What Does Medicare Pay For Urgent Care Visits

Urgent care is primarily covered under Medicare Part B. Thismeans that whatever you currently pay to see the doctor will most likely bewhat you have to pay at an urgent care facility. Your costs can vary based onthe type of coverage you have:

- Original Medicare: If you only have Original Medicare , youll most likely need to pay for 20% of your visit, as well as any applicable deductibles and copays. Theres no cap on the 20% coinsurance for services that Medicare covers, so your total out-of-pocket cost will depend on what your bill is.

- Medicare Supplement Plans: You can use your Medicare Supplement plan anywhere that accepts Medicare. Medicare Supplement plans will pay their portion as long as Medicare pays first. For instance, if you have Medicare Supplement Plan F and Medicare pays its portion for each service, you shouldnt have any out-of-pocket costs. If you have Medicare Supplement Plan N, which doesnt cover copayments, you may be required to pay the Medicare urgent care copay of up to $20 up front.

- Medicare Advantage Plans: Medicare Advantage plans are a form of private insurance and are primary instead of Medicare. If you have an Advantage plan you should review your policy for details on networks, costs, and coverage.

Tips For Taking Control Of Your Health Care

Do You Have The Coverage You Need

Its challenging to know how to get care in some situations. If youve received a bill for urgent care visits, you can contact your Medicare provider to verify if it is accurate. You may be able to file a Medicare reimbursement claim if you feel that you did not receive the coverage you have. You may be able to do this even if the urgent care clinic is not enrolled in Medicare to provide care.

Also Check: Does Medicare Cover Refraction Test

Urgentway Providing Affordable Care To The Community

UrgentWay is committed to providing quality and affordable care to our neighbors. We understand that immediate access is important. Not only are we open 7 days a week, but we also offer extended hours each day so you can get help very early or very late in the day.

With locations in Hempstead, Manhattan, Hicksville, and the Bronx, getting the medical attention you require is more convenient than ever. We are open at the locations of urgent care centers for walk-in visits and have made sure to take all the safety protocols per CDCs guideline against COVID-19.

Moreover, considering the current pandemic of COVID-19, Urgentway has also started providing the facilities of Telemedicine and COVID-19 Screening.

While we accept most insurance plans, including workers compensation, private insurance, Medicaid, and Medicare. We also welcome those without insurance and do our best to offer the most affordable rates and payment options.

UrgentWay truly believes that all members of our community deserve quality healthcare at a price they can comfortably afford.

Dont Miss: Are Blood Glucose Test Strips Covered By Medicare

Medicare And Urgent Care Facilities

Urgent care facilities are basically there to help with acute health problems which need immediate treatment but are not life-threatening. They help you feel better sooner rather than later if you come down with a sudden health problem that cannot wait for an appointment with your primary care provider.

Obviously, if you think that your health affliction is life-threatening, you should dial 911 and/or head to the nearest emergency room. But it can be difficult to know how severe your health problem is , so its often a tough choice to make.

An emergency room, on the other hand, has a plethora of medical experts, equipment, and medications designed to mitigate life-threatening health problems quickly and effectively.

But this type of care isnt cheap, as one might imagine. If youre worried about your health care costs, going to Urgent Care first is obviously the preferred option. But if you have at least Medicare Part A, then you have hospital benefits which will protect you from most out-of-pocket expenses should you end up in the ER.

Don’t Miss: Who Qualifies For Medicare Part C

Know Where To Go: How To Choose Between The Doctors Office Urgent Care And The Er

When youre feeling sick or are injured, there are several places you can go for medical care: a doctors office, an urgent care center, a retail health clinic or the emergency room. Heres a quick guide to help you know where to go, based on the urgency of your ailment and your budget. BCBS members can can visit the Blue Cross Blue Shield Provider Finder to find in-network providers. This includes doctors, dentists, hospitals, urgent care centers, and more. You can also log into your local BCBS company’s site.

Insurance Accepted At Carenow Clinics In Kansas City

- Commercial Payor

Read Also: Can You Get Medicare Advantage Without Part B

Don’t Miss: Does Medicare Cover Droopy Eyelid Surgery

Making The Most Of Your Urgent Care Visit

Since youâre not seeing your regular doctor for this visit, itâs important that you make the most of your visit.

Here are a few tips:

1. Be prepared to talk about your health history.

The doctor or physician is probably seeing you for the first time, so itâs important that you give a good picture of your health and medical history. Even if you think something isnât relevant, tell the doctor anyway!

Make sure you know the medications youâre taking as well as any recent health concerns or surgeries.

2. Describe your main issue in great detail

Youâre obviously going to urgent care for a minor health issue, but be sure to explain it in detail. The last thing you want is to leave out information and potentially leave the clinic without being fully treated.

Think about how long youâve had the symptoms, whether theyâve gotten worse, if youâve had this issue before, if youâve tried anything to help and whether or not it worked, and so on.

3. Leave the urgent care facility with complete understanding

Donât leave the urgent care facility without feeling totally comfortable with the diagnosis and treatment plan. Make sure you know the following things before you go:

- Whatâs the official diagnosis?

- When should I expect to feel better?

- What should I do if it doesnât get better?

- What medication will I be taking, and what do I need to know about it?

- Should I come back or schedule an appointment with my regular doctor for any reason?

Urgent Care Vs Emergency Room

Debating whether to go to urgent care or an emergency room? Typically, urgent care is for illness or injury that isnt an emergency, but you cant wait to get an appointment with your doctor. The emergency room is for medical emergencies or life-threatening illness or injury.

Use this chart to help you decide which may be more appropriate for your needs.

- Stroke

- Heart attack, chest pains or trouble breathing

- Seizure

- Head injuries, loss of consciousness, dizziness, fainting

- Serious burns

- High fever, coughing or vomiting blood, severe vomiting or diarrhea

Urgent care centers may also provide services like physicals, vaccines, drug tests and blood work or other lab tests. |

Additional benefits to urgent care centers typically include shorter wait times, walk-in service, and the ability to make appointments and even check in online.

However, dont hesitate to go to an emergency room if your illness or injury requires greater care and even potentially hospitalization.

You May Like: Does Aetna Medicare Advantage Have Silver Sneakers

Medicare Supplements And Urgent Care Coverage

If you have a Medicare Supplement, your urgent care visit will be much cheaper .

For those with Medicare Supplement Plan F, you have no deductible, no copays, and no coinsurance. This means that as long as the urgent care service is approved by Medicare, your visit will cost you nothing.

For those with Medicare Supplement Plan G, you have no copays or coinsurance, but you do have a $183 deductible for the year. This means your urgent care service would cost you up to $183, and then nothing after that. Keep in mind that you only have to meet the $183 deductible once per year â after that, every service that is approved by Medicare will be covered in full.

For those with Medicare Supplement Plan N, you have a copay of up to $20 for the visit and the $183 deductible, but no coinsurance. Also, with Plan N, you must confirm that the urgent care location accepts Medicare assignment.

If you have Medicare Supplement Plan A, B, C, D, K, L, or M â and we donât recommend any of these plans to our clients â your coverage may not be as great. Since these plans arenât popular, we wonât go into detail, but please contact us if you need more information on how urgent care is covered with these specific Medigap plans.

Read Also: How Much Is Medicare B Cost

Does Medicare Cover Walk In Clinic Visit

Walk-in clinics, like urgent care, are generally considered outpatient care. That means Medicare Part B often covers services received at a walk-in clinic. And like an urgent care visit, Part B will pay 80% for any Medicare-approved services you receive once you meet the deductible.

Before you receive any care, verify with the walk-in clinic that Medicare is accepted. If you visit the walk-in clinic and receive treatments or services before finding out it doesnt accept Medicare, you may have to pay full price for any care you received.

Are you eligible for cost-saving Medicare subsidies?

Read Also: How To Get Medicare Insurance License

Will Medicare Pay For Urgent Care If Im Traveling

Its possible that you might need to visit an urgent care center while youre on vacation. A bad sunburn or a sprained ankle on a hike could have you searching for care. If youre traveling outside the United States, you might not be sure how that care will be paid for.

If you have Medicare, a Medigap plan can help pay your costs when youre traveling abroad. Medigap is supplemental Medicare insurance thats sold by private companies to help cover original Medicare costs.

With most Medigap plans, emergency services will be covered for the first 60 days that youre out of the country. After youve paid a $250 deductible, Medigap will cover 80 percent of the cost for medically necessary emergency treatments.

Traveling And Urgent Care With Original Medicare

Medical emergencies can happen while youre away from home. While Medicare Part B will generally pay for emergency care when traveling inside the United States as long as you visit a provider that accepts it, coverage outside the U.S. is extremely limited even in an emergency.

If you want coverage for urgent care outside of the country, you will need to explore other options.

You May Like: Can You Go On Medicare If You Are Still Working

Does Medicaid Cover Urgent Care

States can determine whether to cover urgent care under their Medicaid programs. If your state’s program covers urgent care, you may have to choose an urgent care center in your network. Even if you’re not required to choose someone in network, some centers may not accept those with Medicaid coverage. You may be assessed a copay for urgent care services, and your state may not cover some types of services performed in an urgent care clinic.

Urgent Care Vs Emergency Room Care

Emergency room care is typically intended for life-threatening conditions that could put you in serious danger. Urgent care facilities can typically be used for minor illnesses or injuries that do not pose an immediate serious threat to your health or wellbeing.

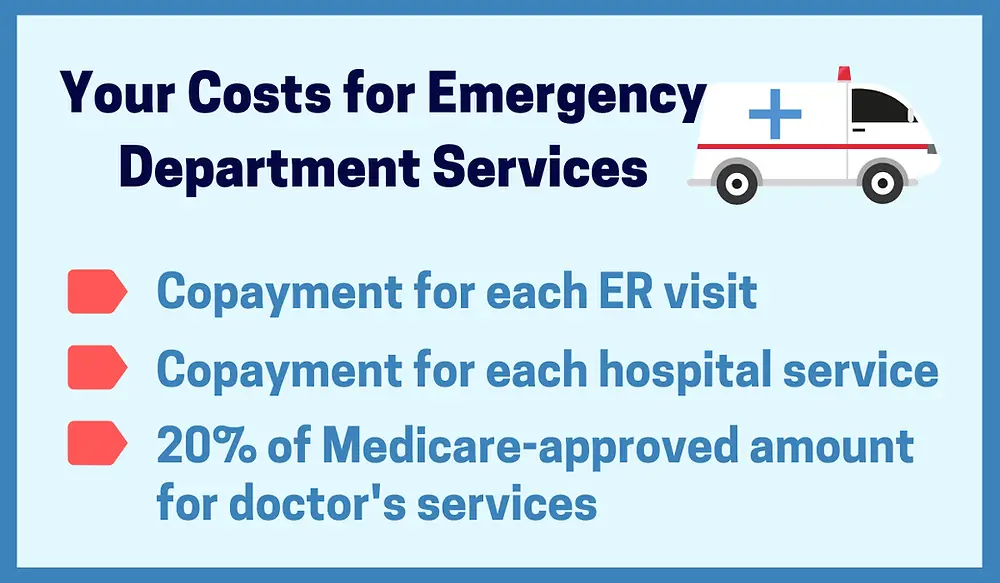

Outpatient ER care and urgent care are both covered by Medicare Part B . If you visit an emergency room and are admitted to the hospital as an inpatient, your hospital stay is covered by Medicare Part A .

Recommended Reading: How To Apply For Part A Medicare Only

What Are My Care Options And What Do They Cost

When you need immediate care, you may have more options than you realize ones that may save you time and money, particularly if you get your health insurance through work. So, before you spend hours waiting in the ER or maybe end up with an unexpected bill, consider the alternatives that could save you up to $2,0001.

Recommended Reading: Does Medicare Cover Laser Therapy

When Should I Go To Urgent Care

You should go to urgent care when you need medical attention quickly but the situation isnt life threatening. Some of the conditions that can be treated at an urgent care center include:

- insect or animal bites

- bleeding that cant be controlled

- suicidal thoughts

- serious wounds

Any condition that threatens your life or could cause you to lose a limb needs to be treated at the ER.

For example, if you fell and hit your head, you should pay attention to your symptoms to decide where to go. If youre slightly dizzy and have a dull headache, you should go to an urgent care center to get checked for a possible mild concussion. But if youre disoriented, confused, slurring your words, or having trouble with your vision, you should go to the ER.

Recommended Reading: How To Pick The Best Medicare Plan

Does My Insurance Cover Urgent Care Visits

The Affordable Care Act requires all ACA-compliant health insurance plans to cover emergency services, but some insurers do not classify urgent care in the same benefit class as emergency care. Most health insurance plans cover urgent care visits, however. Often health plans make the following common distinctions between urgent care visits and emergency room visits.

- A plan may define an urgent care need as a medical condition that is not potentially life-threatening and doesnt require immediate medical attention but still requires care within 24 hours.

- A plan may apply different copayment to urgent care center visits than the plan applies to emergency room visits. For example, you may have to pay the same or similar copay for an urgent care center visit as you pay for a doctor visit.

- To receive urgent care benefits, you may need to choose an urgent care center that participates in your health insurance plan if you are in a health maintenance organization , and you want urgent care where you live. You can check with the insurer or the urgent care center before going to the urgent care center.

When you visit an urgent carecenter, you can expect to pay a copayment. One health plan may pay its share ofthe urgent care center visit but only if you have met the plans annualdeductible If you arent sure if your health insurance plancovers urgent care visits, or what your cost-share is, review your planssummary of benefits.

Also Check: How To Get A Lift Chair From Medicare

What Isnt Covered By Medicare

While Medicare will cover most of your needs from an urgent care facility, there are a few things it wont.

Because Original Medicare doesnt include prescription drug coverage, the cost of any medications you may need will not be covered and youll have to pay for those out-of-pocket. However, if you have a Part D prescription drug plan, or a Medicare Advantage plan that includes Part D coverage, your prescription needs will likely be covered.

Additionally, if you choose an urgent care center that doesnt participate in Medicare or accept assignment, you may have to pay for the services out-of-pocket. In some cases, you may have to pay those costs up front, or before leaving the facility. While most urgent care centers do accept Medicare, keep in mind that there are some that dont.

If you do visit an urgent care center that isnt participating, you still will receive care.

Don’t Miss: How To Check Medicare Deductible

Medicare Advantage And Urgent Care Coverage

Another way to receive Medicare coverage for urgent care is through a Medicare Advantage plan. These plans are sold by private insurers and are required by law to provide all of the same basic benefits as Medicare Part A and Part B.

However, just because an urgent care center accepts Medicare doesnt mean they will accept all Medicare Advantage plans. Much like more traditional health insurance plans, many Medicare Advantage plans feature networks of doctors, hospitals, pharmacies, medical equipment providers and other types of health care providers including urgent care locations.

Before visiting an urgent care location, check to see that the facility is included in your Medicare Advantage plan network. If they are not a network participant, the visit is not likely to be covered and you may be left responsible paying out of pocket for your care.

While the Medicare Part B deductible and coinsurance amounts are standardized, the costs associated with Medicare Advantage can differ from one particular plan to another. So the cost of your urgent care visit will depend on the terms of your specific plan.