Medicare Penalty: Sign Up Before You Turn 65 To Avoid Late Enrollment Charges

If youre closing in on age 65, nows a good time to sign up for Medicare benefits to avoid late enrollment penalties especially since the open enrollment period is currently underway through Dec. 7.

Social Security Poll: What Matters Most to You?Senior Savings: How Exploring Medicare Options Cuts Costs During Open Enrollment

The U.S. Department of Health & Human Services recommends filing for Medicare benefits three months before your 65th birthday when those benefits kick in. If you already receive Social Security, youll automatically be enrolled in original Medicare Part A for hospital coverage and Part B for medically necessary and preventive services without having to fill out an additional application. However, you can opt-out of Part B if you dont want to pay the premium.

If you enroll three months ahead of time, youll receive a Medicare card about two months before age 65. Or, you can wait until you turn 65 to sign up for original Medicare and add on any additional coverage from there, such as Part D for drug coverage. But if you wait too long, youll face late enrollment charges.

Heres how the various rate enrollment penalties work:

Also Check: Can I Use Medicare For Dental

I Didn’t Enroll In Medicare When I Turned 65 Can I Sign Up Later

En español | Yes, but you can enroll only at certain times. You may also have to pay a late-enrollment penalty unless you qualify for a special enrollment period .

You are eligible for Medicare at age 65, but youre enrolled automatically in Medicare only if youre already receiving Social Security or Railroad Retirement Board benefits at least four months before your 65th birthday. Otherwise, you need to take steps to sign up yourself.

I Am Turning 65 Next Year When Can I Sign Up For Medicare

If you are eligible for Medicare, your initial enrollment period for Part A and Part B begins three months before the month of your 65th birthday and ends three months after it. For example, if your 65th birthday is in June, your enrollment period will extend from March 1 through September 30. If you join during one of the 3 months before you turn 65, coverage will begin the first day of the month you turn 65. If you join during the month you turn 65, your coverage will begin the first day of the month after you turn 65. If you join in the month after you turn 65, coverage will begin 2 months later, and if you join 2 or 3 months after you turn 65, coverage will begin 3 months later. A recent change in law limits these gaps in coverage. Starting in 2023, if you enroll in Medicare during the first 3 months after your turn 65, coverage will begin the first day of the month following the month you enroll.

Once you have Part A and Part B, you are then also eligible to enroll in a Medicare Advantage plan and/or a Part D plan. If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Part A and Part B. If you are not already receiving Social Security benefits and you want to enroll in Medicare, you should contact Social Security.

Don’t Miss: Does Medicare Cover A1c Test

Can You Sign Up For Medicare After Age 65

Hereâs the gist: you can decide not to sign up for Medicare, but if you donât have some kind of health coverage, youâll be penalized when you do eventually sign up.

If youâve had credible coverage, such as group health insurance through your employer, youâre free to sign up for Medicare with no penalties.

However, if you just chose to put it off for whatever reason, there will be a penalty on your monthly premium, which is 10% for each year that you could have had Part B but didnât sign up for it.

Again â no one likes penalties, so if youâre confused or just want to make sure you have it figured out, please ask our team to review your Medicare plan.

Also Check: Does Medicare Cover Bed Rails

When Do I Apply For Other Kinds Of Medicare Coverage

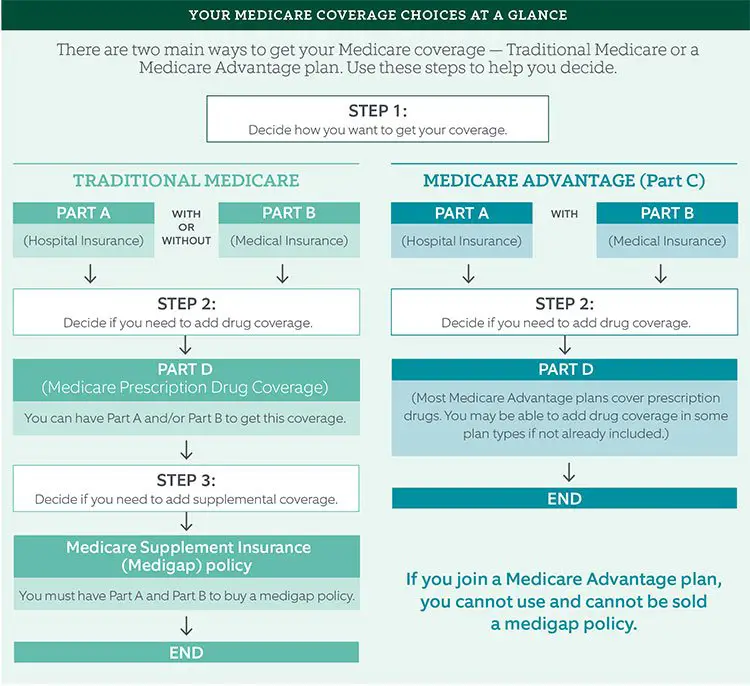

Are you thinking about signing up for a Medicare Advantage plan, a stand-alone Medicare prescription drug plan, or a Medicare Supplement insurance plan?

No matter what type of Medicare coverage you want, youll generally want to start by signing up for Original Medicare, Part A and Part B. Then, its usually a good idea to sign up for any other type of Medicare coverage you want, promptly.

Heres a quick rundown on the main Medicare coverage options you have besides Original Medicare and when to sign up.

- Medicare Advantage this program gives you an alternative way to get your Medicare Part A and Part B benefits . You need Part A and Part B to qualify, and then the plan manages those benefits for you. If you dont enroll during your Medicare Initial Enrollment Period , you might have to wait to sign up. Learn about Medicare Advantage enrollment periods.

- Stand-alone Medicare prescription drug plan you might want this type of plan if you need prescription drug coverage. You need Part A or Part B to qualify. If you dont enroll during your Medicare Initial Enrollment Period , you might have to wait to sign up. Learn about Medicare Part D enrollment periods.

Be aware that if you have a Medicare Advantage plan, it might include prescription drug coverage, so you wouldnt need a stand-alone plan. In fact, you generally cant have both a Medicare Advantage prescription drug plan and a stand-alone Part D prescription drug plan.

New To Medicare?

Also Check: Where Can I Go To Apply For Medicare

How To Apply For Medicare Part A And Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If youve been receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

If you have ALS or Lou Gehrigs disease, youre automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

Some people will need to sign up for Medicare themselves. If you have end-stage renal disease , and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 . If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 , Monday through Friday, 9 AM to 3:30 PM, to speak to an RRB representative.

Some Important Considerations Before Making Your Choice

If you work for a large company, compare your employer coverage and costs with Medicare. Be sure to look carefully at premiums for Parts B and D as well as the cost of a Medigap policy that would cover whatever Original Medicare doesn’t . If you’re happy with your current plan, you may well be better off staying with that and delaying Medicare enrollment until you retire.

Another thing to be aware of is that once you enroll in Medicare , you’re no longer eligible to contribute to a health savings account . Therefore, if you want to continue to boost pre-tax savings with an HSA, you may want to postpone. In fact, to avoid an IRS penalty, you must stop contributions to an HSA 6 months prior to enrolling in Medicare Part A or claiming Social Security benefits after age 65.

If you work for a small company, you should probably sign up for Parts A, B, and D as soon as you’re eligible. In this case, you most likely won’t need a Medigap policy under Original Medicare, since your employer coverage will pick up costs not covered by Medicare. Check with your employer to see the impact of enrolling in Medicare Advantage.

Read Also: Does Medicare Pay For Cancer Drugs

Signing Up For Medicare Part A At 65 If Youre Still Working

If you’re still working at age 65 and not claiming Social Security benefits, the government will not automatically enroll you in Medicare Part A, which covers hospital stays.

If you work for a company with 20 or more employees and you’re enrolled in your employer’s health insurance plan, you do not have to enroll in Part A. If your employer covers the bulk of your premiums, you have a low deductible, and you’re not eligible for premium-free Part A, it might make sense to continue relying solely on your workplace coverage.

If you’re eligible for premium-free Part Amost people are because they’ve paid Medicare taxes throughout their working yearsyou might as well enroll since you’ve earned it. As secondary health insurance, Part A may cover hospital expenses your employer’s plan does not.

If you work for a company with fewer than 20 employees, you should enroll in Part A as soon as you’re eligible. Medicare will become your primary payer.

If you’re covered by a Health Insurance Marketplace plan or COBRA, you should sign up for Medicare Part A during your initial enrollment period, which starts three months before you turn 65, includes your birthday month, and ends three months after you turn 65.

Although Medicare Part A pays for inpatient hospital stays and nursing care, there’s an annual deductible, which is $1,484 for 2021 and $1,556 for 2022. Many people don’t pay a monthly premium for Part A, and there are no coinsurance costs for hospital stays of 60 days or less.

When Is The Earliest I Can Enroll In Medicare

Unless you qualify for Medicare before age 65 because of a disability, the first time youre eligible to sign up is during your initial enrollment period , which begins three months before the month you turn 65 and lasts for three months afterward.

So if youre a few months past your 65th birthday, you still may be in your initial enrollment period. Where you are in your initial enrollment period determines when your Medicare coverage starts:

If you enroll during those first three full months before your birthday, your Medicare begins on the first day of the month you turn 65 or the first day of the previous month if your birthday is on the first of the month.

If you sign up during the month you turn 65, coverage begins on the first day of the following month.

But if you wait until the fifth, sixth or seventh month of your initial enrollment period, coverage will be delayed two or three months.

However, those rules change Jan. 1. Starting in 2023, if you enroll after your birthday month, coverage will take effect at the beginning of the following month.

Don’t Miss: Does Medicare Offer Dental And Vision

When To Sign Up For Medicare

If youre not enrolled automatically, you should sign up in the three months before your 65th birthday. That way, coverage will start on the first day of your birthday month .

You technically have seven months around your 65th birthday to enroll: the three months before your birthday month, your birthday month and the three months after. This is called your initial enrollment period. If your birthday is the first of the month, your initial enrollment period includes the four months before your birthday month and two months after.

Your coverage could be delayed if you wait until your birthday month or the three months afterward to apply for Medicare. And if you miss your initial window, you may need to sign up during Medicare’s general enrollment period. However, you may be subject to a permanent penalty unless you have continuous coverage from a large employer group health insurance plan.

How Do I Sign Up For Medicare At Age 65 If Im Still Working

Medicare Part A is premium-free for most people but you typically pay a monthly premium for Medicare Part B.

So, you may want to delay enrollment in Part B if youre still working and have health insurance through your employer or other organization when you turn 65.

You should check with your plan benefits administrator before you turn 65 to see if your employer coverage changes when you become eligible for Medicare.

If you have the option to choose between Medicare and your employer plan, compare your monthly premiums and benefits before you turn 65 so you know which option makes the best financial sense for you.

Be aware that theres a late enrollment penalty for Medicare Part B if you dont sign up during your Initial Enrollment Period. You may avoid the penalty if you qualify for a Special Enrollment Period for example, if youre covered under an employment-based group health plan.

You May Like: What Makes You Eligible For Medicare

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

You May Like: Is Medicare My Primary Or Secondary Insurance

How To Apply For Medicare

Medicare enrollment is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of plans in which to enroll. As we mentioned earlier, some beneficiaries can receive automatic enrollment, and some must apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday through Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare applications generally take between 30-60 days to obtain approval.

Signing Up For Medicare Supplement Or Medicare Advantage Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan at any time. However, the best time to enroll is during your Medicare Supplement Open Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

You can enroll in any Medigap plan for which youre eligible, with no health underwriting questions during this time. Thus, you wont face denial due to pre-existing conditions.

If you choose to enroll in a Medicare Advantage plan, it is best to do so during your initial enrollment period. This is the same timeframe as applies to Medicare Part A and Part B enrollment.

You can enroll in any Medicare Advantage plan available in your service area during this window. If you miss this enrollment period, you must wait until the Annual Enrollment Period to enroll in a plan.

Keep in mind, when enrolling in a plan, it is important to note that you are not able to enroll in a Medicare Advantage plan and a Medigap plan at the same time. So, before you enroll, it is essential to compare all options available.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Recommended Reading: Does Medicare B Cover Prescriptions

Do I Qualify For A Medicare Special Enrollment Period

Perhaps, if you or your spouse is still working and you have health insurance from that employer. The special enrollment period allows you to sign up for Medicare Part B throughout the time you have coverage from your or your spouses employer and for up to eight months after the job or insurance ends, whichever occurs first.

If you enroll at any point during this time, your Medicare coverage will begin the first day of the following month. And you will not be liable for late penalties, no matter how old you are when you finally sign up.

Your decision also depends on the size of your employer and whether the employers plan is first in line to pay your medical bills or second.

Larger companies. If you or your spouse work for a company with 20 or more employees, you can delay signing up for Medicare until the employment ends or the coverage stops, whichever happens first. These large employers must offer you and your spouse the same benefits they offer younger employees and their spouses, which means that the employers coverage can continue to be your primary coverage and pay your medical bills first.

Many people enroll in Medicare Part A at 65 even though they have employer coverage, because its free if they or their spouse has paid 40 or more quarters of Medicare taxes. But they often delay signing up for Part B while theyre still working so they dont have to pay premiums for both Medicare and the employer coverage.

Keep in mind