Medicare As Your Primary Coverage

Should Medicare be your primary health coverage, be sure to enroll in the program in the 3 months before your 65th birthday. This way, your Medicare will start on the first day of the month in which you turn 65.

However, if you choose to register for Medicare in the 3 months after your 65th birthday, then your start date will be later. This is an important point because you could wind up going without health coverage for a couple of months. Please note that your application date affects your start date.

Can You Qualify For Medicare If You Are Under 65

You can qualify for Medicare benefits if you are younger than 65 and one of these situations applies to you. In any case, you are eligible for premium-free Part A hospital insurance:

- You have a disability as defined by Social Security. You will become eligible for Medicare coverage after receiving your monthly social security or the U.S. Railroad Retirement Board for 24 months. If you are disabled but dont receive disability benefits under United States Social Security or qualify for RRB benefits because you are a government employee, the 24 months is extended to 29 months.

- You have ALS. Coverage starts when you are entitled to receive Social Security or RRB disability benefits. There is no waiting period.

- You have kidney disease requiring dialysis or transplant. You must have completed a Medicare application. You or your spouse must have worked long enough under Social Security, the RRB, or as a government employee to be eligible for retirement benefits. Your Medicare coverage start dates work differently if you have end-stage kidney disease. Click here for more details.

Medicare Eligibility If You Still Have Employee Coverage

If you are leaving your employer healthcare coverage in the middle of your Initial Enrollment Period, then your Initial Enrollment Period trumps any other election period. Many people believe that their Medicare coverage will kick in immediately after their group coverage ends, but this is not the case. Enrolling in Medicare early will ensure that you dont have any lapse in coverage.

Again, you can be subject to penalties if you have no other coverage and fail to enroll in Medicare Part B during your Initial Enrollment Period. The Part B penalty is a 10% charge for every full 12-month period that you are not enrolled in.

If your group plan is a small employer plan , then you should still enroll in both Medicare Parts A and Bt during your initial enrollment period. In this situation, Medicare will serve as your primary health insurance. If you work for a small employer, then enrolling in Medicare is extremely important.

On the flip side of the coin, if you are covered by a large employer plan and still working, Medicare can serve as your secondary healthcare coverage.

In this case, you can choose whether or not you want to enroll in Part B or delay enrollment for later. Group plans typically cover outpatient benefits, so delaying Part B enrollment can save you money until you retire.

Recommended Reading: When Is The Enrollment Period For Medicare Part D

How Do You Enroll In Medicare

If youve received retirement benefits for at least four months before you turn age 65, you are enrolled automatically in Medicare A and B. As you walk through the process, you can tap into helpful tools including an eligibility premium calculator and find out your potential part premium.

If youve received retirement benefits for at least four months before you turn age 65, you are enrolled automatically in Medicare A and B. You can opt out of Part B if you are still covered under an employer-sponsored group health plan. If you wait to enroll in Part B and dont have group coverage, you may have to pay a penalty.

The Social Security Administration usually handles Medicare enrollment, but if you worked for the railroad, you enroll in Medicare through the Railroad Retirement Board.

If you have not received retirement benefits, you will need to self-enroll. or call 772-1213. If you were a railroad worker, visit the RRB website or call 772-5772.

If you are within three months of becoming age 65 and you are not yet ready to be receiving Social Security, you can apply online for Medicare only through Social Security and use their tools to find out information like eligibility premium, along with details about Medicare part hospital, Medicare part medical, Medicare supplement,. And what you can do so you do not pay late enrollment fees.

What If I Work Past Age 65

You still have a Medicare enrollment decision to make.

If you plan to keep working or you have employer health coverage through a spouse, you have some options to consider when signing up for Medicare. Depending on your situation, you may or may not be able to delay Medicare enrollment.

Your Initial Enrollment Period happens when you’re turning 65 whether you’re still going to work or not. Be sure to know your IEP dates and plan ahead.

Recommended Reading: How To Apply For Medicare When You Turn 65

How Do You Enroll In Medicare Supplement Medicare Advantage And Medicare Prescription Plans

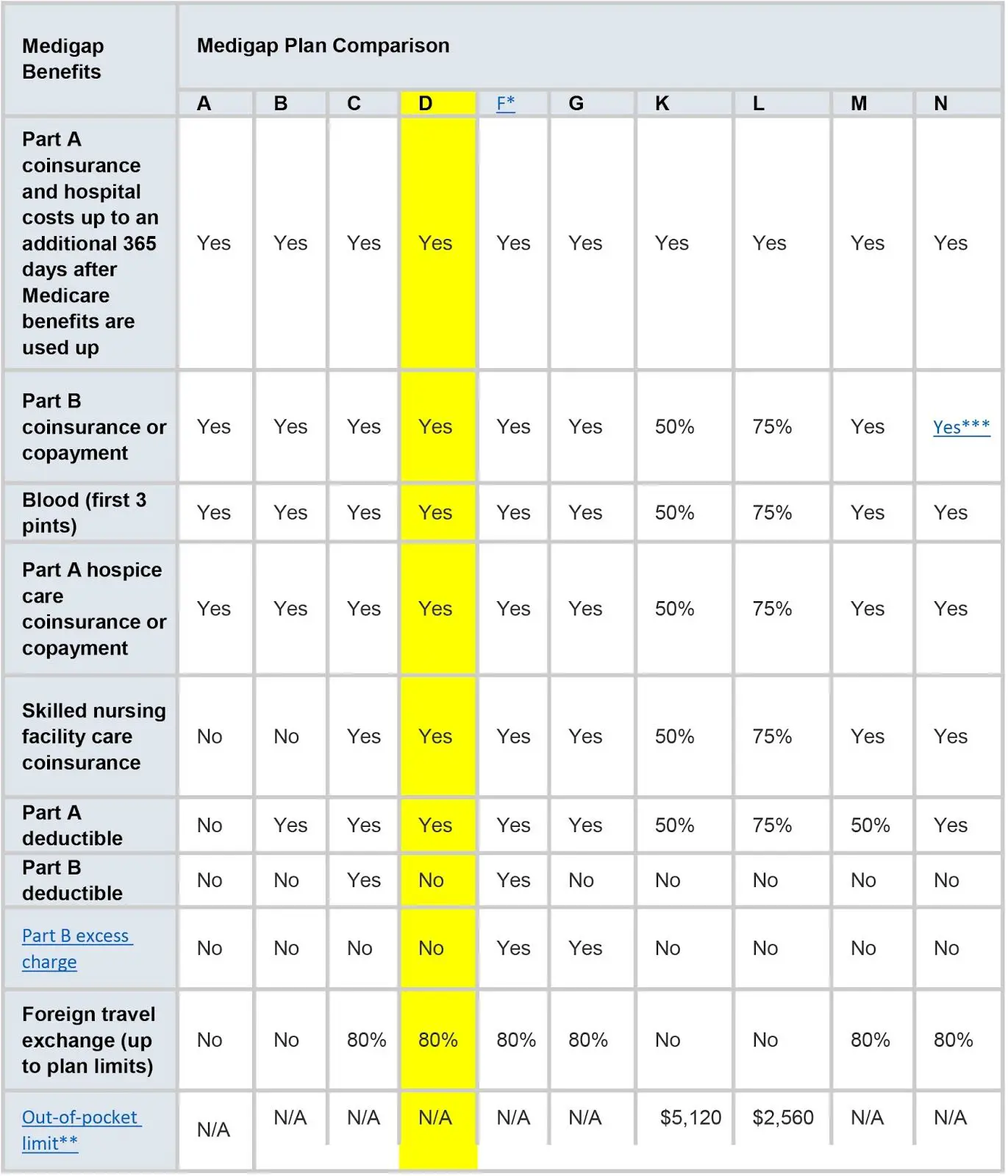

Medigap, Medicare Part C, and Medicare Prescription Drug plans are administered by private insurance companies approved and regulated by Medicare. The company you choose or a licensed agent can help with your enrollment. During your time working, you pay medicare taxes through your employer. Medicare taxes allow this health insurance coverage to be available.

As for finding plans, you can view options on Medicare.gov, where there is also a premium calculator and you can learn more about part coverage. An explanation of each:

What Is Texas Medicaid

Medicaid is a nationwide program funded by the federal government and administered and managed by states within federal guidelines. Medicaid improves the health of Texans who might otherwise go without health care. This includes those with low income or disabilities.

Although the program helps a wide range of Texans, were focusing on Medicaids help to Texans aged 65 and over, especially those with long-term care needs.

In Texas, Medicaid is administered by the Texas Health and Human Services Commission . Most Medicaid plans in Texas are provided by Managed Care Organizations . Texas-managed Medicaid for those 65 and older and the disabled are often referred to as STAR+PLUS. When you have a STAR+PLUS plan, you receive Medicaid health care services such as doctor visits, and long-term services and support for:

- Basic, daily activities in your home

- Help to make modifications to your home so you can safely move around

- Short-term care to provide a break for caregivers

- Personal assistance

With STAR+PLUS, you get to choose your health plan, and many come with value-added or extra services such as dental, vision, hearing, and prescription bonuses. You can use the STAR+PLUS Comparison Charts to find the STAR+PLUS health plans offered in your county or service area.

Or you can reach out to a local Medicare agent who can support you through your Medicare and Medicaid journey. Call to speak to a local licensed agent in your community. Or find your plan online.

Also Check: Is Medicare Part B Necessary

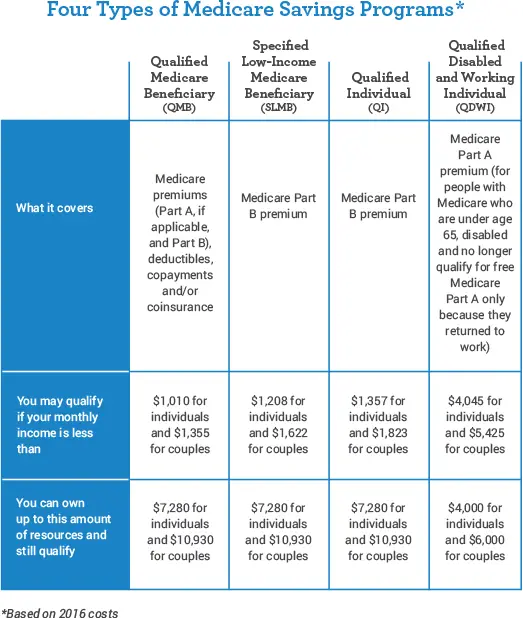

Medicare Savings Programs In Texas

If youâre in need of financial assistance when it comes to Medicare plan deductibles, premiums, copays, or coinsurance these programs may be beneficial for you if you qualify.

Qualified Medicare Beneficiary : To be eligible, you will need to be entitled to Medicare Part A.

- Maximum gross monthly income limits: $1,133 for individuals, $1,526 for couples

- Resource limits: $7,970 â $11,960

Specified Low-Income Medicare Beneficiaries : To be eligible, you will need to be entitled to Medicare Part A.

- Maximum gross monthly income limits: $1,133.01 to $1,359 for individuals, and $1,526.01 to $1,831 for couples.

- Resource limits: $7,970 â $11,960

Qualifying Individuals Program : To be eligible, you must be entitled to Medicare Part A and must not otherwise be receiving Medicaid.

- Monthly income limits: Between $1,359 â $1,529 for individuals and between $1,831 â $2,060.

- Resource limits: $7,970 â $11,960

Qualified Disabled and Working Individuals Program : Must be entitled to enroll in Medicare Part A, be under the age of 65, and not be receiving Medicaid benefits.

- Maximum gross monthly income limits: $2,265 for individuals and $3,052 for couples.

- Resource limits: $4,000 for individuals and $6,000 for couples.

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

You May Like: What Is The Best Medicare Advantage Plan In Ohio

Who Is Eligible For Medicare In Texas

Who is eligible for Medicare in Texas? Texas Medicare is part of a federal program that provides medical, hospital, and prescription drug insurance. More than 4 million seniors and other qualifying people are Texas Medicare members. Most people qualify for Medicare starting when they turn 65. If you or a family member are approaching this milestone birthday, you might be wondering who is eligible for Medicare and how to join the program. Learn more about Medicare eligibility, your Medicare options, and how to apply for Texas Medicare.

Texas Capitated Financial Alignment Model Demonstration

May 23, 2014 – CMS and Texas sign MOU

Texas Dual Eligible Integrated Care Demonstration Project Model

On May 23, 2014, the Centers for Medicare & Medicaid Services announced that the State of Texas partnered with CMS to test a new model for providing Medicare-Medicaid enrollees with a more coordinated, person-centered care experience. Under the demonstration, also called “Texas Dual Eligible Integrated Care Demonstration Project,” Texas and CMS contracted with Medicare-Medicaid plans to coordinate the delivery of, and be accountable for, covered Medicare and Medicaid services for participating Medicare-Medicaid enrollees.

More Information from CMS:

Recommended Reading: What Percentage Does Medicare Part A Cover

Texas Medicare Savings Program

The Medicare Savings Program can help you pay for some or all of your monthly Medicare payments, co-pays, and deductibles. The Medicare Savings Program is managed by the Texas State Health Insurance Assistance Program.

Contact the Texas Medicare Savings Program

Texas Medicare Savings Program Phone Number: 1-800-252-9240Directory of Services

Texas Medicare Part A Hospital Coverage

Texas Medicare Part A covers hospital visits and other services such as stays in a long-term skilled nursing facility, home health care, and hospice services. This was the first form of Medicare offered by the government. You might also hear it called traditional or original Medicare.

If youre wondering who is eligible for Medicare Part A, youll be happy to know that most Texas seniors qualify. You can enroll in Part A once you turn 65. Coverage is free if you or your spouse paid Medicare taxes through your job for ten years or longer. If you dont have this work history, you can often purchase coverage for a small monthly fee.

Also Check: What Are The Different Parts Of Medicare Plans

Texas State Health Insurance Assistance Program

The State Health Insurance Assistance Program provides unbiased counseling and assistance with making decisions about Medicare. The program offers Medicare education, help with Medicare eligibility and enrollment, information about long-term care insurance, and more.

Contact the State Health Insurance Assistance Program

Texas Health Information, Counseling, and Advocacy Program Phone Number: 1-800-252-9240Directory of Services

Medicare Eligibility In Texas

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

More than 4 million Texans are enrolled in Medicare as of 2020,1 which is 14% of the states total population.2

But what does it take to qualify? Learn about your Medicare eligibility in Texas and the coverage options that are available to you.

And if youre ready to start comparing Medicare Advantage plans in Texas, you can do so with our innovative FitScore® technology right now! Get started reviewing your options.

Read Also: Does Medicare Cover Nursing Home Care

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Unitedhealthcare Connected For Mycare Ohio

UnitedHealthcare Connected® for MyCare Ohio is a health plan that contracts with both Medicare and Ohio Medicaid to provide benefits of both programs to enrollees. If you have any problem reading or understanding this or any other UnitedHealthcare Connected® for MyCare Ohio information, please contact our Member Services at from 7 a.m. to 8 p.m. Monday through Friday for help at no cost to you.

Si tiene problemas para leer o comprender esta o cualquier otra documentación de UnitedHealthcare Connected® de MyCare Ohio , comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al de lunes a viernes de 7 a.m. a 8 p.m. .

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays, and restrictions may apply. For more information, call UnitedHealthcare Connected Member Services or read the UnitedHealthcare Connected Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

Recommended Reading: What Is The Maximum Income For Medicare

Medicare Statistical Trends In Texas

In 2018, approximately 3.9 million Texans received Medicare coverage. Take a look at these figures published by the Centers for Medicare & Medicaid Services:

- 2,390,611 Texas beneficiaries enrolled in Medicare Part A and/or Part B

- 1,552,275 Texas beneficiaries enrolled in a Medicare Advantage plan or other health plan

- Of the 2,865,481 people who chose Medicare Part D coverage, more than 1.6 million beneficiaries enrolled in a stand-alone Medicare Prescription Drug Plan, while almost 1.2 people opted to get their Medicare prescription drug coverage from a Medicare Advantage plan that bundled medical and prescription drug coverage in their benefit offering.

As a Texan and Medicare beneficiary , perhaps you are wondering how much freedom of choice you have to match your Medicare coverage with your health-care needs today and in the future. The opportunities look bright in your home state. In 2018*

- 177 Medicare Advantage plans are available statewide and offer a variety of benefit designs, premiums, and cost-sharing structures.

- 100% of Texas Medicare beneficiaries have access to a Medicare Advantage plan.

- 24 Medicare Prescription Drug Plans are available, and for those Medicare beneficiaries who had Part D prescription coverage in the past, 84% have access to a plan with a lower premium than they paid in 2017.

- 32% of people with Medicare Part D receive Extra Help to help pay for their Part D coverage.

New To Medicare?

New To Medicare?

Get Started With Medicare

Medicare is health insurance for people 65 or older. Youre first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease , or ALS .

Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace.

You May Like: How To Reorder Medicare Card

What Are The Medicare Insurance Options In Texas

Medicare is split into different parts that provide different services.

Part A

Original Medicare is the way that many Texans receive their benefits. It is made up of part A and part B coverage. Part A is hospital coverage. Part A also covers care in a skilled nursing facility, hospice care, and some home health care services. Most people do not have to pay a monthly premium for part A coverage in Texas.

You can receive premium-free Medicare part A coverage if:

- you are aged 65 years or older and have paid Medicare taxes for at least 40 quarters.

- Under 65 and received social security or railroad retirement board benefits and received them for at least 24 months.

- Have ESRD or ALS

Part B

Part B is medical insurance. This covers doctors services, preventative services, and outpatient care. Unfortunately, Part B is not free.

Part C

Part C is also known as Medicare advantage. Medicare part C includes benefits from parts A and B. In addition, some Part C plans usually have extra benefits such as dental, drug, and vision coverage. However, plans vary in what they cover. Medicare part C plans can vary based on the county and zip code in Texas.

Part D

Medicare part D is prescription drug coverage. According to medicare.gov, you must join a Medicare-approved plan that offers drug coverage to receive drug coverage. Plans will vary in cost and drugs that are covered.

Medicare Supplement Insurance

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Don’t Miss: Why Are Medicare Advantage Plans So Cheap