What Is Medicare Plan F

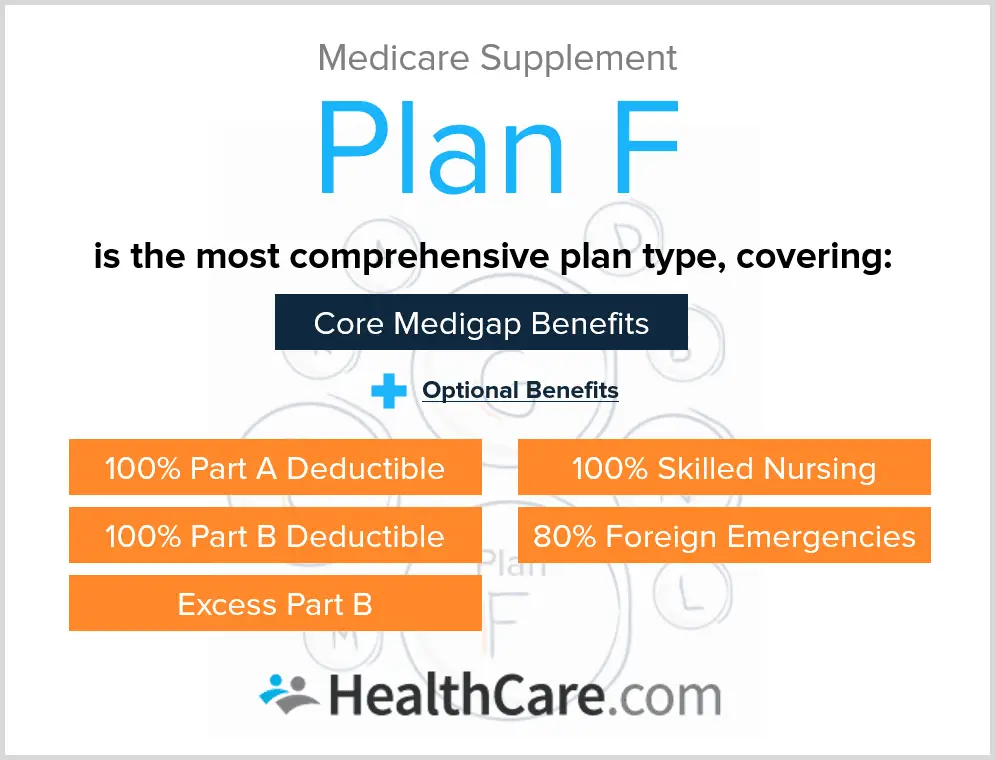

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state. Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

Medicare Supplement Plans Comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

The current Medicare supplement insurance plans offered are Plan A, B, C, D, F, G, K, L, M, and N. Some providers also sell high-deductible Plan F and high-deductible Plan G, which have a lower monthly premium. You can purchase Medigap insurance from private insurance providers.

Each Medicare supplement insurance plan offers varying levels of coverage. For instance:

- Medigap Plan A doesnt cover the Medicare Part A or Part B deductible.

- Medigap Plan B covers the Medicare Plan A deductible only.

- Medigap Plans K and L cover a smaller percentage of costs like skilled nursing coinsurance and hospice coinsurance and also have out-of-pocket maxes.

Before you choose a Medigap plan, its a good idea to compare Medicare supplement plans. Every plan offers a different level of coverage and has a unique premium. Also, keep in mind that not all insurance providers offer every plan.

Plans F and G are similar. Heres a look at how Plans F and G compare:

| Standard Plan F | |

|---|---|

| N/A | $2,340 |

Also, remember that you need Part D for Medicare prescription drug benefits. Medicare supplement plans dont help with prescription drug costs. You can also choose a Medicare Advantage plan rather than Original Medicare and most of Medicare Advantage plans offer prescription drug benefits, too.

What Does Medicare Plan F Cost

Private insurance companies set the cost of Medigap policies. Each company can decide whether they will offer Medigap policies in the state in which a person lives.

If more benefits become added to the policy, its cost may be higher. Some states offer high deductible Medicare Plan F policies.

People can use the Medicare Plan Finder to find the average cost of Medicare Plan F policies in their zip code. This tool allows people to see which companies are offering policies and their contact information and premiums.

You May Like: Will Medicare Pay For Handicap Bathroom

Should You Get Medicare Supplement Plan F

Medicare Supplement Insurance, also known as Medigap, is a policy designed to pay some of the extra healthcare expenses that traditional Medicare doesnt cover. Because of its comprehensive coverage, Medicare Supplement Plan F is one of the most popular policies among seniors using Medicare. However, for some, this policy may not be sold past 2019. Read on to discover if you should consider a Medicare Supplement Plan F before its discontinued.

Where Can You Buy Medicare Supplement Plan F

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

You can also look at the companies that offer each plan and how they set their monthly premiums. Because the cost of a Medigap policy can vary by company, its very important to compare several Medigap policies before selecting one.

Don’t Miss: Who Must Enroll In Medicare

Decide If A Regular Or A High

Some providers offer two versions of Plan F: regular and high deductible. As the name suggests, the main difference is the deductible amount, and beyond that, the timing of the coverage. With a high-deductible Plan F, the coverage doesn’t activate until the deductible amount is met, but in exchange, you can expect much lower monthly payments than the regular Plan F, which works the same as other Plans, with lower deductibles and higher monthly payments.

Medigap F Cost Example

Gracie applies for a Plan F Medigap and the insurance company approves her. The following year she sees an orthopedic specialist about problems with her knee. Medicare pays 80% of the cost of this visit to her specialist. Plan F covers the other 20% owed under Part B. Gracie owes nothing.

The specialist sends her to an imaging facility to have an MRI done on her knee. Medicare pays 80% of the cost of her MRI. Medicare F pays the other 20%. Gracie pays absolutely nothing.

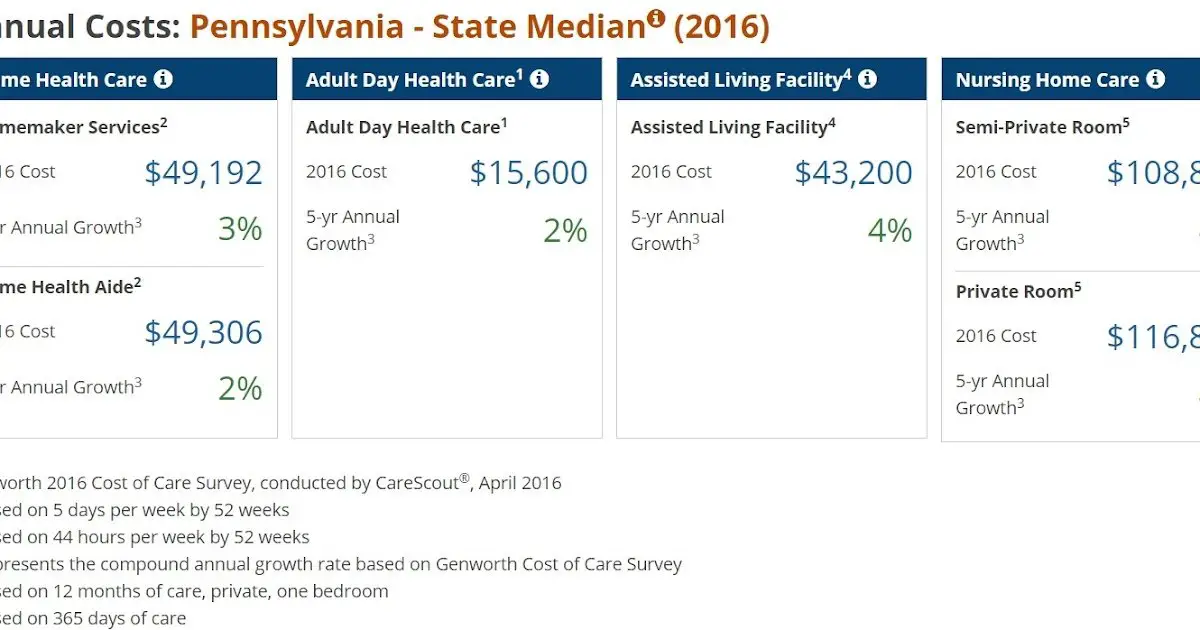

The results of the MRI show serious problems. Her orthopedic specialist tells Gracie that she is a candidate for a total knee replacement. She undergoes surgery at her local hospital and is in the hospital a couple of days. Gracie also has a home health care nurse come out to her home several times in the weeks following her surgery.

The total cost for Gracies surgery, hospital stay and follow-up care is $70,000. Medicare pays its share of the bills and sends the remainder of about $14,000 to Gracies Supplemental insurance carrier. The carrier pays the entire bill, and Gracie owes absolutely nothing for any of these Part A and Part B services. Her only out-of-pocket spending would be for medications.

That means the cost of Medicare Supplement Plan F is really only the premiums that you pay for the plan itself. Medicare Supplement Plan F rates will vary by insurance company, but you can rest assured there is no back-end spending.

Also Check: When Am I Available For Medicare

How Medicare Supplement Plan F From Aarp Covers You

Medigap Plan F is the most comprehensive of the ten standard supplements sold by AARP . Although AARP does not offer Plan F to everyone, or in all areas , where offered the plan covers the following:

The complete coverage of Medicare Plan F makes it well liked, however it is also the most expensive. Plan F leaves its beneficiary with no out-of-pocket costs because it pays all remaining hospital and doctor costs after Medicare pays its share.

IMPORTANT: As of January, 2020, Plan F is not available to new Medicare beneficiaries. See our Medicare Supplement Plan F page for more information.

Plan F may offer expansive coverage, but it does not cover everything. Beneficiaries are still required to pay their Medicare Part B premium payments each month, and you may have a Part A premium if you did not pay Social Security taxes for at least 40 calendar quarters .

Like all other Medigap plans, this policy covers the gaps in your major medical expenses, but it does not pay for prescriptions, hearing, vision, dental and other healthcare needs not covered by Original Medicare.

Changes To Medicare Supplement Plan F In 2020

If you enrolled in Medicare prior to January 1, 2020, you will remain eligible to apply for Medicare Supplement Plan F at any time in the future. On the other hand, those who became eligible for Medicare after January 1, 2020, will not be able to enroll in Medicare Supplement Plan F or Plan C.

The reason Plan F is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

But even if youre unable to get a plan that pays your Part B deductible, the good news is that this deductible is relatively inexpensive. Its $198 in 2020, a slight increase from $185 in 2019.

While this means changes for individuals researching Medicare Supplement policies, Casey Schwarz, senior counsel for education and federal policy at the Medicare Rights Center, .

I think its really important to highlight that for people who have been enrolled in Plan C and Plan F, there is absolutely nothing changing, she said.

Read Also: Which Is Better Original Medicare Or Medicare Advantage Plan

Medicare Plan F: Who Is It For

- People on a fixed income: When your deductibles and most cost-sharing expenses are covered, your out-of-pocket costs may be more predictable.

- International travelers: Plan F may cover most of your health care costs while traveling abroad.

- People expecting high health care costs: Plan Fs higher premiums may be worth it for those with a lot of medical expenses to cover.

- People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you’ve never had this particular plan before.

John is 73, and he has end-stage renal disease . Hes choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury. He has a wife and helps care for two teenage grandchildren, so John needs fixed health care costs each month. Several times a year, he and his family visit relatives in Mexico, and John sometimes receives care while out of the country.

Medicare Plan F Vs Plan G: Which Is Better

If you cant get Plan F, because you got your Medicare benefits after 1 January 2020, or youre comparing the cost of Plan F vs. Plan G, heres what you need to know. Theres just one benefit that separates Plan F and Plan G, the annual Medicare Part B deductible. In most cases, a Plan G premium, plus the annual deductible, costs less than a Plan F policy, sometimes as much as $100 or more. You can learn more about Medicare Plan F vs. G in this comparison.

Recommended Reading: How Much Is A Colonoscopy With Medicare

Consider Talking To A Broker Or Consultant

A Medicare broker or independent consultant can be an excellent resource. Not only is a broker’s service completely free to you, but they must follow very specific rules, so they are prohibited from selling you on a plan you haven’t specifically asked to hear about. Brokers have a wealth of knowledgeand in some cases, better access to plans and programsso they may be able to get you a better price.

Why You Need A Medigap Plan F Policy

Most people know a little about Medicare Part A and B, often called Original Medicare, but not much about the other options available to them. Medicare Supplement Plan F is also referred to as Medigap Plan F. It is a supplemental policy that you can buy from a private insurance company. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs.

Original Medicare pays for about 80 percent of your major medical costs. A Medigap plan can be used to cover various parts of your 20 percent share . Medicare Supplement Plan F covers all the gaps in Original Medicare.

NOTE: The correct terminology is Medicare Supplement Plan F, not Part F. Here is an easy way to remember. Only Medicare uses Parts . Private insurance companies sell Plans.

Don’t Miss: Does Quest Labs Accept Medicare

What Does Medicare Supplement Plan F Pay For

Medicare Supplement Plan F is the only plan that covers all Medicare Supplement insurance benefits. The following are the benefits available with Medicare Supplement plans. Yes means that Plan F covers 100% of this benefit.

| Medigap Benefits | ||

|---|---|---|

| This plan covers the annual Part B medical insurance deductible, which is $203 in 2021.3 | ||

| Part B excess charge | Yes | A provider who doesnt accept the Medicare-approved amount for a covered service as full payment can charge you extra. Medicare Supplement Plan F is one of the few plans that covers this charge |

| Foreign travel exchange up to plan limits | 80% | This benefit has a lifetime limit of $50,000 to help pay the costs for certain emergency care you receive outside the U.S. after youve paid a $250 annual deductible. |

| Out-of-pocket limit | N/A | Some Medigap plans have an annual out-of-pocket limit that you must meet before the plan begins to pay all the costs for covered services. This doesnt apply to Medigap Plan F. An out-of-pocket limit is different from a deductible. |

About Medicare Supplement Plan F

Medicare Supplement Plan F, administered by Premera Blue Cross, allows the use of any Medicare contracted physician or hospital nationwide. The plan is designed to supplement your Medicare coverage by reducing your out-of-pocket expenses and providing additional benefits. It pays some Medicare deductibles and coinsurances, but primarily supplements only those services covered by Medicare.

There is no prescription drug coverage with this plan so a Part D prescription drug plan is also needed unless you have other creditable drug coverage .

In Medicare Supplement Plan F, benefits such as vision, hearing exams, and routine physical exams may have limited coverage or may not be covered at all.

If you select Medicare Supplement Plan F, any eligible family members who are not entitled to Medicare will be enrolled in UMP Classic.

Medicare Supplement Plan F does not include prescription drug coverage. If you select this plan, you may have to enroll in Medicare Part D to get your prescriptions, unless you have other creditable prescription drug coverage.

Note: The PEBB Program does not offer the high-deductible Plan F shown in the Outline of Medicare Supplement Coverage.

Also Check: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

What Does Medicare Part F Cover

With Medicare Supplement Plan F, you get the most complete coverage available. First, it includes all the benefits of Medicare Supplement Plans A, B and C. In addition, Plan F provides coverage for skilled nursing facility care, Medicare Part A and B deductibles, and international travel medical emergency help.

Because the plan also covers costs in excess of Medicare-approved amounts, you may have no out-of-pocket costs for hospital and doctors office care with this plan.

Read Also: What Is The Medicare Supplement Plan

The Advantages Of Medicare Supplement Plan F

Medicare Supplement Plan Fs main advantage is that it covers all the Medigap benefitssome of which only a few other plans cover. For instance, Medigap Plan F is the only that covers both your Part B deductible and Part B excess charge. You could pay an excess charge of up to 15% more than the Medicare-approved amount to a provider who doesnt accept Medicare assignment. While most providers accept assignment, there are some who dont accept assignment for all services covered under Medicare.

Having the most comprehensive coverage often means paying a higher monthly premium than you would with other plansunless you go with the high-deductible Plan F option. If you do choose this option, theres still that $2,490 deductible to think about.4 Look at it is like this: Would you rather pay a specific monthly premium to get the most coverage, or not know how much you may pay out-of-pocket for certain expenses like excess charges?

46569-HM-1121

Medicare Supplement Plan G: What You Need To Know Before Enrolling

Before you can sign up for Plan G, you must enroll in both Medicare Part A and Part B. The best time to enroll in Plan G is during your Medigap Open Enrollment period. Thats the six months immediately after you turn 65 and sign up for Part B, when youre guaranteed by federal law to be accepted by any plan, regardless of health. You can enroll in or switch Medicare Supplement plans at other times, but the insurance companies can deny you or charge you more based on your health.

Most Medigap plans are standardized across the nation. However, if you live in Massachusetts, Minnesota, or Wisconsin, different types of plans are available. Contact one of our licensed insurance agents or your local state insurance department to help you understand your options.

Read Also: Why Choose Medicare Advantage Over Medigap

Who Is Eligible For Medicare Plan F

People become eligible for all Medigap policies during the Medigap Open Enrollment Period. The open enrollment starts in the month a person turns 65 and ends 6 months later.

To be eligible, a person must also have enrolled in Medicare Part B. During the Medigap Open Enrollment Period, insurance companies must offer a policy even if a person has a preexisting health condition.

Private insurance companies can use medical underwriting if a person waits until after the Medigap Open Enrollment Period to enroll. This process estimates how much a person may cost an insurance company based on age and medical conditions.

A person may not qualify for a Medigap policy after the Open Enrollment Period.

Before January 1, 2020, everyone was eligible for Medicare Plan F. However, Medigap policies can no longer pay for the Medicare Part B deductible. Therefore, people new to Medicare can no longer get Medicare Plan F.

Standardized benefits include the Medigap Plan F options that state and federal law allow. Some private insurance companies offer more benefits.

The standard benefits that all Medigap Plan F policies offer include:

- Part A hospital costs for an additional 365 days after the end of Medicare benefits

- Part A coinsurance for an additional 365 days after the end of Medicare benefits

- Part A hospice coinsurance or copayments

- Part A deductible

- Part B coinsurance or copayments

- Part B deductible

- blood

- foreign travel 80% of expenses up to the plan limit