What Does Medicare Supplement Insurance Cover

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020.

Every company must sell Plan A, which is the basic plan, or the “core benefit” plan. The standard plans are labeled A through L. Remember, the plans are standardized. So, Plan F from one company will be the same as Plan F from another company. Select the supplement policy which fits your needs, and then purchase that plan from the company which offers the lowest premiums and best customer service. Core Benefits: Included in all plans.

- Pays Part A Hospital copayment

- Pays for an additional 365 days of hospitalization after Medicare benefits end.

- Pays Part B copayment

You will have to pay part of the cost-sharing of some covered services until you meet the annual out-of-pocket limit. Plan K has a $6,220 out-of-pocket limit. Plan L has a $3,110 out-of-pocket limit . Once you meet the annual limit, the plan pays 100% of the Medicare copayments, coinsurance, and deductibles for the rest of the calendar year. These amounts can change each year.

Changes To Medicare Supplement Plan F

Its worth noting that Medicare Supplement Plan F may not be available to those new to Medicare. Starting in 2020, Medicare Supplement plans that cover the Part B deductible are being gradually discontinued.

If you qualify for Medicare before January 1, 2020:

- You may be able to buy Medicare Supplement Plan F .

- You can typically keep your existing Plan F or Plan C.

You can talk to your insurance company about how these upcoming changes may affect you. In the meantime, its important to continue to pay your plan premiums.

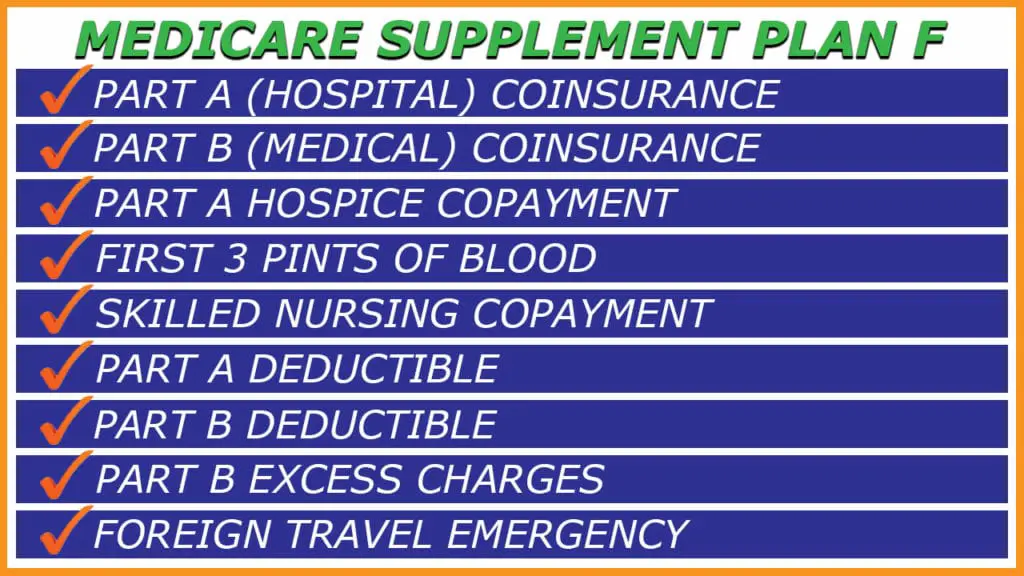

What Is Medicare Supplement Plan F

Medicare Supplement Plan F is far and away the least expensive Medicare Supplement Plan that offers the most coverage. This means it isor wasthe most popular supplement for Original Medicare, especially because Plan F covers the Part B deductible. However, as of January 1, 2020, Plan F is being phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. If youre new, you can enroll in Plan G instead.

Also Check: Does Medicare Cover Any Dental Surgery

Medicare Supplement Plan F Comparison: Plan F Versus Other Plans

To understand the benefits of Medigap PLan, it helps to do a side-by-side comparison with other plans. The chart below shows the percentage rate at which benefits are covered under each plan. Sections with No means the plan does not cover that benefit. You will notice that Plan C and Plan G are the most similar to Medicare Supplement Plan F in terms of the level of coverage available. The only differences are:

- Plan C does not cover Part B excess charge while Plan F covers at 100%.

- Plan G does not cover Part B deductible while Plan F covers at 100%.

You will also notice that Plan K and Plan L provide the least amount of coveragemany benefits are covered at less than 100% and some have no coverage at all. Plus, those plans have out-of-pocket limits.

| Medigap Benefits | |

| N/A | N/A |

| **The plan pays 100% of the costs for covered services for the calendar year after the out-of-pocket yearly limit and yearly Part B deductible has been met.

***Plan Ns Part B coinsurance is covered at 100%, except for up to $20 in copayment for some doctors office visits and up to $50 in copayment for emergency room visits that dont require inpatient admission. |

What Is A High

The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits. For 2019, the deductible for the high-deductible Plan F is set at $2,300. If you want to switch from a high-deductible plan back to the standard Plan F, you may need to undergo a medical exam for underwriting.

A high-deductible Medicare Plan F policy could be useful if you are healthier and do not think you’ll need many medical services. However, you should carefully evaluate your own medical situation before committing to the high-deductible plan, as you would be responsible for the entire $2,300 if you incurred a large medical cost.

For example, say you needed to get a colonoscopy, which can cost up to $3,500. Under a standard Medicare parts A and B plan with Medigap Plan F, the first 80% of that bill would be paid for by Medicare Part B. The remaining 20% would be covered by Plan F. You would end up paying nothing in medical expenses under this scenario, but you would pay the monthly premium of $140, which adds up to $1,680 per year.

In this scenario, you would save $500 if you have the high- deductible policy. However, this assumes you have only one medical expense during the year. For most older adults, this would not be the case. You should carefully evaluate your expected medical expenses for the year before selecting the high-deductible version of Medigap Plan F.

Also Check: What Is The Best Medicare Supplement Plan In Arizona

How To Purchase Medicare Plan F

To get a comprehensive Medicare Plan F, you must purchase it through a private insurance company. This is the only way to get any Medicare Supplement insurance plan.

The process of getting coverage is similar to getting a Medicare Part C Advantage plan. Medicare Part C is also offered by private insurance companies. These plans include the benefits of Medicare Parts A and B, as well as other healthcare benefits.

The cost of Medicare Supplement Plan F will vary depending on where you live. When searching for a plan, youll start by inputting your ZIP code, at which point youll receive quotes for monthly premiums based on your information. Medicare Supplement insurance plans include Plans A, B, C, D, F, G, K, L, M, and N.

For the most part, Plan F monthly premiums are relatively inexpensive, starting as little as $40 a month.

If you need a Medicare Supplement insurance plan, the first step is to enroll in Original Medicare Part A and Part B. Youre eligible to enroll in a Medicare Supplement insurance plan during your Medicare Supplement Open Enrollment Period. This is a six-month period that begins the first day of the month you turn 65. If you dont enroll during this period, you can apply anytime once you’re enrolled in Medicare Part A and Part B.

Why Is Plan F Not Taking New Enrollees

The changes are the result of the Medicare Access and CHIP Reauthorization Act of 2015.1 Congress intended to increase the amount of skin in the game for Medicare beneficiaries. Specifically, MACRA prevents insurance companies from offering plans that cover the Part B deductible to newly eligible beneficiaries after 2020.

You May Like: Will Medicare Cover Walk In Tubs

I Live In Minnesota/wisconsin/massachusetts Does This Still Affect Me

Definitely these three states have their own plans that are similar to the standardized plans offered in other states but with different plan names. If you live in one of these three states, your Medigap coverage options also changed.

For instance, in Minnesota, two Medicare Supplement plan options offer coverage for the Part B deductible. For the Extended Basic plan, this coverage is included for certain enrollees. For the Basic plan, the Part B deductible coverage is available through an optional rider.

Now, with the passage of MACRA, the Part B deductible coverage is only available depending on your eligibility take a look at the next section for more information.

Is Medicare Plan F Being Discontinued

No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act prevented Medicare Supplement plans from providing coverage for Part B deductibles. As a result of this legislation, Medicare beneficiaries who become eligible after December 31, 2019, will not have access to Medicare Supplement Plan F coverage, unless they have a Medicare Part A effective date prior to 2020.

However, beneficiaries who became eligible for Medicare before January 1, 2020, are able to keep Plan F coverage or enroll in a new Plan F policy.

You May Like: Is Obamacare Medicare Or Medicaid

Medicare Supplement Plan F Insurance Coverage

The Medicare Supplement policy that provides the most coverage and no out-of-pocket costs for Medicare covered services.

Get a Free Online Quote

Find out what your monthly premium would be with Cigna’s1 competitive rates.

Apply online and you could save 5% on your premium. Learn more*

Mon-Fri, 8:30 am-8:30 pm, ET

This plan offers the most coverage and the lowest out-of-pocket costs for Medicare-covered services. Most notably, Plan F pays the Medicare Part B calendar year deductible, which most other standardized plans do not.

Plan F is only available if you first became eligible for Medicare before January 1, 2020 . Or you qualified for Medicare due to a disability before January 1, 2020.

Review the chart below for all the details of Plan F coverage or explore other Medicare Supplement plans.

What Is The Difference Between Medicare Supplement Plans F And G

Medicare Supplement Plans F and G are very similar. The one difference is that Plan G does not cover the Part B deductible. Otherwise, they each pay toward the following:

- 80% of foreign travel expenses

- 100% of blood products

- 100% of Part A coinsurance and hospital costs up to 365 days

- 100% of Part A deductible

- 100% of Part A hospice care coinsurance/copayments

- 100% of Part B coinsurance/copayments

- 100% of Part B excess charge

- 100% of skilled nursing facility coinsurance

Also Check: Is Upmc For You Medicare Or Medicaid

All Medicare Beneficiaries Must Be Subject To A Deductible

Currently Medicare Parts A & B both have deductibles. Deductibles are the amount of money that you pay out of pocket before your benefits begin.

Medigap plans can still cover the Part A Hospital deductible, but as of 2020, the plans can no longer cover the Part B deductible for new enrollees. Currently this annual deductible is $233 in 2022.

Since Plan F covers that deductible, it is going to be phased out for new enrollees.

The goal of this measure, in the view of Congress, is to make Medicare beneficiaries put a little more skin in the game.

You see, people with Plan F have what we call first dollar coverage. Right from the first day, Medicare covers 80% and their Medigap Plan F covers the deductibles and the other 20%. So at the time of service, people currently on Plan F pay no copay for their Medicare-related doctor visits. No deductible either. Lawmakers fear that this lack of cost-sharing results in people running to the doctor for minor issues that may not really require medical care.

These changes mean that all Medicare beneficiaries will have least $233 in deductible spending out of your own pocket each year. In light of this, they hope you might think twice before seeing a doctor and perhaps causing the Medicare Trust Fund some unnecessary spending.

Basically. they want you to think about whether you really need to see a doctor for every little sniffle.

How Can I Enroll In Or Switch To Silver Sneakers

You are able to add a Medicare advantage or supplemental insurance plan with Silver Sneakers benefits to your insurance, when you first become eligible, and enroll in original Medicare, typically when you turn 65 . You will have an initial enrollment period for Medicare that lasts from 6 months prior to 6 months past your 65th birthday. If you miss this time period, you may be able to join a supplemental policy at a later time, but you wont have a guaranteed right to be accepted anymore. If you plan on adding a Medicare advantage plan at a later time, you may do so each year in fall during the Open Enrollment period, which is each year in fall. If you missed the open enrollment, you have to wait, and enroll between October 15 and December 7 or switch to a Medicare advantage plan with SilverSneakers benefits. However, if a 5 Star Rated Medicare advantage plan with SilverSneakers is available to you, you may join that plan at any time during the year. Check with Medicare.gov for available 5 Star Rated Medicare advantage plans in your area.

We hope that you will find your SilverSneakers plan and can join a fun fitness class! A regular workout will not only help you improve your agility and flexibility, by improving your fitness and overall health you may even be able to reduce the amount of drugs you are required to take and cut down your prescription drug expenses!

Don’t Miss: How To Disenroll From A Medicare Advantage Plan

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

When Is Plan F Going Away

As of 2020, both Plan F and Plan C are no longer available the same way they used to be. People eligible for Medicare Part A prior to 2020 will continue to have options to enroll in Plans C and F later on.

Every so often, Congress decides to change the landscape on Medicare Supplement plans. In 1990, they first standardized plan options. Then in 2010, they eliminated some plan options like E, H, I, and J. Now, as of the year 2020, Plan C and Plan F are gone for good.

This may make you feel like you missed out on a great opportunity but keep reading. Its possible rates for Plan F may be negatively affected long-term. To explain why, we need to first dive into why these changes are taking place.

Read Also: How To Qualify For Extra Help With Medicare Part D

What Do I Need To Know About Medicare Supplement Plans C F And G

Who is this for?

If you’re an individual and are newly eligible for Medicare on or after Jan. 1, 2020, these changes might affect you.

As you consider your options with Medicare Supplement, Blue Cross Blue Shield wants to make you aware of some changes that could affect your health plan decision. The Medicare Access and CHIP Reauthorization Act of 2015, or MACRA, will affect supplement plans nationwide that cover the Part B deductible. Medicare supplement plans that cover the Part B deductible will no longer be available for individuals who turn 65 or become eligible for Medicare on or after Jan. 1, 2020. Because of these changes, Blue Cross now offers Plan G, which is comparable in benefits and available at a less expensive price than Plan F.

If youre Medicare eligible before Jan. 1, 2020

- Your plan options covering the Part B deductible will not change.

- If you already have a Medicare supplement Plan C, Plan F or high-deductible Plan F, you can keep it. Your policy will continue if your premiums are paid on time.

- You still have the option to purchase a Medicare supplement Plan C, Plan F, or high-deductible Plan F in 2020 and beyond, where offered.

- If you delayed enrolling in Part B because you were still working or had other coverage, you may still have the option of purchasing a Medicare supplement Plan C, Plan F, or high-deductible Plan F, where offered, even if its after Jan. 1, 2020.

If you’re Medicare eligible on or after Jan. 1, 2020

Introducing A New Plan G Option: Plan G Plus

Beginning February 1st, 2021 all three Blue Medicare Supplement Plan Gs have Plus options. Plan G Plus plans have the same medical coverage as their regular versions as well as additional benefits and programs included so members can get more out of their Blue Medicare Supplement insurance plans. Additional benefits and programs include dental, vision, hearing, and fitness. Read this chart for more details:

| Benefit |

|---|

The out-of-pocket annual limit will increase each year for inflation.

Rates as of 04/01/2020. Rates are illustrative only. Actual rates are based on your age, where you live, and your choice of coverage. Please do not send money, you cannot obtain coverage under the above plans until an application is completed and approved. Benefit exclusions and limitations might apply.

Important Information About Quotes for Medicare Supplement Insurance Plans

Quoted prices are based on the criteria specified during your search. This illustration is subject to Blue Cross and Blue Shield of Illinois’s rating or underwriting and approval, as appropriate, and does not guarantee rates, coverage or effective date. Furthermore, rates are subject to change if any of the information you have provided changes when and if a policy is approved. In addition, Blue Cross and Blue Shield of Illinois reserves the right to change rates from time to time.

Recommended Reading: Do I Need Medicare Part C