What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Medicare Part D Premiums In 2022

Medicare Part D prescription drug coverage is optional. Some Medicare Advantage plans also incorporate prescription drug coverage. Monthly premiums vary from plan to plan.

Most people only pay their monthly premium for Medicare Part D coverage. But people with higher incomes also have to pay an additional fee based on their income reported to the Internal Revenue Service. For 2022, that would most likely be based on 2020 income.

2022 Medicare Part D Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Your Monthly Premium in 2022 |

|---|---|---|

| $91,000 or less |

The extra amount you pay is not part of your plan premium and you do not pay it to your Medicare Part D insurer.

In most cases, the extra amount will be held out of your Social Security check. If it isnt withheld, youll get a bill from either the Social Security Administration or the Railroad Retirement Board.

You also have to pay the extra fee if you are in a Medicare Advantage plan that includes prescription drug coverage.

If you dont pay the extra fee, you can lose your Medicare Part D coverage.

You May Like: What Medicare Part D Plan Is Best For Me

Paying For Medicare Premiums Tips: Your Hsa And Employer Health Plan

From the above, you can see you may face higher costs for Medicare than you originally thought. Thats why you should consider two things a health savings account plan and if you have employer health coverage.

If you have an HSA and must get Medicare at age 65, the good news is that you can use your HSA funds to pay for Medicare costs including Part B and Part D premiums. Your HSA also can help with other costs, and you can learn more about how Medicare and HSAs work here.

Medicare Supplement Insurance Costs And Coverage

If youre enrolled in Original Medicare, enrolling in Medicare supplemental insurance also known as Medigap may help cover additional costs such as copayments and deductibles.

The average monthly premium for Medigap was $175 per month, according to a 2017 study published by Harvard University. But costs can vary widely for a Medigap plan.

Companies are free to set their own prices for each plan they offer, but the rates are filed and reviewed by the various state insurance departments.

Different insurers may charge different premiums for the exact same plan, so its important to compare prices between companies to find the best deal.

Long-term care, vision, dental, hearing aids and eyeglasses generally arent covered with Medigap. Medicare Advantage plans cannot be paired with Medigap.

Also Check: What Is The Medicare Part A

Medicare Part A Premium In 2022

There is no Medicare Part A premium for most people. The hospital coverage is premium-free if you have worked and paid Medicare payroll taxes for at least 10 years measured as 40 quarters by the Centers for Medicare & Medicaid Services .

If you havent met that 10-year mark, you can buy Medicare Part A, but the premiums will cost you $499 per month in 2022. Only about one percent of Medicare beneficiaries have to pay for Part A coverage.

How Much Will I Pay For Premiums In 2022

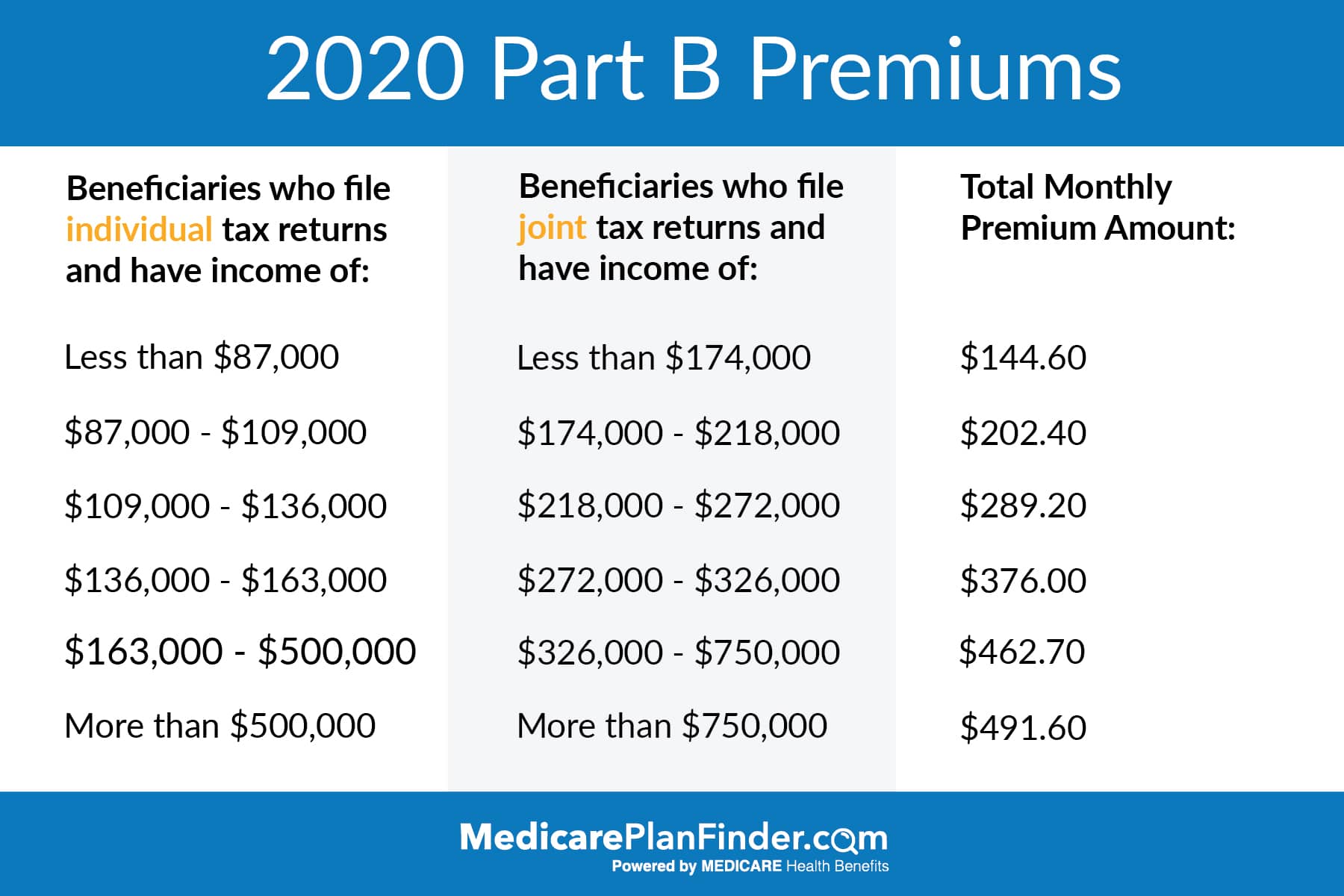

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Recommended Reading: What Is Medicare In Simple Terms

Medicare Advantage Plans Costs And Coverage

Medicare Advantage plans, is an all-in-one alternative to Original Medicare. These plans are administered by private insurance companies approved by the federal government.

Medicare Advantage bundled plans include Part A and Part B and usually have Part D drug coverage. Plans may also include other extra benefits such as vision and dental.

What Medicare Advantage Covers

- All the services covered by Original Medicare.

- Vision, hearing and dental are usually included.

- Emergency and urgent medical care is always covered.

- Most plans offer some form of prescription drug coverage.

Since Medicare Advantage plans are provided through private insurers, there are no fixed premiums, deductibles or coinsurance. Instead, they vary from plan to plan. You first must have Original Medicare before you can buy a Medicare Advantage plan.

The companies that administer the plans decide what to charge for premiums, deductibles and coinsurance once a year. Medicare does not have a hand in determining the costs. Changes take effect on Jan. 1 of the following year.

Cost-Determining Factors of Medicare Advantage PlansDon’t Leave Your Health to Chance

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Don’t Miss: How Much Does Medicare A And B Cost Per Month

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

How Much Medicare Costs

En español | Medicare covers a lot of your health care costs, but not all. There are also premiums and other out-of-pocket costs to consider. AARPs Medicare Question and Answer Tool is a starting point to guide you through some of the more common questions about costs and options for people with limited incomes.

Q:What does Medicare generally cost?

A: Generally, how much you pay for Medicare depends on: which Medicare plan you choose how often you go to the doctor or hospital whether you have other health insurance and whether you qualify for help with Medicare costs. Read Full Answer

A: Medicare does not cover all of your health care costs. Depending on which plan you choose, you might have to share in the cost of your care by paying premiums, deductibles, copayments and coinsurance. Read Full Answer

A: A premium is the monthly amount you pay to Medicare or a private insurance plan for your health care and your prescription drug coverage. Read Full Answer

A: A deductible is the amount you must pay for health care or prescriptions before Medicare begins to pay its share. Read Full Answer

A: A copayment is usually a set amount you pay for each medical service, such as a doctors visit, or prescription. Read Full Answer

A: Coinsurance is the amount you may be required to pay for services after you pay any deductibles. This could be a percentage of the Medicare-approved amount or a fixed dollar amount. Read Full Answer

Don’t Miss: How Does An Indemnity Plan Work With Medicare

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, Updated November 15, 2021

designer491 / Alamy Stock Photo

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $92 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Also Check: How To Get A Lift Chair From Medicare

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

89 percent of Medicare Advantage plans include prescription drug coverage in 2021 . More than half of all 2021 MA-PD plans charge no premium, other than the Medicare Part B premium.1

The average 2022 Medicare Advantage plan premium is $62.66 per month.2

Medicare Advantage plans are required to offer the same benefits as Original Medicare , and some Medicare Advantage plans may also offer additional benefits for things like routine dental and vision coverage, non-emergency transportation, caregiver support, allowances for over-the-counter items and more.

And according to Medicare expert John Barkett, Medicare Advantage monthly premiums dropped in 2020 by as much as 14 percent. Hear more about this in the video below.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Don’t Miss: How To Sign Up For Medicare In Arkansas

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Medicare Part B : Out

Part B is your doctor’s office insurance under Original Medicare. It covers necessary medical treatments and preventive healthcare services. You pay a monthly premium for this coverage, which can be automatically taken out of your Social Security benefits.

Most people pay a standard monthly premium, which is set each year. In 2022, the standard monthly Part B premium amount is $170.10 . If you earn over $88,000 a year, you will pay a higher premium. If the premium is deducted from your Social Security benefits, you will pay a lower premium.

Your total annual costs for Medicare Part B premium can be up to $6,939.60.

Read Also: Can I Use Medicare For Dental

Why Did I Get An Extra Social Security Payment This Month 2020

The extra payment compensates those Social Security beneficiaries who were affected by the error for any shortfall they experienced between January 2000 and July 2001, when the payments will be made. … Most Social Security beneficiaries and SSI recipients had a shortfall as a result of the CPI error.

What Youll Pay For Medicare Part C

Medicare Advantage is a bundled alternative to Original Medicare that includes the benefits of Part A, Part B and usually Part D. These plans often include additional benefits, such as some coverage for dental or vision care. They’re sold by private health insurance companies, and premiums vary.

Although the average monthly premium for a Medicare Advantage plan is $19 in 2022, many available plans have a $0 premium. Youll pay your Medicare Advantage premium in addition to your Part B premium . That said, some plans will pay part or all of your Part B premiums.

In addition to the monthly premium, Medicare Advantage plans may come with deductibles, copays or coinsurance. Look through each plans fine print to understand what kind of charges youll pay for medical services.

Also Check: Who To Talk To About Medicare

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.