How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $148.50 for Part B premiums in 2021. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

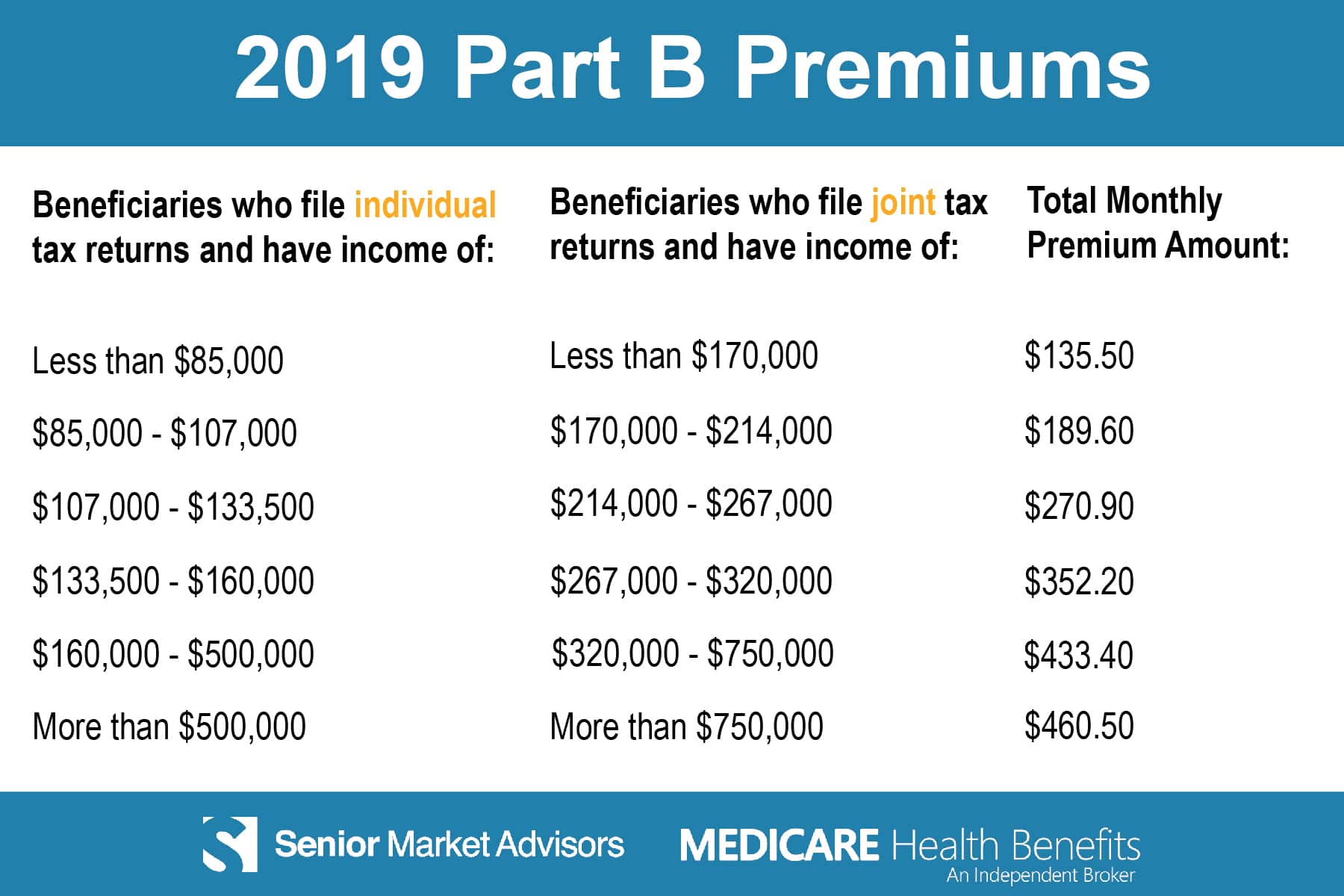

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2021 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2021 is $203.

B Premiums And Deductible

Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and other items. According to the , the standard monthly Part B premium will be $170.10 for 2022, an increase of $21.60. In 2022, the annual deductible for Medicare Part B beneficiaries will be $233, an increase of $30.

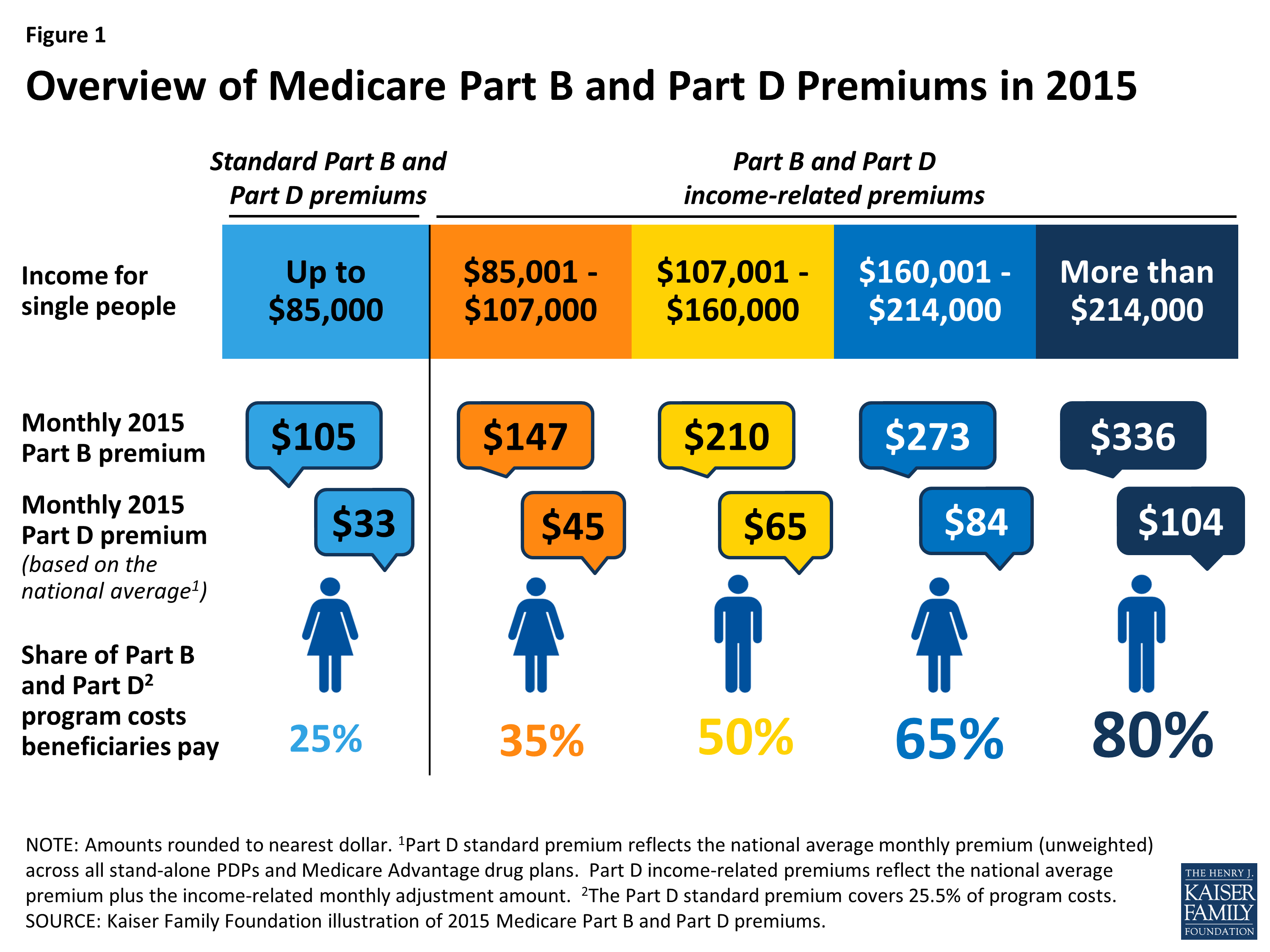

The Part B dollar amounts are in the first four rows of the following table, which also shows the base Part D beneficiary premium for prescription drug coverage.

How To Tell If Part B Covers What You Need

1. Consult with your doctor or health care provider to find out if Medicare covers your needed services or supplies.

In some cases, you may require something that is typically covered by Medicare but your provider isnt sure if coverage will extend in your specific situation. If this happens, you can sign a notice that says you may be required to pay for the test, item, or service.

2. You can also always search your Medicare coverage by test, item, or service at this Medicare.gov Coverage Page.

Remember: Your Medicare coverage will be based on federal and state laws, national coverage decisions by Medicare, and local coverage decisions made by Medicare claims processors in each state.

To get a fuller understanding of your Medicare Part B costs, coverage, and more, read our Comprehensive Guide to Medicare Part B.

Helpful Resource:

Recommended Reading: Where To Send Medicare Payments

And 2022 Irmaa Brackets

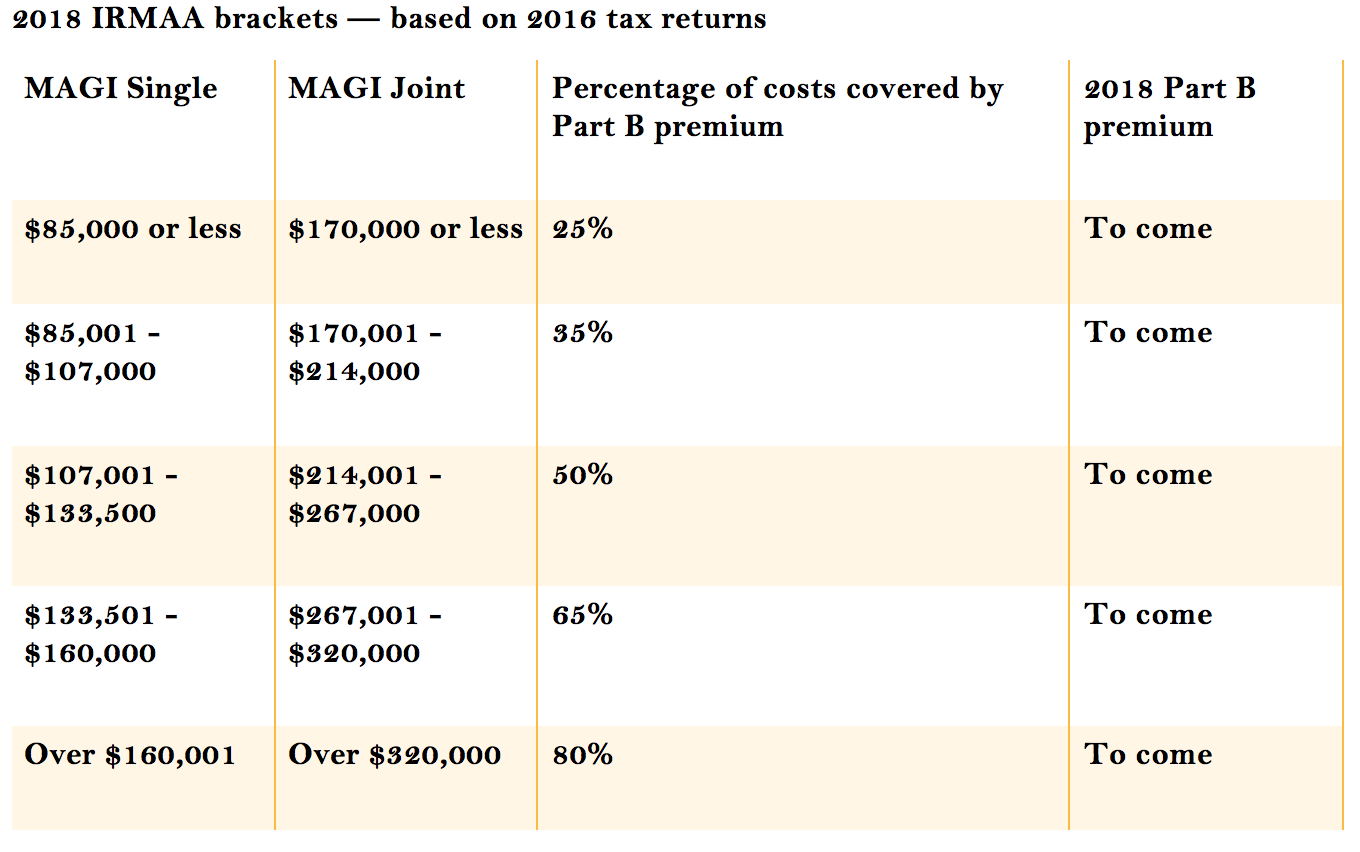

The IRMAA income brackets started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, Im able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return determines the IRMAA you pay in 2022. The income on your 2021 tax return determines the IRMAA you pay in 2023.

| Part B Premium |

|---|

| Single: > $500,000Married Filing Jointly: > $750,000 |

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and dont accidentally cross a line for IRMAA.

Medicare Part A Premium

Most beneficiaries qualify for premium-free Medicare Part A. This insurance isnt income-based rather, the premium depends on how many years you worked and paid Medicare taxes. Heres a breakdown of the Part A monthly premium in 2016. If youve worked while paying Medicare taxes:

- For at least 10 years while paying Medicare taxes, you dont pay a premium

- For 30 to 39 quarters, you pay $226

- For less than 30 quarters, you pay $411

Recommended Reading: Does Medicare Require A Referral To See A Podiatrist

Medicare Part B Premium For 2022

The standard monthly Part B premium has increased from the past year’s amount.

For Medicare recipients, Part B coverage is known as your medical insurance. It helps to cover costs for doctor services, outpatient therapy, durable medical equipment, and other medically necessary services and preventive services not covered by Part A.

To receive your Medicare Part B coverage, you must pay a monthly premium amount, which is adjusted in accordance with the Social Security Act and correlates with your annual income.

The 2022 Medicare Part B monthly premium amount has increased for each income bracket from the 2021 amounts, which we will outline in greater detail below.

If Youre In One Of These 5 Groups Heres What Youll Pay In :

2021 Medicare Part B IRMAA chart

Get more Medicare help on our Facebook community page.

The Medicare Cost for some people in higher income brackets went up in 2018 and 2019 due to the MACRA legislation passed a few years ago. Its a good idea to keep an eye on these Medicare income limits in the future because they may be adjusted every few years.

You May Like: When Is Medicare Supplement Open Enrollment

Is Medicare Part B Based On Income

Yes,Medicare Part B pricing is based on income. However, coverage is federally regulated, which means that Medicare Part A is usually a $0 premium, but Part B requires a monthly premium that is based on your tax filings.

âThe most common monthly Part B premium is $148.50. If you have a high income, you’ll pay more.

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Recommended Reading: Do I Need Medicare If I Have Tricare

A Deductible And Coinsurance

| Daily Part A coinsurance for the 21st through 100th day in a skilled nursing facility | $185.50 | $194.50 |

1 There is no cost-sharing requirement for the second through 60th day of a hospital stay.

Many public plans and employers have current and future retirees that do not have, or will not qualify for, zero-premium Part A coverage. Alternative market opportunities and strategies exist to provide benefits to these retirees in a more effective manner.

About The Author: By Marcia Mantell Rma Nssa

Marcia Mantell is the founder and president of Mantell Retirement Consulting, Inc., a retirement business development, marketing & communications, and education company supporting the financial services industry, advisors, and their clients. She is author of Whats the Deal with Retirement Planning for Women,Whats the Deal with Social Security for Women and blogs at BoomerRetirementBriefs.com.

Also Check: How To Change Primary Doctor On Medicare

What Is The Part B Premium Amount For 2022

The standard monthly Part B premium for 2022 is $170.10. This amount has increased by $21.60 from the standard monthly Part B premium for 2021, which was $148.50.

The standard monthly Part B premium amount applies to all enrollees whose annual income does not exceed $91,000 or $182,000 if married and filing jointly.

To determine which income bracket you fall in, Medicare uses the modified adjusted gross income from your 2020 tax return. Most Medicare beneficiaries pay the standard Part B premium amount, but if your annual income exceeds $91,000, then you will pay a higher monthly Part B premium amount.

The Part B premium amounts for higher income brackets are listed below.

Rising Health Care Costs And The Approval Of Aduhelm A New Expensive Alzheimer’s Drug Were Partly To Blame For Increases In The Part B Premium And Deductible

Medicare beneficiaries will pay more a lot more for Part B in 2022.

The Centers for Medicare & Medicaid Services said on Friday that the standard monthly Part B premium for next year will be $170.10. Thats an increase of 14.5%, or $21.60, from 2021. The annual Part B deductible will be $233, an increase of $30 from 2021.

The increases were due in part to rising health care costs and higher utilization of health care services, Medicare said. Medicare beneficiaries potentially being prescribed the Alzheimers drug, Aduhelm, which was approved by the Food and Drug Administration earlier this year, was also to blame, Medicare said. Aduhelms price tag $56,000 per person each year has been criticized and has raised questions about the strain it would put on Medicares finances.

The Kaiser Family Foundation estimated in June that if just a quarter of the 2 million beneficiaries who were prescribed an Alzheimers treatment under Part D in 2017 took Aduhelm, it would cost Medicare $29 billion in one year. To put that into perspective, Medicare spent $37 billion on all Part B drugs in 2019, KFF said.

Since Aduhelm must be administered by a doctor, it is covered under Part B and not under a prescription drug plan. Medicare started a National Coverage Determination in July to determine whether and how the agency would cover the treatment and other similar Alzheimers drugs.

Don’t Miss: What Is Centers For Medicare And Medicaid Services

Is Medicare Ever Free

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums.

However, it’s possible to receive assistance for your Medicare Part A and Part B premiums, copays, and other fees. This is called a Medicare Savings Program, which is state-funded help with paying your premiums.

In some situations, Part A and Part B deductibles, coinsurance, and copayments may be paid as well.

If you receive Social Security benefits, it may feel like Medicare is free because your Part B premiums can be automatically deducted from your benefit checks, but you are still paying for your coverage.

Though this doesnât necessarily make Medicare free, it’s definitely worthwhile to check out the Medicare Savings Program if you need financial assistance.

Read more: Is Medicare Coverage Free at Age 65?

What Do Medicare Savings Programs Pay For

Because each program is different, they all pay for different things.

- A QMB program helps pay for Part A premiums and/or Part B premiums, deductibles, coinsurance and copayments except outpatient prescription drugs. â

- A SLBM program helps pay for Part B premiums only. â

- A QI program helps pay for Part B premiums and is allocated on a first-come, first-serve basis. You also canât qualify for QI if you qualify for Medicaid. â

- A QDWI program helps pay for Part A premiums only.

Also Check: Is Healthfirst Medicaid Or Medicare

Who Will Have To Pay The Extra Amount

When you sign up for Social Security, youll also want to sign up for Medicare. As long as you meet the age and work history qualifications, youll get Medicare Part A for free. But youll also want Part B, which covers your doctors visits and other specific medically necessary services.For Part B, youll pay monthly premiums.These Medicare payments, based on income, can change from one year to the next. In 2021, as long as your 2019 adjusted gross income was $88,000 or less, or $176,000 or less if youre married filing jointly, youll pay only $148.50 per month.

Once youve exceeded that Medicare threshold, the amount you pay depends on your income. If you earn between $88,000 and $111,000, your premium will be $207.90. It goes all the way up to $504.90, which applies to single filers earning $500,000 or more in 2019.

How Much Does It Cost

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if youre enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

Be sure to enter your zip code below and compare Medicare costs to ensure you have the best and most affordable coverage.

Also Check: How To Get Medicare Insurance License

What If Your Financial Situation Has Significantly Changed Since Filing Your Tax Return From Two Years Ago

As mentioned earlier, most people pay the standard rate for 2021 Part B or Part D premiums. Few pay IRMAA surcharges. But if you are one of the seniors that have had a life-altering event that drastically affects your income level since you first enrolled, such as the death of a spouse or retirement, you can go to Social Securitys website to fill out theMedicare income-related monthly adjustment amount life changing event form. You dont have to pay an amount that no longer makes sense.

Premiums Rise Well Above General Inflation

Part B premiums fluctuate considerably year to year. Generally, health care costs increase and therefore, Part B premiums rise as well. But there are years when the premium remains flat. And there were three times since the inception of Medicare that premiums decreased for some beneficiaries.

Looking at the last 10 years, Part B premium prices have fluctuated significantly:

Historic Medicare Part B premiums

Those who have been in Part B since 2013 have seen their premiums increase 62%. Overall inflation during the same time period is up only 13.5%.

Don’t Miss: What Age Can A Woman Get Medicare

How Do I Qualify For Medicare Financial Assistance

Income limits change every year, so if you arenât sure about your qualification, donât count yourself out yet!

Each type of Medicare Savings Program has a different monthly income limit that varies based on marital status. Here are this yearâs limits to qualify for all the different programs*:

- QMB program: $1,094/month and $1,472/month

- SLMB program: $1,308/month and $1,762/month â

- QI program: $1,469/month and $1,980/month â

- QDWI program: $4,379/month and $5,892/month

*Income limits can be slightly higher in Alaska and Hawaii, so be sure to talk to a trusted agent to learn more about your specific qualifications.

Aside from income, there are also resource limits to qualify for Medicare Savings Programs. Countable resources include:

- Money in checking or savings accounts

- Stocks

However, the following resources are exempt:

- One home

- Up to $1,500 in set-aside burial expenses

- Furniture

- Any other household and personal items

All of these programs have personal qualifications, from age to disability status, so be sure to check with your agent or our team here at Medicare Allies to learn more about the best program for you.

What Is The Difference Between Extra Help And The Medicare Savings Program

When investigating affordable Medicare options, you’ve likely come across the names Extra Help and Medicare Savings Progam.

Though Extra Help is a great resource, it is only going to help with Medicare Part D prescription drug costs.

If you’re looking for help with your Original Medicare-related costs, look for a Medicare Savings Program. There are four kinds:

- Qualified Medicare Beneficiary program

- Specified Low-income Medicare Beneficiary program

- Qualifying Individual program

- Qualified Disabled and Working Individuals program

Bonus Tip: If you qualify for the QMB program, SLMB program, or QI program, you automatically qualify for Extra Help to assist with your Medicare prescription drug coverage costs.

Don’t Miss: Who Pays The Premium For Medicare Advantage Plans

What Affects Medicare Advantage Premiums

Medicare Advantage premiums are primarily based on the services offered within a plan, not a policyholders income. Not all Medicare Advantage plans have premiums these plans are usually the same price as Original Medicare. Pricing can be even less than Original Medicare if a Medicare Advantage plan pays part of the standard Plan B premium amount but does not require its own premium.

However, many Medicare Advantage plans will come with an individual premium, in addition to standard Part B premiums. This amount must be paid to the insurance provider on top of any Plan B premiums owed. Medicare Advantage premiums will vary from one plan to another, as well as from one insurance provider to another. There is no standard pricing for Part C premiums.

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium. However, plans with more expansive coverage, such as those that cover hearing, vision, dental or prescription drugs, will likely have a higher premium.

Overall, how much seniors pay in Medicare premiums has two components: the income-based Plan B premium and any additional premium a Medicare Advantage provider charges. Medicare Plan B premiums are based on income, and thus the total amount owed is income-driven, but Medicare Advantage premiums are based on services.

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2021, most people earning no more than $88,000 pay $148.50/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The Part B premium increase from 2020 to 2021 was smaller than initially projected, thanks to a short-term government spending bill that was enacted in the fall of 2020, and that included a provision to cap the increase in the Part B premium for 2021.

Recommended Reading: Where Do I File For Medicare