Best For Simplicity And Clarity: Blue Cross Blue Shield

Blue Cross Blue Shield

-

No estimates available on the main page

-

Must go to individual plan websites for local details

-

No Medicare Advantage coverage in Mississippi and Wyoming

If you want Medicare information broken down clearly and in a straightforward manner, Blue Cross Blue Shield is the best company to go through for Medicare Advantage. We chose it primarily for features such as its Medicare Advantage Plans document, available for anyone to view on its website without having to enter any personal information. It gives a detailed look into the company’s plan offerings, explaining what types of plans are offered in which state, and who to contact if you want to enroll.

For example, in Florida, you have the option of going through multiple PPOs and HMOs as well as a HMO -D-SNP. Each of these options is sponsored by Florida Blue. Each organization may offer different plans and the plans can differ by ZIP code within the state too. So it’s important you gather information about the plans in your specific area.

The basic website is clean and easy to navigate, but its a little more complicated to actually get an estimate.

However, Blue Cross Blue Shield is actually an association of 35 independent insurance companies, not a single insurer. To get the details of your specific options, youll have to track down the BCBS affiliate in your market. Beware: BCBS affiliation may not be obvious from its name or how its commonly referred to, such as Anthem or Highmark.

Learn More About Medicare Enrollment

1 MedicareAdvantage.com’s The Best States for Medicare in 2021 report. .

2 AHIP. . State of Medigap: Trends in Enrollment and Demographics. Retrieved from www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Medicare has neither reviewed nor endorsed this information.

Best Customer Ratings: Highmark Blue Cross Blue Shield

Highmark Blue Cross Blue Shield

Why we chose it: Highmark was selected primarily because of its high customer satisfaction ratings. In the J.D. Power U.S. Medicare Advantage Study, Highmark Medicare Advantage members rated it the most satisfied of those with any other health plan, surpassing Kaiser Foundation.

-

Gets 4.5 to 5 stars

-

Many preventative and specialty services

-

24/7 nursing line is available to answer medical questions

-

Offers an HMO and a PPO plan

-

A prescription drug plan is available

-

Offers several wellness and fitness programs

-

Offers benefits to cover some over-the-counter medications

-

Worldwide coverage is included

-

Coverage is only available in three states: Pennsylvania, Delaware, and West Virginia

-

Some specialty services have an added fee

-

Costs can vary depending on the level of care required

See FAQs below to learn more about the difference between a PPO and an HMO.

Highmark offers two different types of Medicare Advantage plans: an HMO and a PPO plan. Several plans include a Medicare Part D coverage, but some plans do not include Part D, so the monthly premium reflects which benefits you select, and can vary a lot. Prices vary according to your location, the level of care required, and the policy and type of services that you select.

Worldwide coverage is included, provided you are traveling or living in a Blue Medicare Advantage PPO plan service area.

Recommended Reading: Does Medicare Cover Tooth Extraction

How To Compare And Choose A Medicare Advantage Plan

Find a knowledgeable insurance agent, says Joe Valenzuela, co-owner of Vista Mutual Insurance Services in the San Francisco Bay area. Having an agent doesnt cost the member anything. Medicare insurance agents are subject matter expertsmany have spent years learning the ins and outs of each plan they represent. There are also many nuanced differences between Medicare Advantage plans. An agent can narrow down the search to only those plans that most closely align with the clients needs.

Valenzuela recommends asking what is most important to you when choosing a Medicare Advantage plan and keeping that priority top of mind. He also suggests paying attention to the fine print in the plan you select.

Once you narrow your search down to one or two plans, ook through the plans benefits line by lineyou dont want any surprises, he says. For example, a plan may have a low premium and copayments but might cost you much more each month in prescription copays.

A couple of important benefits to look at are the plans annual out-of-pocket maximum and your prescription drug costs, adds Valenzuela. Check all your medications on the plans formulary so youre aware of the prescription copayments, deductibles and any restrictions.

How Much Does Medicare Advantage Cost In 2022

The average monthly premium for a Washington State Medicare Advantage plan was around $40 in 2021 and 2022. There is a downward trend for rates, so that average may decrease in years to come.

Most beneficiaries in Washington have access at least one HMO with no premium. Some areas may also have $0 premium PPO plans available.

There are other expenses that come with an Advantage plan. For instance, you may still need to pay deductibles, copays, and coinsurance when visiting doctors or securing medical equipment. You also need to pay the Part B premium each year.

Also Check: Does Medicare Pay For Foot Care

Look For Networks That Include Your Doctors

When you are looking at plans through the Plan Finder Tool, you will be able to view a directory of in-network providers for each individual plan. If you already have doctors that you would like to continue seeing, verify they are within the plans network of providers so you can avoid paying out-of-network costs to see them.

Find Cheap Medicare Plans In Your Area

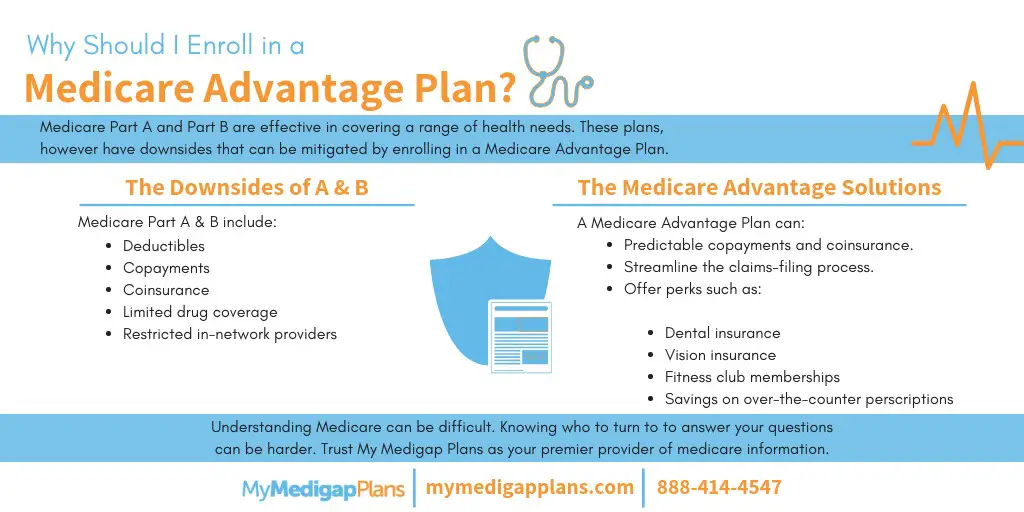

Medicare Advantage, also known as Medicare Part C, provides health coverage that is more extensive than what is offered through Medicare Part A and B, including dental coverage, vision coverage and other extras depending on the company. Available through private-sector health insurers, you are eligible to purchase a Medicare Advantage plan only after you enroll in Medicare Part A and B.

Don’t Miss: Does Medicare Part C Cover Dentures

How Much Does Medicare Part C Cost In Each State In 2021

The chart below shows the average monthly premium for Medicare Advantage plans that include prescription drug coverage in each state.1

- Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month.

- The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota.

*Medicare Advantage plans are not sold in Alaska.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Is A Medicare Advantage Plan Better Than A Medigap Plan

It depends on your individual situation when comparing the two one downside to most Medicare Advantage plans is that you must choose a provider that is in the plans network for optimal cost-effectiveness . If you are OK with seeing an in-network physician, you stand to save the most money and get the most benefits from a Medicare Advantage plan. But, if you travel quite often and you prefer to see your own health care provider , a Medigap policy may be best for you.

Recommended Reading: What Is The Difference Between Medicare Advantage And Regular Medicare

Best For Concierge Service: Aetna

If youre hesitant about signing onto a health maintenance organization plan because youre afraid of accidentally going out of network, consider a plan from Aetna. Aetna offers medical concierge services that can help you find local resources and understand your coverage. All of Aetnas plans come with a $0 medical deductible and there is a $0 premium option for both HMO and preferred provider organization plans.

Aetna Medicare Advantage plans have some of the widest ranges of coverage available. Aetna offers both HMO and PPO plans. If you have a doctor or specialist that you want to stay with, you can save money by choosing a more flexible plan.

Aetna offers a limited selection of special needs plans in 12 states. Its plan benefits go beyond the services offered by Original Medicare and include local healthy living resources, prescription drug deliveries and SilverSneakers fitness membership programs.

Most plans also include vision and dental coverage options. With wide availability and 24/7 on-call nursing services, Aetna is one of the best Medicare Advantage providers for individualized plan solutions.

When Can I Enroll In A Medicare Advantage Plan

You can enroll in Medicare Advantage after you complete your Medicare enrollment process. Once you have Medicare Part A and Part B, you can get an MA healthcare plan. Those who want to switch from Original Medicare will have to wait until the Open Enrollment Period, which runs from October 15 through December 7 every year.

Also Check: Will Medicare Pay For Handicap Bathroom

Legalities Of Medicare In Washington

Before choosing a Medicare option, its important to understand the difference between Medicare and Medicare Advantage. Medicare is a health insurance plan that is controlled by the federal government. This type of coverage may also be called Original Medicare. When you shop for an Original Medicare plan, you can be assured that your plan is held to the standards set by the federal government. You will also be able to see any doctor that accepts Medicare insurance plans.

Medicare Advantage is offered by private insurance companies. While the companies must be approved by Medicare to offer a Medicare Advantage plan, these plans may not be held to the same standards as Original Medicare. The provider of your Medicare Advantage plan can restrict the doctors and specialists that are covered by your plan. These insurance providers also reserve the right to change your insurance premiums at their will.

You may need to get a referral from your primary care doctor before your Medicare Advantage plan covers any visits with a specialist. Your prescription drug coverage may also be restricted by your Medicare Advantage plan. Some plans require you to use generic drug treatments and only cover brand-name options if the generic drug did not work for you.

Local Medicare Advantage Resources

Washington Association of Area Agencies on Aging

The Washington Association of Area Agencies on Aging is a membership organization that comprises over a dozen Area Agencies on Aging in the state. W4A provides a variety of resources to seniors and individuals with disabilities, including advocacy and informational resources. Services vary by location and include caregiver support, information on Medicare Advantage plans and guidance on assistance programs that are available for low-income seniors who are unable to afford their premiums, deductibles and copays. To be eligible for assistance through W4A, seniors must be at least 65 years old and live in the service area of a local agency. In addition to helping seniors understand their Medicare Advantage options, W4A facilitates services, such as meal deliveries, volunteer chore services and case management.

You May Like: Will Medicare Pay For A Patient Lift

Should I Get Medicare Part C

Whether you should enroll in a Medicare Part C plan depends on a variety of factors that are unique to you. Keep in mind that its possible to switch Medicare Advantage plans during enrollment periods if you find your current plan does not meet your needs.

Here are some things to consider when deciding if Medicare Part C is right for you:

| Original Medicare | ||

|---|---|---|

| No spending caps on out-of-pocket costs

Limit on number of days covered for hospital stays and skilled nursing facilities |

Spending caps on out-of-pocket costs | |

| Coinsurance vs. copayments | Uses coinsurance customers pay a percentage of the total cost of care.

Out-of-pocket costs fluctuate based on the cost of the service provided on average, youll pay 20% of all Medicare-covered services. |

Uses copayments and coinsurance customers will have set prices for different types of care and services provided

Out-of-pocket costs are fixed, regardless of the cost of the service provided |

| Network | No networks. Customers can go to any doctor, hospital, or healthcare provider that accepts Medicare. | Most, but not all, plans have a network of providers that customers must use. Using an out-of-network doctor or hospital can result in higher out-of-pocket costs. |

| Travel | With few exceptions, does not cover any services, even emergency care, that are administered outside the U.S. | Some plans may offer coverage for emergency care that customers receive outside the U.S. |

Best For Veterans: Humana

-

Highly accessible customer service department

-

Offers wide variety of plans including Private-Fee-For-Service plans

-

Honors veterans with a Humana Honor Medicare Advantage plan

-

Doesnt offer HMO plans in all states

-

More PPO plan options mean you may pay a premium

Humana is one of the largest Medicare Advantage insurers in the country, with more than 4 million members in all 50 states, the District of Columbia, and Puerto Rico enrolled in its Medicare plans. Currently, an estimated 18% of all Medicare Advantage enrollees are in a Humana health plan.

Humana has a strategic partnership with the Walgreens pharmacy chain, which provides cost savings at Walgreens locations as well as in-store customer service by further discounting medications compared with other pharmacies. It also offers a large library of articles in its Member Resources section and a mobile MyHumana app, so youll always have your member card and information about your coverage accessible on your phone.

It offers one of the widest varieties of plans we reviewed, including HMO, PPO, SNP, and private-fee-for-service plans, which allow you to see any Medicare-approved doctor who accepts the terms for payment.

PFFS represent a small percentage of plans patients use nationwide, but they are often a good option if you live in a rural area and dont want to have to get a physicians referral for specialty care, or if you have limited choices for in-network providers.

Recommended Reading: How To Get A Lift Chair From Medicare

What’s The Downside To Medicare Advantage Plans

There are many benefits to enrolling in Part C in Washington for 2022, but its important to highlight some of the potential downsides as well:

- Not all insurance providers have a high star rating. If you enroll in the cheapest plans available in your service area without paying attention to that rating, you may end up unsatisfied with your coverage.

- Thats a reflection on the plan rather than Medicare Advantage plans in general.

- Advantage plans may limit your options for healthcare providers due to network restrictions.

- You may pay more out of pocket with an Advantage plan than you would with Medigap. Supplement plans are designed to limit out of pocket costs, but Advantage plans reduce monthly premiums with more out of pocket expenses.

- There are some maintenance duties required when you choose an Advantage plan. For instance, you need to make sure your providers are all within your network, do some research to decide if you want to change plans each year, and keep up with copayments, coinsurance, and other bills.

- Benefits, premiums, and other details can change every year. Small changes like updates to the covered drug list can have significant impact on your health and wellness.

Best For Member Satisfaction: Kaiser

Average Medicare star rating: 4.9 out of 5.

Service area: Available in eight states and Washington, D.C.

Standout feature: Kaiser stands head-and-shoulders above other providers in terms of the companys Medicare star ratings, and the company tops a list of nine providers for member satisfaction.

Kaiser Permanente is the fifth-largest provider of Medicare Advantage plans, with 1.7 million members enrolled in 2021. Kaiser is also the largest not-for-profit health maintenance organization in the U.S., and the company uses an integrated care model, which means members can get all their care in one place and all their providers are connected. Kaiser plans are available in only eight states and Washington, D.C.

Pros:

-

Kaiser Permanente earned 846 points out of 1,000 in J.D. Powers latest U.S. Medicare Advantage Study, netting it the top spot for customer satisfaction out of nine providers measured.

-

Only four Medicare health plans received a 5 out of 5 rating from the National Committee for Quality Assurance, and three of them are Kaiser Permanente plans.

Cons:

-

Kaiser Permanente plans are available only in eight states and Washington, D.C., so the majority of U.S. adults cant access them.

-

Kaiser offers only HMO plans, so members must work within Kaisers network of medical providers.

Read Also: Which Medicare Plans Cover Silver Sneakers

Costs Coverage And Benefits

Medicare Advantage costs include your monthly premium, deductible, out-of-pocket maximum, copays and coinsurance. The monthly premium for a policy usually determines the level of the deductible and out-of-pocket maximum. For example, if you select a plan with a higher monthly premium, then usually the deductible and the amount you need to pay out of pocket are cheaper.

Additionally, plans usually have copays for certain health events, such as visits to a primary care physician or inpatient care. If you decide to select a cheaper Medicare Advantage plan, your copays may be more expensive.

Some Medicare Advantage policies include added benefits, such as fitness programs, dental care, vision care or online concierge services. You should take these into account before deciding what is the best Medicare Advantage plan for you.