What About Medicare Part C

In the confusing alphabet soup of the federal retiree health insurance world, its important to understand that Medicare Advantage is just another name for Medicare Part C.

In effect, when you sign up for Medicare Part C, the private insurance company providing you with Medicare advantage also agrees to offer you the same Medicare Part A and Medicare Part B benefits that are included with original Medicare.

Medicare Part A covers hospitalization and skilled nursing care, for a limited period after hospitalization. Medicare Part B covers doctor visits, exams and care you receive outside of a hospital.

Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs…. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

Paying For A Medicare Advantage Special Needs Plan

Along with having a qualifying medical condition, you must have Original Medicare to be eligible for a Special Needs Plan . Some people who meet these requirements also have Medicaid. For those who have both Medicare and Medicaid, Medicaid helps pay for most of the costs in joining a plan. These costs include premiums, coinsurance, and copayments.

CMS requires that Medicaid pay for copayments and coinsurance for certain people enrolled in MSPs. However, Medicaid is not required to help pay for Medicare Part C insurance premiums. Federal Medicaid laws allow each state Medicaid agency to decide if they will pay Medicare Part C premiums for those enrolled in a MSP as a qualified Medicare beneficiary.

An insurance company can also decide to charge a premium for Part C SNP enrollees who have both Medicare and Medicaid as well as those who dont have both. In this case, you would pay the full Part C premium . According to Medicare.gov, SNPs typically have the same basic costs as other Part C plans. This means you could pay around the same average monthly premiums as shown in the table above or maybe even $0 in premiums.

Read Also: Does Aspen Dental Accept Medicare

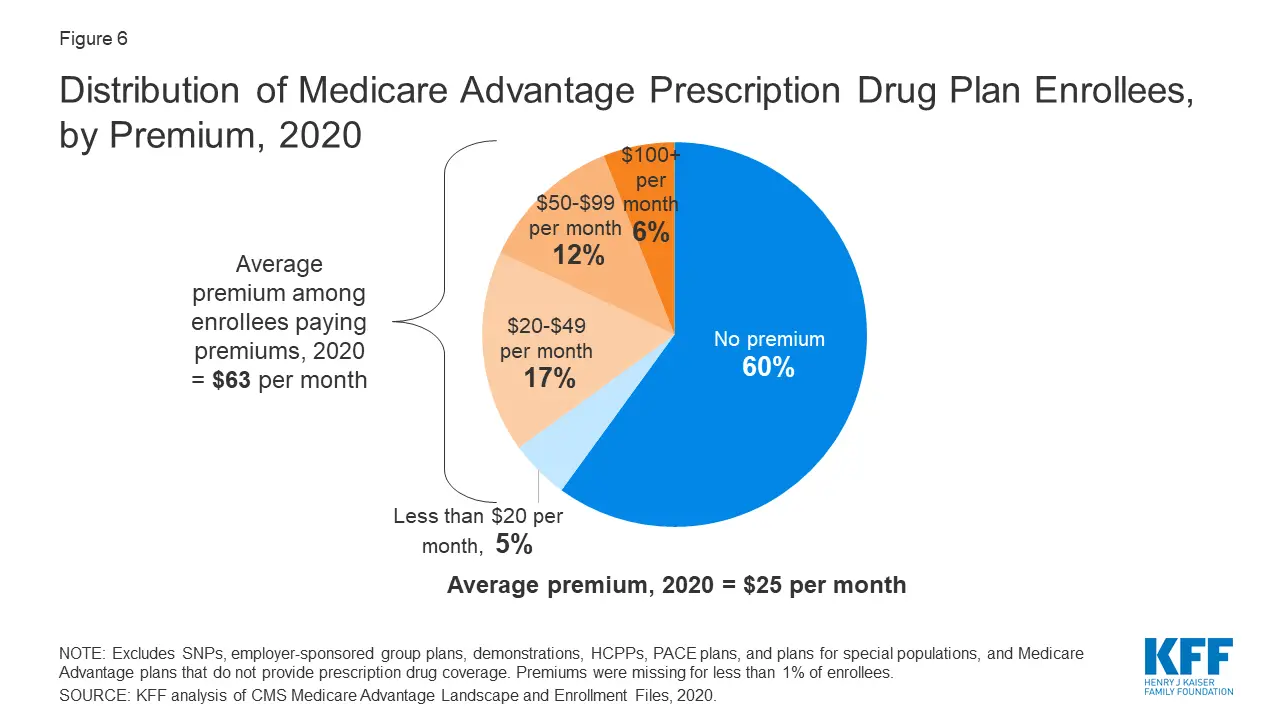

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

Top 9 Advantages And Disadvantages Of Medicare Advantage Plans

by David Bynon, June 18, 2021

If you are about to make plan election choices for yourself or a loved one, you might find yourself asking what are the advantages and disadvantages of Medicare Advantage plansMedicare Advantage , also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ….? Well answer that important question in this article.

Read Also: Can You Change Medicare Plans After Open Enrollment

Medicare Advantage Plans Cant Turn You Down

When President G. W. Bush signed Medicare Advantage into law in 2003, he started the pre-existing conditionA pre-existing condition is any health problem that occurred before enrolling in a health plan. The Affordable Care Act law made it illegal for health plans to or charge more due to a pre-existing condition…. coverage revolution that went into The Affordable Care Act. Unlike Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…., which only has one guaranteed-issue period, people with Medicare Advantage medical insurance can change plans every year without having to answer questions about their health.

Only those with ESRD , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age….) and a few rare health conditions can be turned down. For these people, Medicare offers special coverage directly.

This is a significant benefit of the Medicare Advantage program that cannot be overstated. Millions of Americans, who would otherwise be bankrupted by healthcare costs in traditional Medicare, are able to get quality care through an MA plan.

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2021 standard premium for Part B is $148.50 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

Recommended Reading: Does Medicare Cover Full Body Scans

Why Are Medicare Advantage Plans So Heavily Advertised

Co-Founder of Elite Insurance Partners, a Medicare learning resource center for all Medicare beneficiaries.

getty

If you’ve ever watched cable television during Medicare’s annual enrollment period, you’ve probably noticed a bounty of commercials for Medicare Advantage plans. Some of these TV ads feature celebrity spokespeople, touting the plans’ benefits.

How Medicare Advantage Plans Work

Private insurance companies offer Advantage plans, also known as Part C, to Medicare beneficiaries. Advantage plans enable participants to receive multiple benefits from one plan, but all Advantage plans must also include the same coverage as Original Medicare .

When you have an Advantage plan and receive care, the insurance company pays instead of Medicare. Advantage plans are often HMOs or PPOs, likely similar to your employer coverage. Thus, these plans involve provider networks. So if you see a practitioner outside your network, you incur additional out-of-pocket costs.

This is in contrast to the red, white and blue card for Original Medicare. With or without secondary Medigap insurance, Original Medicare coverage enables you to see any doctor accepting Medicare assignment. As of 2020, only 1% of physicians treating adults had formally opted out of Medicare assignment, so this is similar to having an unlimited “network.”

Medicare Advantage Funding

Easy To Advertise

Does A Zero-Dollar Premium Mean Free Medicare?

Main Takeaways

What Else Do I Need To Know About $0

Average Medicare Advantage premiums dropped 33 percent year over year in 2019, according to eHealth research. The popularity of $0-premium plans contributed to the low average premiums.

Medicare Part D plans are not available with $0-premiums.

Whether or not its a $0-premium Medicare Advantage plan that you sign up for, you still need to continue paying your Medicare Part B premium, in addition to any premium your plan may charge. Youre still in the Medicare program even when you receive your benefits through a Medicare Advantage plan.

As you can see, the cost of a Medicare Advantage plans premium isnt all there is to choosing which Medicare Advantage plan may be right for you. It could be a $0-premium Medicare Advantage plan, or a different plan that might suit your needs. Would you like help comparing $0-premium Medicare Advantage plans and other Medicare health plans? Just enter your ZIP code on this page.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

You May Like: What Are Medicare Part Abcd

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer $0 premiums, the devil is in the details. You will find that most have unexpected out-of-pocket expenses when you get sick, and what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

How Can Medicare Advantage Plans Have $0 Monthly Premiums

A health insurance plan with no monthly premium almost sounds too good to be true, but in the world of Medicare Advantage, itâs very common.

In case youâre new to Medicare, Medicare Advantage is an alternative option for health coverage. Medicare Advantage, or MA, is offered by private insurance companies, and itâs approved by Medicare.

MA plans cover everything traditional Medicare covers as well as emergency and urgent care. These plans often include extra perks, like dental coverage, wellness programs, and prescription drug coverage.

Some of the tradeoffs of Medicare Advantage when comparing it to Original Medicare are the networks and the co-pays, which accumulate to a maximum out-of-pocket limit anywhere between a couple thousand dollars to as high as $6,000 and even a little higher. Networks are restrictive, so youâll need to make sure your preferred doctors are in the network before choosing a plan. Deductibles and co-pays also tend to range anywhere from $3,000 to nearly $7,000, which is much higher than Original Medicare.

Before you aged into Medicare, you were probably used to seeing health insurance plans with monthly premiums of over $500, and in some cases, even $800+.

So, how is it even possible that Medicare Advantage plans often have little to no monthly premium?

Get Your âI’m Turning 65â Checklist

Are you turning 65 soon? Avoid missing critical Medicare enrollment deadlines with this Turning 65 Checklist.

Also Check: Can I Switch Medicare Supplement Plans

Can I Get Help Paying For Medicare Advantage

Yes, you can get help paying for your Medicare Advantage plan through Medicare Savings Programs made available by the Centers for Medicare and Medicaid Services . If you meet the requirements for low-income, disability, or certain chronic health conditions, MSPs can help pay for some of your plan costs, which may include premiums.

Reason : Free Plans Are Not Really Free

This is true.

The real issue here is peoples misunderstanding of how Medicare Advantage plans work. Specifically, many people dont understand copayments and coinsuranceCoinsurance is a percentage of the total you are required to pay for a medical service. …. So, if you are wondering, how can Medicare Advantage plans be free?, they arent. Far from it.

Just like Original Medicare , Medicare Advantage is a cost-sharing system. With Original Medicare beneficiaries pay about 20 percent of the cost for all Medicare-approved services and Medicare pays 80 percent. With a Medicare Advantage plan, you also pay about 20 percent of your costs, but there is an annual cap that limits your out-of-pocket costs, which solves one of the biggest problems with Medicare Parts A and B.

NOTE: The annual maximum out-of-pocket limit thats built into all Medicare Advantage plans is a major advantage. For those beneficiaries with chronic health conditions, who cannot get a Medicare supplement, the annual MOOP keeps them out of bankruptcy from excessive medical bills.

ALSO: Some zero-dollar premium Advantage health plans can rebate all or a portion of your Medicare Part B premium back to members as part of their monthly Social Security check. In other words, the Medicare Advantage plan pays your Part B premium for you.

You May Like: How To Apply For Medicare Insurance

Tips On How To Pay Medicare Premiums

- Make sure to pay both your Part B and Part C premiums on time so you wont lose coverage. Automatic deductions are the best way to avoid missing a payment.

- Make sure both Medicare and your Part C provider have your current mailing address for bill delivery .

- Dont miss more than three months of Medicare Part B payments. Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made.

- Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

Medicare Advantage Plans: Common Elements

- All plans have a contract with the Centers for Medicare and Medicaid Services .

- The plan must enroll anyone in the service area that has Part A and Part B, except for end-stage renal disease patients.

- Each plan must offer an annual enrollment period.

- You must pay your Medicare Part B premium.

- You pay any plan premium, deductibles, or copayments.

- All plans may provide additional benefits or services not covered by Medicare.

- There is usually less paperwork for you.

- The Centers for Medicare and Medicaid Services pays the plan a set amount for each month that a beneficiary is enrolled.

The Centers for Medicare and Medicaid Services monitors appeals and marketing plans. All plans, except for Private Fee-for-Service, must have a quality assurance program.

If you meet the following requirements, the Medicare Advantage plan must enroll you.

You may be under 65 and you cannot be denied coverage due to pre-existing conditions.

- You have Medicare Part A and Part B.

- You pay the Medicare Part B premium.

- You live in a county serviced by the plan.

- You pay the plan’s monthly premium.

- You are not receiving Medicare due to end-stage kidney disease.

Another type of Medicare Managed Health Maintenance Organization is a Cost Contract HMO. These plans have different requirements for enrollment.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

Is A $0 Premium Medicare Advantage Plan Worth It

Whether a $0 premium plan is right for you depends on your situation. With these plans, you could save money upfront only to pay more when you receive health services. Generally, the more you use your coverage, the more out-of-pocket costs youll have.

For people who use their coverage often, a $0 premium plan may not be worth it. But for those who mostly use their coverage for preventative services and the occasional doctor visit, the premium savings could be worth it.

Keep in mind that its not just about the money: some $0 premium Medicare Advantage plans have fewer benefits too. And if the cost of a service without insurance is prohibitively expensive, many people might try to make do without it. To weed out plans with poor health results, choose a plan with a high Medicare Star Rating. These ratings are primarily based on health outcomes. Plans that fail to improve your health may see a lower score.

Medicare Advantage plans with $0 premiums aren’t for everyone. If they don’t seem like the right fit for you, consider other options using our Medicare guide.

If a $0 plan does sound like the right fit, heres how to enroll. But you may run into one hiccup: availability.

Are Medicare Advantage Plans Really Bad

The only way to determine if a Medicare Advantage plan is right for you is to take time to understand plan costs and limitations and balance that with your healthcare needs. When you do this you will discover:

Read Also: How To Get A Lift Chair From Medicare