Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

How Old Do You Have To Be To Get Medicare Part C Or Medicare Supplement

To get Medicare Part C or Medicare Supplement plans, you must be enrolled in Original Medicare. This means, you must be at least 65 years old or meet the Medicare criteria for enrolling under age 65. If you do not meet these criteria, you can get Medicare at age 65.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part C and Medicare Supplement plans both act as a supplemental coverage to Original Medicare. However, you cannot have both plans. You are only able to enroll in Medigap OR Part C. If you enroll in Medicare Part C, the plan becomes your primary coverage over Original Medicare. If you enroll in a Medicare Supplement plan, it will pay secondary to Original Medicare. Because they require you to have Original Medicare, you cannot enroll in a plan without Medicare Part A and Part B.

Explore Your Other Medicare Coverage Options

Once you are enrolled in Original Medicare, you can explore additional coverage options.

You can decide to:

- Add a Medigap supplement insurance policy.

- Add a Part D prescription drug plan.

- Switch to a Medicare Advantage plan also known as Part C to replace your Original Medicare coverage.

Medicare Part D, Medigap and Medicare Advantage are all administered by private insurance companies that contract with CMS.

You can apply for these benefits online.

Use the Medicare Plan Finder tool to explore and compare plans in your area.

Also Check: Can You Only Have Medicare Part B

C: Medicare Advantage Plans

| Learn how and when to remove this template message) |

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

You May Like: Is It Too Late To Sign Up For Medicare Advantage

Ways To Apply For Disability Benefits:

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

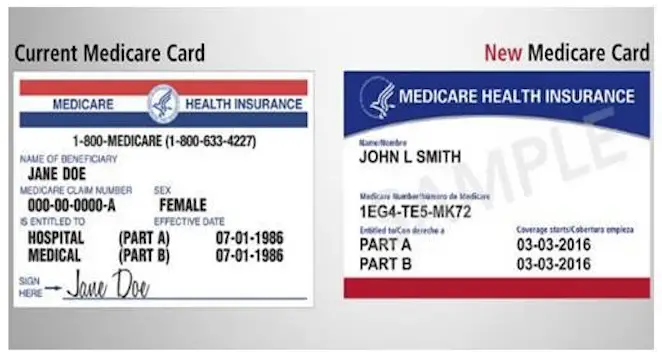

Once your disability benefits start, well mail you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up for Part B and pay a monthly late enrollment penalty.

Be Aware Of Other Enrollment Periods

Most people sign up for Medicare during the seven-month initial enrollment period around their 65th birthday.

But what if you missed your initial enrollment period and want to make changes or add additional coverage?

There are specific times each year when you can do this.

Alternate Medicare Enrollment Periods

Also Check: What Is The Current Cost Of Medicare

Medicare Costs In Georgia In 2022

Original Medicare costs in Georgia are the same nationwide.

The Medicare Part A premium can cost you $0, $274, or $499, depending on how long you or your spouse worked and paid Medicare taxes. For Part A hospital inpatient deductibles and coinsurance, you pay:

- $1,556 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $389 coinsurance per day of each benefit period

- Days 91 and beyond: $778 coinsurance per each âlifetime reserve dayâ after day 90 for each benefit period

- Beyond lifetime reserve days: all costs

Premium-free Part A coverage is available if you or your spouse paid Medicare taxes for a certain amount of time while working. You can receive this at 65 if:

- You already get benefits from Social Security or Railroad Retirement Board.

- Youâre eligible for Social Security or Railroad benefits but havenât filed yet.

- You or your spouse has Medicare-covered government employment.

If youâre under 65, you get premium-free Part A if:

- You have Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have End-Stage Renal Disease and meet certain requirements.

The standard monthly Medicare Part B premium is $170.10 in 2022, and the Part B deductible is $233. Once the deductible is met, you usually pay 20% of the Medicare-approved amount for most doctor services , outpatient therapy, and durable medical equipment.

Applying For Extra Help

If you qualify for the QMB program, you automatically qualify for Extra Help. You can enroll in the Extra Help program on the SSA website.

Once youre enrolled in Extra Help, the SSA will review your income and resource status each year, typically at the end of August. Based on this review, your Extra Help benefits for the upcoming year may stay the same, be adjusted, or be terminated.

You May Like: Washington State Medicaid Residency Requirements

Recommended Reading: Does Medicare Coverage Work Overseas

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

About Medicare In Georgia

Medicare beneficiaries in Georgia may choose to enroll in Original Medicare, Part A and Part B, which is administered by the federal government. Alternatively, you can choose Medicare Advantage , which must offer everything thats covered under Part A and Part B , and may include other benefits such as routine dental services and prescription medication coverage.

Read Also: When Am I Eligible For Medicare Benefits

Georgia Medicare Advantage Plans With Prescription Drug Coverage

Most Medicare Advantage HMO and PPO plans and all SNP plans provide prescription drug coverage like you would get from Medicare Part D. Some PFFS plans may provide prescription drug coverage, but not all do. Evaluate a plans prescription drug coverage when deciding which Georgia Medicare Advantage Plan to use.

Prescription drug coverage may vary by cost, coverage, and convenience among Medicare Advantage Plans. Your monthly premium may include a premium for the drug coverage in the plan. There is usually a copayment or coinsurance amount that you have to pay for each prescription after you reach your annual deductible.

Some plans use different cost tiers with different costs for different drugs. For instance, you may pay less for generic drugs than brand-name drugs or less for brand-name drugs within different tiers. If your plan uses tiers, the formulary will list all covered drugs and their tiers. Verify your preferred or local pharmacies are included in the plans network.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Read Also: Does Medicare Cover Wheelchair Repairs

How To Pay For Benefits With Your Health Reimbursement Account

As a Post-65 USG retiree, when you enroll in either a healthcare plan or a pharmacy plan through Alight Retiree Health Solution you will receive an annual contribution to your Health Reimbursement Account administered by Your Spending Account . These funds can be used to help pay for Medicare Supplement premiums, vision/dental premiums, and other eligible healthcare expenses, including prescription drug costs and more. As long as you are enrolled and remain enrolled in a healthcare or pharmacy plan through Alight Retiree Health Solutions, USG will make an annual contribution to your Health Reimbursement Account for you and your covered Medicare-enrolled dependents.

If you have a break in coverage or drop coverage with the ARHS, you will no longer be eligible for the HRA funding.

Learn more about the HRA here.

If you are currently enrolled in USG life insurance, dental or vision coverage, you are eligible to continue this coverage in retirement. You do not need to take any action to continue this coverage. However, if you have supplemental and/or dependent life insurance greater than the amount allowed in retirement, you must contact MetLife within 30 days to convert the difference to an individual policy.

ARHS also offers dental and vision plans. If you drop coverage under these plans, you cannot re-enroll.

Can I Have Medicare And Medicaid In Georgia

In short, yes! It is possible to be eligible for both Medicare and Medicaid in Georgia. If you meet the income requirements for Georgia Medicaid but also meet Georgia Medicare eligibility, you can get benefits from both programs.

To get help choosing a Medicare plan, contact a Medicare Plan Finder licensed agent by completing this form or calling 833-438-3676.

Read Also: Do Medicare Supplements Cover Pre Existing Conditions

Getting Medicare Enrollment Assistance

If you have questions about or need help with Medicare eligibility or enrollment due to disability, you will want to talk with Social Security office. You can also go to your local State Health Insurance Assistance Program office for Medicare counseling.

If you get approved for disability benefits but arent yet eligible for Medicare yet , you can reach out your local state human services agency to see if Medicaid may be an option for you.11

What You Need To Know About Medicaid Medicare And Paying For Health Care In Georgia

Feeling stuck with healthcare costs and dont know what insurance options are right for you?

We all have healthcare costs at some point in our lives, and these costs are likely to rise as we age or have a disability. Many things bring health insurance top of mindmaybe you are on the verge of retirement, or have recently received a new diagnosis, or are experiencing a change in employment, or are seeing your medical bills start to pile up. Whatever the reason, you might be looking at some alternative options to private insurance and trying to find opportunities to access public funds to help pay for your healthcare.

If you dont have much income, you might be wondering how to access Medicaid. If you turned 65 recently, you are probably thinking about Medicare. If you already have Medicare and you are wondering how you can get additional help, you may qualify for Medicare Supplement Insurance, sometimes called Medigap Insurance. If you were or are a uniformed U.S. service member, you may be interested in TRICARE, or perhaps you qualify for veterans benefits.

Together, we can understand your payment options, identify the best approach to managing your care, and access resources to confidently navigate the healthcare system informed and educated.

Read Also: Does Medicare Cover Heart Catheterization

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

Athens Community Council On Aging

The Athens Community Council on Aging is a private nonprofit organization that provides aging services to more than a dozen Georgia counties. In partnership with GeorgiaCares, ACCA provides free counseling and assistance with health insurance-related issues for beneficiaries and caregivers in the area. All ACCA Medicare services through GeorgiaCares are free of charge. Counselors are not affiliated with any insurance company and provide unbiased opinions.

Contact information: Website | 549-4850 or 552-4464 and press 4

Don’t Miss: Does Medicare Cover Ct Lung Cancer Screening

Will The Medicare Age Be Raised To 67

In recent years, the proposal to raise the Medicare eligibility age to 67 began to gain traction. However, many are actually in favor of lowering the Medicare age below 65 rather than pushing it back to 67.

As of now, there has not been any indication that either of these proposals will become law. The standard Medicare enrollment age is currently 65 and there are no plans of changing that in the near future.

Get A Free Quote

Find the most affordable Medicare Plan in your area

- Was this article helpful ?

Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. He is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Stacy Crayder