Difference Between Medicare Vs Private Health Insurance

Even if you qualify for Medicare, you may want to assess all your health insurance options. For example, if you are over 65 but havent retired, you may still get private insurance options from your employer. Your employer-provided plan may offer better coverage than Medicare.

If you arent getting insurance through your employer, you can still shop for private insurance through the insurance marketplace. When shopping for a plan, youll want to consider how much the monthly payments are , what out-of-pocket costs will look like after insurance is used, and what all is covered. Looking at each insurance plan carefully is helpful during this part of the process.4

When choosing between Medicare and a private health insurance plan, it depends on what your priorities are. Youll want to compare the costs and benefits of the private insurance plans you are considering and Medicare. For your reference, Medicare monthly premiums can cost up to $170.5 On the other hand, the average cost of private health insurance for individuals is $456 per month.6

What Is Private Insurance

Private insurance is offered by health insurance companies.

You can access private insurance through individual or group plans. Many employers offer health coverage as part of their benefit. When health insurance is offered through an employer, the employer will generally pay a portion or all of the premium.

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace:

- Bronze Plans: Cover 60% of healthcare costs.

- Silver Plans: Cover 70% of costs.

- Gold Plans: Cover 80% of costs.

- Platinum Plans:latcosts.

Deductibles vary based on the plan. Premiums are higher the more coverage you have.

All private plans will structure their coverage differently. You will find a wide variety of structures such as HMOs , PPOs , PFFS and MSAs .

Medicare vs Private Insurance Differences

A good way to understand the differences between Medicare and private Insurance is to look at a side-by-side chart of options offered by each.

| Medicare | |

|---|---|

| This is an add-on to Original Medicare. It can be included in some Advantage plans | These are almost always additional coverages that need to be added. |

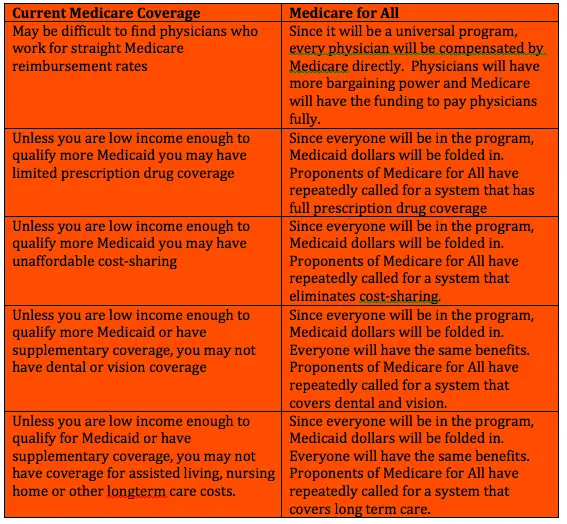

What are the Gaps in Medicare?

Part A Gaps

Most people will not pay for Part A because of Medicare taxes taken from their paycheck while they worked. Premium costs are not the concern.

Medicare also does not pay for blood if it is needed while being hospitalized.

Medicare Plans In Arizona

Know your options for Medicare plans in Arizona, whether youre looking for Original Medicare or Medicare Advantage.

Arizona has more than 1.3 million people enrolled in Medicare and the number of plan options is also growing. Comparing the different plans is key to finding the best plan for you.

- Original Medicare

- Medicare Advantage

- Medicare Part D

You may also elect to add a Medicare Supplement Plan to go along with Original Medicare to help with additional out-of-pocket expenses.

Before you pick a plan, learn about your costs, coverage, and choosing the best Medicare plan for your needs.

- Average costs of Medicare in Arizona: In 2022, Medicare Advantage premiums decreased 0.9% from $11.74 to $11.64. The lowest Part D plan in Arizona is $7.50.

- Average expenditure per enrollee: In Arizona, the average Medicare spending per enrollee is $9,614.

- Number of enrollees in Arizona: As of 2022, 1,388,745 individuals are enrolled in Medicare in the state of Arizona. Approximately 570,322 individuals are on a Medicare Advantage Plan.

- Medicare Advantage availability: Arizona has had a 29.20% increase in Medicare Advantage Plans since 2021.There are 155 Arizona Medicare Advantage Plans available in 2022, which is an increase from 120 plans in 2021.

Read Also: Does A Person On Disability Qualify For Medicare

How Medicare Plan Finder Can Help You

We specialize in Medicare and serving the underserved senior and Medicare-eligible population. Do you or a loved one need help selecting a Medicare plan that truly helps? Set up a free appointment with one of our licensed agents in your area to get bias-free assistance. Call us to set it up at 1-844-431-1832.

Who Qualifies For Medicare In Arizona

To qualify for Medicare, you must meet certain eligibility requirements. First, you must be a U.S. citizen or permanent resident. You must also be at least 65 years old or have a disability and receive Social Security Disability Insurance benefits for at least 24 months. You may qualify for Medicare at a younger age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Read Also: What Are The Parts Of Medicare

Medicare Costs Vs Private Insurance Costs

How do Medicare costs compare to private insurance? Medicare Part A is usually free. Part B costs $148.50 per month for most enrollees in 2021. You can delay purchasing Part B if your private insurance is less expensive. You can even bundle this with a Part D prescription drug plan and a Medicare Supplement policy.

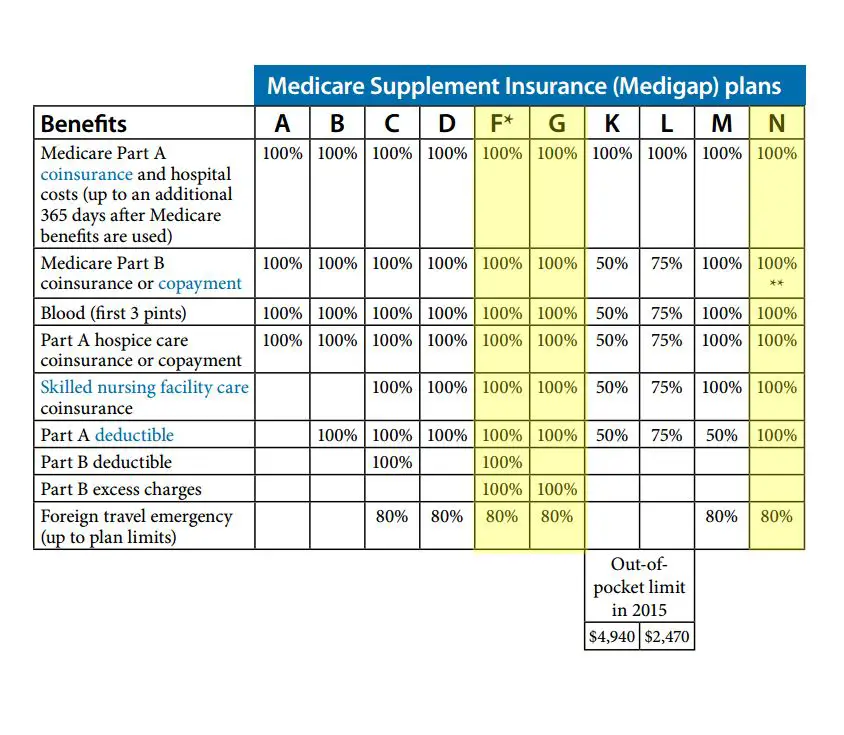

What you need to consider is not only the comparison of monthly premiums, but potential out-of-pocket costs. This is where supplemental policies shine. They dramatically limit out-of-pocket expenses depending on what plan you choose

How does Medicare Compare with My Employer-Sponsored Plan?

If you only have Original Medicare, you will find many gaps between the plan and the employer plan you had. But if you bundle that with a Part D prescription drug plan and a Medicare Supplement policy , your coverage will be similar. Often there will be fewer out-of-pocket expenses depending on the type of supplement policy you purchase.

How Does Private Insurance and Medicare Work together?

Are you wondering how private insurance and Medicare work together? If you have private insurance along with Medicare, the two insurance carriers follow a coordination of benefits. This process helps them decide which insurer will pay first.

If the employer plan has 20 or more employees, the group plan will usually pay first. If the employer plan has fewer than 20 employees, Medicare will usually pay first.

Choosing Private Insurance

Medicare Supplement Plans

Plan A

Plan B

Plan C

Plan D

Contact Mbhealth For Assistance With Medicare Enrollment

If you need help choosing the right insurance for your needs, contact MBhealth today. Well review your prescription drug use, your healthcare needs, and the frequency of your care to help you determine which Medicare or Medicare Advantage plans will suit you best. To get started, call us at or visit ourcontact page to get in touch.

MBhealth Insurance Agency

You May Like: Will Medicare Cover Walk In Tubs

Changes Attributable To Medicare Entry At Age 65

Our findings add to the evidence on changes in health care use and outcomes attributable to entry into Medicare at age sixty-five. First, we analyzed a national cohort of previously insured adults who switched from private insurance to traditional Medicare as their primary source of coverage at age sixty-fivea path followed by the majority of working US adults. Earlier studies have focused on previously uninsured individuals entering Medicare, who differ from continuously insured adults on measures of race, education, income, geography, health status, and health behaviors.10

Second, earlier studies that included previously insured beneficiaries used them as controls instead of focusing on their outcomes, and they analyzed measures of health care utilization constructed from household surveys or hospital discharge data.914 In contrast, we used detailed claims data integrated with enrollment information. Finally, our estimates of how spending and volume change for imaging and surgery at age sixty-five complement findings from earlier studies, which report no decreases in the volume of office visits and certain tests upon entry to Medicare.10,11

How Does Original Medicare Work

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them. Theres no limit on what youll pay out-of-pocket in a year unless you have other coverage . Get details on cost saving programs.

Services covered by Medicare must be medically necessary. Medicare also covers many preventive services, like shots and screenings. If you go to a doctor or other health care provider that accepts the Medicare-approved amount, your share of costs may be less. If you get a service that Medicare doesnt cover, you pay the full cost.

With Original Medicare, you can:

- Go to any doctor or hospital that takes Medicare, anywhere in the U.S. Find providers that work with Medicare.

- Join a separate Medicare drug plan to get drug coverage.

- Buy a Medicare Supplement Insurance policy to help lower your share of costs for services you get.

If you’re not lawfully present in the U.S., Medicare won’t pay for your Part A and Part B claims, and you can’t enroll in a Medicare Advantage Plan or a Medicare drug plan.

You May Like: Is Bevespi Covered By Medicare

Youll Need To Pay For Supplemental Plans

Unfortunately, Medicare coverage isnt as complete as traditional insurance. Youll need to buy supplemental plans if you want your coverage to work like private insurance.

For example, if you need prescription drug coverage, youll need to buy a Part D supplement to avoid paying full price.

Private insurance often offers more comprehensive coverage and includes more services than Medicare. This makes it easier to keep track of your healthcare costs and keeps you from having to pay premiums for more than one policy.

That said, Medicare and Medicare Advantage plans can still be a more affordable alternative to private insurance. You just need to remember to shop around and choose the company that offers you the best price.

Try to do this for every supplement plan you buy.

Cigna Benefits In Full

Cigna Global Health Options helps you create a health insurance plan that’s perfectly tailored for the needs of you and your family by offering you the reassurance of comprehensive core cover, and the flexibility of adding as many extra benefits as you want.

Find out what each of our benefits covers:

- International Medical Insurance – your essential core cover, for all inpatient, day case surgery and accommodation costs. In addition, essential cover for cancer, maternity and psychiatric care on an inpatient, outpatient day case basis.

- International Medical Insurance Plus – additional and more extensive outpatient cover that protects you for any treatments that don’t require a hospital stay.

- International Emergency Evacuation – peace of mind cover for transport and repatriation costs for you and a family member if you need treatment in another country.

- International Health and Wellbeing – allows you to manage your health in your own way with cover for screenings, tests, examinations and other wellbeing activities.

- International Vision and Dental – complete cover for all your vision and dental costs.

Recommended Reading: How Much For Part B Medicare

What Are The Cost Differences

Private insurance premiums vary greatly, depending on the persons location, age, and chosen type of coverage. For example, high deductible plans often cost less per month than those that charge a low deductible. The reason for this is that the insurers cover their costs by having people contribute a higher amount toward their healthcare expenses before the company fund any treatment.

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

Medicare Vs Private Insurance: Benefits

Original Medicare has some significant gaps in coverage for things that private insurance usually covers, like prescription drugs. Original Medicare may cover prescription drugs you receive in the hospital or certain medications you receive in a doctorâs office, but generally doesnât cover most prescription drugs you take at home.

The only way to get Medicare prescription drug coverage for most medications you take at home is through a Medicare-approved private insurance company. You can opt for a stand-alone Medicare Part D prescription drug plan to go alongside Original Medicare, or a Medicare Advantage prescription drug plan.

To look for a Medicare plan from a Medicare-approved private insurance company, enter your zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Also Check: How Much Will Bernie Sanders Medicare For All Cost

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide who pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” to pay. In some rare cases, there may also be a third payer.

Disadvantages Of Original Medicare

- Does not cover dependents. Original Medicare is individual insurance, so people with Medicare do not have the option to add their spouse or children to their plan. Private insurance policies, on the other hand, may cover an insured persons spouse, children, or other eligible dependents if they are added to the plan.

- No out-of-pocket maximum. Original Medicare does not have an annual cap on members spending for covered services, so a serious injury or illness could result in high costs. Private plans set an annual out-of-pocket maximum for more predictable budgeting. For Marketplace plans in 2023, the cap is $9,100 for an individual.

- Excludes coverage for some services. Original Medicare does not cover some health care services, such as routine dental care, routine foot care, vision exams, or exams for fitting hearing aids. These services may be covered by employer-sponsored plans or Marketplace plans.

Also Check: Can You Get Medicare Advantage Without Part B

How We Picked The Best Medicare Advantage Providers

To determine the best Medicare Advantage providers, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

- How many states in which they provide coverage

- The types of benefits their plans can offer

- How the Centers for Medicare & Medicaid Services ranked their plans, using an average to represent the company as a whole

- How agencies like A.M. Best ranked them in terms of their financial health

- How agencies like J.D. Power ranked them in terms of consumer feedback

We focused exclusively on providing general summaries of the companies and their reputations. In order to provide specific plan recommendations accurately, its important to take into account the ZIP code and demographic details of the individual seeking insurance coverage. To do so, we recommend using Medicare.govs plan finder tool or seeking the expertise of an independent, agnostic insurance agent.

Adding To Original Medicare

There are two optional policies available to people with Original Medicare: Medicare Supplement insurance and Medicare drug plans . Both types of policies are sold by private companies and add certain benefits to Original Medicare.

Medigap plans help people with Original Medicare pay for their share of the cost of covered services. These costs may include Original Medicares deductibles, copayments, and coinsurance. Some Medigap plans also include an annual out-of-pocket maximum to cap members Medicare costs.

Medicare Part D drug plans offer coverage for prescription drugs. Each plan has its own list of covered drugs, known as the formulary, which may include both brand name and generic drugs.

Read Also: Which Of The Following Is True Regarding Medicare Supplement Policies

Private Health Insurance Coverage

Bare minimum private health insurance covers preventative care visits. But it can be customized to include additional coverage at additional cost.

You can choose an all-in-one coverage plan covering hospitalization, medical visits, prescription drug, dental, vision and other types of benefits. Or you can choose different add-ons to get only the ones you need.

And unlike Medicare, private health insurance usually allows you to extend your coverage for other family members.

Is Medicare Or Private Insurance Better For People With Dependents

If you have dependents, Medicare isnt going to help you. But that doesnt mean you shouldnt enroll. Medicare only provides individual coverage there are no family plans or spouse Medicare plans. However, your Medicare Part A might be free. If thats the case, you might want to consider enrolling in Medicare for yourself first, and then taking a look at options for your dependents.

If you have access to an employer plan, do the math to figure out if it may be more cost-effective for you to have your group vs. individual Medicare Advantage coverage. In some cases, it might even make sense for you to keep both. If your Medicare Advantage premium is low enough, you can keep that for yourself but also hang onto your group coverage for as long as you can to support your family. An insurance agent can help you figure out whats best for you.

Don’t Miss: Do You Have To Pay Back Medicare

The Coverage Lacks True Flexibility

When you enroll in any type of insurance, youre permitted to see any doctor you wish. However, its up to the doctor to decide if theyll accept your insurance or not. This is the case for both private insurance and Medicare coverage.

Typically, more doctors are willing to accept private insurance than Medicare plans. This is because they already network with those private insurance providers. Theyre able to get higher payments from the companies.

For those that enroll in Medicare instead, finding a doctor you like thats willing to accept your insurance coverage can be more difficult. You could end up paying more for the same services than you would with a private insurance policy. Worse, you may need to change your primary care doctor once you enroll.

If youre trying to figure out which type of insurance is best for your needs, consider the amount of flexibility you need. Call your doctor and find out what plans they accept and make the decision that works best for you.