The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID-19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID-19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Crowdfund To Pay Your Medical Bills

If youre having trouble figuring out how to pay for an emergency room visit, crowdfunding can help. Share your experience with your network of friends and family by starting a fundraiser and asking them if they can please help. When your community sees the struggle youre going through, they may want to make a donation to help you get back on your feet. Its also important to note that while government assistance programs and grants can take a long time to come through, you can receive funds to your bank account in a matter of days through fundraising online. Before you get started, read through these medical fundraising tips and look through existing crowdfunding campaigns for ideas on how to tell your story as well as some of the benefits of using crowdfunding. Below are three stories of people who used online fundraising to help pay their medical bills:

Codys Medical Bills

27-year-old Cody slipped and hit his head when he was at his friends house. At first, he thought nothing of it and got up and went about his day. A few hours later, he struggled to maintain consciousness and he was rushed to the hospital where they found that he had a brain bleed. While Cody is recovering, a family friend started a GoFundMe to help pay for his stay in the hospital. So far, friends and family members have raised over $80,000 for Cody.

Jons bike accident medical fund

Jens ER Visit

Medicare Supplements And Urgent Care Coverage

If you have a Medicare Supplement, your urgent care visit will be much cheaper .

For those with Medicare Supplement Plan F, you have no deductible, no copays, and no coinsurance. This means that as long as the urgent care service is approved by Medicare, your visit will cost you nothing.

For those with Medicare Supplement Plan G, you have no copays or coinsurance, but you do have a $183 deductible for the year. This means your urgent care service would cost you up to $183, and then nothing after that. Keep in mind that you only have to meet the $183 deductible once per year â after that, every service that is approved by Medicare will be covered in full.

For those with Medicare Supplement Plan N, you have a copay of up to $20 for the visit and the $183 deductible, but no coinsurance. Also, with Plan N, you must confirm that the urgent care location accepts Medicare assignment.

If you have Medicare Supplement Plan A, B, C, D, K, L, or M â and we donât recommend any of these plans to our clients â your coverage may not be as great. Since these plans arenât popular, we wonât go into detail, but please contact us if you need more information on how urgent care is covered with these specific Medigap plans.

Read Also: How Much Is Medicare B Cost

Folks Are Using Crowdfunding To Cover Coronavirus Related Medical Bills

As the coronavirus continues to burden the United States healthcare system, emergency room visits will likely continue to increase. While coronavirus tests are for all Americans, CNBC estimates that uninsured folks who are hospitalized with the coronavirus will likely pay between $42,000 and $74,000 for their hospital stay. To mitigate those costs as much as possible, many people have turned to fundraising for coronavirus medical expenses:

What Do I Need To Know About Medicare Urgent Care Coverage

Just like with any other healthcare provider, you need to make sure that the urgent care center accepts Medicare before you go, or you risk paying for the costs yourself. You can determine if the urgent care center, or any other provider, accepts Medicare simply by calling them and asking. If you need to locate a center that accepts Medicare, you can use Medicares online tool. Its always wise to confirm that the provider accepts Medicare before your visit, in case theyve made recent changes that havent been reflected online yet.

If youre traveling, we recommend that you make a note ofthe urgent care centers available near your destination. You could also bookmarkMedicares tool for easy retrieval should you need it.

Also Check: Does Plan N Cover Medicare Deductible

Does Original Medicare Pay For Urgent Care

Original Medicare insurance is made up of Medicare Part A and Medicare Part B. Medicare Part B, the medical insurance portion, covers healthcare services for treating sudden, non-emergency illness or injury. This includes urgent care, though the urgent care facility must be in-network. Patients should contact the urgent care clinic before visiting to ensure it accepts Medicare.

Medicare Part B covers two types of services: medically-necessary services and preventative services. Coverage starts once the yearly deductible is met. In 2021, the deductible is $203.

Once that is met, Medicare beneficiaries must pay 20% of their Medicare Approved amount of the urgent care visit. The Medicare-approved cost refers to the amount a healthcare provider can be paid. It may be less than the actual number charged. Medicare pays for part of the amount, and the patient is responsible for paying the difference. In a hospital outpatient setting, you also pay a copayment.

What Are My Care Options And What Do They Cost

When you need immediate care, you may have more options than you realize ones that may save you time and money, particularly if you get your health insurance through work. So, before you spend hours waiting in the ER or maybe end up with an unexpected bill, consider the alternatives that could save you up to $2,0001.

Recommended Reading: Does Medicare Cover Laser Therapy

Where To Get Medicare Urgent Care

Urgent care is an increasingly popular choice for people who need to get seen without an appointment, but whose medical condition doesnt rise to the level of an emergency. Because of its growing demand, urgent care is available in just about every city in the United States, and many plan and independent providers offer it.

If you are enrolled in an HMO or PPO style network for healthcare, your first choice for urgent care should be at a plan providers office. Many provider networks offer urgent care at member clinics that operate apart from the inpatient facilities in the network, while some provide urgent care services from the same medical office buildings where your regular physician works. It’s a good idea to know beforehand where your nearest urgent care center is located.

Independent urgent care clinics are common in many places. Almost all of them accept walk-ins, though there might be a wait to see a doctor. If you have the symptoms of a serious illness, or you think youve suffered a serious injury, it’s important to seek medical attention without delay. If you think your injury or illness puts you at risk of serious further harm, go to the emergency room right away. If your condition is less threatening, go to an urgent care center as soon as you reasonably can. You do not need preapproval from Medicare to get emergency or urgent care when youre sick.

Can I Receive Screenings And Other Preventive Services At An Urgent Care

With Medicare, urgent care centers offer a range of treatments and services, including some preventive services. This can include flu shots and other immunizations and vaccines. Medicare will fully cover these services. More in-depth preventive care, such as screenings, diabetes care and other services, can often be performed by an urgent care center. However, many patients benefit more by receiving this care from a primary care physician that can take a more proactive role in your health care. To recap: does urgent care take Medicare for preventive services? Often yes, but youll probably receive complete care by visiting your regular doctor.

Recommended Reading: When Do Medicare Benefits Start

If You Have Insurance And Youve Already Met Your Deductible

A deductible is an amount you pay for healthcare before your insurance starts to pay. If youve met your deductible, youll only owe your copay at the time of your urgent care visit. The typical copay at urgent care is between $25 and $75, though this depends on your insurance. Its the insurance company who sets the copay, not the urgent care center. If youre not sure what your copay is, you can call your insurance provider directly to find out.

The only exception to this is if your insurance plan includes co-insurance. Co-insurance is a fixed percentage of costs of a covered health service you pay after youve met your deductible. So, if youve already met your deductible and you have co-insurance, youll have to pay a percentage of the cost of the urgent care visit, along with your co-pay. The good news here is that even if you do have to pay your co-pay and co-insurance, youll still likely be paying less than you would at the ER or your doctors office.

Urgentway Providing Affordable Care To The Community

UrgentWay is committed to providing quality and affordable care to our neighbors. We understand that immediate access is important. Not only are we open 7 days a week, but we also offer extended hours each day so you can get help very early or very late in the day.

With locations in Hempstead, Manhattan, Hicksville, and the Bronx, getting the medical attention you require is more convenient than ever. We are open at the locations of urgent care centers for walk-in visits and have made sure to take all the safety protocols per CDCs guideline against COVID-19.

Moreover, considering the current pandemic of COVID-19, Urgentway has also started providing the facilities of Telemedicine and COVID-19 Screening.

While we accept most insurance plans, including workers compensation, private insurance, Medicaid, and Medicare. We also welcome those without insurance and do our best to offer the most affordable rates and payment options.

UrgentWay truly believes that all members of our community deserve quality healthcare at a price they can comfortably afford.

Don’t Miss: Are Blood Glucose Test Strips Covered By Medicare

Original Medicare And Urgent Care Coverage

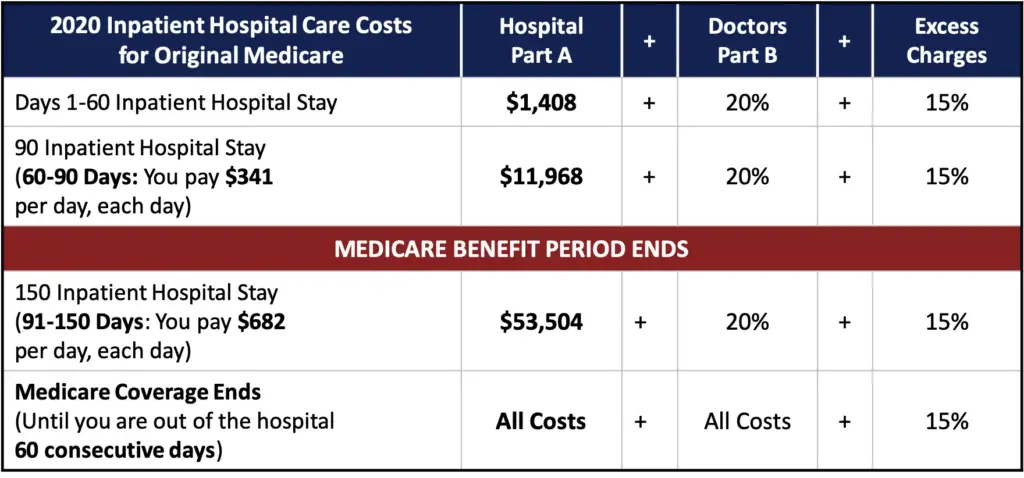

If you only have Original Medicare and no supplemental health coverage, youâll be covered for urgent care under Medicare Part B, because urgent care is considered outpatient care.

Medicare Part B has a deductible , and after the deductible is met, you typically pay a 20% coinsurance on the Medicare-approved amount.

So, if you only have Original Medicare, youâd be looking at paying fees up to $183, and then 20% of the fees after that .

Does My Insurance Cover Urgent Care Visits

The Affordable Care Act requires all ACA-compliant health insurance plans to cover emergency services, but some insurers do not classify urgent care in the same benefit class as emergency care. Most health insurance plans cover urgent care visits, however. Often health plans make the following common distinctions between urgent care visits and emergency room visits.

- A plan may define an urgent care need as a medical condition that is not potentially life-threatening and doesnt require immediate medical attention but still requires care within 24 hours.

- A plan may apply different copayment to urgent care center visits than the plan applies to emergency room visits. For example, you may have to pay the same or similar copay for an urgent care center visit as you pay for a doctor visit.

- To receive urgent care benefits, you may need to choose an urgent care center that participates in your health insurance plan if you are in a health maintenance organization , and you want urgent care where you live. You can check with the insurer or the urgent care center before going to the urgent care center.

When you visit an urgent carecenter, you can expect to pay a copayment. One health plan may pay its share ofthe urgent care center visit but only if you have met the plans annualdeductible If you arent sure if your health insurance plancovers urgent care visits, or what your cost-share is, review your planssummary of benefits.

Also Check: How To Get A Lift Chair From Medicare

Can Doctors Refuse Medicare

The short answer is “yes.” Thanks to the federal programs low reimbursement rates, stringent rules, and grueling paperwork process, many doctors are refusing to accept Medicares payment for services.

Medicare typically pays doctors only 80% of what private health insurance pays. While a gap always existed, many physicians feel that in the past several years, Medicare reimbursements haven’t kept pace with inflation, especially the rising costs of running a medical practice. At the same time, the rules and regulations keep getting more onerous, as do penalties for not complying with them.

Most American physicians participate in Medicare and “accept assignment” for their services without additional charges. However, if your doctor is non-participating or has opted out of Medicare, here are five options.

Telemedicine Visits In San Antonio

Telehealth aims to change the playing field for people who dont have access to healthcare. As long as you have a cell phone, tablet, or computer with the internet you have access to healthcare.

With telehealth, people who used to travel for hours to wait in an office can be seen within minutes with a telehealth visit. Telehealth enables everyone to meet with a healthcare professional, wherever they may be.

Your first appointment may feel a bit different due to the distance and the technology, but adjusting to the format is easy. Theres no need for transportation or to wait in an office. Your healthcare provider is simply there, at the touch of a finger.

You May Like: When Can You Start Collecting Medicare

Additional Benefits Of Visiting Urgent Care

Urgent care centers can be a great option for many conditions. They offer many advantages, in addition to cost savings, and are becoming a popular choice. In fact, the Urgent Care Association reports that as of November 2019, there were 9,616 urgent care locations in the United States.

In many parts of the country, you can find urgent care centers in convenient locations, such as strip malls or shopping centers. They tend to have longer hours than traditional doctors offices, making it easier to stop in after work or on the weekend.

Other perks of urgent care include:

- shorter wait times

- the ability to make appointments online

- the ability to sign in online

- wide Medicare acceptance

You can check to see if your nearest urgent care center accepts Medicare by using the find-and-compare tool on the Medicare website.

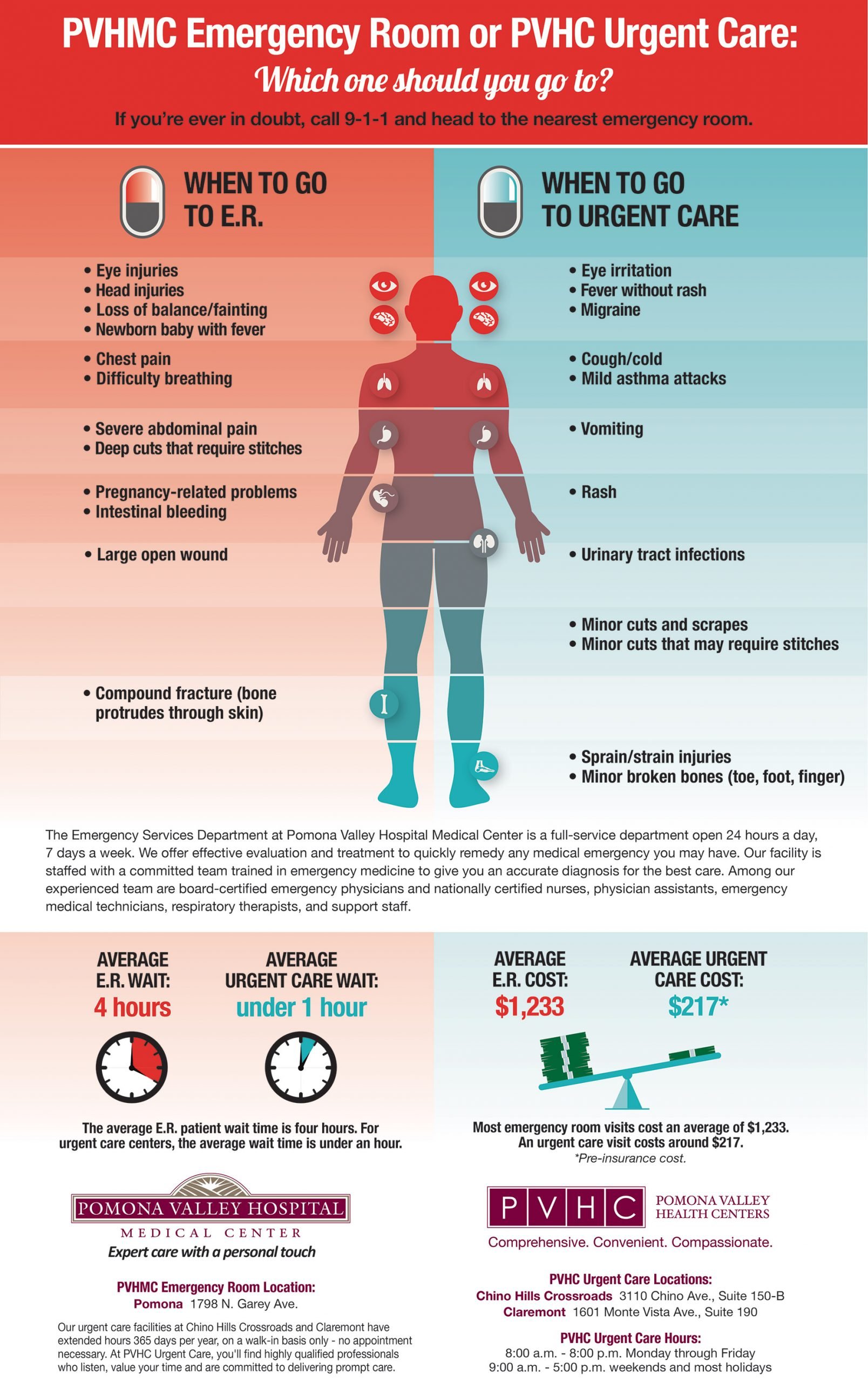

How Much Cheaper Is Urgent Care Than The Emergency Room

The average cost of an urgent care visit is generally higher than a comparable visit to your doctor, but significantly lower than the average cost of an emergency room visit. ER visits can cost anywhere from around $600 for a minor problem to well over $3,000 for a serious and complex health issue or injury. According to debt.com, the cost of treating a non-life-threatening issue such as strep throat at the ER can cost up to 5 times more than seeking treatment from an urgent care facility.

Why the dramatic difference in cost? A hospital emergency room has overhead costs not found in a doctors office or urgent care center, such as a team of nurses and doctors who specialize in trauma and emergency care, and immediate access to highly sophisticated diagnostic lab, x-ray, heart, and brain monitoring equipment.

Don’t Miss: How Old Do I Have To Be For Medicare

Tips For Taking Control Of Your Health Care

Will Medicare Pay For Urgent Care If Im Traveling

Its possible that you might need to visit an urgent care center while youre on vacation. A bad sunburn or a sprained ankle on a hike could have you searching for care. If youre traveling outside the United States, you might not be sure how that care will be paid for.

If you have Medicare, a Medigap plan can help pay your costs when youre traveling abroad. Medigap is supplemental Medicare insurance thats sold by private companies to help cover original Medicare costs.

With most Medigap plans, emergency services will be covered for the first 60 days that youre out of the country. After youve paid a $250 deductible, Medigap will cover 80 percent of the cost for medically necessary emergency treatments.

Also Check: Is Omnipod Covered By Medicare