Other Ways To Get Medicare Coverage At Age 65

If you dont qualify for premium-free Medicare Part A coverage, you may still be eligible to buy coverage.

You still have to be a U.S. citizen or a permanent resident for at least five years.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. These vary on how long you have worked and paid into Medicare. If you continue working until youve totaled 10 years of paying into the system, you wont have to pay premiums anymore.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. This is the same as anyone else would pay depending on the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Is Medicare Ever Free

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums.

However, it’s possible to receive assistance for your Medicare Part A and Part B premiums, copays, and other fees. This is called a Medicare Savings Program, which is state-funded help with paying your premiums.

In some situations, Part A and Part B deductibles, coinsurance, and copayments may be paid as well.

If you receive Social Security benefits, it may feel like Medicare is free because your Part B premiums can be automatically deducted from your benefit checks, but you are still paying for your coverage.

Though this doesnât necessarily make Medicare free, it’s definitely worthwhile to check out the Medicare Savings Program if you need financial assistance.

Read more: Is Medicare Coverage Free at Age 65?

Recommended Reading: Why Is My First Medicare Bill So High

How To Enroll For Medicare

If you meet the requirements for those 65 and older, you can receive Medicare Part A without paying any premiums. However, if you or your spouse did not pay Medicare taxes, you may have to pay for Part A. Medicare Part A covers hospital insurance. Medicare part B covers things like outpatient care, preventive services and medical equipment. It can also cover part-time home health services and physical therapy. Should you decide you also want Medicare Part B, you must pay a monthly premium.

If you have received Social Security disability benefits for 24 months, you will automatically be enrolled in Medicare at the start of the 25th month. If you have Lou Gehrigs disease, you are automatically enrolled the first month you begin receiving benefits. For these situations, enrollment includes both Medicare Part A and Part B. However, if you have end-stage renal disease, your Medicare benefits are determined on a case-by-case basis. In this case, you will need to manually apply.

Enrolling In Medicare With A Disability

Just like when you become eligible for Medicare at age 65, when you are eligible with disability, you have an Initial Enrollment Period of 7 months.

Your Initial Enrollment Period will begin after you have received either disability benefits from Social Security for 24 months or certain disability benefits from the Rail Road Retirement Board for 24 months.1 In other words, your IEP starts on the 25th month of disability benefits.

You will be automatically enrolled in Medicare Part A and Part B, but if you decide you want to get a Medicare Advantage or Part D prescription drug plan, you will need to enroll yourself directly with the private plan provider. You will need to enroll during your IEP to avoid late enrollment penalties.

NOTE: If you become eligible for Medicare because of ALS or ESRD, your situation is different. See the below special sections for eligibility and enrollment for ALS and ESRD.

You May Like: Does Cigna Have A Medicare Supplement Plan

What Do Medicare Savings Programs Pay For

Because each program is different, they all pay for different things.

- A QMB program helps pay for Part A premiums and/or Part B premiums, deductibles, coinsurance and copayments except outpatient prescription drugs. â

- A SLBM program helps pay for Part B premiums only. â

- A QI program helps pay for Part B premiums and is allocated on a first-come, first-serve basis. You also canât qualify for QI if you qualify for Medicaid. â

- A QDWI program helps pay for Part A premiums only.

Medicare Supplement Plan Eligibility

Medicare supplemental insurance, often called Medigap because it fills in the out-of-pocket coverage gaps in Medicare Parts A and B, is purchased from private insurers.

Medigap helps cover copayments, coinsurance and deductibles from Medicare Part A and Part B.

To be eligible for Medigap coverage, you must meet one of these qualifications:

- You must be 65 or older.

- You have been diagnosed with Lou Gehrigs disease.

- You have been receiving Social Security or Railroad Board disability payments for 24 months.

- You must have been diagnosed with end-stage renal disease, requiring regular dialysis or a kidney transplant.

You cannot enroll in a Medicare Advantage plan and a Medigap plan at the same time. You have to choose one or the other.

Also Check: What Does Part B Cover Under Medicare

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

1

Medicare Before The Medicare Eligibility Age

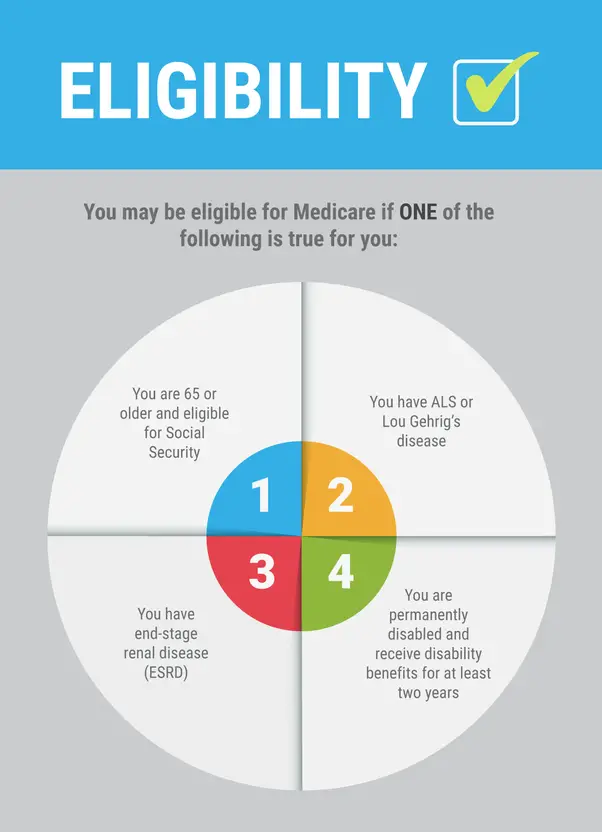

There are also ways an individual under the age of 65 can be eligible for Medicare. For one, you may qualify if you have been eligible for Social Security benefits for at least 24 months. If you have a Railroad Retirement board disability pension you can also qualify. Or, if you have end-stage renal disease or Lou Gehrigs disease, you may qualify for Medicare benefits below the eligibility age.

You can also still get full Medicare benefits even if you dont qualify based on your work record or your spouses. However, you still must be at least 65 and a U.S. citizen or a legal resident of the U.S. for at least five years. To qualify, you must pay premiums for hospital insurance and pay the same monthly premiums that other enrollees pay for doctor visits and prescription drug coverage .

Read Also: When Can You Get Medicare Health Insurance

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Medicare Eligibility Age Qualifications And Requirements

Fact checkedReviewed by: Leron Moore, Medicare consultant –

Medicare, the federal health insurance program, is available to people 65 and older and for younger people who live with disabilities or permanent kidney failure. To qualify for Medicare, you must be a U.S. citizen or lawful permanent resident, unless you are entitled to receive Social Security retirement benefits, Railroad Retirement Board benefits, or Social Security Disability Insurance .

What you should know:

- 1The age requirement for Medicare is 65, unless you are entitled to disability benefits or have permanent kidney failure.

- 2If you dont qualify for premium-free Part A, you can pay a premium.

- 3You must qualify for Parts A and B to opt for Medicare Advantage or Part D, or a Medicare supplement .

- 4You can use Medicares eligibility tool to determine whether you qualify for coverage.

- Part A: hospital insurance, which helps cover hospital inpatient stays, skilled nursing facility care, hospice, and home health services

- Part B: medical insurance which helps cover outpatient doctor visits, durable medical equipment, and some preventive services

- Part C: Medicare Advantage, which bundles together Parts A, B, and usually D

- Part D: drug coverage, which helps cover the cost of prescription drugs

You must qualify for Parts A and B to opt for a Medicare Advantage Plan or Part D, or a Medicare supplement .

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.

How Long Do Medicare Benefits Last For People With Disabilities

As long as youre receiving Social Security disability benefits, your Medicare coverage will continue. In some cases, your Medicare coverage can extend beyond your disability payments.

For example, if you return to work and become ineligible for SSDI, you could stay on Medicare for another eight and a half years93 monthsas long as your disability persists. However, you have to opt in to your employers health plan if they offer one.

In this case, your employer’s health plan would become the primary payer, and Medicare would pay secondary . Unfortunately, if your employer offers only an HSA plan, you wont be able to use Medicare since HSAs and Medicare dont mix.

Recommended Reading: What Age Do You Apply For Medicare

Eligibility For Medicare Part B

You are eligible for Medicare Part B at age 65 as well. However, you must pay a monthly premium for Part B. This provides for your outpatient benefits such as doctor visits, lab work, surgery fees, and more. Check out our Part B page for more on what Part B covers. Our Ultimate Medicare Quick Reference Guide goes over the costs for Medicare Part B which is based on income.

Generally, if you are taking Social Security early you will automatically be enrolled in Medicare Part B unless you specifically ask Social Security NOT to enroll you.

If you are not taking Social Security, then the situation is murkier. For those who were born in the US, you can almost always enroll by either going online Medicare.gov, enrolling over the phone with Social Security, or asking us to enroll you. The same generally applies for US Citizens and Permanent Residents whove been in the US for a very long time. If one of the self-enrollment techniques fails to work, then youll likely need to go to a local social security office to apply.

Should that occur, please call us first so we can ensure you bring the proper paperwork and dont have to wait in line multiple times.

If you delay enrollment into Part B, consult with a local insurance agent who specializes in Florida Medicare. He or she can explain the special election periods which you must use later on so that you wont be subject to a late enrollment penalty.

Find out about your Medicare Eligibility

If You Get Medicare For Disability And Then Return To Work

If you get Medicare due to disability and then decide to go back to work, you can keep your Medicare coverage for as long as youre medically disabled.3 And, if you do go back to work, you wont have to pay the Part A premium for the first 8.5 years.

Part A is premium-free for those with a disability and under 65 only if you get Social Security or Railroad Retirement Board benefits for 24 months or have ESRD and meet certain requirements.4

If youre 65 or older, Part A is premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years, you already get retirement benefits from Social Security or the Railroad Retirement Board, or youre eligible for these benefits but havent filed for them yet.5

Don’t Miss: Does Medicare Cover Mental Health Visits

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Medicare Disability Is ‘regular’ Medicare

There is no special program for younger, disabled beneficiaries Medicare is Medicare, and the same rules and coverage apply to beneficiaries under age 65 with disability as they do to seniors. Therefore, you can still be enrolled in Medicare when living or traveling overseas. However, Medicare will usually not pay for any care you receive overseas.

If you plan to travel outside the U.S., you may want to consider a Medicare Supplement or Medicare Advantage plan that includes overseas coverage. Beneficiaries under age 65 with disabilities can choose to supplement their Original Medicare just like seniors can.

Note: If you are eligible for Medicare disability because you have ESRD, you may face additional limitations on enrolling in Medicare Advantage plans.

Read Also: What Age Can You Get Medicare Health Insurance

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

Read Also: What Is The Extra Help Program For Medicare

How Do Medicare Spending And Use Of Services Differ For Beneficiaries Under Age 65 With Disabilities And Older Beneficiaries

Medicare per capita spending

Average total Medicare spending is higher for traditional Medicare beneficiaries under age 65, mainly due to higher Part D prescription drug spending.13 Medicare per capita spending for beneficiaries younger than age 65 averaged $13,098 in 2014, nearly one third more than average per capita spending for beneficiaries over age 65 .14 Excluding Part D drug spending, the difference narrows considerably to $9,281 for beneficiaries under age 65 and $8,814 for those over age 65, on average. On average, beneficiaries under age 65 have higher per capita spending for drugs covered under Part D and for inpatient and outpatient services, but lower spending on post-acute and hospice care than beneficiaries over age 65 .

Figure 5: Average Medicare Per Capita Spending for Beneficiaries Under Age 65 With Disabilities and Over Age 65, by Type of Service, 2014

Use of medical services