Making Medigap Plan Changes

For Medigap plans, enrollment periods are a little different. Its best to buy a Medigap policy during the 6-month period immediately after you first enroll in Medicare Part B.

You may be able to buy a Medigap plan after that, but there are no guarantees that an insurance company will sell you a policy.

Even if youre able to get a Medigap policy after the initial enrollment period, you may have to pay more.

Original Medicare Vs Medicare Advantage

It’s important to learn about the differences in coverage, cost and care provider rules because these will impact how you decide which option is best for you. Read below to learn about each in detail below.

| Original Medicare | |

|---|---|

| Includes hospital coverage + medical coverage | Combines hospital coverage + medical coverage + additional health benefits under one plan |

| Does not provide prescription drug coverage | Often includes prescription drug coverage |

| Does not provide additional health benefits | Can include additional health benefits – dental, vision, hearing, fitness |

| Provided by the federal government | Provided by private insurance companies with varying benefits, costs and coverage options based on location and provider |

Unitedhealthcare And Humana Have Consistently Accounted For A Relatively Large Share Of Medicare Advantage Enrollment

UnitedHealthcare has had the largest share of Medicare Advantage enrollment and largest growth in enrollment since 2010, increasing from 20 percent of all Medicare Advantage enrollment in 2010 to 28 percent in 2022. Humana has also had a high share of Medicare Advantage enrollment, though its share of enrollment has grown more slowly, from 16 percent in 2010 to 18 percent in 2022. BCBS plans share of enrollment has been more constant over time, but has declined moderately since 2014. CVS Health, which purchased Aetna in 2018, has seen its share of enrollment nearly double from 6 percent in 2010 to 11 percent in 2022. Kaiser Permanente now accounts for 6% of total enrollment, a moderate decline as a share of total since 2010 , mainly due to the growth of enrollment in plans offered by other insurers and only a modest increase in enrollment growth for Kaiser Permanente over that time. However, for those insurers that have seen declines in their overall share of enrollment, the actual number of enrollees for each insurer is larger than it was in 2010.

Read Also: What Is The Cheapest Medicare Plan

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, youll pay nothing for services Part A and Part B cover.

Variation In Population Size And Characteristics

Medicare spending and enrollment varies across the Nation according to the distribution of beneficiaries and their individual characteristics. Altogether, almost 34 million elderly are covered by the program. Persons age 65 or over represent 85.7 percent of all Medicare beneficiaries. The rest qualify for Social Security as disabled persons or because they have end stage renal disease . In 1998, the program spent $211 billion covering these persons’ acute care needs .

About 35 percent of all beneficiaries live in one of five States: California, Florida, New York, Pennsylvania, and Texas . In Florida and Pennsylvania, beneficiaries represent both large numbers of patients and a large proportion of the States’ residents . In California, New York, and Texas, the beneficiaries represent 15 percent or less of the population, but the sheer number of enrollees makes Medicare an important economic force in these States. Even in certain rural States, such as Arkansas, Iowa, Maine, and West Virginia, Medicare insures almost one-fifth of the population, making an important contribution to each State’s financing and delivery system.

Also Check: When Can You Change Your Medicare Supplement Plan

Can I Change My Medicare If I Move

You can switch to a new plan in the new service area. Or you can leave your Medicare Advantage plan and enroll in Original Medicare. If you have new plan options in your new area, you can switch to a new Medicare Advantage plan or Medicare prescription drug plan during your special enrollment period.

Differences In Medigap Plans Between States

Medicare Supplement insurance also known as Medigap policies help you cover your out-of-pocket expenses if you have Original Medicare. Its the only private Medicare-related insurance for which the federal government does not set a mandatory open enrollment period.

You have six months starting with your 65th birthday and once youre enrolled in Medicare Part B to buy a Medigap policy available in your area.

After that, youre often locked into the Medigap plan you choose. It is difficult or extremely expensive to switch to another Medigap plan in most states.

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Examples of Rare State Rules for Medigap

Medicare does not require states to guarantee access to Medigap plans for people under 65 who qualify for Medicare due to a disability such as End-Stage Renal Disease or ALS . But most states have some type of rule in place giving people with these conditions access.

Don’t Miss: What Is Medicare Extra Help

Medicare Advantage And Part D

Federal guidelines call for an annual open enrollment period for Medicare Advantage and Medicare Part D coverage in every state. Theres also a Medicare Advantage open enrollment period that allows people who already have Medicare Advantage to switch to a different Advantage plan or switch to Original Medicare. But while these provisions apply nationwide, plan availability and prices are different from one state to another.

Medicare uses a star rating system for Medicare Advantage and Part D plans, and the availability of high-quality plans is not the same in every state.

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only about one percent of the Medicare population enrolled in Advantage plans in Alaska. Contrast that with 55% enrollment in Minnesota.

Part D prescription drug plan availability differs from state to state as well, with the number of plans for sale in 2022 varying from 19 to 27, depending on the region. The number of available premium-free prescription plans for low-income enrollees varies from four to nine, depending on the state.

Will Moving To Another State Affect My Medicare Coverage

- Medicare is a federal healthcare program, so moving from one state to another will not affect your basic benefits from original Medicare.

- Optional Medicare products, like Medicare Advantage plans, might change if you move out of state.

- If you have a plan from a private health insurance provider, contact the company before you move to prepare for any benefit changes.

Moving is a lot of work, especially if youre making a big move from one state to another. The good news is your original Medicare coverage will stay the same, no matter what state you live in.

However, moving to a new state can impact your other optional benefits, such as a Medicare Advantage or Part D plan.

Below, well explain when moving out of state can affect your Medicare options and benefits, plus what you need to do to prepare.

Medicare is a federal healthcare program that funds medical care for people ages 65 and over or those who have certain health conditions or disabilities.

Because its a federal program, Medicare provides services in every part of the country. So it doesnt matter which state you live in your basic Medicare coverage will stay the same.

Although your Medicare coverage wont end or change when you move, youll often need to find new providers who participate in Medicare. Doctors must accept Medicares payment terms and meet certain requirements to participate in the program.

- U.S. Virgin Islands

You May Like: How To Qualify For Medicare Part B

Drug Coverage In Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage . You can join a separate Medicare Prescription Drug Plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- Youre in a Medicare Advantage HMO or PPO.

- You join a separate Medicare Prescription Drug Plan.

Note:

Keeping Your Coverage If You Move

If you are moving to another county or state, make sure your Medicare plan will still be in effect after you move.

If you have original Medicare, federal rules usually allow you to keep your Medicare supplement policy. There are exceptions to this if you have a Medicare Select plan or if you have a plan that includes added benefits, such as vision coverage or discounts that were available only where you bought the plan.

If you have a Medicare Advantage plan, ask the plan whether its available in your new ZIP code. If the plan isnt available, youll have to get a new one. You can switch to another Medicare Advantage plan in your new area or to original Medicare.

Don’t Miss: Is Medicare A Social Security Benefit

Ask If Your Doctor Accepts Assignment

Assignment is an agreement between doctors and other health care providers and Medicare. Doctors who accept assignment charge only what Medicare will pay them for a service. You must pay any deductibles, coinsurance, and copayments that you owe.

Doctors who dont accept assignment may charge more than the Medicare-approved amount. You are responsible for the higher charges. You also might have to pay the full cost of the service at the doctors office, and then wait to be reimbursed by Medicare.

Use your Medicare Summary Notice to review the charges. You get a Medicare Summary Notice each quarter. If you were overcharged and werent reimbursed, follow the instructions on the notice to report the overcharge to Medicare. The notice will also show you any deadlines to complain or appeal charges and denied services. If you are in original Medicare, you can also look at your Medicare claims online at MyMedicare.gov.

Medicare has a directory of doctors, hospitals, and suppliers that work with Medicare. The Physician Compare directory also shows which providers accepted assignment on Medicare claims.

States That Have No Coverage Requirement For Insurers But Some Coverage Is Available

Iowa Insurers are not required to offer Medigap plans to people under 65.

New Mexico Insurers are not required to offer plans to people under 65.

South Carolina Insurers dont have to offer Medigap plans for people under 65.

Utah Insurers dont have to offer Medigap plans for people under 65.

West Virginia Medigap plans are not offered for people under 65.

Wyoming Only two insurance companies offer Medigap plans for people under 65.

Please visit Medicare.gov for more information.

You May Like: Is Passport Medicaid Or Medicare

What To Do When Moving To Another State With Medicare

When it comes to moving, many people create a checklist to stay organized in the process. As a Medicare beneficiary, one thing you will need to add to your list is Updating Medicare.

This is not as simple as it may seem, as not all Medicare parts are transferable between states. For example, Medicare Advantage and Medicare Part D drug plans are offered based on the residential area you live in.

When you move out of that area, you need to notify your Medicare Plan providers. Its important to inform the right parties within the allotted timeframe, so you dont accidentally end up with a lapse in coverage.

If youre enrolled in a Medicare supplement, the rules are slightly different, but your policy may change in price depending on where you move to.

The 10 Standard Medicare Supplement Insurance Plans

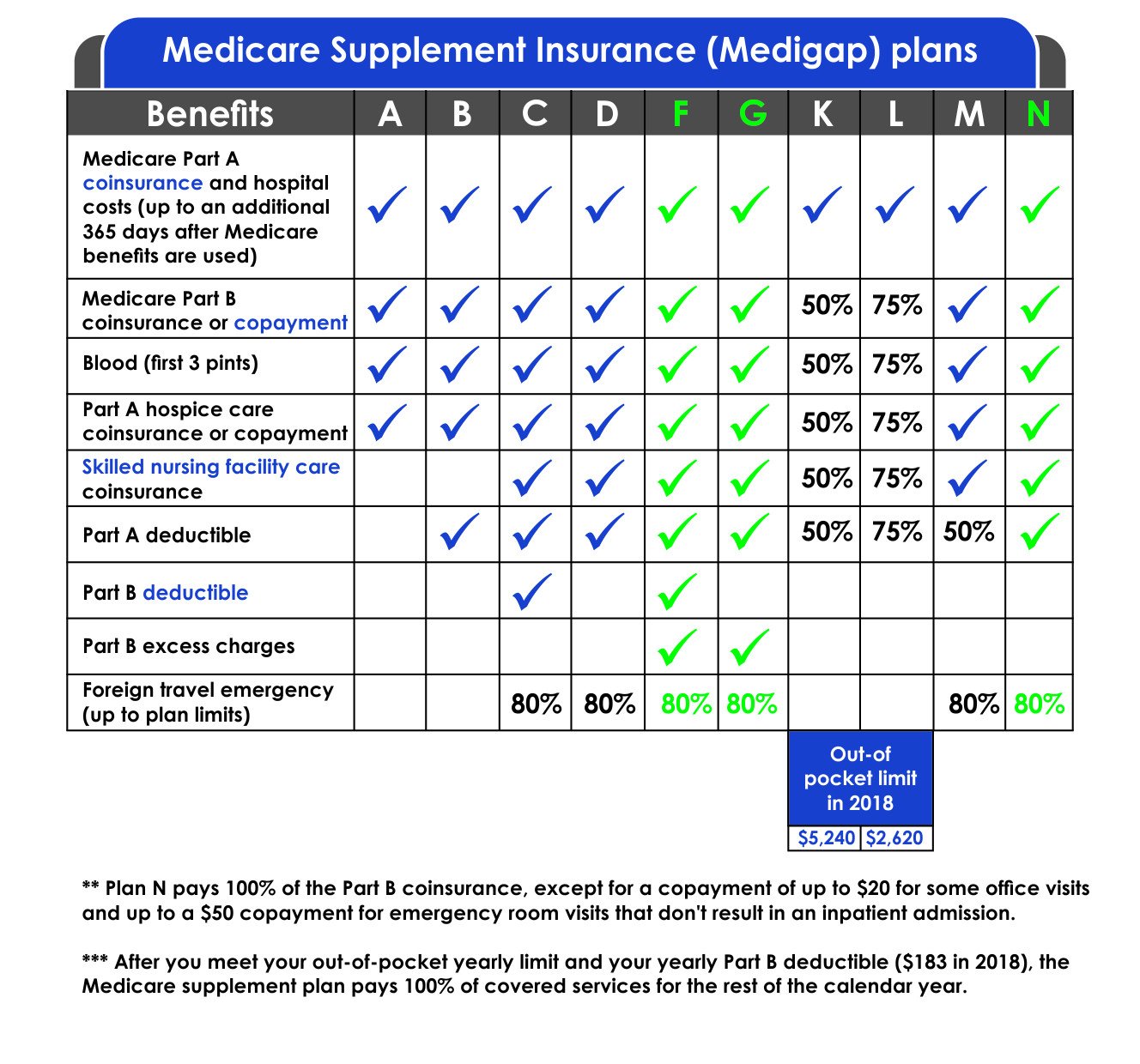

There are 10 Medicare supplement insurance plans. Each plan is labeled with a letter of the alphabet and has a different combination of benefits. Plan F has a high-deductible option. Plans K, L, M, and N have a different cost-sharing component.

Every company must offer Plan A. If they offer other plans, they must offer Plan C or Plan F.

Read Also: Is There A Charge For Medicare Part B

How Is Medicare Different In Each State

Original Medicare is made up of Medicare Part A and Medicare Part B. These parts of Medicare cover your inpatient services, outpatient services, durable medical equipment, and more. No matter where you live in the U.S. Original Medicare coverage will be the exact same. This is because Original Medicare is regulated by the federal government.

Once you have enrolled in Original Medicare, you can enroll in Medicare Part D plans which cover the cost of prescription drugs.

To supplement your Original Medicare benefits, you can enroll in a Medicare Supplement plan or a Medicare Advantage plan. These two plan types provide benefits to enrollees that Original Medicare does not cover. Medicare Supplement plans cover the out-of-pocket costs left over by Original Medicare and some plans provide international emergency coverage. Medicare Advantage plans can cover additional benefits like dental, vision, transportation, or hearing.

Tips For Selecting Plans That Meet Your Needs

- Assess your current and potential healthcare needs. Are there doctors, facilities, or medications that you can’t compromise on for your care? This may impact your policy choice, particularly when deciding between original Medicare and Medicare Advantage.

- Consider your income. If you have a fixed or limited income, paying monthly premiums may be difficult. However, if you may need care that only Medicare Advantage would cover, this might be a good option to save costs in the long run.

- Look for cost savings programs. You may qualify for certain programs to help with your costs, including Medicaid and Extra Help.

- Find the right plan. Use Medicares plan finder tool to compare available Medicare Advantage plans in your area. You can search by prescription drugs you need, as well as covered providers and services.

Also Check: How Do I Apply For Medicare In Illinois

Medicare Supplement Difference By State: Birthday Rules

Medicare Supplement Open Enrollment allows you to enroll in a Medicare Supplement plan without answering medical underwriting health questions. This means that your policy cannot be denied due to pre-existing health conditions. Typically, this is a one-time enrollment period. However, certain states open this enrollment period annually for enrollees.

Birthday rules are a unique opportunity for in some states. If your state includes a provision for a birthday rule, each year around your birthday, you can enroll in a Medicare Supplement plan with no underwriting health questions and no risk of denial.

You can still enroll in a Medicare Supplement plan outside of this enrollment period. However, you may be required to answer underwriting health questions. So, your policy could be denied due to your health. Having a birthday rule in place allows you to have the freedom to change plans if your health changes and you would otherwise not be eligible to change plans.

Not every state allows a birthday rule. Further, states offering this perk have their own regulations regarding enrollment. Below is a list of the states providing birthday rules for their Medicare Supplement enrollees and how to utilize each states rule.

Remember, all birthday rules only apply to those with a Medigap plan already.

What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the âcore benefitâ plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Also Check: What Is Step Therapy In Medicare

Do Medicare Benefits Vary By State

There are four main parts to Medicare. These include Part A and B which form Original Medicare. There is also Part C, known as Medicare Advantage, and Medicare Part D, which offers prescription drug coverage.

Original Medicare is provided by the government to those who are age 65 and over, and who have worked in Medicare-covered employment for at least 10 years. Some individuals who are under the age of 65 may also qualify for Medicare benefits, provided that they have received Social Security disability benefits for at least 24 consecutive months.

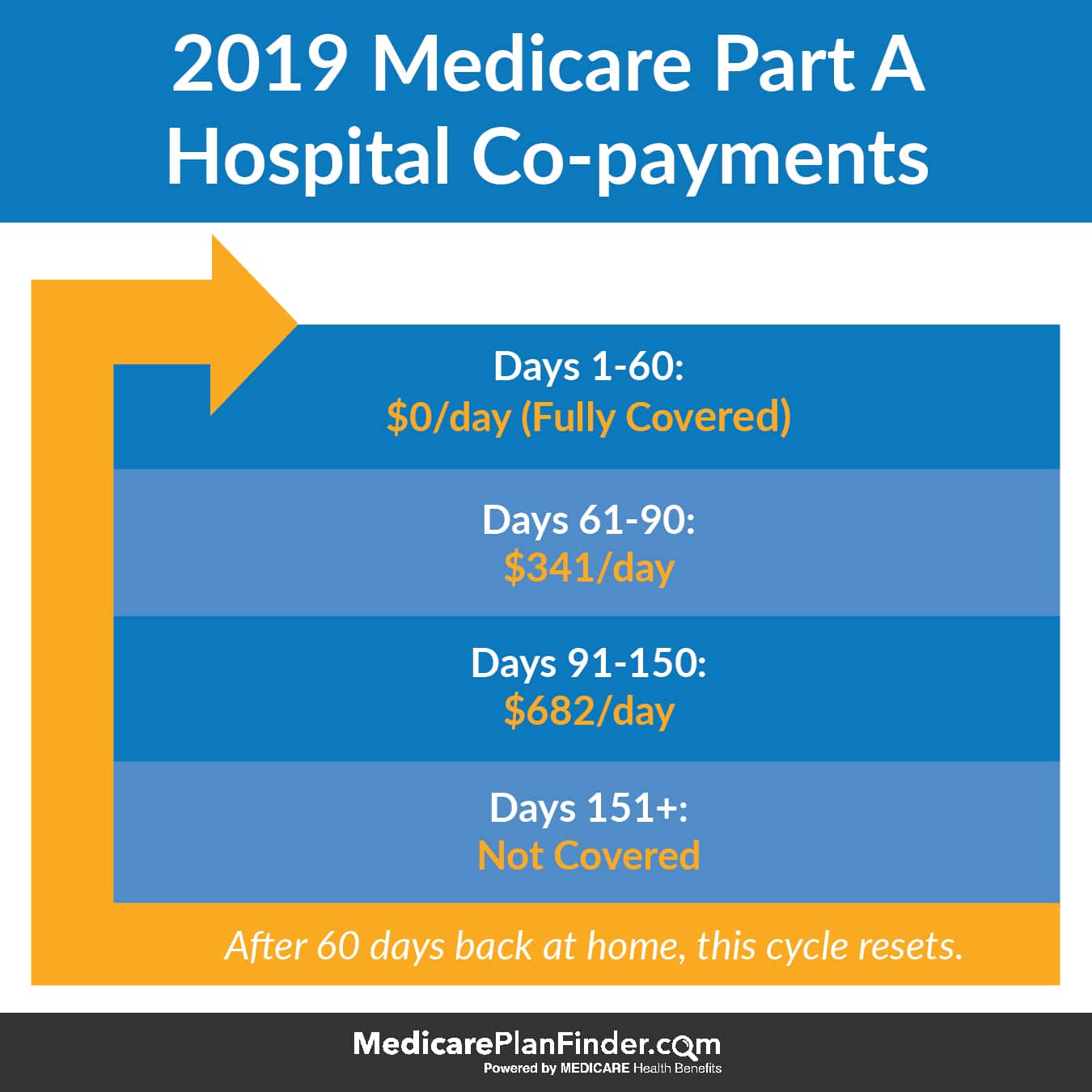

Coverage that is provided via Medicare Parts A and B is primarily the same from state to state in terms of hospitalization and medical insurance , as well as the required out-of-pocket co-payments and deductibles that are required from enrollees.

However, for those who opt to also include Medicare Part D for prescription drug coverage, benefits can vary from one plan to another, as well as from state to state. In many instances, the benefits can even differ from one region to another.

Likewise, for those who choose to receive their Medicare coverage through a Medicare Advantage plan , both the cost and availability of plans can vary from one state to another, as well as by the private health insurance company that offers them.