How Medicare Supplement Plan N From Aetna Covers You

Plan N is one of the newest Medigap plans. Aetna Health and Life Insurance Co offers it some areas because it helps seniors fill the gaps in their Medicare Part A and Part B benefits in a slightly different way.

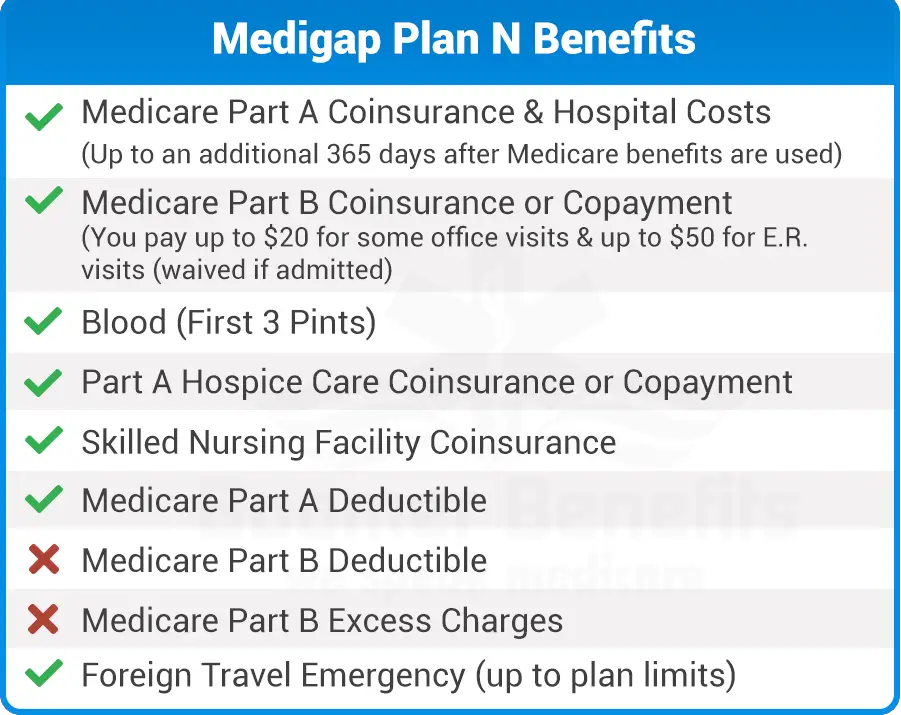

Unlike Plan F and Plan G, with a Medicare Plan N policy, you’ll be required to pay a copayment of up to $20 for certain office visits and up to $50 for emergency room care that doesn’t require you to be admitted as an inpatient. For healthy seniors, the co-pays add up to savings due to the lower monthly premiums.

Here’s how Plan N covers you:

This plan also offers the following additional benefits:

With its lower cost and good coverage, it is easy to see why Plan N’s popularity is increasing.

Generally, a Plan N costs about 25% less than the more comprehensive Plan F. The lower premium is available because Plan N covers fewer gaps in Original Medicare. In addition to the co-pays, be aware that this plan does not cover the Part B deductible or Part B excess charges. For this reason, this plan is best for people who do not have chronic health conditions.

Your Complete Guide To Medicare Supplement Plan N

If youre shopping for an insurance supplement for Medicare, you owe it to yourself to get to know the benefits of the Plan N Supplement.

For a relative newcomer to the world of Medicare supplements, Medicare Supplement Plan N has gained popularity over some of the older plans for its strong coverage for a low monthly premium.

Since Medicare supplement plans each have their own sets of strengths and weaknesses, it is important to break down each aspect of the plan to fully understand what Plan N can offer.

Medigap Plan N Vs Plan G

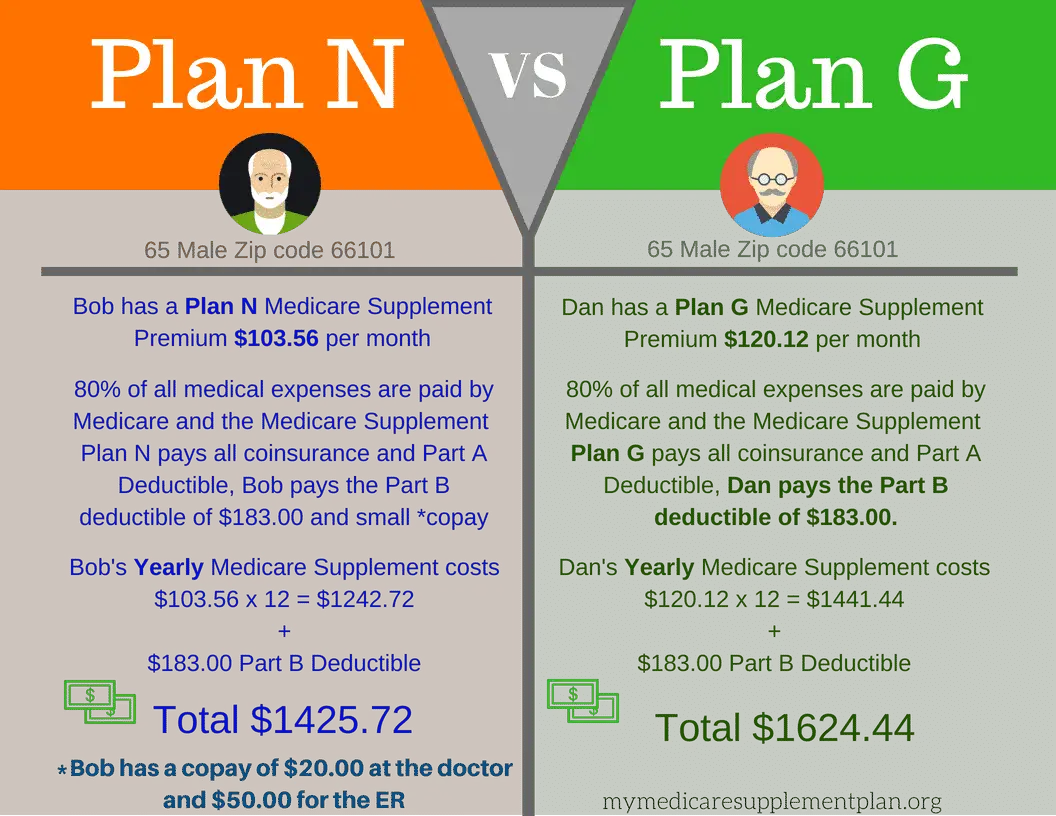

Plan N and Plan G are frequently compared to one another. We recommend Plan N if you want lower monthly costs and are willing to have some expenses for medical care like doctor appointments. However, Plan G is a better option if you’re willing to pay more each month for a plan that provides the most comprehensive coverage for new enrollees. Note that neither plan covers the Medicare Part B deductible.

| Coverage differences |

|---|

| Medicare Part B excess charges |

The cost structures may determine which plan is better for you.

The standard Medicare Supplement Plan G has higher monthly premiums than Plan N, making Plan N a budget-friendly choice. Plan G, however, does not impose copays for physician office visits or trips to the ER that do not result in hospitalization, a major difference from Plan N, thus appealing to beneficiaries who do not like shelling out copays for these services. Conversely, other beneficiaries may not mind paying more in copays, especially if they do not make frequent trips to physician offices or ERs.

With Plan N, low-end users of health services may come out ahead. High-end users of health care services will have a different experience.

Similarly, if that same beneficiary visits the ER and the visit does not result in a hospitalization, the beneficiary will pay a $50 copay, resulting in the same total cost that month for Plan N as they would pay for Plan G.

Don’t Miss: What You Need To Know About Signing Up For Medicare

What Does Plan N Cost

Your costs under Plan N include:

Monthly premium

This monthly premium varies by insurer, and its different from the standard monthly Part B premium that Medicare collects.

Part B deductible

You are required to pay the annual Part B deductible before Plan N starts to cover your coinsurance costs. In 2022, the deductible is $233.3

Copayments

You pay up to $20 for doctors office visits and up to $50 for ER visits.

Excess charges

Some healthcare providers are allowed to charge a bit above the amount that Medicare covers for services. Providers who do not accept Medicares approved amount as full payment are allowed to charge this additional amount known as excess charge. Plan N does not cover excess charges, and youll be responsible for them yourself.

What Does Medicare Supplement Plan F Cover

Medicare Supplement Plan F offers comprehensive protection against Medicare Part A and Part B out-of-pocket costs. It may pay 100% of your Part A and Part B coinsurance, and adds in 100% coverage for your Part A and Part B deductibles, too.

Medicare Supplement Plan F also pays 100% of your excess charges under Part B. You might face excess charges when you get care from a provider who doesnt accept Medicare assignment. Health-care providers who dont accept Medicare assignment may charge up to 15% more than the Medicare-approved amount for a service, if theyre legally allowed to do so. Plan F usually pays 100% of those charges for you.

If you travel outside the country, Medicare Supplement Plan F may cover 80% of your emergency health-care costs, up to the plans limit.

There is also a high-deductible version of Plan F that might have a lower premium than the regular Plan F, because of its high deductible.

Its important to know that changes in Medicare law are phasing out plans that pay your Part B deductible, as of January 2020. Medicare Supplement Plan F is one of these plans. This only affects you if you wont be eligible for Medicare until at least January 1, 2020. If you already have Plan F when the new law goes into effect, youre allowed to keep it. You might even be able to buy Plan F after that date, if you qualify for Medicare by the end of 2019.

Also Check: Does Medicare Cover Transportation To Physical Therapy

Medicare Supplement Plan N Reviews

Plan N is available from our three top Medicare Supplement companies for 2022: Aetna, Cigna and AARP/United Healthcare. Among these providers, you’ll save an average of $31 per month by choosing Plan N over Plan G.

| Insurance company |

|---|

| $193 |

Monthly cost for a 65-year old female non smoker

Your actual costs for Medicare Supplement plans can vary by age, location and other factors. Request a personalized quote to find out how much you’ll pay.

Remember that coverage for Plan N is standardized so you’ll get the same medical benefits with all providers. However, providers have different rates, customer service and add-on benefits.

Why Choose Plan N

Finding the right Medigap plan for your needs depends on the types of coverages you want, but there are several reasons you may choose Plan N, such as:

- While Plan N doesn’t cover the Medicare Part B deductible, the deductible cost is only $185 per year in 2019.

- Plan N doesn’t cover Part B excess charges, but you can typically avoid facing these excess charges by making sure you only visit health care providers who accept Medicare assignment. This means that they accept Medicare reimbursement as payment in full.Most providers who participate in Medicare accept Medicare assignment.

Don’t Miss: How Do I Report A Lost Medicare Card

What Is Medicare Supplement Insurance

Medicare Supplement Insurance is sold by private insurance companies.

While the costs of each type of Medigap plan may vary depending on where and by whom it is sold, all of the benefits remain standardized by the federal government. For example, Plan N purchased in New York will include the same coverage as a Plan N purchased in California, though the monthly premiums will vary for the two plans.

Medicare Supplement Insurance is accepted by any doctor or provider who accepts Medicare.

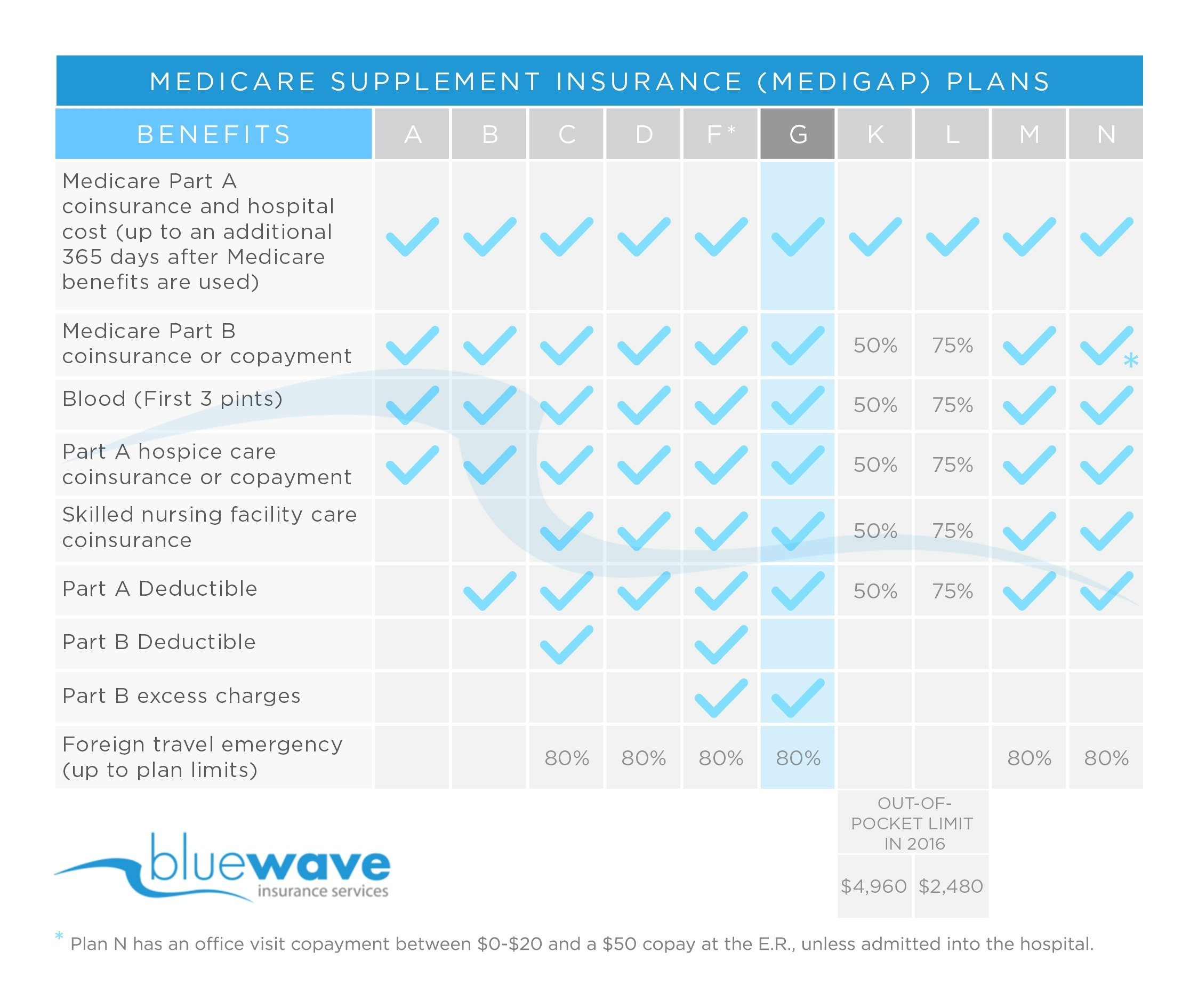

You can use the chart below to compare the different types of standardized Medicare Supplement plans.

Medicare Supplement Insurance Plans 2021

| Medicare Supplement Benefits |

What Benefits Does Medicare Supplement Plan N From Aarp Include

Plan N is one of the newest Medigap plans. AARP offers it some areas because it helps seniors fill the gaps in their original Medicare benefits in a unique way.

Unlike Plan F and Plan G, with a Medicare Plan N policy, you’ll be required to pay a copayment of up to $20 for some doctor visits and up to $50 for emergency room care that does not require you to be admitted into the hospital. For healthy seniors, the co-pays add up to savings due to the lower monthly premiums.

Here’s how Plan N covers you:

This plan also offers the following additional benefits:

With its lower cost and good coverage, it is easy to see why Plan N’s popularity is growing.

Generally, a Plan N costs about 25% less than the more comprehensive Plan F. The lower premium is available because Plan N covers fewer gaps in Original Medicare. In addition to the co-pays, be aware that this plan does not cover the Part B deductible or Part B excess charges. For this reason, this plan is best for people who do not have chronic health conditions.

You May Like: Is It Mandatory To Have Medicare Part D

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

Some of the Medicare costs that are covered in full by Medicare Supplement Plan N include:

The seventh and final benefit area covered by Medicare Supplement Insurance Plan N is emergency care that is received outside the U.S. Medicare only covers such care under very limited circumstances, but Medicare Supplement Insurance Plan N covers 80 percent of the costs for qualified emergency medical care abroad.

| 80% | 80% |

What Are Medicare Supplement Plan Basic Benefits

Basic benefits for each lettered Medicare Supplement plans are set by the government. If you buy Medicare Supplement Plan G from one company, it will have essentially the same basic benefits as Plan G offered by another insurance company.

All Medicare Supplement plans may pay 100% of your daily hospital coinsurance under Medicare Part A, and include an additional 365 days of coverage after Medicare coverage runs out. All plans generally pay between 50% and 100% of your Medicare Part B coinsurance and copayments, your Part A skilled nursing home coinsurance, and your Part A hospice coinsurance. They all may cover your first three pints of blood.

Read Also: When Do You Sign Up For Medicare

Does Aarp Have To Issue Me A Policy For Plan N

That depends on whether you enroll during your initial enrollment period, which runs for six months from the time you are enrolled in Part B. During this period, AARP has to issue the policy and may not charge a higher premium for health conditions you may have. After this period, you may be refused a policy and/or the costs may be higher.

Plan G Vs Plan N Which Medigap Plan Is Right For You

For many years, Plan F dominated the market as the most-popular plan for beneficiaries. However, in recent years Plan G and Plan N have been gaining in popularity. There are many people out there who would rather have lower premiums and then just pay the Part B deductible and doctor copays IF they need to use those services.

Its up to you but heres a great infographic to help you see a side by side example. In this image we are using rates for a male, non-tobacco user turning 65 in Texas in 2022.

Read Also: How Much Does Medicare Pay For Urgent Care Visit

Overview Medigap Policy N Provides The Following:

- Basic Benefits

- Part A Hospital Coinsurance

- Days 61-90 of a hospital stay in each Medicare benefit period

- Days 91-150 of a hospital stay. Medicare will only pay for these 60 days once during your lifetime

How Do I Sign Up For Plan N

Plan N options may be available where you live.

Find Medigap Plan N in your area.

1 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

1 AHIP. The State of Medigap 2019. . Retrieved from www.ahip.org/wp-content/uploads/IB_StateofMedigap2019.pdf.

Recommended Reading: What Is The Difference Between Medicare Supplemental And Advantage Plans

Medicare Supplement Plan N Qualification And Enrollment

The ideal time to enroll in a Medigap Plan N policy is during your Initial Enrollment Period, which extends from the three months before your 65th birthday through your birthday month, and ends three months later. During this period, you have guaranteed-issue rightsto sign on to a Medicare Supplement plan at a standard rate, regardless of any preexisting health conditions.

In any other time period, your Medigap insurance provider can conduct a medical underwriting processto assess your health status before they agree to sell you a plan. If this happens, they can charge you a higher premium based on your medical history and preexisting conditions. They can even deny your application altogether.

To enroll in a Medigap Plan N policy, you need to apply with the insurance company directly. Before enrolling, you might want to read through some Medicare Supplement Plan N reviews to get a sense of the experience other beneficiaries have had with your desired plan.

Medigap Plan N Enrollment

Plan N was first offered in 2010, and by 2017, 56% of all insurance companies that sold Medigap plans offered Plan N as part of their lineup.2The number of beneficiaries enrolled in Plan N reached 1,280,507 in 2018, which accounted for 10 percent of all Medigap beneficiaries.

Plan N is the third-most popular plan, behind only Plan F and Plan G.Plan N has also been the second-fastest growing plan, experiencing a 12 percent increase in enrollment fro 2016 to 2017.

Read Also: How Do I Get A Lift Chair Through Medicare

How Much Does Medigap Plan N Cost

Theres a monthly premium for Medicare supplement plans. Your costs for Plan N can vary depending on where you live and the insurance company youre buying the policy from.

To get an estimate of how much you will pay for Plan N in your area, you can go to Medicares plan finder tool and enter your ZIP code.

What Is Medicare Supplementmedicare Supplements Are Additional Insurance Policies That Medicare Beneficiaries Can Purchase To Cover The Gaps In Their Original Medicare Health Insurance Coverage Plan N

Medicare Supplement Plan N is one of the ten standardized Medigap plans. Although it is one of the newest plans available, Medicare Plan N is quickly becoming a favorite with people aging into their Medicare benefits. This is particularly true of people accustomed to sharing healthcare costs with their employers group health planA group health plan is a health plan offered by an employer or employee organization that provides health coverage to employees, their families, and retirees…..

Also Check: How To Get Medicare To Pay For Hearing Aids

Medicare Part B Coinsurance And Copayment

Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care.

Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving you to pay 20% coinsurance in most cases .

Plan N will fully pay for your Part B coinsurance costs, except for a copayment of up to $20 for some office visits. A second copayment of up to $50 could be required for emergency room visits that do not result in an inpatient admission.

Medicare Supplement Plan N

If youre eligible for Medicare, a Medicare supplement or Medigap plan offers optional supplemental insurance coverage. Medigap Plan N is a plan and not a part of Medicare, such as Part A and Part B, which cover your basic medical needs.

Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. These plans can cover costs like premiums, copays, and deductibles.

Choosing a Medigap plan can be confusing since various plans offer different levels of coverage and benefits. Understanding these benefits can help you choose a Medigap plan thats right for you.

Read Also: Is Sonobello Covered By Medicare

The Best Medicare Plan For You: Plan N +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

How Much Is The Copays For Medicare Plan N

In exchange for lower monthly premiums, youre responsible for a small copay of $50 when visiting the emergency room and a $20 copay at the doctors office. Yet, if you visit an Urgent Care center, there is NO copay.

Thus, if you cant get an appointment with your primary care physician, instead of going to the emergency room over something minor, you can go to urgent care and avoid copays. Remember that these copays will NOT count towards the Part B deductible.

You May Like: How To Qualify For Oxygen With Medicare