What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Medicare Advantage Plans Must Spend At Least 85% Of Premiums On Medical Costs

The ACA added new medical loss ratio requirements for commercial insurers offering plans in the individual, small group, and large group markets. It also added similar requirements for Medicare Advantage plans, although they took effect three years later, in January 2014.

Medicare Advantage plans must have MLRs of at least 85%, which is the same as the requirement for plans issued to employers in the large group market. That means 85% of their revenue must be used for patient care and quality improvements, and their administrative costs, including profits and salaries, cant exceed 15% of their revenue . The specifics of the calculations are laid out in this HHS regulation from 2013, with the calculation details starting on page 31288.

In the individual, small-group, and large-group health insurance markets, insurers that fail to meet the MLR requirements must send rebates to policyholders . But for Medicare Advantage plans, the rebates must be sent to the Centers for Medicare and Medicaid Services instead.

If a Medicare Advantage plan fails to meet the MLR requirement for three consecutive years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the MLR requirements for five consecutive years, the Medicare Advantage contract will be terminated altogether.

The federal government has ordered several plans to suspend enrollment in 2022 coverage due to a failure to meet the MRL requirements.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Read Also: What Is The Medicare Expansion

Can I Buy A Medicare Supplement Insurance Plan At Any Time

You can enroll in a Medigap plan or change Medigap plans at any time of the year. However, you may be subject to medical underwriting as part of the application process.The best time to buy a Medigap plan, however, is during your Medigap Open Enrollment period or during another time when you have a Medigap guaranteed issue right. This can help protect you from potentially paying higher Medicare Supplement Insurance costs due to your health.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Managing Part C Costs

One of the first things you can do to manage your Medicare Part C costs is to read through the following annual notices from your plan:

- evidence of coverage

- annual notice of change

These notices can help you determine exactly what costs youll pay out of pocket for your plan, as well as any price changes that will take effect the following year.

You May Like: Is Medicare Part D Necessary

Most Medicare Advantage Plans Offer Prescription Drug Coverage

Medicare Advantage plans are an alternative to Original Medicare .

Medicare Advantage plans provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesnt cover.

Some of these additional benefits can include things like:

- Routine dental, vision and hearing care

- Membership to health and wellness programs like SilverSneakers

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patientâs situation worsens, it might be difficult or expensive to switch plans.

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2022 Part B deductible is $233 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Don’t Miss: Which Medicare Plan Covers Prescription Medications

Coverage Choices For Medicare

If you’re older than 65 and not already getting benefits from Social Security, you have to sign up for Medicare Part A and Part B. It doesn’t happen automatically. However, if you already get Social Security benefits, you’ll get Medicare Part A and Part B automatically when you first become eligible .

There are two main ways to get Medicare coverage:

Compare Medigap Plans Where You Live

| TTY 711

1 MedicareAdvantageplan.net internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies MedicareAdvantageplan.net has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

2 AHIP. State of Medicare Supplement Coverage: Trends in Enrollment and Demographics. . https://www.ahip.org/wp-content/uploads/AHIP_IB-Medicare-Supp-Cvg-Report.pdf.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for medicareadvantageplan.net. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

For California residents, CA-Do Not Sell My Personal Info, .

medicareadvantageplan.net is a website owned and operated by MedicareAdvantageplan.net. MedicareAdvantageplan.net represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: Can I Cancel My Medicare

How Much Does Medicare Part C Cost Per Month

You may be surprised how affordable Plan C coverage can be.

Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A , Part B , and prescription drug coverage, Medicare Advantage plans allow you to bundle your coverage together into one simple insurance plan.

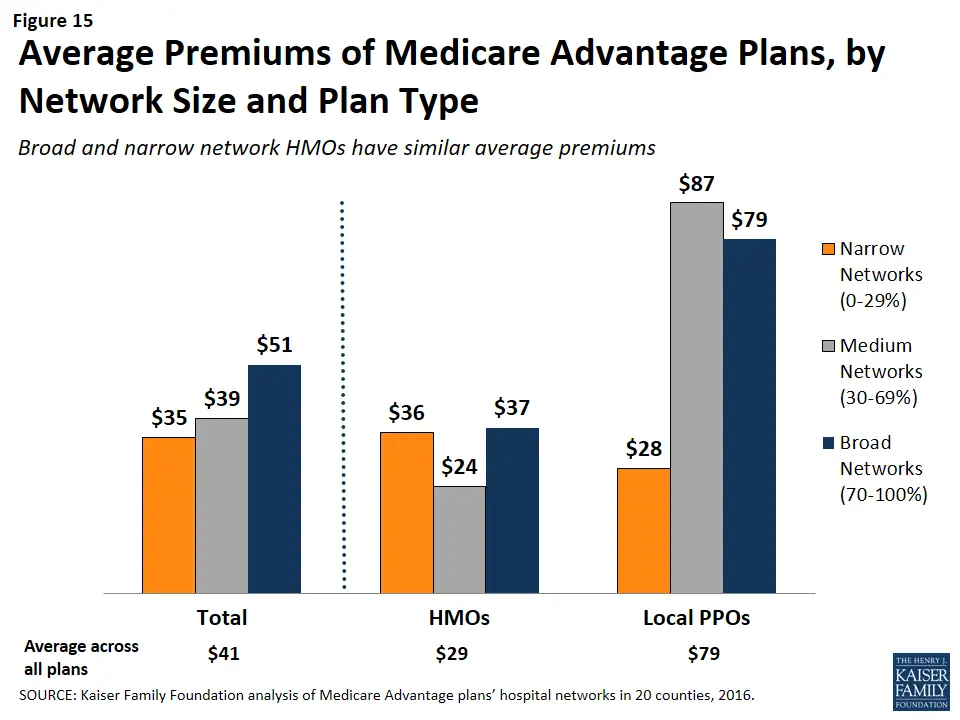

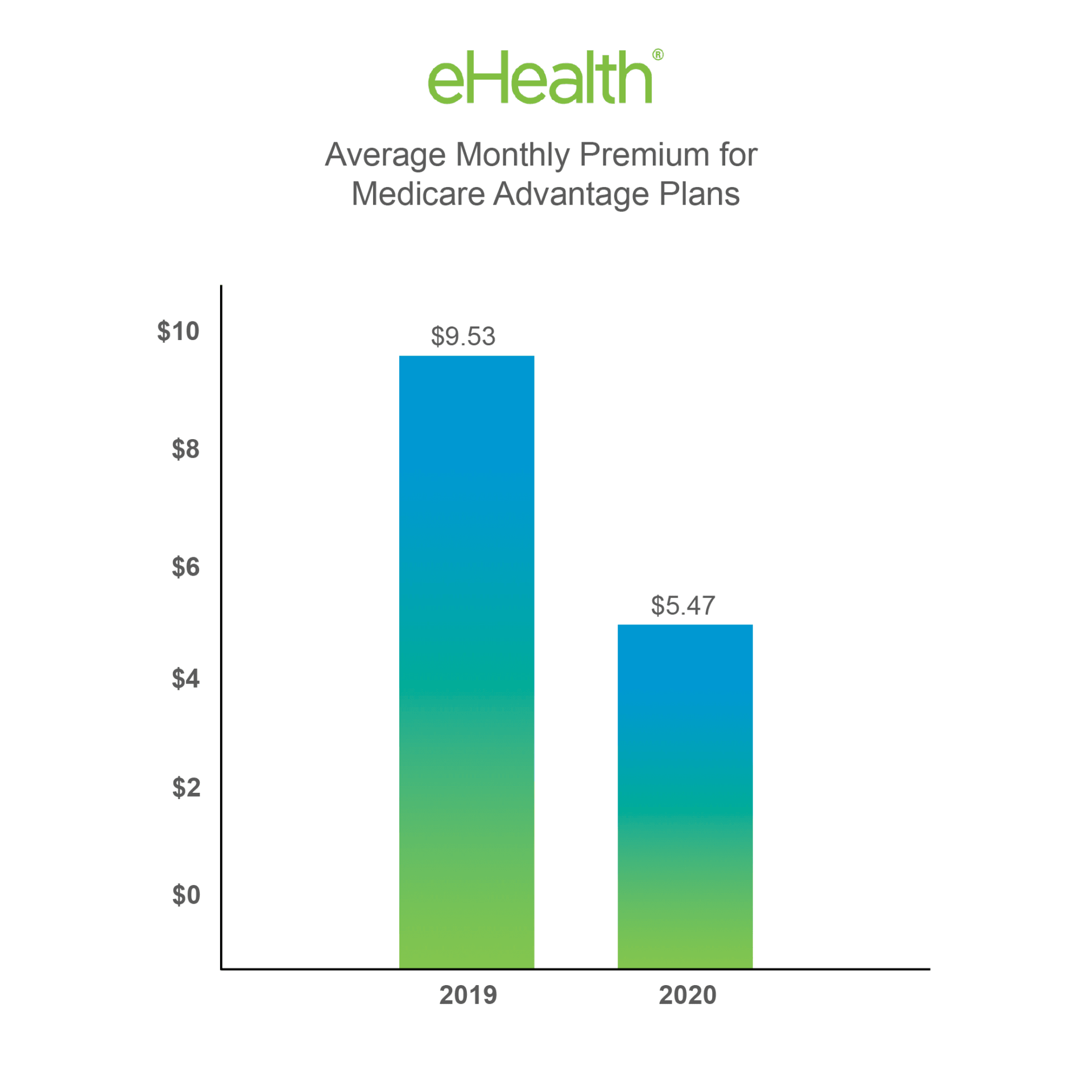

However, Medicare Part C isnt run by the government, so youll have to pay for Medicare Advantage plans. How much does Medicare Part C cost per month? While your actual cost is dependent on several factors, you may be surprised by how affordable Medicare Advantage Plans can be. According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020.

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans.

While the average cost for Medicare Part C is $25 per month, its possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.

However, prices for Medicare Advantage plans can range widely. According to the National Council on Aging, plans can range from $0 to $270 per month. How much youll pay is dependent on your MA plan type.

In general, the lower your deductible, the higher your premium will be.

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

You May Like: What Is Medicare Managed Care

What Can You Expect To Pay For Medicare Advantage

Along with your Medicare Advantage monthly premium, the costs youll incur can include deductibles and cost-sharing .

Heres what we mean:

Deductible: This is the annual cost you must pay out of pocket within a specific period of time. Some Medicare Advantage plans require that you meet a yearly deductible before your coinsurance kicks in.

Coinsurance: This is a percentage of the cost for treatment that you will need to pay. For example, with Medicare Part B, the percentage youll pay is 20%. Medicare Advantage plans share costs with plan members, which means that youll mostly have copays rather than require coinsurance.

Copayment: This is a small, fixed amount you will pay when receiving certain treatments or services. With Medicare, this typically applies to prescription drugs.

The good news is that, unlike Original Medicare, all Medicare Advantage plans must set an out-of-pocket limit for their plan members.

Some general information to consider:

- You must pay for Medicare Part B plus your monthly Advantage premium. However, some Advantage plans all or part of your Part B premium.

- There is typically one annual deductible you must meet. This varies by plan. Some higher-premium plans have a $0 deductible.

Top Rated Assisted Living Communities By City

In 2021, seniors paid an average of $21 a month for their Medicare Advantage plans. Available plans vary by state, and monthly premiums vary too: Some plans pay for a persons Medicare Part B premiums, while other plans include extra benefits, like dental and vision coverage. Usually, seniors can choose at least one plan with no monthly premium costs at all, although zero-premium plans often carry a higher deductible

Also Check: Does Medicare Cover Heart Catheterization

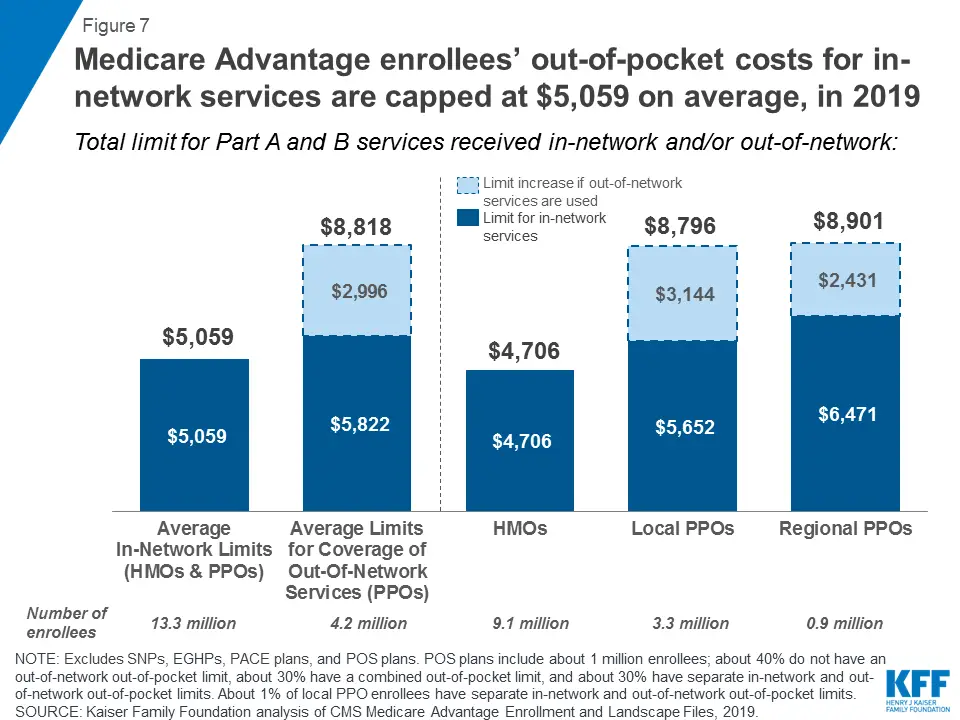

Consider Your Potential Out

Medicare sets limits on how much a Medicare Advantage plan can require you to pay out-of-pocket each year. In 2022, the limit is $7,550 for in-network services and $11,300 combined for in-network and out-of-network services.

The average is considerably lower than those limits, but it can still cost you thousands of dollars.

What Happened To Plan C And Plan F In 2020

Some Medicare beneficiaries commonly ask, Is Medicare Supplement Insurance Plan F ending?

The answer is that Plan F, as well as Plan C, are not ending. Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020.

If you already had Plan C or Plan F before 2020, you will be able to keep your plan. If you became eligible for Medicare before 2020, you may still be able to buy either Plan C or Plan F if either is available where you live.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Don’t Miss: Where Do I Apply For Medicare Card

Average Cost Of Medicare Advantage Plans By State In 2022

Home / FAQs / Medicare Advantage / Average Cost of Medicare Advantage Plans by State in 2022

Unlike Original Medicare , the price of Medicare Advantage plans varies depending on where you live. Thus, the average cost of Medicare Advantage is different in each state. Check the chart below for the average monthly premium and prescription drug deductible of Medicare Advantage plans in your state.

Get A Free Quote

Find the most affordable Medicare Plan in your area

What Does The Future Look Like For Medicare Advantage

Medicare Advantage plans are an integral part of the Medicare program. They provide beneficiaries a multitude of options and offer additional benefits to enrollees. As the popularity of these plans continues to grow and enrollment rises, however, the Medicare program will face several challenges. First, higher costs relative to traditional Medicare will strain federal spending and the solvency of the Hospital Insurance trust fund. Second, increased enrollment could necessitate changes to the payment system for Medicare Advantage plans. Third, questions remain about the quality of Medicare Advantage plans relative to traditional Medicare.

With Medicare Advantage plans predicted to soon become the dominant form of Medicare coverage, it will be important to assess beneficiaries experiences and the long-term sustainability of the program to ensure Medicare Advantage plans provide effective, efficient, and equitable care.

Recommended Reading: Does Medicare Cover Enbrel Injections

Slightly More Than Half Of All Medicare Advantage Enrollees Would Incur Higher Costs Than Beneficiaries In Traditional Medicare For A 6

Medicare Advantage plans have the flexibility to modify cost sharing for most services, subject to limitations. Total Medicare Advantage cost sharing for Part A and B services cannot exceed cost sharing for those services in traditional Medicare on an actuarially equivalent basis. Further, Medicare Advantage plans may not charge enrollees higher cost sharing than under traditional Medicare for certain specific services, including chemotherapy, skilled nursing facility care, and renal dialysis services.

However, Medicare Advantage plans may reduce cost sharing as a mandatory supplemental benefit, and may use rebate dollars to do so. According to the Medicare Payment Advisory Commission , in 2021, about 46 percent of rebate dollars were used to lower cost sharing for Medicare services.

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day. In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,484 in 2021 with no copayments until day 60 of an inpatient stay .

What If You Want To Leave Medicare Advantage And Switch To Original Medicare

If you change your mind and want to switch back to Original Medicare in the future, youll be able to do so during the annual open enrollment period or the annual Medicare Advantage open enrollment period Youll have an opportunity to also enroll in a Medicare D plan at that point, regardless of how long youve been enrolled in Medicare Advantage.

But if youve been on the Medicare Advantage plan for more than a year, there is no requirement that Medigap plans be guaranteed issue for people switching back from Medicare Advantage to Original Medicare. So if youve got health conditions, it may be expensive or impossible to get another Medigap plan .

If youve been in the Medicare Advantage plan for less than a year, youre still in your trial period and you do have the option to enroll in a guaranteed issue Medigap plan when you switch back to Original Medicare. If you enrolled in Medicare Advantage when you were first eligible and are switching to Original Medicare within a year, you can enroll in any Medigap plan sold in your state. If you dropped your Medigap plan to enroll in a Medicare Advantage plan and you switch back within a year, you can enroll in the Medigap plan you had before, or if its no longer available, you can enroll in any plan A, B, C, F, K, or L sold in your state .

Also Check: What Age Am I Medicare Eligible

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

TTY 711, 24/7

A closer look at 2021 data also reveals:

- Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

- All states except for Alaska offer at least one $0 monthly premium Medicare Advantage plan. $0 premium plans may not be available in all locations within each state.

In addition to premiums, many Medicare Advantage plans typically include some out-of-pocket expenses. These can include plan deductibles, copayments or coinsurance and an out-of-pocket spending maximum.

Disadvantages Of Medicare Part C

- Limited range of service providers: Depending on the insurance provider you use, you may be required to stay within the service providers network. If you choose to see a medical professional outside of the network, you may face higher fees and out-of-pocket costs. This can be detrimental if you already have a long-standing patient-provider relationship with an out-of-network medical professional.

- An overwhelming number of plan options: In most states, there are multiple health insurance companies offering a variety of Medicare Part C plans. If you live in an area with many plan providers, comparing all of these options can quickly become a headache.

- Coverage may be limited by state: Many health insurance providers are only licensed to offer plans in a limited number of states. This means that if you sign onto a Part C plan in 1 state and you decide to move, your coverage may not be valid in your new location. This is not a problem with original Medicare Part A and Part B, and the insurance is offered by the federal government and can be applied in any state.

Recommended Reading: What Does Medicare Cost Me

Don’t Miss: Does Medicare Cover Hearing Test For Tinnitus