preventive services to prevent or detect disease. Medicare Part C covers the same benefits as Medicare Part B including:

- Doctor visits

- Laboratory tests and X-rays

Medicare Part C may have different cost sharing amounts for outpatient care than Original Medicare has.

When Can You Sign Up For Medicare Advantage

There are specific times during the year when you can sign up for a Medicare Advantage plan. These are HMO and PPO plans or Part D coverage plans that you can sign up for with a private health insurance carrier. In addition, you can only make changes to your coverage during certain parts of the year. Initial enrollment periods are as follows:

| If youre | ||

| Turning 65 for the first time | Enroll in a Medicare Advantage plan for the first time | During the 7-month period surrounding your 65th birthday |

| Under 65 and disabled | Enroll in a Medicare Advantage plan for the first time | Beginning 21 months after you start receiving SSI or Railroad Retirement benefits and ending the 28th month you get those benefits |

| Already enrolled in Medicare due to disability and you turn 65 | Enroll in a Medicare Advantage plan for the first time -OR-

Switch from one MA plan to a different one -OR- Drop your Advantage plan entirely |

During the 7-month period surrounding your 65th birthday |

| Already enrolled in Medicare Part A but sign up for a Part B plan for the first time during the Part B general enrollment period | Enroll in a Medicare Advantage plan for the first time | From April 1 through June 30 |

The above table is for initial enrollment periods. There are other times when you can make changes to your Medicare Advantage plans or enroll in an MA plan from an existing Original Medicare plan. Alternate enrollment periods are as follows:

Recommended Reading: What Does Medicare Supplement Plan N Cover

What Isn’t Covered By Medicare Part C

Medicare Advantage plans must provide at least the same amount of coverage as Original Medicare. Once a plan meets the minimum requirements, its up to the insurer to determine if additional services are covered.

Depending on the plan selected, Medicare Part C may not cover prescription medications. If it doesnt, you must have other prescription drug coverage. If you have a HMO or PPO, you are not allowed to purchase a separate Part D prescription drug plan. Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care.

If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary. A private room is medically necessary if putting you in a semi-private room would endanger your health or the health of someone else. For example, if you have an infectious disease, Medicare Part C will cover a private room to ensure you remain isolated and prevent the disease from spreading to other patients.

Why Is Medicare Advantage A Bad Choice

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan if you decide to switch to Medigap, there often are lifetime penalties.

Recommended Reading: How Long Does It Take For Medicare To Become Effective

How Does The Government Rate Medicare Advantage Plans

Medicare beneficiaries who have Medicare Advantage plans are more likely to pick a plan with a higher star rating than one with one or two stars according to recent findings. Ratings have a significant impact on the plans that are most popular for Medicare recipients they also help members pick plans with better offerings.

Studies also show that ratings make a difference to consumers because quality matters. With the creation of the online plan quality and ratings finder on Medicare.gov, anyone can quickly find top-rated Medicare Advantage plans for their service areas. However, its important to understand how these plans are rated and what the government looks for when determining the quality of a health insurance plan. Ratings for Medicare plans are based on the following:

- Screenings, tests and vaccines

- Member complaints, improvements, plan performance and issues getting service

- Customer service

Medicare drug plans that are separate from Medicare Advantage are rated slightly differently. These plans are rated according to the following:

- Patient safety and drug pricing accuracy

- Drug plan customer service

- Member complaints, problems with getting drugs and improvements in performance

- Member experiences with the plan

Five Important Myths About Medicare Advantage

Many Americans dont realize what Medicare is or understand how Medicare Advantage works. In particular, they have questions when it comes to private health insurance companies providing a supplement to a government healthcare program. These myths and facts provide some further insight into the current state of Medicare Advantage and how it benefits Americans.

- Prescription drugs

- Exams for hearing aid fittings

- Acupuncture

Don’t Miss: Are Medicare Advantage Plans Hmos