What Is Medicare Easy Pay

Medicare Easy Pay automatically deducts your Medicare premium from a designated checking or savings account. Youll still get a Medicare Premium Bill in the mail, but it will say, This is not a bill. It will serve as a statement letting you know that your premium has automatically been deducted from your bank account.

If you prefer to not have your Medicare premiums automatically deducted, there are a few other ways you can pay:

- You can sign onto MyMedicare.gov and pay your premiums online with your credit card or debit card.

- If you receive Social Security benefits, you can have your Medicare premiums deducted from your benefits.

- If you prefer to pay by check or credit card, you can return your Medicare bill with a check or credit card number by mail.

Using Medicare Easy Pay will save you time and prevent you from accidentally forgetting to pay your premiums.

As Inflation Rises Rapidly The Senior Citizens League Is Calling On Congress To Send Those On Social Security A Fourth Stimulus Check Worth $1400

More than 169 million payments have been sent out in the third round of stimulus checks, but groups are continuing to push for a fourth as inflation continues to bite, as well as the dominance of a new covid-19 variant, Omicron, that is scaring markets and creating a burgeoning new wave of illness.

In New York, new covid-19 cases rose 60% in the week that ended on Sunday as the Omicron variant spreads rapidly around the US northeast. New York has set records for the most new cases reported in a single day since the pandemic started for three consecutive days. This has given a boost to the prospect of further stimulus checks as the risk of great economic trouble lies ahead.

One such is, the Senior Citizens League , a non-partisan advocacy group, started a pressure campaign to push Congress to send those receiving Social Security additional stimulus money. In a letter to leaders of Congress, TSCL Chairman Rick Delaney called for a one-off $1,400 Social Security stimulus payment for seniors. Such a measure could help defray the costs associated for some seniors from the 2022 cost-of-living adjustment, which was the highest in 40 years, pushing them into a higher tax bracket.

Do You Have To Pay For Medicare

Part A

- A monthly payment, or premium, is not required for people who are 65 or older and paid Medicare taxes while they were working.

- You don’t pay a premium if you are 65 or older and you get retirement benefits from Social Security or the Railroad Retirement Board. You also don’t pay a premium if:

- You are younger than 65 and have received Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have and need dialysis or a transplant.

Part B

- Most people pay a standard monthly premium and an annual deductible. Above a certain income, you pay more based on the amount of your income.

- Most preventive servicesâsuch as flu shots, mammograms, colorectal screeningsâare free if the provider accepts Medicare.

Part C

These plans have different costs depending on the plan you choose. You may have monthly premiums, as well as deductibles and co-pays.

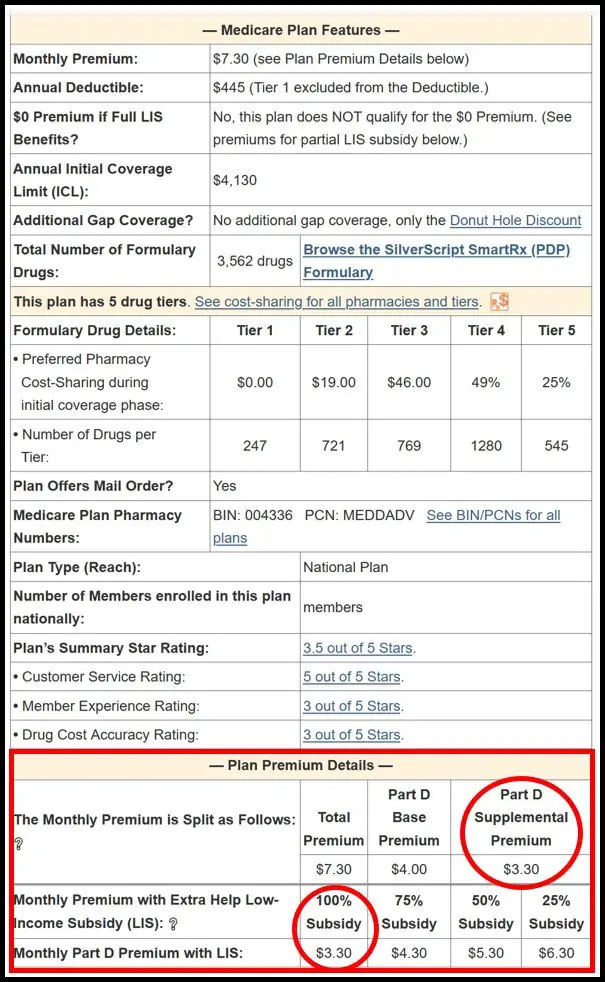

Part D

You pay a premium for the drug plan, which can vary based on what is covered in the plan.

Read Also: Do Husband And Wife Pay Separate Medicare Premiums

Be Smart About Medicare

Only a small number of Medicare participants have incomes that trigger these surcharges. But it’s something to keep in mind if you’re looking at options like a lump-sum pension payout or a large withdrawal from tax-favored retirement plans like IRAs or 401s, because those moves can dramatically increase your taxable income in a way that could force you to pay these higher amounts for your Medicare coverage.

Who Qualifies For Premium

Most people dont have to pay a monthly premium for their Medicare Part A coverage. If youve worked for a total of 40 quarters or more during your lifetime, youve already paid for your Medicare Part A coverage through those income taxes.

Outside of qualifying for premium-free Part A based on your work history, there are a few other situations when you may receive coverage without a monthly premium:

- Youre 65 years old and receive retirement benefits from Social Security or the Railroad Retirement Board .

- Youre 65 years old and you or your spouse had Medicare-covered health benefits from a government job.

- Youre under age 65 and have received Social Security or RRB disability benefits for 24 months.

Also Check: What Is A Medicare Supplement Plan N

What Can I Do If I Dont Want To Pay Irmaa

The Social Security Administration can make a determination if you must pay IRMAA at any time after you apply for Medicare benefits. If you receive a notice from the SSA that you owe IRMAA, and you disagree with the finding, you can file an appeal with the Social Security Administration using information the SSA sends with your initial determination notice. You can also file this form if you experience a life-changing event that has significantly impacted your income for the year.

Do you need Medicare coverage for prescription drugs? Just enter your zip code to begin looking for Medicare Part D plans in your area.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Why Are You Forced Into Medicare

If you or your spouse worked for at least 10 years in a job where Medicare taxes were withheld , you’ll become automatically eligible for Medicare once you turn 65.

Recent immigrants are not eligible for Medicare, but once they’ve been legal permanent residents for five years and are at least 65, they have the option to purchase Medicare coverageas opposed to getting Medicare Part A for freewhich is the same option available to long-term U.S. residents who, for one reason or another, don’t have a work history that gives them access to premium-free Medicare Part A . Note that immigrants who go on to work for at least 10 years in the US do then become eligible for premium-free Part A Medicare if they’re 65 or older, just like anyone else who has paid into the Medicare system for at least a decade.

Once you become eligible for premium-free Medicare Part A, you have to enroll in Medicare Part A or you forfeit your Social Security benefits. Most individuals are unwilling to forfeit their Social Security benefits, and thus accept the enrollment into Medicare. Note that you’re only required to accept Medicare Part Awhich is premium-free if you’re receiving Social Security benefitsin order to retain your Social Security benefits. You are allowed to reject Medicare Part Bwhich has a premiumif you choose to do so, although you could be subject to a late enrollment penalty if you choose to enroll in Part B at a later date. .

Also Check: Is Xarelto Covered By Medicare Part D

D Late Enrollment Penalty

The Part D late enrollment penalty is similar to the Part B late enrollment penalty, in that you have to keep paying it for as long as you have Part D coverage. But it’s calculated a little differently. For each month that you were eligible but didn’t enroll , you’ll pay an extra 1% of the national base beneficiary amount.

In 2020, the national base beneficiary amount is $32.74/month. Medicare Part D premiums vary significantly from one plan to another, but the penalty amount isn’t based on a percentage of your specific planit’s based instead on a percentage of the national base beneficiary amount. Just as with other parts of Medicare, Part D premiums change from one year to the next, and the national base beneficiary amount generally increases over time.

So a person who delayed Medicare Part D enrollment by 27 months would be paying an extra $8.84/month , on top of their Part D plan’s monthly premium in 2020. A person who had delayed their Part D enrollment by 52 months would be paying an extra $17.02/month. As time goes by, that amount could increase if the national base beneficiary amount increases . People subject to the Part D late enrollment penalty can pick from among several plans, with varying premiums. But the Part D penalty will continue to be added to their premiums for as long as they have Part D coverage.

Medicare Premium Assistance: What Options Are Available

The Centers for Medicare and Medicaid Services provide assistance with premium payments. Medicaid operates four types of Medicare Savings Programs:

- Qualified Medicare Beneficiary

- Qualified Disabled and Working Individual

Most of the help you can get to pay premiums are available through these programs.

Don’t Miss: How Often Does Medicare Pay For A1c Blood Test

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B as soon as youre eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enroll into Part B, for as long as you get Medicare Part B benefits. The penalty adds 10% to your Part B premium for each year that you could have signed up for Part B, but didnt enroll. For example, if you became eligible for Medicare Part B in September 2019 but didnt enroll until January 2021 , your Medicare Part B premium might include a 10% late enrollment penalty.

If you qualify for a Special Enrollment Period to enroll in Part B, you may not have to pay a late-enrollment penalty. For example, if you delayed Part B enrollment because you were still covered by an employers plan , you might qualify for an SEP when you can enroll in Part B without a penalty.

For Insurance Quotes By Phonetty 711 Mon

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2021

Read Also: How Much Is Medicare Plan F Cost

How Does It Work

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

The tax is calculated off of what’s called “Medicare taxable wages,” which uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings.

Your employer is required to collect the tax as a part of the IRS Employer’s Tax Guide , and it sends both the employee and employer version to the IRS through regular electronic deposits.

For example, an individual with an annual salary of $50,000 would have a 1.45% Medicare tax deducted from their paycheck. That’s about $60 each month. The employer would pay an additional $60 each month on their behalf, totaling $120 contributed to Medicare.

Those who are self-employed pay a Medicare tax as a part of the self-employment tax. Rather than being deducted from a paycheck, it’s paid through quarterly estimated tax payments.

The Medicare tax rate has remained unchanged since 1986. However, the Additional Medicare Tax for high-income earners was implemented in 2013 as a part of the Affordable Care Act.

Medicare Part C Advantage Plans

The Part C monthly premiums vary based on your reported income for two years, the benefit options, and the plan itself.

The amount you pay for Part C deductibles, copayments, and coinsurance varies by plan.

Like traditional Medicare, Advantage Plans make you pay part of the cost for covered medical services. Your share of the bill typically ranges from 20 percent to 40 percent or more, depending on the care you receive.

All Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. The average out-of-pocket limit typically ranges from $3,400 to $7,550. In 2022, the maximum out-of-pocket limit is $10,000.

With most plans, once you reach this limit, youll pay nothing for covered services. Any monthly premium you pay for Medicare Advantage coverage does not count towards your plans out-of-pocket maximum.

Any costs paid for outpatient prescription drug coverage do not apply to your out-of-pocket maximum.

Don’t Miss: When Do I Apply For Medicare Part B

How Does The Health Insurance Marketplace Affect Medicare

The health insurance marketplace is a way for people who don’t have health insurance to get coverage. The marketplace is part of the Affordable Care Act. Here are some important things to know:

- If you have Medicare, the insurance marketplace doesn’t affect your coverage.

- It’s illegal for anyone to try to sell you a health insurance plan if they know you have Medicare.

- If you aren’t yet eligible for Medicare, you can seek insurance through the marketplace.

- If you are eligible for Medicare but aren’t yet enrolled, you can get a marketplace plan to cover you before you go on Medicare. Your marketplace plan would stop when Medicare starts. You can’t have Medicare and a marketplace plan at the same time.

Investment Income And Medicare Taxes

Enacted on Jan. 1, 2013, the net investment income tax took effect under the Affordable Care Act. If you earned any income that resulted from dividends, interest, capital gains, royalty income or rental income, you may be subject to the net investment income tax.

The law states that you are responsible for a 3.8 percent NIIT tax based on statutory threshold amounts. Here are the current thresholds as of 2016,

- $250,000 Married, filing jointly

Also Check: Is Silver Sneakers Part Of Medicare

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

What Is The Medicare Late Enrollment Penalty

You may owe the late enrollment penalty for Part A, Part B, or Part D or all three. How much you owe and how it’s calculated depends on the part and how long you went without Medicare coverage.

Very few people pay the Medicare Part A late enrollment penalty, because nearly everyone gets premium-free Part A. But, if you delayed enrollment for a full 12 months AND you don’t get premium-free Part A, you may owe the penalty.

The Part A late penalty is 10 percent of your premium for twice the number of years you could have had Part A but didn’t. So, if you delay for 12 full months, you pay the penalty for 2 years. A 24-month delay leaves you owing the late fee for 4 years, and so on.

The Medicare Part B late enrollment penalty is also calculated in 12-month increments. However, you owe the late fee for the entire time you have Medicare. In addition, every year you delay enrollment adds another 10 percent to your late fee. In this case, that means 12 months equals 10 percent, 24 months equals 20 percent, and so on.

Part D’s late fee is different, since you can only go 63 days without creditable prescription drug coverage before you begin accruing the penalty. “Creditable” means that your prescription drug plan is comparable to Medicare in terms of both costs and coverage. That means that prescription savings clubs do not qualify as .

Like Part B, you owe the Part D late enrollment penalty for the entire time you have Medicare.

Also Check: Does Medicare Cover Breast Prosthesis

Does The Medicare Tax Pay For The Entire Medicare Program

The Centers for Medicare & Medicaid Services notes that there are two federal trust funds that pay for Medicare. One of them, the Hospital Insurance Trust Fund, uses Medicare taxes along with other income sources to pay for Medicare Part A . Another trust fund, the Supplementary Medical Insurance Trust Fund, uses Medicare Part B and Part D premiums and funds authorized by Congress, along with money from other sources, to pay for Medicare Part B benefits. Some of the money also goes to the Medicare Part D program.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

What Is The Additional Medicare Tax Used For

Even though it has Medicare in the name, the Additional Medicare Tax paid by high-income earners is used to offset the costs of the Affordable Care Act , according to the IRS.

In 2021, a total of about $12.3 billion is expected to be paid on employee earnings in excess of $200,000. These funds are used for the provisions of the ACA, including providing health insurance tax credits to make health insurance more affordable for more than 9 million people.

Also Check: Which Medicare Plans Cover Silver Sneakers