Understand Medicare In Illinois

Medicare, the United States federal medical insurance program, provides coverage for about 1.5 million people in Illinois who qualify for Medicare. You can get Medicare if youre 65 or older or have a qualifying disability.

Your disability typically qualifies if youve received at least 24 Social Security or Railroad Retirement Board disability insurance payments. You can also enroll in Medicare Advantage Plans if you have End-Stage Renal Disease or amyotrophic lateral sclerosis .

Most people have premium-free Part A but, if you have to buy it, the cost can reach up to $499 per month in 2022. Part B costs $170.10 per month but can be more if you have higher income. There are 101 Medicare Advantage Plans in the state that are an alternative to Original Medicare. Learn more about your Medicare options in Illinois.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

When Should I Apply

Typically, if you are receiving benefits either from Social Security, disability or Railroad, you should receive information in the mail three months prior to turning 65. In fact, enrollment in Medicare Parts A and B is automatic if you live in one of the fifty states or Washington D.C. However, because the premium for Part B is deducted from your Social Security benefits, you have the right to refuse. Keep in mind you are automatically signed up for Part A, but not for Part B. You have a 7-month period your initial enrollment period to sign up for Medicare Part B, and this period begins three months before the month of your 65th birthday. If you are not receiving benefits currently, it is your responsibility to contact Social Security three months prior to turning 65. Even if you do not plan on retiring at age 65, you can still sign up.

Medicare is available to everyone over the age of 65 and those under 65 with a disability or kidney failure. You will automatically be enrolled in Medicare Part A but you must take steps to enroll in Part B as this is not automatic.

Suzon was very pleased with Lilly being professional, knowledgeable and great at what she does.S. Lanz, Woodridge

Debbie was so polite. She didnt make me feel incompetent when I didnt understand something.S. Scheibly, Decatur

Kathleen was helpful and provided me with information quickly!M. Greaney, Oak Lawn

Don’t Miss: Does Medicare Pay For Mobility Scooters

Whos Eligible For Medicaid For The Aged Blind And Disabled In Illinois

Medicare covers a wide range of services including hospitalization, physician services, and prescription drugs but Original Medicare doesnt cover important services like vision and dental benefits. Some beneficiaries those whose incomes make them eligible for Medicaid can receive coverage for those additional services if theyre enrolled in Medicaid for the aged, blind and disabled .

In Illinois, Medicaid ABD now covers extensive dental benefits for adults. These services were added to the Medicaid benefit applicable to Medicare beneficiaries in 2019, and are available for a small co-payment.

Medicaid ABD also covers one pair of eyeglasses every two years for adults.

In Illinois, Medicaid ABD is called Aid to the Aged, Blind and Disabled .

Asset limits: The asset limit is $2,000 if single and $3,000 if married.

Help with prescription drug expenses in Illinois

Medicare beneficiaries who are enrolled in Medicaid, an MSP, or Supplemental Security Income also receive Extra Help a federal program that lowers prescription drug costs under Medicare Part D. Beneficiaries can also apply for Extra Help if they dont receive it automatically. The income limit is $1,615 a month for singles and $2,175 a month for couples, and the asset limit is $14,610 for individuals and $29,160 for spouses.

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Read Also: How Old To Get Medicare Benefits

Medicare Advantage Plans In Illinois

Medicare Advantage is privately offered health insurance, also known as Medicare Part C. It is an all-in-one alternative option to the federal Medicare Parts A and B, or Original Medicare, program. Unlike Original Medicare, where all participants receive the same coverage, Medicare Advantage plans have different levels of coverage and cost. All Medicare Advantage plans have to provide the same level of coverage as Original Medicare, but many have additional benefits for members, such as hearing, dental and prescription drug coverage. The out-of-pocket costs for Medicare Advantage participants also tend to be lower than the Original Medicare costs. The downside is that Medicare Advantage plans tend to limit the options participants have when choosing their health care providers.

The popularity of Medicare Advantage varies widely between states. The rate of Medicare Advantage participants across the 50 states ranges from 1% of total Medicare recipients in Alaska to 47% in Hawaii. The rate in Illinois is 27%, which is lower than nearby Wisconsin and Minnesota, which have rates of 46% and 48% respectively. However, the popularity in many other Midwestern states is lower. In neighboring Iowa, the rate is 24%, and in Nebraska, which has the lowest rate in the Midwest, only 19% of Medicare beneficiaries have signed up for Medicare Advantage.

How To Qualify For Automatic Enrollment

Some people dont have to follow any of the above steps and are enrolled in Original Medicare automatically. If any of the following situations apply to you, youll automatically be enrolled in Original Medicare, and youll get your card in the mail:

- If youre already receiving retirement benefits from Social Security or the Railroad Retirement Board , and youre approaching 65

- If your employer benefits allow you to delay Medicare past 65, but you decide to draw retirement benefits through Social Security or the RRB

- If you have a disability that qualifies you for Medicare, even if youre under 65

Read Also: How To Find Someone’s Medicare Number

What Illinois Medicare Plans Are Available

Residents living in the state of Illinois can qualify for Medicare Part A, Medicare Part B, a Medicare Advantage Plan, Medicare Part D and privately offered Medicare Supplement plans. Since the cost of Medicare is mitigated by Social Security, the cost for coverage might vary depending on your personal situation. Understanding your financial responsibility is important so that you are able to make appropriate financial plans for your medical care. The Medicare plans available in Illinois are the following.

Medicare Advantage plans are not nearly as popular as traditional Medicare in Illinois. During 2020, 1.6 million Illinoisans were enrolled in traditional Medicare plans compared to 600,000 who selected a Medicare Advantage plan. Your personal needs and any underlying health concerns determine which plan is right for you. If you have a health condition that requires ongoing care, you may want to enroll in a Medicare Supplement plan to lessen your long-term financial burden.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: Do I Have To Have A Medicare Drug Plan

Important Dates To Know:

Your Personal Initial Enrollment Period This is the period during which you can enroll in Medicare for the first time. It is unique to the month you turn 65. It is a 7-month period:

- The three months before your 65th birthday month

- Your birthday month

- The three months after your 65th birthday month

For example, if you were born in June, your window to enroll is March 1 through September 30.

Annual Enrollment Period This is the period set by HCSC. If you have multiple plan options, the Annual Enrollment Period gives you the chance to switch to a different Medicare plan for the following year. Because your health care and/or financial needs may change from year to year, the Annual Enrollment Period is a good time to review your options. That way, you can make sure the coverage you have it still the coverage that works best for you.

If you decide to leave your HCSC retirement plan, you will not be able to rejoin a plan at a future date. Please contact HCSC Employee Services for more information.

Special Enrollment Period If you do not enroll during your IEP, special circumstances including late retirement allow you to sign up for Part A and/or B during a Special Enrollment Period . To learn more about SEPs refer to your Medicare & You handbook or go to www.medicare.gov.

Is It Difficult To Sign Up For Medicare Online

Signing up for Medicare is not tricky, but it can be a bit time-consuming.

Our agents here at Sams/Hockaday recommend grabbing your favorite beverage of choice, kicking your feet up, and taking your time! They say it takes at least 30 minutes, even though the SSA says it takes around 10.

Sign up online if you can â going to your local SSA office takes even longer.

Also Check: How To Cancel Medicare Online

Applying For Medicare Over The Phone

Applying by phone is another good option that works for many. Just follow these simple steps.

If you apply over the phone, you will need to send in documents such as your original birth certificate to verify your identity. If this makes you nervous, applying in person is probably your best bet.

You May Be Eligible For Medicare Before You Turn 65

As a valued HealthLink member, we want to make sure you’re aware of all of the resources available to help control your health care costs.

You may be eligible for Medicare before you turn 65 if you meet one of these guidelines:

- Have received Social Security disability benefits for at least two years

- Have been diagnosed with Lou Gehrig’s Disease, also called Amyotrophic Lateral Sclerosis AND are starting to receive SSDI

- Have been diagnosed with End Stage Renal Disease AND have been on dialysis for three months OR have had a kidney transplant

You Can Also Keep Your Current Plan

If you meet these requirements and are eligible for Medicare, you may be able keep your current HealthLink health plan while you receive Medicare benefits.

You Must Apply

Because Medicare eligibility rules are complex, it is recommended that you call Social Security at 800-772-1213, or visit your local Social Security office, to get the most accurate information regarding your particular situation. You can also apply for Medicare online at www.ssa.gov.

Questions?

You can call HealthLink Customer Service at 800-624-2356.

If you have ALS or ESRD and are not enrolled in HealthLink Case Management, call 877-284-0102 to enroll. Our Case Managers can help you navigate the health care system and offer added support when you need it.

Also Check: Does Medicare Pay For Hospital Beds At Home

Applying For Medicare In Person

Although applying in person is not as convenient as applying online or over the phone, it has an advantage over the other methods: you can bring your precious documents to the office, where theyll stay securely with you the whole time.

This is the best option for some folks, like legal permanent residents, for example. Foreign birth certificates or immigration documents are not only costly but also difficult to replace, and the Social Security Administration even asks you not to mail them.

If you want to apply in person, heres what the process looks like for you:

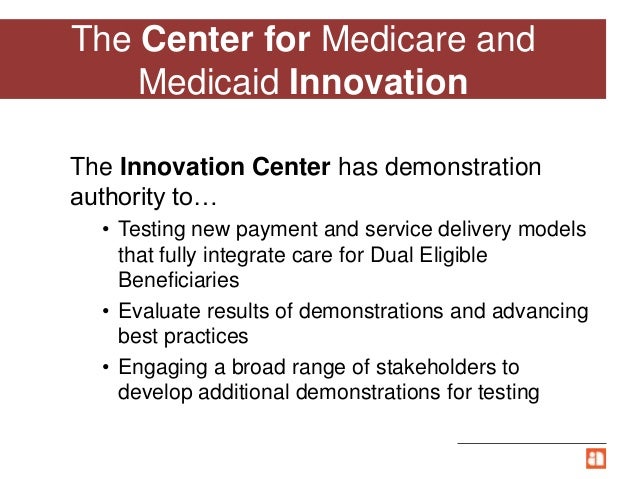

Getting Help With Medicare Advantage In Illinois

Although Medicare is an invaluable resource for many seniors, its vast array of plans and options can be confusing for people new to the program. Each plan has different coverage, costs and elements, so it can be difficult to identify the right plan for an individuals needs. There is a range of government and other sources at the state and local level that can help seniors navigate the system and find the best coverage. Below are some resources that can help Illinois seniors.

You May Like: Can A 60 Year Old Get Medicare

If You Have Other Prescription Drug Coverage

If you already have prescription drug coverage through an employer or union, check with your plan administrator. Your plan administrator can help you learn how your plan works with Part D. You need to learn whether your drug coverage is at least as good as Medicares standard drug coverage. This is called creditable coverage. If you continue to have employee or retiree prescription drug coverage, you have 3 choices:

- If your plan covers as much as or more than Medicares standard drug plan, you can keep it. Here, you don’t have to buy Medicare drug coverage. You can later enroll in a Medicare Part D plan without paying the penalty described above. This is as long as you enroll within 63 days of losing or dropping your coverage.

- If your plan covers less than Medicares standard drug plan, you can drop it and buy Medicare drug coverage. Be sure to find out if you can drop your current drug coverage without losing needed health benefits. Also know that if you drop your employer-based coverage, you may not be able to get it back. If you drop coverage for yourself, you may also have to drop coverage for your spouse and dependents.

- If your plan will work with Medicares drug coverage, you can keep it and buy Medicare drug coverage, as well.

Medicare Eligibility In Illinois

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

Do you have questions regarding your Medicare eligibility in Illinois? HealthMarkets can provide answers and help you find the right Medicare plan.

Illinois has more than 2 million residents enrolled in a Medicare plan as of 20201 and over 49% of Medicare beneficiaries who applied for Extra Help with their prescription drug plan costs were approved.2

Are you ready to see what you could be eligible for?

Read Also: Does Medicare Cover Eylea Injections

Medicare Eligibility And Requirements

- Are you age 65 or older and have Social Security or Railroad Retirement Board benefits?

- Are you under age 65 with certain disabilities?

- Do you have ALS or, at any age, End-Stage Renal Disease?

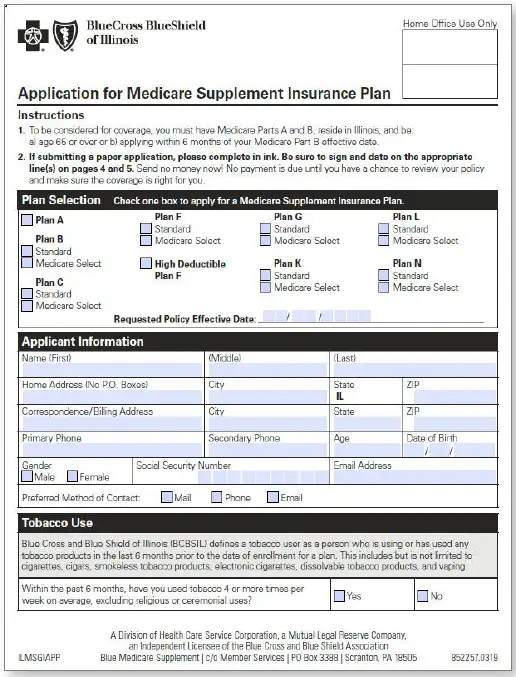

To be eligible for a Medicare Supplement insurance plan, you must have Medicare Part A and Part B.

To be eligible for a Medicare Part D or Medicare Advantage plan, you must be entitled to benefits under Medicare Part A and/or enrolled under Part B.

You must continue to pay your Medicare Part B premium.

Are Illinois Teachers Eligible For Medicare

Yes, Illinois teachers who are U.S. citizens are eligible for Medicare when they turn 65.3

It is important to note that group Medicare Advantage plans for Illinois teachers may be available depending on if your school district has selected a group retirement plan. Consult with your school district administrators to learn more about your what specific benefits are offered to you.

Recommended Reading: How Much Is Part B Medicare For 2020