Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Medicare Supplement Insurance Reduces Original Medicare Out

Since the inception of the Medicare program, the Centers for Medicare & Medicaid Services has regulated and promoted Medigap plans to help beneficiaries reduce their health care costs. They do so by paying some or all of Part A and Part B deductibles and coinsurance.

In all but three states supplemental Medicare insurance is standardized into 10 lettered plans , which are not to be confused with Medicare Parts A, B, C, and D. Each plan covers none, some, or all of a shared cost. Plans are easily compared using a simple chart:

Most people who properly choose a Medicare supplement plan will save money over the life of their policy. Heres why:

Does Medicare Have A Cap

In general, there’s no upper dollar limit on Medicare benefits. As long as you’re using medical services that Medicare coversand provided that they’re medically necessaryyou can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Recommended Reading: What Is Medicare Part A B C And D

Does Medicare Have A Maximum Out

There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

Under Original Medicare, you are responsible for your annual Part B deductible, a Part A deductible for each benefit period , and your coinsurance and copayment amounts.

You can get a Medicare Supplement insurance plan to help cover your Medicare out of pocket costs.

Understanding The Therapy Cap

Ending the therapy cap does not mean that you can get as much therapy as you want. The government wants to be sure that these services are medically necessary.

Once you have spent $2,010 on physical therapy and speech therapy combined or on occupational therapy alone in a calendar year, your therapist needs to add a billing code to your medical record as a flag to the government. Technically, the $2,010 amount is not a cap since it does not stop you from getting more therapy. It is instead seen as a “threshold” limit.

After you have spent $3,000 for physical therapy and speech therapy combined or $3,000 for occupational therapy, Medicare may audit your case to make sure continued sessions are medically necessary. Your therapist needs to explain why additional sessions are indicated and clearly document this in your medical record. Failure to properly document this information could lead to Medicare denying coverage for additional therapy that calendar year.

Recommended Reading: How To Change Medicare Direct Deposit

How Many Physical Therapy Visits Does Medicare Allow

Medicare had a cap on the number of sessions you could have in a year. But, these physical therapy limits are no longer active. You can have as much physical therapy as is medically necessary each year.

However, the threshold amount that Medicare pays for physical and speech therapy combined is $2,150 before reviewing a patients case to ensure medical necessity. Also, once a patient spends $2,150 on physical and speech therapy, providers add special billing codes to flag this amount.

Cost Caps: Cap Premiums Deductibles And Other Out

Cost Caps and Coverage for All provides a simple guarantee to everyone in the country: you will be protected from paying too much for your health care, no matter where you get your coverage. It accomplishes this through four steps:

Cost Caps and Coverage for All will make health care universal, stable, and affordable for everyone without disrupting existing coverage through employers, Medicare, and Medicaid. It will limit how much they have to pay and guarantee universal coverage without disruption.

Step 1. Protect People in the ACA exchanges

Step 2. Protect workers in employer-based plans

The employer mandate from the ACA would no longer be necessary because the protection it provides for workers would be superseded by the cost caps.

Step 3. Protect people on Medicaid

Step 4. Protect People in Medicare

You May Like: How Much Does Medicare Pay For Hospice

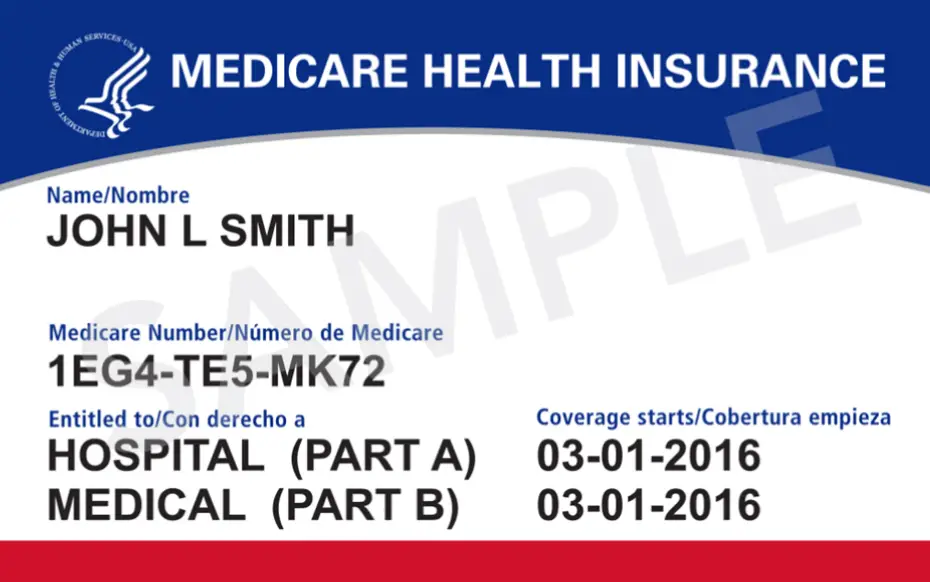

Q: What Are The Changes To Medicare Benefits For 2022

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more.

The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the programs history. But the 5.9% Social Security cost-of-living adjustment is also historically large, and will more than cover the increase in Part B premiums for beneficiaries who receive Social Security retirement benefits.

CMS noted that the significant Part B premium increase is due to several factors, including costs associated with COVID, uncertainty around potential spending increases due to Aduhelm , and the fact that 2021 premiums were lower than they would otherwise have been, due to a short-term spending bill enacted in 2020 that limited the Part B premium increase for 2021. Under the terms of the spending bill, the increase for 2021 was limited to 25 percent of what it would otherwise have been.

Looking for Medicare coverage with lower costs? Talk with a licensed advisor now. Call .

Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2022 is $33.37, but costs vary.

Your Part D Premium will depend on the plan you choose. Just like with your Part B coverage, youll pay an increased cost if you make more than the preset income level.

In 2022, if your income is more than $91,000 per year, youll pay an IRMAA of $12.40 each month on top of the cost of your Part D premium. IRMAA amounts go up from there at higher levels of income.

This means that if you make $95,000 per year, and you select a Part D plan with a monthly premium of $36, your total monthly cost will actually be $48.40.

Also Check: How Long Do You Have To Sign Up For Medicare

Does Medicare Advantage Cover Cancer

Medicare Advantage plans give you Part A and B benefits through private insurance coverage. Although Advantage plans usually arent the best choice for cancer patients. This is because most plans benefits arent as good as Medicare plus a Medigap policy.

- Advantage plans either require you to go to specific doctors within a network, or you will pay less if you use a network doctor. With Medicare plus Medigap, you can see any healthcare provider that accepts Medicare.

- Many plans require you to pay coinsurance until you meet your annual out of pocket maximum.

- You cant add a Medigap plan to your Advantage coverage. If you want better cancer coverage, you will have to buy a separate cancer policy.

Medicare Doesn’t Cover Routine Vision Care

Medicare generally doesnt cover routine eye exams or glasses . But some Medicare Advantage plans provide vision coverage, or you may be able to buy a separate supplemental policy that provides vision care alone or includes both dental and vision care. If you set aside money in a health savings account before you enroll in Medicare, you can use the money tax-free at any age for glasses, contact lenses, prescription sunglasses and other out-of-pocket costs for vision care.

Recommended Reading: Does Southeastern Spine Institute Accept Medicare

Medicare Payment Thresholds For Outpatient Therapy Services

How to use the KX modiifier.

As of 2018, the former Medicare therapy caps now are annual thresholds that physical therapists are permitted to exceed when they append claims with the KX modifier for medically necessary services. This change from the earlier “hard” therapy caps is the result of the Bipartisan Budget Act of 2018 which provides for Medicare payment for outpatient therapy services including physical therapy , speech-language pathology , and occupational therapy services.

What Is The Targeted Medical Review Process

The targeted medical review process was implemented long before the Medicare physical therapy cap of 2021 and 2022. In fact, the process has been in place since the Medicare Access and CHIP Reauthorization Act of 2015 and was upheld in the Bipartisan Budget Act of 2018. It serves as a type of checks and balances for providers who exceed the Medicare physical therapy cap.

Between 2018 and 2028, the targeted medical review threshold is $3,000 for combined PT and SLP services and $3,000 for OT services. Services above $3,000 may be subject to targeted medical review. As the name might imply, not all claims that exceed the therapy threshold will be reviewed. Rather, CMS uses a variety of factors to target specific claims for the review process.

A provider may be subject to targeted medical review if:

- They are not in compliance with applicable requirements.

- They have a high claims denial percentage for therapy services.

- They have a pattern of billing for services that deviate from typical claims, such as billing for an unreasonable amount of units of services within a single day.

- They are newly enrolled or have not previously rendered therapy services.

- They are part of a group that includes providers that meet the above criteria.

Also Check: Does Medicare Pay For Home Care Services

What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

The Plan: Cost Caps And Coverage For All

Cost Caps and Coverage for All will make health care universal, stable, and affordable for everyone without disrupting existing coverage through employers, Medicare, Medicaid, and the exchanges. It will protect everyone with a limit on how much they have to pay and guarantees universal coverage. This sweeping policy builds off the architecture of the Affordable Care Act and has two main parts:

- Cost Caps: It caps premiums, deductibles and other out-of-pocket costs for everyone based on income.

- Universal Coverage: It ensures health care is a basic right by automatically covering everyone not currently insured in an affordable plan.

Also Check: How To Get Prior Authorization For Medicare

Why Is There A Cap On The Fica Tax

Social Security and Medicare together constitute what’s known as the Federal Insurance Contributions Act tax. Collectively, FICA taxes amount to 15.3% of wages in 2021 and 2022. It breaks down into 12.4% of earned income up to an annual limit that must be paid into Social Security and an additional 2.9% that must be paid into Medicare.

There is no income cap for the Medicare portion of the tax, meaning you continue to owe your half of the 2.9% tax on all wages earned for the year, regardless of the amount of money you make. The Social Security tax, however, does have a wage-based limit, which means there is a maximum wage that is subject to the tax for that year, and, beyond that, there are no more taxes to pay.

So why is this? And what are the pros and cons of the FICA cap?

Todays Health Care Problems

The ACA was a historic step forward. It has covered 22 million more Americans, which includes 18 million working adults.1 Since 2010, the nations growth in health care costs has slowed to half the rate it was in the previous decade.2 Americans now have coverage for pre-existing conditions and a host of other consumer protections.3

But our nation has far more to do to ensure stable and secure coverage for all. Even without Republican efforts to sabotage the ACA, health care faces three big problems:

You May Like: Does Aetna Follow Medicare Guidelines

What Happens If Physical Therapy Services Exceed The Financial Threshold

If therapy services continue to be medically necessary based on established CMS guidelines, local MAC published guidelines, and the clinical judgement of the provider, then the KX modifier may be added to the CPT code claim line item and payment will be issued from Medicare.

If therapy services are deemed no longer medically necessary AND the patient wants to continue to receive therapy services while paying out of pocket then the provider may choose to issue a mandatory advanced beneficiary notice before continuing care.

The Problem: Gaps In Coverage Under Medicare

Typically, Medicare pays for 73% of an individuals health care costs without factoring in any other supplemental coverage .5 Because of that, most beneficiaries have some source of supplemental coverage, which could be a Medigap plan, a Medicare Advantage plan, a prescription drug plan, a low-income supplement known as Medicare Savings Programs , or various combinations. Within that structure, however, Medicare has two major gaps in coverage:

First, Medicare doesnt have a limit on costs for very expensive drugs in Medicare Part D. This gap stems from the lack of coverage for beneficiaries whose personal spending on drugs exceeds the current $5,100 limit. After reaching that annual limit, individuals must continue to pay 5% of the cost for each drug.6 That leaves older and disabled Americansparticularly those with multiple chronic conditions or expensive specialty drugsunprotected. A maximum out-of-pocket limit simply does not exist, except for low-income beneficiaries through the Low-Income Subsidy Program.

These two gaps in coverage have serious financial and health consequences for beneficiaries.

Read Also: When Can I Start Collecting Medicare Benefits

Can I Still Buy Medigap Plans C And F

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 , Medigap plans C and F are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

Medigap Plans C and F cover the Part B deductible in full. But other Medigap plans require enrollees to pay the Part B deductible themselves. The idea behind the change is to discourage overutilization of services by ensuring that enrollees have to pay at least something when they receive outpatient care, as opposed to having all costs covered by a combination of Medicare Part B and a Medigap plan.

Because the high-deductible Plan F was discontinued for newly-eligible enrollees as of 2020, there is a high-deductible Plan G available instead.

Kx Modifier And Exceptions Process

If services exceed the annual threshold amounts, claims must include the KX modifier as confirmation that services are medically necessary as justified by appropriate documentation in the medical record. There is one amount for PT and SLP services combined and a separate amount for OT services. This amount is indexed annually by the Medicare Economic Index .

For 2022 this KX modifier threshold amount is:

- $2,150 for PT and SLP services combined, and

- $2,150 for OT services.

For 2021 this KX modifier threshold amount is:

- $2,110 for PT and SLP services combined, and

- $2,110 for OT services.

The threshold process consists of 2 tiers:

Also Check: How To Cancel Medicare Online