When Do I Reach The Part D Coverage Gap

In 2022, youll hit the coverage gap when you and your insurance company have paid $4,430 in total for your medications during a year. That number includes any deductible you must pay before a plan will cover your prescriptions. In 2022, Part D plans can have a deductible of up to $480, although many plans dont have any deductible.

Youll stay in the gap until youve spent $7,050 out of your own pocket during the year. Then youll enter the catastrophic coverage phase. Both the threshold and the ceiling in the coverage gap can change each year.

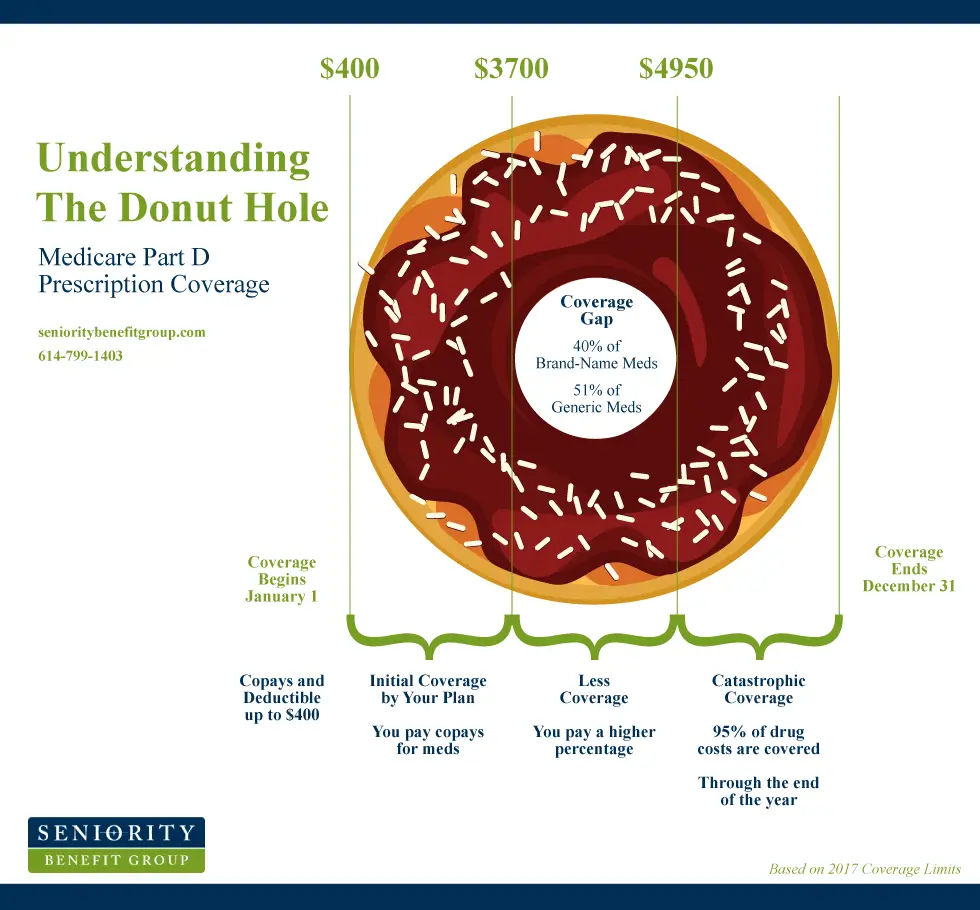

Part D plans have up to four coverage phases throughout a year, each with different out-of-pocket costs: deductible, initial coverage phase, coverage gap and catastrophic coverage phase. You may not reach all the coverage phases during a year, depending on the cost of your medications.

And you start over again when a new plan year begins each Jan. 1.

What Is Your Part D Out

The out-of-pocket maximum is the highest amount you have to pay before catastrophic coverage kicks in. Under the standard drug benefit, this amount is $7,400 in 2023.

Expenses that contribute to your out-of-pocket maximum include:

- Your Part D deductible

- The amount you paid during the initial coverage period

- Your out-of-pocket costs for generic drugs purchased during the coverage gap

- The cost of brand-name drugs purchased during the coverage gap

- Amounts covered by State Pharmaceutical Assistance Programs , AIDS Drug Assistance Programs, and Indian Health Service

How Do I Get Out Of The Medicare Donut Hole

The amount of time you spend in the donut hole depends on the cost of your covered drugs and the benefits of the Part D plan you selected. Not everyone will get to the Medicare donut hole. If you do, you stay there until youve spent a specific amount for covered drugs.

This amount changes each year. It includes what youve paid for the deductible, copayments or coinsurance for covered drugs, and the amount of the manufacturer discount for brand-name drugs in the gap. It doesnt include what you pay for your monthly premium or what your plan paid for covered drugs in the gap. People who qualify for the Extra Help program wont enter the coverage gap.

Once youve spent the maximum amount in the donut hole, you move on to the catastrophic coverage phase.

You May Like: Does Medicare Pay For Air Evac

What Costs Count Toward The Coverage Gap

The total cost of medications counts towards entering and exiting the coverage gap. The total cost of your drugs includes the portion you pay for your prescriptions and the portion the plan pays for your medications.

When exiting the donut hole, the total cost of the drug includes what you, your plan, and the manufacturer pay. So, the manufacturer pays 70%, your plan pays 5% of the cost, and you pay 25%.

95% of the cost of the drug counts toward out-of-pocket spending. The total cost only applies to medications on your plans formulary.

Costs that dont count toward the coverage gap include premiums and drugs that arent covered.

How To Avoid The Donut Hole

Take these steps to slow or avoid your approach to the donut hole each year.

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Purchase your brand name drugs at another pharmacy and pay the insurance copay. This strategy will reduce your out-of-pocket costs in Stage 2, and often keep you from falling in the Stage 3 donut hole.

Its key to use a pharmacy that does not have your insurance information. If a pharmacy has your insurance information, the accounting department may apply your insurance coverage on record to acquire reimbursement even for cash purchases. This will add the retail drug cost to the total used in calculating your Stage 2 $4,430 limit, placing you in the donut hole and nullifying this important strategy.

- Use prescription assistance programs : These programs have helped millions of people slash their drug expenses. They are free to use and work with your existing prescriptions to produce substantial savings. Several have an app for your phone or tablet that will enable you to use them on the go. Some popular APs include:

Read Also: How Do I Sign Up For Medicare Supplemental Insurance

Final Tip: Its Helpful To Understand The Medicare Part D Payment Stages

The donut hole can seem overwhelming, but its just one of four payment stages with Medicare Part D. The payment stage youre in determines the amount you pay when you fill a prescription. You always begin each year in the deductible stage or the initial coverage stage, depending on your plan. A final helpful tip is to learn about each of the Part D payment stages and understand how your financial responsibilities will change in each.

How Does The Donut Hole Affect Beneficiaries

Lets say your Medicare drug plan has a coinsurance requirement of 10%. During the initial coverage phase, you will be responsible for 10% of the cost of your prescriptions.

But during the donut hole, you might be responsible for up to 25% of the cost of the same prescriptions. So if the cost of your drug was $100, you would only pay $10 during the initial coverage phase, but you would pay $25 during the donut hole phase.

Not everyone is affected by the donut hole. Some people never reach the donut hole limit in a plan year and therefore never exit the initial coverage phase. Some may never even exit the deductible phase of their plan.

Other people may be less affected by the donut hole or not affected at all. If your plans coinsurance is already 20%, then making the jump to 25% for the donut hole phase presents only a minimal impact. And if your plans coinsurance is 25% to begin with, your costs in the donut hole may remain unchanged.

Lets use a hypothetical scenario to show the donut hole at work.

Doug continues making these higher coinsurance payments for his refills until he and his plan have combined to spend $7,050 on his drugs. He then enters the catastrophic coverage phase where he will only be responsible for a very small coinsurance payment for his refills, typically just 5%.

Read Also: How Can You Have Both Medicare And Medicaid

When Does The Donut Hole End

The donut hole, or coverage gap, begins when you spend enough on prescription drugs to reach the Part D coverage maximum. It ends when you reach your Part D out-of-pocket maximum. Once the donut hole ends, catastrophic coverage automatically begins. During this period, you pay a smaller amount for your coverage until the end of your plan year. After this, everything resets, and the cycle begins again with a new deductible.

Review Your Medications With Your Doctor Regularly

Speaking with your doctor about your medications is just as helpful for your wallet as it is for your health. By regularly reviewing your prescriptions your doctor can confirm that you are only taking what is necessary and remove medications you no longer need. Your doctor also may be able to help you find discounts or lower-cost options if you explain that you are concerned with cost. It is important to keep in mind that while changing your medication to a generic option can save you money, it may impact your health. You should speak with your doctor about any potential risks before deciding if that is the right choice for you.

Recommended Reading: Does Medicare Cover Ct Scans

How My Mom Prepares For The Medicare Part D Donut Hole

A few years ago my mom developed a health problem and started taking regular medicine every day. The medicine wasnt cheap, so she hit the Medicare donut hole for the first time. Heres how she plans for the donut hole:

1. My mom is retired and on a fixed income. We figure out the cost of her medicine and keep track of the Part D stages. This helps know how much it will cost in the coverage gap. She sets aside money throughout the year for the cost of her medicines so shes ready if she hits the donut hole.

2. She pays close attention to the Explanation of Benefits document she gets each month from her Medicare plan. It tells how much more money you have to spend before you hit the donut hole and, later, how much you have left to spend before you get out of it.

3. She takes steps to lower her medicine costs. She switched to getting her regular prescription through the mail, in larger quantities. When she sees her doctor each year, she asks about each of her medicines to see if she still needs to take them, if there are cheaper options, or if she can take them less often.

When Does The Medicare Donut Hole End

The donut hole ends when you reach the catastrophic coverage limit for the year. In 2023, the donut hole will end when you and your plan reach $7,400 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole. So, your out-of-pocket will be somewhat less than that.

So how do you get out of the donut hole? Unfortunately, its by paying for medications through the donut hole until you reach catastrophic coverage level.

You May Like: How Do I Find My New Medicare Id Number

Medicare Part D Donut Hole

Home / Original Medicare / Medicare Parts / Part D / Medicare Part D Donut Hole

It is vital to understand how out-of-pocket costs are determined when you use your Medicare benefits. One example is the donut hole in Medicare Part D prescription drug plans. Below, we explain the donut hole phases, how to prepare for them, and everything else beneficiaries should know about the coverage gap.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What Is The Donut Hole In Medicare

This is the coverage gap for prescription drugs or sometimes people call it the donut hole in Medicare which is for Medicare users.

It is estimated that you together with your health insurance plan will have spent a combined total of $4,430 on drugs & medications considered appropriate, the coverage gap became effective in 2022.

In 2023, the limit will be raised to $4,660 from its current level of $2,400. If your Medicare Part D prescription drug costs in 2022 or 2023 are more than the limit, you may fall into the coverage gap known as the donut hole.

The best way to control the Medicare donut hole expenses in 2023 is to be familiar with the programs annual coverage cycle and how charges are applied at each step.

Copays hide the full cost of drugs in Medicare prescription coverage. This annual cycle consists of four distinct phases:

Recommended Reading: How Much Are Premiums For Medicare

Stage 3medicare Part D Coverage Gap

Most Medicare drug plans have a Coverage Gap . This means theres a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the Coverage Gap, and it doesnt apply to members who get Extra Help to pay for their Part D costs.

Once in the gap, youll pay no more than 25% of the cost for brand-name and generic prescription drugs covered by your Part D plan, although the full cost of those drugs will be used to move you closer to the Catastrophic Coverage stage.

For 2023, once youve spent $7,400 out of pocket, youre out of the Coverage Gap and moved into stage 4Catastrophic Coverage.

What counts toward the Coverage Gap:

- Your yearly deductible, coinsurance and copayments

- The discount you get on brand-name drugs in the Coverage Gap

- What you pay in the Coverage Gap

What doesnt count toward the Coverage Gap:

- Your drug plan premium

- What you pay for drugs that arent covered by your particular plan

How Much Am I Responsible For During The Medicare Donut Hole

You will be responsible for 25% of your drug costs while in the donut hole. It used to be more, but in 2020, a limit was set and now you wont have to pay an excess of 25%.

This doesnt mean you wont have to pay more for your prescription drugs than you did during your initial coverage, however.

Lets look at this example: If, during your initial coverage, your $200 drugs total cost came with a 20%, $40 copay, then, during the Medicare donut hole, you will have to pay 25%, $50 out-of-pocket.

Don’t Miss: Does Medicare Pay For A Mattress

Tips For Navigating The Part D Coverage Gap

Its best to avoid the coverage gap all together if you can. People who reach the coverage gap need to get through it wisely so they can get the most from their Part D coverage.

Drug costs can take a bite out of your budget. Here are some ideas to help turn that bite into a nibble, even if you are unlikely to reach the coverage gap.

What Is Part D Catastrophic Coverage

Catastrophic coverage automatically applies once youve reached your out-of-pocket maximum. During this phase of coverage, you pay 5% of the drugs cost or a set amount of $3.95 for generic drugs and $9.85 for brand-name drugs. This is different from your standard Part D coverage, as the copay is replaced by this lower payment amount.

You do not need to manually track your out-of-pocket spending to move into the catastrophic coverage phase. Instead, your plan keeps track of how much youve spent and how youre progressing to the end of the coverage gap. This information can be found on your monthly statements.

Recommended Reading: What Does Part B Cover Under Medicare

What You Need To Know About The Medicare Donut Hole 2023

What is the donut hole?

Medicare Part D prescription drug plans have a limit on the amount they cover for prescription medication during the year. This coverage gap is still known as the donut hole, although the donut hole was officially closed in 2020. While many people wont reach the limit and have to pay out of pocket, it may be very difficult for those who do.

What are the donut hole limits in 2023?

Stage 1 Deductible: Depending on your plan, you may have to pay a deductible for your prescription medication before your Medicare prescription drug plan kicks in. Some plans may have no deductible at all, some may have specific tiers, but no plan may have a deductible more than $505 in 2023.

Stage 2 The Initial Coverage Period: After having spent your deductible and still in need of medication, you will enter the next level, the so-called Initial Coverage Period. Now, you and your plan must pay up to $4,660 in total for your prescription drugs. You must pay the co-payment/co-insurance according to your plan, while your plan will cover the remainder.

Stage 4 Catastrophic Coverage: Medicare beneficiaries with more than $7.400 prescription drug cost expenses will get Catastrophic Coverage. This means, for the rest of the year, you are back to only paying co-payment/co-insurance according to your plan.

These numbers are changing each year, so make sure to always get the latest information.

How can you save money in the donut hole?

What Is Part D Donut Hole And How Does It Work

Donut holes are the gaps in Medicare prescription drug coverage. The beneficiary will be subject to a limit of Part D coverage. Once youve spent the amount specified in a prescription plan, youll be responsible for the cost that exceeds a certain amount.

Medicare Part D is structured into four payment stages and knowing them is essential for you to understand how the Part D Donut Hole works.

The four phases for each year are:

Annual Deductible: You have to pay that dollar amount before your plan begins to pay.

Initial Coverage: You are responsible for coinsurance or copays, usually a fixed amount. In this phase, a beneficiary pays 25% of the medications cost. Once you have spent a set amount of $4,430 in 2022, you will enter the next stage, i.e., Donut Hole.

Coverage Gap : You will have to pay most or all of your medication costs once youre in Donut Hole. However, it is not the case anymore more about it is below. Earlier, beneficiaries had to pay 100% of every drugs cost due to this, most people quit their medications. The Affordable Care Act came as a relief in 2012.

Catastrophic Protection: Once you have exited the Donut Hole, you will enter catastrophic coverage. You will pay whichever is higher in this coverage, i.e., copay or five percent of a drugs cost. However, the copay varies for generic and brand-name drugs.

Heres the minimum copay for both in 2022

Generic drugs: minimum copay is $3.95,

Brand-name drugs: minimum copay is $9.85

Recommended Reading: Does Medicare Pay For Chiropractic

Look For Generic Or Lower

If youre currently prescribed brand name drugs from manufacturers that dont provide prescription coupons, speak to your health care provider or pharmacist about potential generic or lower-cost options, says Parker. Sometimes, theres another medication option thats similar enough to your existing prescription in terms of efficacy but comes at a much more affordable price.

Whats The Donut Hole In Medicare

So what exactly is the Medicare donut hole?

donut hole used to be a much more noticeable feature of Part D plans before 2010, says , an assistant professor of Health Policy at Stanford School of Medicine and a Faculty Fellow at Stanford Institute for Economic Policy Research. The idea was that once you reached a pre-specified amount of spending on your prescription drugs, you had to pay for 100% of your prescriptions until you reached another pre-specified amount. Today, the donut hole starts much later. You have to spend $4,430 in total on drugs in 2022 to get to the donut hole. And if you get there, you pay 25%, not 100%, for your prescriptions.

You may be wondering why Medicare would have a donut hole at all. While the coverage gap has closed in past years thanks to the Affordable Care Act , it was intended as a way to keep the cost of the program down when first passed by Congress. Here is a breakdown of what you can expect in 2022 and what prices have been in previous years.

Don’t Miss: Does Medicare Pay For Hotel Stay