Do I Have To Sign Up For Medicare If Im Still Working At 65

If you are receiving health insurance through your employer, you can choose to delay your Medicare Part B without being penalized. When your group coverage or private insurance coverage is ending, dont forget to apply for Medicare Part B. Even if you choose to delay your Part B, we suggest you still take out your Medicare Part A when you turn 65.

Dont be afraid to ask questions. Before signing up with a Medicare plan, know what will be covered and what the projected cost of your health needs will be for the year. Caress Insurance Agency, Inc. has agents in San Diego County, and we work with Mercy Scripps Hospital to help answer your Medicare questions and provide you with the latest information on your Medicare Insurance Plans.

Use our online tool to easily compare plans and get a custom quote tailored to your unique needs: !

- 550 Washington St., Suite 841San Diego, CA 92103

Cant Get A Medigap Policy Try Medicare Advantage

If no insurer will sell you a Medigap policy, you have an option. Medicare Advantage is another private health plan that can save you money. Plans have a maximum limit on out-of-pocket costs, typically $5,000. Some plans even have no monthly premium.

Medicare Advantage plans provide Part A and Part B, and often include Part D prescription drug coverage. You can have either a Medigap policy or Medicare Advantage plan, not both.

Now that you know when you can enroll in a Medicare Supplement plan and the types of plans available, youre better prepared to sign up. Remember that your Medigap Open Enrollment Period is a one-time event thats unique to you, so dont miss it!

Medicare Late Enrollment Penalties

If you do not take the corresponding action above that reflects your situation, you may be faced with Medicare late enrollment penalties. These penalties are dual in nature you may receive a financial penalty as well as be restricted on when you can get into Medicare.

The financial penalty for late enrollment into Medicare Part B is 10% for each 12 month period that you were not enrolled but were eligible to do so.

The time period restriction is that there are certain times of year during which you can get into Medicare Part B. So, if you do not enroll on time, you may have to wait several months before your Medicare can start.

Note that there are also late enrollment penalties for Medicare Part D 1% of the national base beneficiary premium for every month that you were eligible but not enrolled.

Recommended Reading: Do Any Medicare Supplement Plans Cover Dental And Vision

When Can You Sign Up For Medicare Supplement Plans

When it comes to Medicare Supplement plans, you can join at any time of the year. If your Open Enrollment window has passed, you can still apply. However, youll most likely have to go through medical underwriting and answer health questions during the application process.

Outside your one-time open enrollment window, a carrier can deny you coverage due to pre-existing conditions or health issues. The only way around this is if youre granted guaranteed issue rights due to a circumstance that would qualify you for a Special Enrollment Period.

Some states have unique open enrollment rules, such as birthday rules that allow you to enroll in Medigap around your birthday each year, without answering health questions. In Connecticut, there is a year-round open enrollment window for all beneficiaries.

How Do I Choose Medicare Supplement Insurance

Insurance companies label Medigap plans with a letter to show what benefits are included. For example, according to Medicare.gov, Medigap Plan F will pay for health care during foreign travel but Plan A will not.

To make it easier for consumers, the government requires that insurance companies offer the same benefits for each type of Medigap policy. In other words, Medigap Plan G will offer identical coverage at every company. The premium could be different, but the benefits will be the same.

Each plan is a trade-off between the amount of coverage and the premium cost. Medigap Plan K might have a lower premium because it only covers 50% of the Medicare Part B coinsurance . On the other hand, Plan C covers the entire Medicare Part B coinsurance but will likely charge a higher monthly premium.

Also Check: How Old To Be Eligible For Medicare

What If I Miss My Medicare Supplement Open Enrollment Period

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

Advantage plans only have one health question, and most applicants can pass. However, youll have to wait until the fall enrollment period to sign up for one of these plans.

Youll be required to stay within the plans network of doctors. However, if youre willing to pay more for a PPO plan that gives you access to doctors outside their network, you may be able to keep the same doctor.

Who Is Eligible For Supplemental Insurance

Anyone who has Medicare Part A and Part B is eligible to apply for a Medicare supplement plan. However, you need to qualify for coverage with the private insurance company. When you first turn 65 and sign up for Medicare Part B, you have a Medigap open enrollment period that lasts six months. During this time, you could sign up for any Medigap plan in your area and the insurer must accept your application, even if you have preexisting health conditions.

After the open enrollment period, you can still try signing up for a policy, but the insurance company could ask you questions about your health for underwriting. If you have preexisting conditions, they could increase the premium or even deny giving you a policy.

Also Check: Does Medicare Pay For Dtap Shots

What Do Medicare Supplement Plans Cover

Medigap policies cover the following out-of-pocket costs:4

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up.

- Part B coinsurance or copays.

- Blood .

- Foreign travel emergency .

- Above out-of-pocket limits.

The Part B excess charge is little understood but essential to know. Doctors who accept Medicare assignment agree to rates set by Medicare for covered services. Those who dont can charge up to 15% more than the Medicare-approved amount.

Unless you have a Medigap plan that covers excess charges, you will be responsible for those charges. The alternative? To only use participating doctors, although thats not always easy in an emergency or surgery involving many doctors.

Also, Original Medicare does not cover you outside the U.S. But some Medigap policies do.

What If You Cant Enroll In A Medigap Policy

If you dont qualify for a Medigap policy, youll have to pay all your Original Medicare out-of-pocket expenses yourself. Because Original Medicare doesnt have a cap on those expenses, your out-of-pocket costs can add up pretty quickly.10

Heres an example:

| Carl has outpatient surgery. His total Medicare-approved bill under Part B is $10,000Carl is responsible for a 20% coinsurance, which amounts to $2,000 out-of-pocket | Carl has a Medigap policy that pays 100% of his Part B coinsurance after meeting the Part deductible.Carls Medigap policy pays the $2,000 coinsurance directly to his doctor, leaving Carl with $0 out-of-pocket |

Also Check: What Diabetic Supplies Are Covered By Medicare Part B

Rates Points And Closing Costs

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

- How do I sign up for a Medicare Supplement Insurance Plan?+-

With high-value products and services, Randolph-Brooks Federal Credit Union is a trusted financial partner for thousands of members in Texas, as well as around the world. RBFCU offers all the banking services you would expect from a leading credit union, and we’ve also made it our mission to help improve our members’ economic well-being and quality of life. Our commitment to personalized service makes RBFCU membership the smarter banking choice.

We use cookies to analyze and improve website use, and assist in overall user experience.

For your protection, please do not provide any personal information via email. If you are a member, please to send a secure message.

What Does The Standard Medigap Coverage Provide

In general, Medigap covers your coinsurance bill once youve paid the Medicare deductible. Some plans pay your Part A deductible as well.

All Medigap plans cover 100% of Part A coinsurance and hospital costs after Medicare benefits are used, for as many as 365 days. Also, almost all plans cover 100% of the cost of:

-

Part B coinsurance or copayment

-

Blood

-

Part A hospice-care coinsurance or copayment

The exceptions are Plans K and L, which cover these costs only partially.

Also Check: What Is The Requirement For Medicare

How Does Medigap Work

In order to buy a Medigap policy, you must sign up for Medicare Part A and B.

Medicare coordinates the billing and claims between Original Medicare and your Medicare Supplement plan.

The provider bills Medicare first, then bills your Medigap plan. Depending on the plan, the provider then bills you for what remains, such as the Part B deductible, and your check goes to the provider.

You can renew your Medigap policy as long as you pay the premium. The insurer cannot use your health problems to cancel your policy or raise your premium.

State-by-state differences exist in some guarantees and limitations.

What Is The Difference Between Plan F And Plan F High Deductible

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

As a reminder, your deductible is the out-of-pocket cost you must pay toward covered health services before your insurance company starts paying for care. Both insurance plans have identical coverage.

Also Check: What Is The Window To Sign Up For Medicare

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

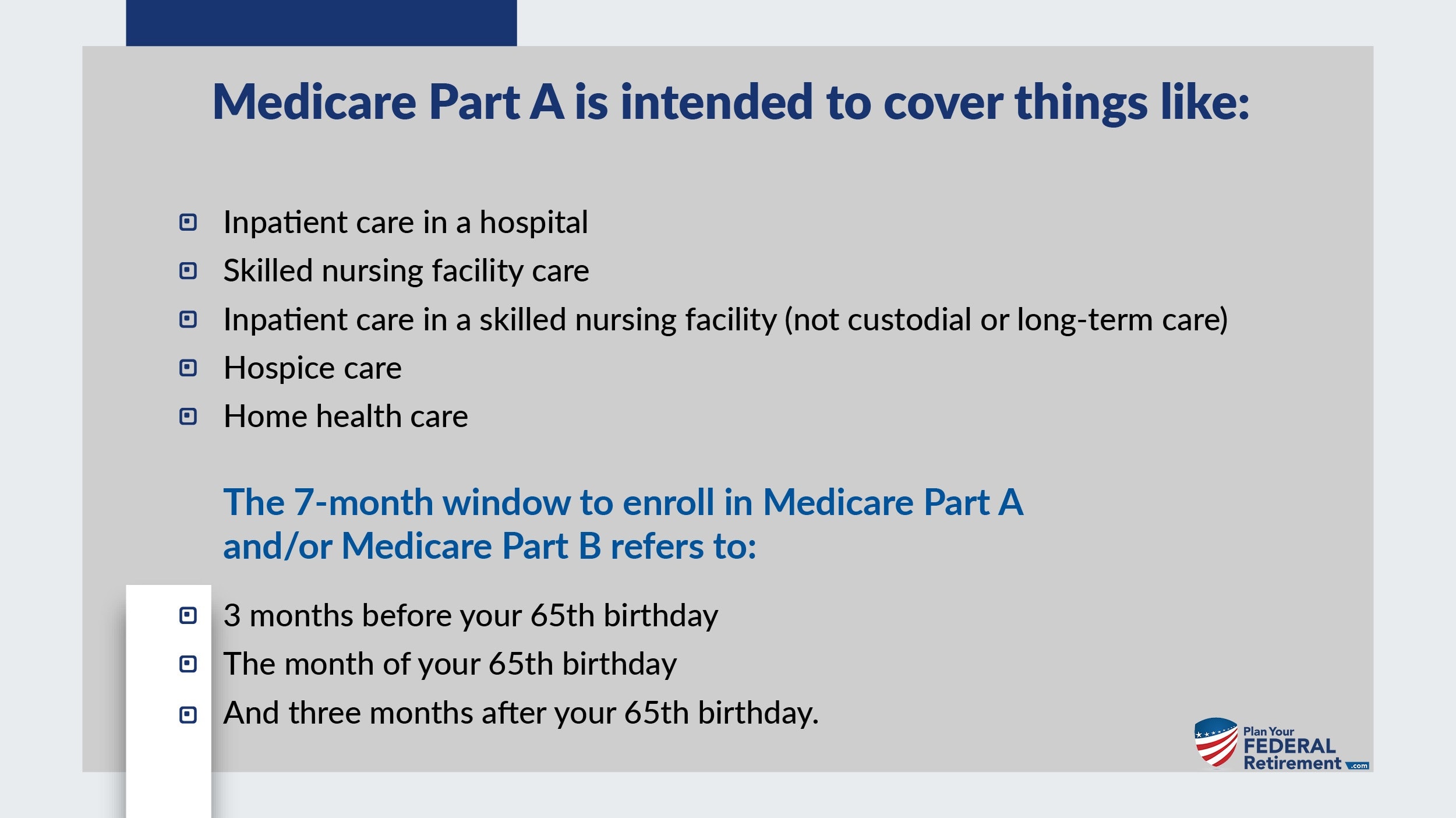

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

If I Dont Like My Plan When Can I Change

Each year between October 15 and December 7, there is an annual enrollment period for Medicare beneficiaries. At this time, you can change your MAPD or PDP plans for a January 1 start date. There are other special enrollment periods that may allow you to change your plan during the rest of year. Read this article to find out more.

Also Check: What Is The Difference Between Medicare

How Do I Purchase A Medicare Supplement Plan Or A Medicare Advantage Plan

- Speak to a licensed agent: local agents understand local plans and the healthcare landscape. They are best positioned to help you make the right decision. Local agents, like Connie Health, will also help you navigate your Medicare insurance after purchasing your coverage.

- Enroll online: If you feel you have everything you need to make a decision, you can enroll online on Connie Health, Medicare.gov, or other sites. If you purchase online through Connie Health, you will still be eligible for our services to help you with any Medicare-related questions after you purchase coverage.

- Enroll directly with the insurance company this is always an option, though it doesnt save you any money compared to enrolling online or with an agent. They also only sell their plans and not all insurance companys plans like the options above. Please keep in mind that if you choose this option you wont have an independent agent to consult with or who can advocate for you.

Medicare Supplements And Pacemakers

A pacemaker is a small device implanted under the skin to help control your heartbeat. This requires a surgical procedure.

Your Medicare plan should cover your pacemaker if it is deemed medically necessary. If you already have a pacemaker, you might be issued a decline because of Medigap underwriting.

However, this isnât an immediately declinable condition. There may be some wiggle room, depending on your lifestyle and the companyâs specific rules.

Many companies have a two-year lookback, so they may ask you something like âIn the past 2 years, have you had a pacemaker installed ?â

A few companies have a 12-month lookback, but two years is fairly common. Donât worry â we can analyze all of your options to make choosing a plan simple.

Also Check: Can You Use Medicare In Any State

What If You Miss Your Medigap Open Enrollment

Insurance companies can use medical underwriting to qualify you for a policy outside of your open enrollment. They can charge you more based on your health, and even deny your application. However, youre exempt from these rules if you have a guaranteed issue right to buy Medigap. Well talk more about these rights later.6

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Recommended Reading: Does Medicare Cover Chiropractic X Rays

Why Is It So Important When I Sign Up For A Medicare Supplement Plan

During your six-month enrollment period, federal law protects you with guaranteed issue rights . These rights allow you to purchase any policy available in your area, regardless of your current health. But outside of this window, insurance companies are legally allowed to refuse you a policy, charge more because of your health, or impose waiting periods on your coverage.

As you can see, Medigap guaranteed issue rights are incredibly valuable. Outside your open enrollment period, there are a few other scenarios where you have these rights as well. Typically these situations apply to you when you lose your existing coverage or after you try out Medicare Advantage.

Youll have guaranteed issue rights in any of these additional scenarios:

- You have Original Medicare and employer coverage that works in tandem with Medicare, but your employer coverage is ending.

- Youre enrolled in Medicare Advantage or have a Medicare SELECT policy, but you move out of the service area or the provider stops covering your area.

- You had a Medigap plan and dropped it to join an MA plan, but before a year passes you decide to switch back to Original Medicare. This situation is known as a trial right.

- You initially joined an MA plan at 65, but before a year has passed, you switch to Original Medicare .

- Youre in an MA or Medigap plan but leave because you’ve been misled or the company broke the rules relating to your coverage.

- The insurance company providing your Medigap coverage goes bankrupt.

How Do I Know If I Should Change Plans

Health care and budget needs change over time. If your current plan isnt meeting your needs, you can switch to a different plan or even a different type of Medicare coverage.1

Medicare Advantage and Medicare prescription drug plans send information to members every fall. This is called the Annual Notice of Changes . The ANOC explains upcoming updates to the plans benefit coverage, costs, or service area for the next plan year. When looking at your current and future needs, the ANOC can help you decide if you need a different plan.

Also Check: How Much Does Medicare Cost Me

Top 10 Medicare Supplement Insurance Companies In 2022

Home / FAQs / Medigap Plans / Top Medicare Supplement Companies

When shopping around for the best Medigap policy available to you, its helpful to be familiar with the top 10 Medicare Supplement insurance companies in 2022. Whether youre new to Medicare or are now considering supplemental coverage a few years after enrolling, were here with the information you need to make the best decision!

For a company offering Medigap to be one of the best, we must consider several elements. These measures include consumer reports, AM Best rating, Standard and Poor rating, and the companys number of years in the market. Knowing about these carriers reputations will help when you compare Medigap rates to find the best plan for your budget.