Can I Qualify For A New Guaranteed Issue Medicare Supplement If I Dont Like My Current One

Disliking your policy is not enough to qualify for a new guaranteed issue window. However, you can qualify for a new GI window if you show proof that your insurer either did not follow the rules or attempted to mislead you in some way. If this occurs, you can drop your policy and obtain a new policy with your guaranteed issue right.

AGENT TIP:

You can access All Medigap plans during your initial Open Enrollment Period. This period starts the first of the month you turn 65 or start Medicare Part B and lasts for 6 months.

If You Have Certain Health Issues

You cant be denied or charged more for coverage if you apply during your Medigap open enrollment period. But after that six-month period ends, insurers are allowed to collect information about your health and use it to decide whether to accept or deny your application. Many companies will deny Medigap coverage for conditions such as chronic lung, kidney or heart conditions, AIDS, and cancer. Some companies may consider each case for how acute conditions such as diabetes are for the applicant before making their decision.

Even if an insurer offers you a policy after Medigap open enrollment ends, it may increase your rate due to health issues and attach waiting periods for coverage for preexisting conditions.

How Is Pricing Calculated With A Guaranteed Issue Medicare Supplement

As previously stated, the guaranteed issue window grants you the same benefits as the open enrollment. This means that insurers must provide the best possible prices for your circumstances. That said, not every Medigap plan is priced the same way. There are three basic pricing models for Medicare supplements:

- Current Age Pricing Your Medigap insurance premium is calculated based on your current age. As you get older, your premiums will increase accordingly.

- Entry Age Pricing Your Medigap insurance premium is calculated based on the age you were when you first purchased the policy. Your premium will not change over time.

- Community Pricing Premiums are the same for everyone who obtains the policy.

Read more about how Medigap plans are priced here.

You May Like: Is Dexcom G6 Cgm Covered By Medicare

Cant Get A Medigap Policy Try Medicare Advantage

If no insurer will sell you a Medigap policy, you have an option. Medicare Advantage is another private health plan that can save you money. Plans have a maximum limit on out-of-pocket costs, typically $5,000. Some plans even have no monthly premium.

Medicare Advantage plans provide Part A and Part B, and often include Part D prescription drug coverage. You can have either a Medigap policy or Medicare Advantage plan, not both.

Now that you know when you can enroll in a Medicare Supplement plan and the types of plans available, youre better prepared to sign up. Remember that your Medigap Open Enrollment Period is a one-time event thats unique to you, so dont miss it!

What If I Missed My Medicare Supplement Open Enrollment Period

In the past, Medicare has not been proactive about notifying people turning 65 about this Medicare Supplement Open Enrollment window. It has been, to some degree, up to each individual to research and understand this. Because of this, we encounter many people who have missed their open enrollment period.

This does not mean you cannot apply for a plan at all. On the contrary, you can still apply for a plan. If you are in good health, generally speaking, you should still be able to get a plan. You should contact a broker or the plan that you want and get a copy of the medical questions. An independent broker should be familiar with the different underwriting guidelines and health questions from each insurance company, so they should be able to advise which company may issue you a policy outside of your Medicare Supplement open enrollment period.

Also, there are some states that do not allow insurance companies to use underwriting, regardless of age or whether you are in open enrollment. Rates are, of course, higher in these states, but it does at least allow people who miss their open enrollment period the opportunity to get a plan.

Lastly, note that there are other situations that permit enrollment into a Medicare Supplement without having to answer medical questions. These situations are called guaranteed issue situations. Weve written about those here: When Is a Medicare Supplement Guaranteed Issue?

Don’t Miss: Do You Have To Apply For Medicare

You Do Not Check Your Annual Notice Of Change

Medicare Advantage plans and Part D plans are run by insurance companies. The federal government requires them to cover certain services. That said, they can change what other services they cover and who provides them.

Once a year, they will send out an Annual Notice of Change. This document outlines what changes are coming in the new year regarding costs and coverage.

Check to make sure that there are no changes in your plan that could affect your care, including:

- Will your doctors be in your network next year?

- Are any medications you take being taken off your formulary or being moved to a higher tier ?

- Will the cost of your deductibles, coinsurance, and copayments change, and how much more could you end up paying?

You Joined An Advantage Or Programs Of All

If, during your first year of Medicare eligibility, you joined an MA or PACE plan and want to switch to Original Medicare within 12 months, you qualify for guaranteed issue under trial rights. Guidelines include:

- You may buy any Medigap policy offered by insurers in your state

- You may apply for a Supplement policy 60 days before your current coverage ends

- The window closes 63 days after you lose your current Medicare coverage

Also Check: How Many Parts Medicare Has

Medicare Advantage Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Advantage plan. You need to enroll in Original Medicare before you enroll in Medicare Advantage. Before enrolling in a plan, it may be a good idea to compare Medicare Advantage quotes.

To be eligible for Medicare Part C, you must already be enrolled in Part A and Part B.

If you are interested in joining a Medicare Advantage plan, you typically can only do so during specific times of the year.

The first time you may be able to enroll is during your Medicare Initial Enrollment Period, as outlined above.

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

I Want To Enroll In Medicare What Are My Next Steps

Once you’re ready to enroll in Medicare, you’ll want to consider the following next steps:

Also Check: Does Medicare Pay For Maintenance Chiropractic Care

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

What’s New for Medicare beneficiaries under age 65?

Medicare Supplemental Insurance federal regulations do not guarantee eligibility to individuals under age 65 who are eligible for Medicare due to disability. However, thirty-three states have adopted state legislation extending guarantee issue to that group of individuals. North Carolina is one of the states that legislatively mandates eligibility to individuals eligible for Medicare due to disability.

Below is the link to review the new regulation.

What is the Open Enrollment Period?

Cost of Medigap Policies

Medicare Supplement Enrollment Period Explained

When you first turn age 65 and qualify for your Medicare benefits, you have a six-month window to enroll in the Medigap plan of your choice without the fear of being turned down or charged more due to a pre-existing condition. You must be enrolled in both Medicare Part A and Medicare Part B, but you have a guaranteed-issue right.

You Might Also Like:Do I Really Need Supplemental Insurance with Medicare?

Your Medicare supplement guaranteed-issue right, which starts on the effective date of your Part B coverage, means that insurance companies cant ask you any questions about your health. They can ask you your age, gender, where you live, and your use of tobacco, but they cant force you to ask intrusive health questions. And, so long as you can afford to pay the monthly premiumA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. … for the policy, they cant turn you down.

Unless you live in one of the few states, like California, Oregon, and Washington State, that have enacted new guaranteed-issue legislation, your one-time open enrollment is the only time you are guaranteed to get the coverage you want. A few states have slightly different rules, which are covered below.

Read Also: Can I Change My Medicare Advantage Plan Now

When Should I Enroll In Medicare For The First Time

Most people enroll in Medicare for the first time around age 65. Some people may qualify to enroll in Medicare earlier than age 65 with a qualifying disability or medical condition. If you become eligible for Medicare due to age or disability, you will have a 7-month Initial Enrollment Period. The rules for enrolling are different if you are enrolling due to a qualifying medical condition.

The Medicare Initial Enrollment Period

You can enroll in Medicare for the first time due to age or disability during what’s known as the Medicare Initial Enrollment Period.

Enrolling in Medicare at 65

Around age 65 you have your Medicare Initial Enrollment Period . It is 7 months long and includes your 65th birthday month, the 3 months before and the 3 months after. During this time, you can enroll in Medicare Part A, Part B, Medicare Advantage and Part D without penalty.

Video transcript

Blue text appears in the center of a beige background. Animated calendar pages are strewn in the corners of the screen.

ON SCREEN TEXT: Important Medicare Dates & Timelines

ON SCREEN TEXT:

More blue text appears at the top of the screen. White and black text on colorful cards fan out in a list beneath the blue text.

ON SCREEN TEXT: Keep these important Medicare dates in mind

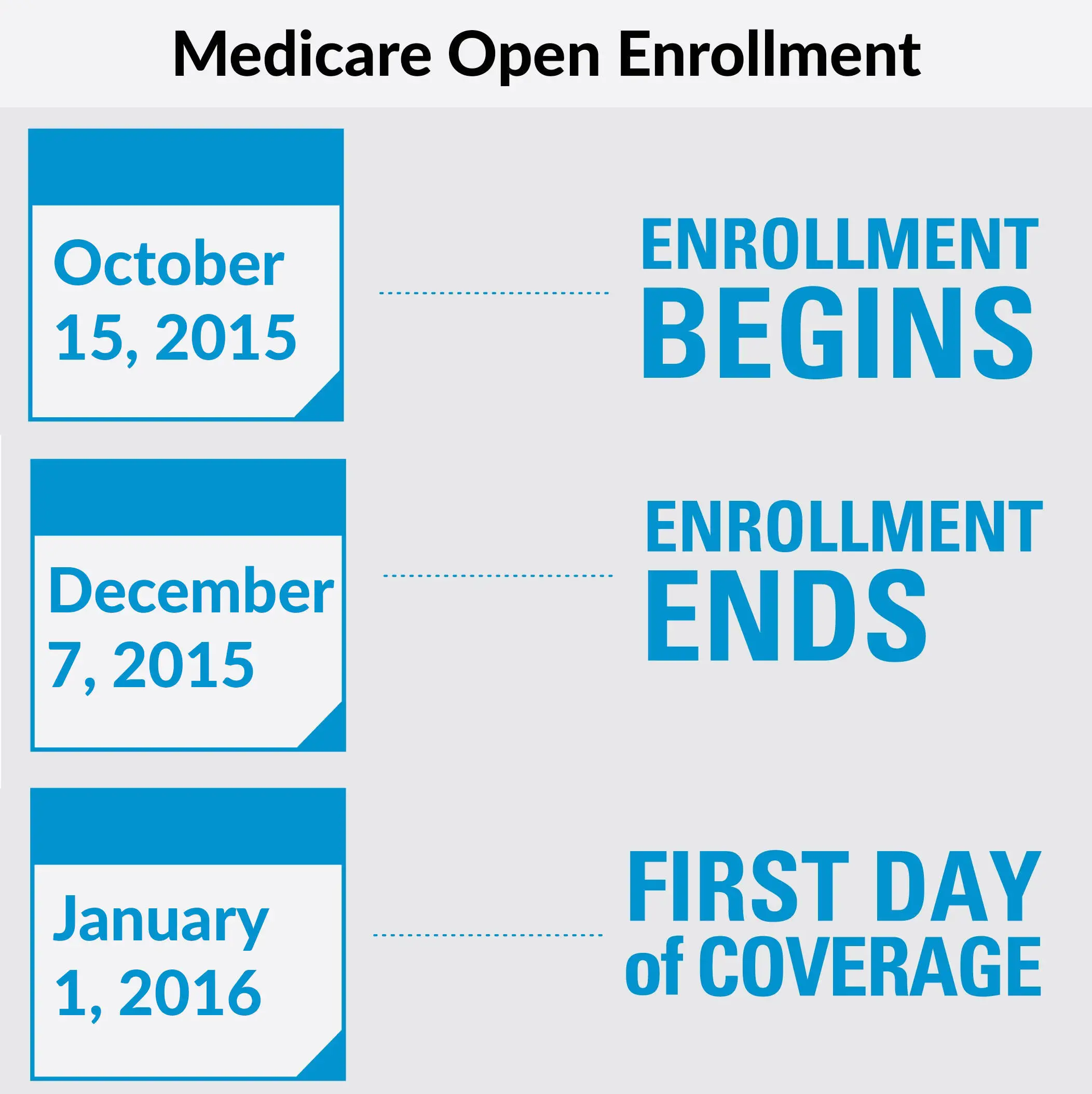

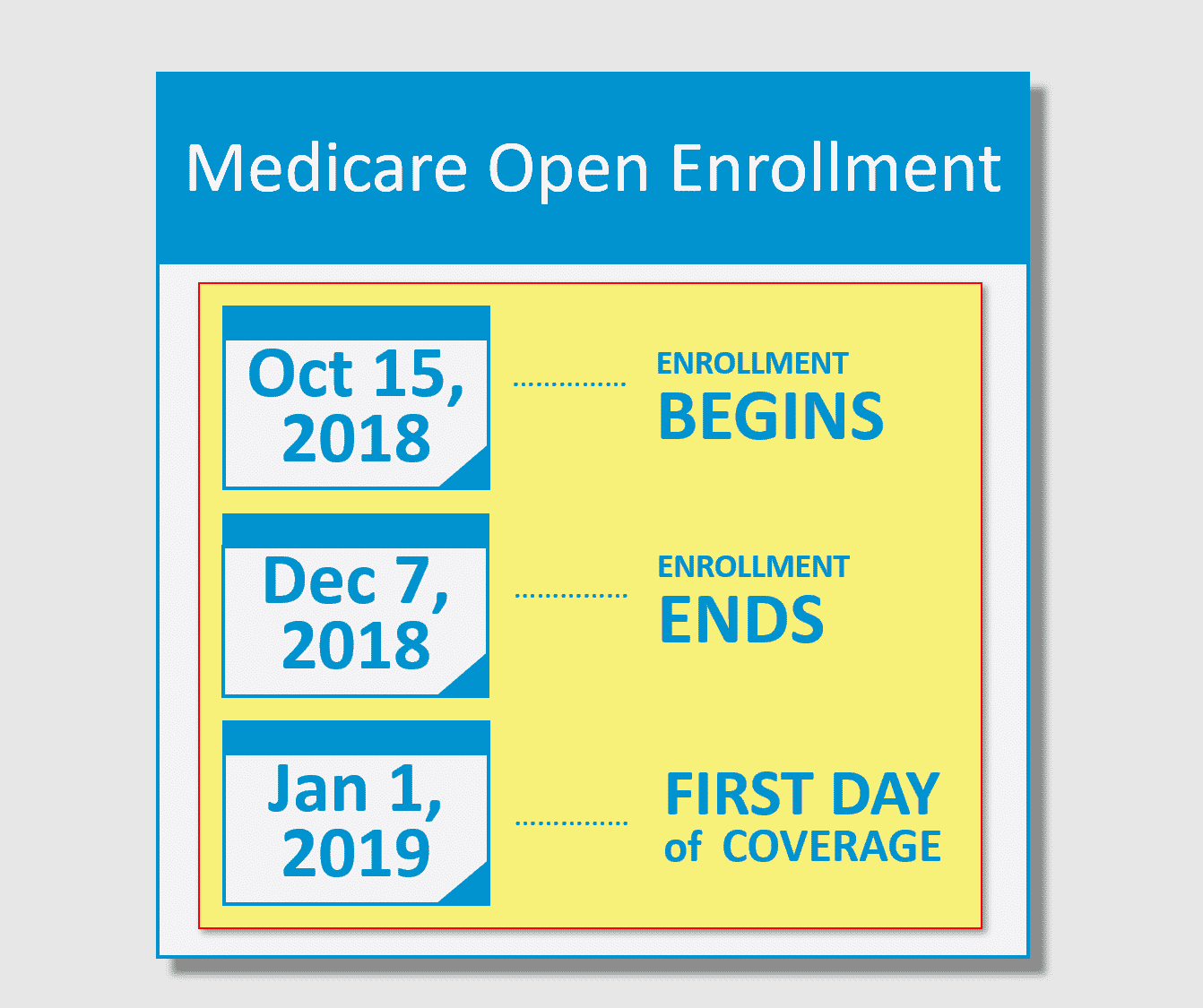

ON SCREEN TEXT: Annual Enrollment Period October 15 – December 7

Initial Enrollment PeriodDates vary by person, 7 months

Special Enrollment Period Dates vary by person, 2-8 months

Do You Have To Enroll In Medicare Every Year

You dont have to enroll in Medicare every year. You also dont have to renew your Medicare plan each year.

This is true if youre enrolled in Original Medicare, as well as if you have Medicare Advantage, Medigap or Part D coverage.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided “as is” and “as available” for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

Also Trending

Also Check: What Age Can You Start To Collect Medicare

Fall Open Enrollment Period

People already enrolled in Medicare can make changes to their coverage each year during the annual open enrollment period from Oct. 15 to Dec. 7. Its always a good idea to compare coverage and assess your health and prescription drug needs during this time to make sure you have the Medicare coverage thats best for you and your budget, advises David Lipschutz, associate director of the Center for Medicare Advocacy.

You can:

-

Change from Original Medicare to a Medicare Advantage plan.

-

Change from a Medicare Advantage plan back to Original Medicare.

-

Switch from one Medicare Advantage plan to another Medicare Advantage plan.

-

Switch from a Medicare Advantage plan that doesn’t offer drug coverage to a Medicare Advantage plan that offers drug coverage.

-

Switch from a Medicare Advantage plan that offers drug coverage to a Medicare Advantage plan that doesn’t offer drug coverage.

-

Join a Medicare prescription drug plan.

-

Switch from one Medicare drug plan to another Medicare drug plan.

-

Drop your Medicare prescription drug coverage completely.

Keep in mind that if you return to Original Medicare during this period and you want Medicare Insurance , you may pay more for a supplement policy than you expected.

Your Guide To Medicare Supplement Open Enrollment

About 10,000 people turn 65 years old every day in the U.Sa significant birthday signaling eligibility for MedicareEmpowering Beneficiaries and Modernizing Medicare Enrollment. Better Medicare Alliance. Accessed 09/22/2021. . If enrollment in Medicare is on the horizon for you or a loved one, its also worth looking into Medicare Supplement insurance, commonly known as Medigap.

Read on to learn more about your health insurance options, including details on Medicare Supplements and information to help you navigate the open enrollment process.

You May Like: How To Change Medicare Direct Deposit

What If You Continued Working Past 65

If youre still working past 65 and you or your spouse get health insurance through an employer or union with 20 or more employees or members, you may already have coverage thats similar to Part B. In this case, you can postpone Part B enrollment and you wont face a penalty when you enroll later.12 Part B has a standard monthly premium , so you can save money by not enrolling until you really need it.9

Your Medigap Open Enrollment Period will start once you sign up for Part B. Youll have six months to buy any plan sold in your state at the lowest possible rate with no medical questions asked.

Ditching An Advantage Plan

If your Advantage Plan isn’t working for you and you want to drop it altogether instead of switching to another, you can do that.

You would simply be left with original Medicare and would need to get a standalone Part D prescription drug plan if you want that coverage.

Additionally, although beneficiaries in that situation may want to purchase a Medigap policy, there are rules that apply to enrolling in one. Generally, unless you live in a state whose rules differ or you meet an exception, you get a six-month window when you first enroll in Part B to purchase Medigap without having to answer health questions and be penalized for pre-existing conditions.

If underwriting will occur, it’s wise to apply for the Medigap policy early in this fall enrollment window and to hang on to your Advantage Plan until you know you can get the supplemental coverage, Roberts said.

Read Also: Does Medicare Cover Skin Removal

Faqs About Medicare Supplement Enrollment

What Is Medicare Supplement?

Medicare Supplement plans work with Original Medicare (Medicare Part A and Part B to limit out-of-pocket costs. Unlike Medicare Advantage programs, these are not replacement plans for Original Medicare.

When you get sick or injured, deductibles and copayments with Original Medicare are harsh. The solution is Medicare Supplement plans. Theyre designed by the federal government but sold by private companies.

Medicare Supplement plans are a valuable part of your complete Medicare coverage. These tightly-regulated plans pay the coverage gaps that Original Medicare would otherwise bill to you.

With so many Medicare Supplement providers to choose from, its no wonder folks are surprised when they can get Medigap at a competitive price at any age.

You can learn more about Medicare Supplement plans here.

Do You Need to Apply for Medicare Supplement Every Year?

Medicare Supplement plans are guaranteed renewable each year. Simply continue paying your monthly premiums so that your coverage will continue.

In the rare case that your insurer stops offering your plan, you will be informed well in advance. Youll be able to join any Medicare Supplement plan at the lowest possible rate. Even if you have a plan thats no longer offered , youll be able to buy into that same plan if you can find a carrier who offers it.

When Can You Change Medicare Supplement Plans?

Should You Wait to Apply for Medigap?

What If You Have Employer Coverage?

Is There Any Other Time To Buy A Medigap Plan

Yes. Actually, you can buy a Medigap Plan anytime after turning 65 and having Medicare Part B. However, you wont get the same benefits as like those who enrolled during the Medigap Open Enrollment Period.

Most states may require you to answer medical questions and undergo a medical underwriting. The results of underwriting also do not guarantee that your Medigap application will be accepted . If ever you passed and your application is accepted, insurance companies may charge you with higher premiums than others.

Also Check: When Does Medicare Coverage Start