Do I Always Have A Copay

Not necessarily. Not all plans use copays to share in the cost of covered expenses. Or, some plans may use both copays and a deductible/coinsurance, depending on the type of covered service. Also, some services may be covered at no out-of-pocket cost to you, such as annual checkups and certain other preventive care services.*

How Do I Apply For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. You mustregister yourself if you are not collecting Social Security benefits. You can apply for Medicare Part B online, over the phone, or in person.

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll.

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2022. Prior authorization is most often required for relatively expensive services, such as Part B drugs , skilled nursing facility stays , and inpatient hospital stays , and is rarely required for preventive services . Prior authorization is also required for the majority of enrollees for some extra benefits , including comprehensive dental services, hearing and eye exams, and transportation. The number of enrollees in plans that require prior authorization for one or more services stayed the same from 2021 to 2022. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services and does not require step therapy for Part B drugs.

You May Like: How To Get Medicare D

How To Save Money On Medicare

Prescription drug costs are among the most concerning items that Medicare enrollees must consider in retirement. These costs can be small, and other times can be excessive. Several programs are available to help Medicare beneficiaries with the costs associated with prescription drugs.

The most common program that helps with prescription plans is called Extra Help, also known as Part D Low-income Subsidy . Extra Help is available for low-income Medicare beneficiaries. This program can help with the prescription drug plan premiums, deductibles, copays, and coinsurance.

There are several levels of Extra Help to help those in need of financial assistance. In many cases, beneficiaries that qualify for these programs can also qualify for Medicare Savings Programs .

These MSP programs can help low-income beneficiaries by paying for their monthly premiums and some or all of their Medicare cost-sharing.

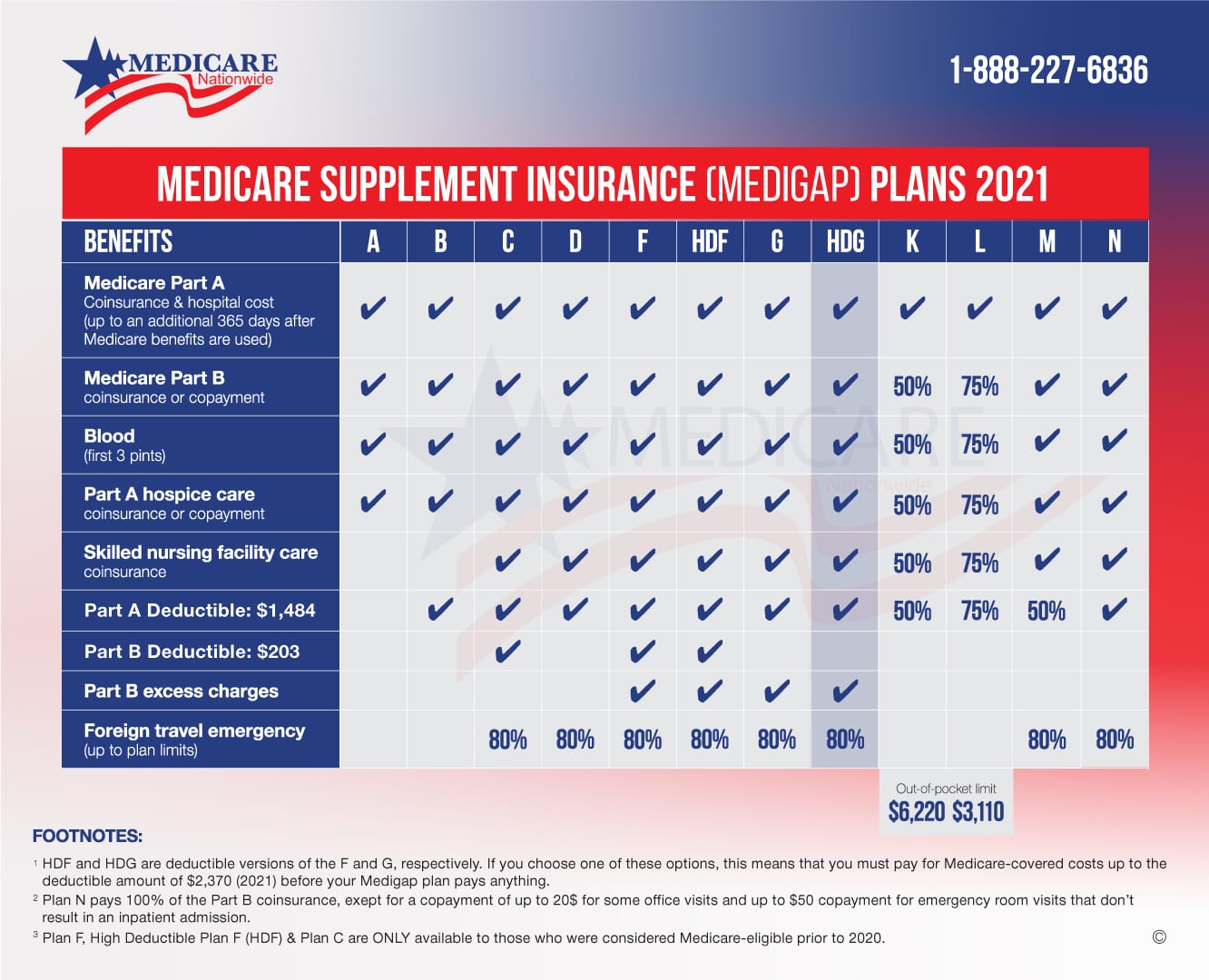

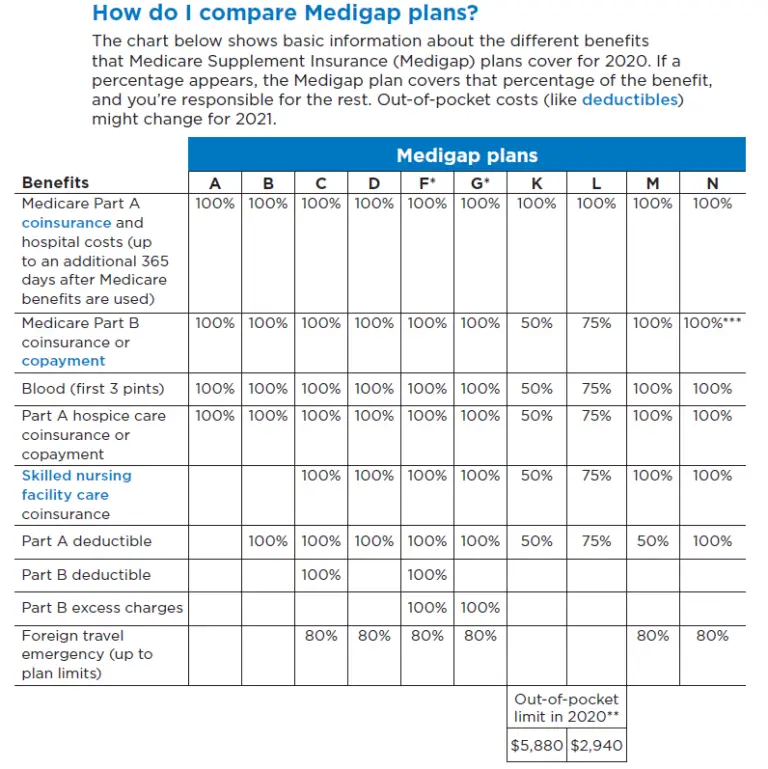

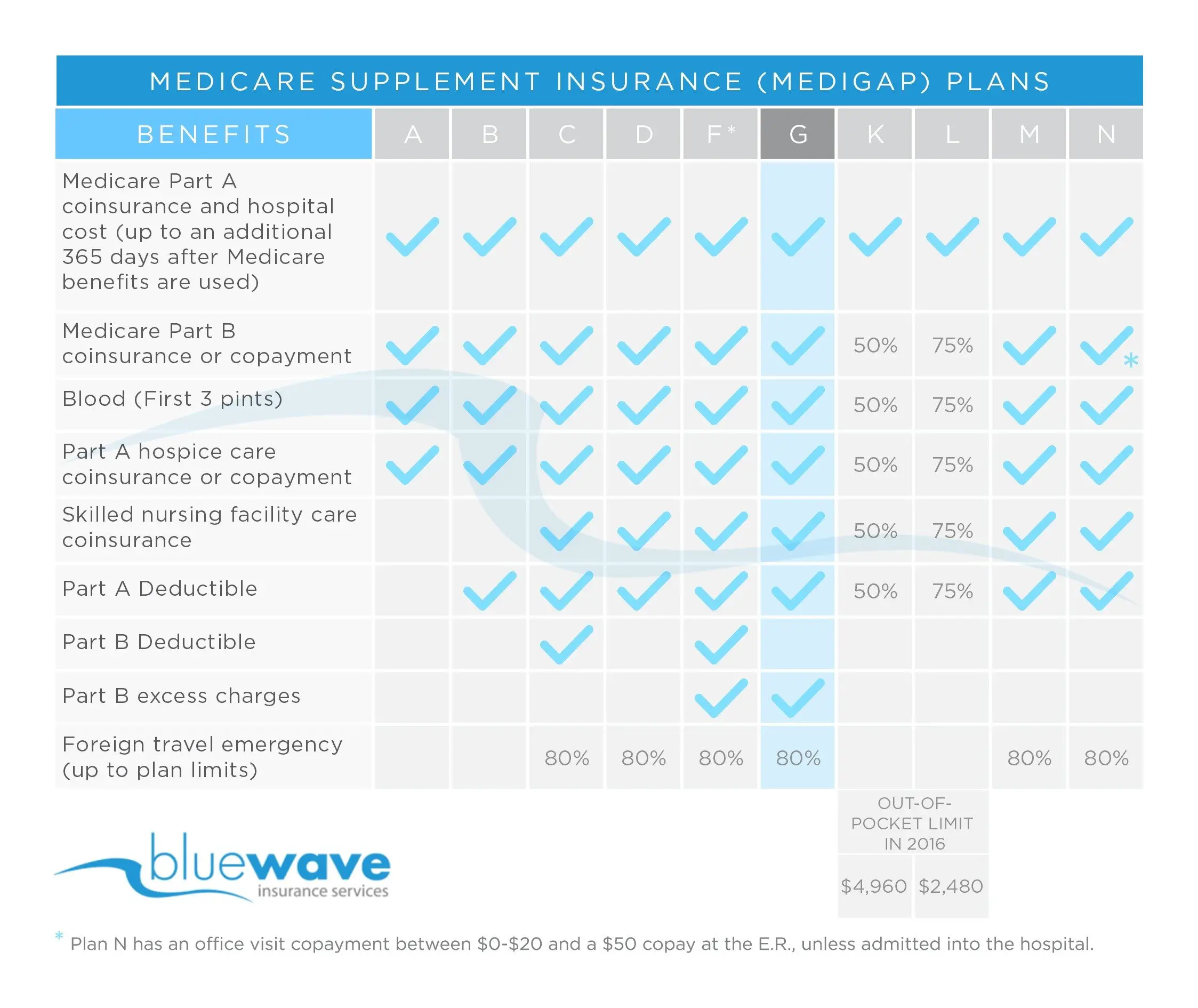

Suppose you dont fall into the category of low-income. In that case, you can consider a Medicare Supplement plan to lower your out-of-pocket costs for your Medicare-covered items and services.

Medicare Supplement or Medigap plans could offset all or most of your cost-sharing with Original Medicare.

Another way to lower prescription drug costs is to choose a discount prescription card program. Using a free SingleCare discount card may get you a lower price if used instead of Medicare Part D coverage.

How Does Medicare Plan G Work

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Medicare Plan G is a supplemental policy, meaning itâs not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits would pay for health services you need. Once those benefits are exhausted, Plan G pays for any remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you donât have Plan G, then youâll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.

Don’t Miss: Is It Mandatory To Take Medicare At 65

Where To Get Medigap Plan K And When To Get It

Plan K, like all Medicare Supplement plans, is available year-round, not only during the annual open enrollment period. Medicare Supplement plans are available year-round, but the optimum time to enroll is during your guaranteed issue period when you are guaranteed acceptance and the lowest possible premiums.

Companies like UnitedHealthcare and other commercial insurers provide coverage under the federal governments Plan K program. The insurers who offer Plan K coverage are not uniform across the country. The best Medicare rate can be found by comparing prices from different providers and learning which businesses offer plans that most closely fit the individuals requirements for the lowest overall cost.

Medicare Deductible: Part A

Medicare Part A benefits include inpatient hospital care, skilled nursing facility care, home health services, and hospice.

For a hospital stay, you usually have to pay the Part A hospital inpatient deductible, which is $1,484 in 2021 for each benefit period. You may have other costs for the specific health-care services you receive while in the hospital. On the 61st day of a hospital stay, you would also start to have coinsurance costs. Your coinsurance costs depend on the length of your stay:

- Days 61 to 90: Daily coinsurance of $371 in 2021 for each benefit period

- Days 91 and over: Daily coinsurance of $742 in 2021 for each lifetime reserve day in each benefit period

- After lifetime reserve days are used up: You pay all costs

For home health-care services, all costs are covered under Medicare Part A for a limited time under certain conditions. However, if your doctor orders durable medical equipment and supplies it as part of your care, youll pay 20% of the Medicare-approved amount for the equipment.

For hospice care, all costs are covered. Some exceptions include:

- If you take prescription medications or similar items for pain relief or symptom control while on hospice. You may be responsible for a copayment of no greater than $5 per prescription drug.

- If you need inpatient respite services. You may need to pay 5% of the Medicare-approved amount for that care.

- If you get hospice care in a nursing home. You typically pay for room and board costs.

Also Check: Can I See A Doctor In Another State With Medicare

And 2023 Medicare Part A Deductible

Original Medicare requires that you pay a deductible for each inpatient hospital benefit period, which means you may have to pay a deductible more than once in a single year.

A benefit period begins the day you’re admitted to a hospital or skilled nursing facility and ends when you haven’t spent the night in one of them for 60 consecutive days. If you’re admitted to a hospital or skilled nursing facility after one benefit period has ended, then a new one begins, and youll have to pay another deductible.

The 2023 Medicare Part A deductible for each benefit period is $1,600 .

Is Thermal Imaging Better Than A Mammogram

Thermography does not detect cancer in its early stages Mammograms can detect very small abnormalities before they can be felt or seen. Some research has shown that thermography may be able to detect big, advanced cancers, Cohen says. Unfortunately, detecting large, later-stage cancers is not as beneficial.

Recommended Reading: What If Someone Gets Your Medicare Number

What Does Deductible Mean

In most cases, a deductible is the amount of money you the insured must pay for medical care before your insurance plan starts to pay.

When you pay a deductible, youre actually paying some or all of the allowed amount for your treatment. The allowed amount, or allowable charge, is the maximum dollar amount your insurance provider considers to be reasonable for a medical service or treatment.

Your deductible amount may be high or low, depending on the type of plan you choose. Regardless, your insurance company typically begins paying once you reach your predetermined deductible, though thats not always the case.

Does Medicare Cover Oral Anti Nausea

Oral anti-nausea drugs. Medicare Part B helps cover the costs of oral anti-nausea drugs if you take them before, during, or within 48 hours after receiving chemotherapy. Part B will also cover these drugs if theyre used as a replacement for an intravenous anti-nausea drug. If Medicare Part B covers drugs you use to treat breast cancer

Read Also: Does Medicare Cover Diagnostic Mammograms

Track Your Medicare Claim Information Online

The MyMedicare.gov account is a great resource for viewing up to date claims. However, its best used for cross referencing, and not as your sole resource for tracking the Part B deductible.

And, thats because your online Medicare account tells you when youve met the Part B deductible, but it doesnt keep track of what youve actually paid out of your pocket towards the Medicare deductible.

So, you need to look at actual claims and cross reference them with what youve paid. Then, see if it matches up with what Medicare says you are responsible for paying. If this seems cumbersome, watch my Part B Video. I actually show you how to use your Medicare account for this purpose.

So, why is it important to cross reference your Medicare claims?

Because you may get a bill from a provider when youve already met the Medicare Part B deductible. I had a client who received a bill and over paid it, because the provider included the amount he owed for the Part B deductible and the co-insurance. Thankfully, it wasnt much, but these mistakes take place.

Is The Medicare Part A Deductible Increasing For 2021

Part A has a deductible that applies to each benefit period . The deductible generally increases each year. In 2019 it was $1,364, but it increased to $1,408 in 2020. And it has increased to $1,484 for 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Also Check: What Is Aetna Medicare Advantage Plan

You May Like: Do You Have To Pay For Part B Medicare

Understanding Health Insurance Costs: Premiums Deductibles & More

In almost any area of your life, if you dont have a clear idea of your expenses, you may feel like youre not in control. But, when you get clear about all the costs, you feel in control, helping you make the right choices. To get a clear understanding of your health insurance costs, the first step is to look at all the key types of costs, not just obvious expenses. Its a lot like adding up your automobile expenses some of the clear costs include your car payment, insurance, gas, oil changes and repairs. Less obvious costs include the finance charge on your payment, windshield wiper fluid and parking tickets. Lets take a look at obvious health insurance costs and some examples.

Yearly Deductible For Drug Plans

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share.

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $505 in 2023. Some Medicare drug plans don’t have a deductible. In some plans that do have a deductible, drugs on some tiers are covered before the deductible.

Recommended Reading: When Can You Change Your Medicare Supplement Plan

The Impact On Your Healthcare Costs

The Medicare Part B deductible can have a significant impact on your overall healthcare costs. If you receive services that exceed the deductible amount, you will be responsible for paying the difference between the deductible and the cost of the services. This can add up quickly, so its important to understand the deductible and plan accordingly.

How The Annual Deductible Could Impact New Enrollees

If you qualify for Medicare late in the calendar year say, in November or December you could end up paying the Medicare Part B deductible more than once within a few months or even a few weeks.

For example, if you enroll in Medicare in December 2023, when you get medical care that month, you will have to meet the Part B deductible of $226 for 2023, and then in January, you will have another deductible for 2024, effectively paying the Part B deductible twice within a few weeks.

In other words, if your Medicare coverage begins late in the calendar year, you may want to postpone non-urgent medical procedures until the new year to avoid paying the Medicare part B deductible twice within a few-week span.

Recommended Reading: Does Medicare Pay For Assisted Living In Florida

What Happens When You Meet Your Deductible And Out

Once you’ve met your deductible, your plan starts to pay its share of costs. Then, instead of paying the full cost for services, you’ll usually pay a copayment or coinsurance for medical care and prescriptions. Your deductible is part of your out-of-pocket costs and counts towards meeting your yearly limit.

How Much Does Medicare Cost

The cost of Medicare depends on how much you worked, when you sign up, and which types of coverage options you choose. You’re eligible for premium-free Medicare Part A if you paid Medicare taxes for 40 or more quarters. You’ll pay a premium for Part A if you worked less than 40 quarters, and you’ll also pay a premium for additional coverage you want from Part B, Part C, or Part D, as well as penalties if you enroll in these after your initial enrollment period.

Recommended Reading: What’s The Difference Between Medicare And Medicaid

Making Sense Of The Medicare Part D Drug Plan Deductible

Medicare Part B Drug Plan Deductibles Can Be Complicated

getty

Medicare Part D prescription drug coverage can cause confusion, and much of that starts with the deductible, which is the first of the Part D drug coverage payment stages. Confusing yes, but the inherent hazards of the deductible, those with financial implications, can be avoided with some factual information.

Lets start with some typical questions.

If my plan has a deductible, why are my drugs free?

Why do I keep paying toward the deductible every month and never seem to meet it?

How come what I pay for drugs can change during the year?

Drug plan deductible facts

How the deductible works

In each of these examples, the plan has the standard deductible, $445.

- Daniel takes a Tier 3 insulin with a full cost of $1,038. He will meet the deductible in the first month.

- Dorothys one medication, a Tier 4 muscle relaxant with a full cost of $2.26, is subject to the deductible. She will pay that amount, $2.26, every month and wont meet the plans deductible this year.

- Dons regimen of seven drugs includes two of Tier 3 in the mix. The full cost for those two is $70.96. He will meet the deductible in July.

- Dianas drug list includes seven medications, all Tier 1. This tier is not subject to the deductible. Plus, her plan does not charge a copayment for Tier 1 medications.

Going forward

What Is The Maximum Out

Original Medicare does not have an out-of-pocket limit. Youâll keep paying co-pays and co-insurance regardless of how many services you receive or how much you spend in a plan year. However, Medicare Advantage plans are required by law to have an out-of-pocket maximum. A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

You May Like: Does Medicare Cover Bariatric Surgery

Recommended Reading: Does Medicare Cover Nursing Home For Dementia Patients

What Is The Medicare Part B Premium

When you become a Medicare beneficiary, you are automatically enrolled in Medicare Part A. You must also enroll in Medicare Part B, which covers outpatient services, if you want coverage. Your monthly premium for Medicare Part B can be deducted from your Social Security check. The amount you’ll pay for these Medicare premiums will be based on your modified adjusted gross income as reported on your IRS tax return from 2 years ago. If it is above a certain amount, you may pay an Income-Related Monthly Adjustment Amount .

How Much Does Original Medicare Cost

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

The chart below shows the Part B monthly premium amounts for 2018 based on income. If you pay a late-enrollment penalty, this amount is higher.

Looking for Medicare coverage? We offer free, accurate comparisons for Medicare Advantage , Medicare Supplement , and Medicare Prescription Drug plans.

Get an online quote at Medicare.org for Medicare plans that fit your healthcare needs today! Or call TTY 711 to get answers and guidance over the phone from an experienced licensed sales agent.

Related Information:

Don’t Miss: Does Medicare Cover Wheelchair Repairs

What Is The Medicare Part B Deductible

The Medicare Part B deductible is the amount of money you must pay out-of-pocket for covered services before your Medicare Part B coverage begins. Depending on the type of service you are receiving, the deductible can range from $183 to $445 annually. The deductible is calculated differently depending on the type of service you are receiving.

Does The Plan K Medicare Supplement Cover Silversneakers

SilverSneakers, an initiative that incentivizes seniors to engage in physical activity, may be included in some versions of Plan K. The SilverSneakers network is a group of fitness centers that accepts insurance as payment for a basic membership. Whether or not your insurer covers the SilverSneakers program is contingent on whether or not the insurer provides SilverSneakers as part of its Plan K. Where you live and where you bought Plan K could impact this. SilverSneakers website lets you verify your policy eligibility.

Don’t Miss: Does Medicare Pay For Tummy Tuck