What To Know About Medicare Part B Premiums

With proper planning, you can avoid unnecessary surprises, and hopefully save money on Medicare B premiums

There are many things to look forward to as you contemplate the next chapter of your life the chapter after full-time work comprised of travel, family, leisure and more purposeful work. However, in all of my years offering advice and guidance, I have never heard of planning for Medicare as one of them. But with proper planning, you can avoid unnecessary surprises, and hopefully save money on Medicare B premiums.

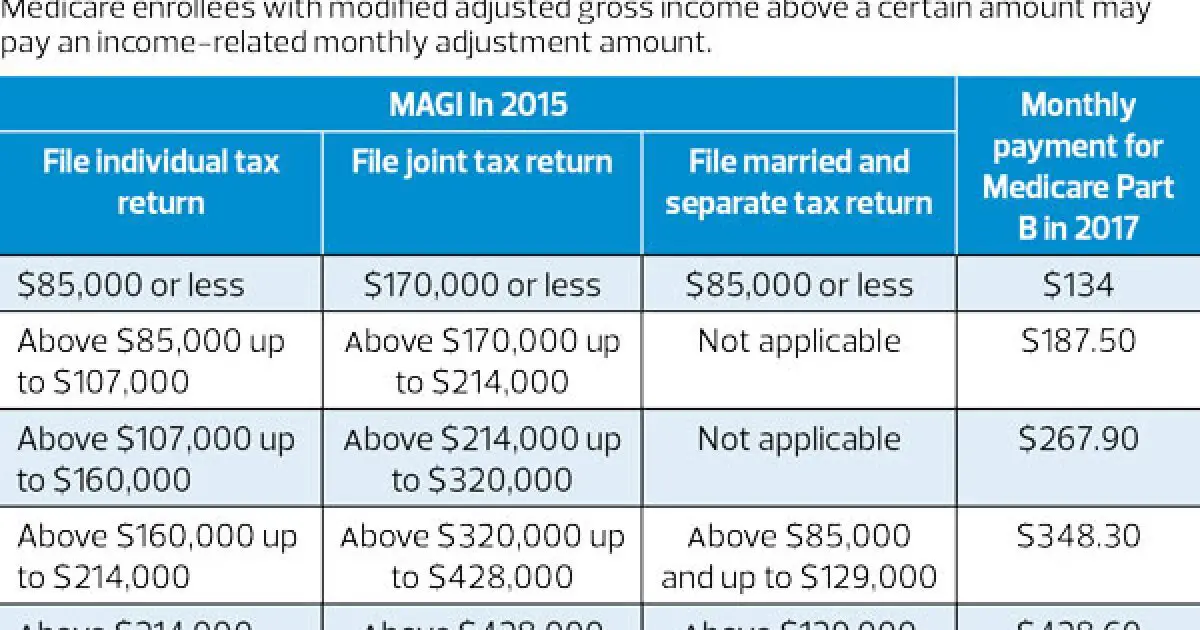

The amount of your Medicare Part B premium is based on your modified adjusted gross income . The higher your MAGI, the higher your potential premium. One thing to note about MAGI is that it is not universally applied. However, adjusted gross income is. AGI is a line item on your tax return, and everyone computes it using the same formula. The starting point for MAGI is generally AGI then adjustments are made specific to the particular provision in question. In the case of your Medicare premium, MAGI is your AGI plus tax-exempt interest. To make things a bit more complicated, your MAGI from two years prior is used. For example, to determine your 2019 premiums, your MAGI reported on your 2017 tax return is used. This is repeated each subsequent year. The premiums for Medicare Part B generally range from $135 to $460, per-month. The increase in the premium is an income-related monthly adjustment amount .

What Is A Medicare Part B Premium Reduction Plan

Part B premium reductions are becoming very prevalent throughout the USA. Its very important you know what they are, since theyre essentially a raise in your Social Security check.

At the end of this short article, you will know:

A Part B premium reduction, also known as a giveback, is a type of Medicare Advantage plan that essentially gives back a portion of your Part B premium that is being deducted off your Social Security check. The availability of a giveback plan varies by the county and state you live in. The example below explains how this works:

John, 68, is a Medicare beneficiary that receives a Social Security deposit every month for about $1,800 per month. His ACTUAL paycheck is $1944, but every month John must pay his Part B premium for his Medicare, so $144 per month is deducted off the top of his check, which is why his deposit is $1,800. The amount of Part B premium deduction is shown on his annual Social Security statement.

So what this means, is that if you know that you pay a Part B premium, then you NOW KNOW that you can get part or all of that money back in YOUR pocket, with a Medicare Advantage Part B premium reduction program.

How Do You Know If You Owe The Income

Using data from the Internal Revenue Service , the Social Security Administration determines who owes the Income-Related Monthly Adjustment Amount. SSA will notify you if you owe IRMAA. This notification will include information about appealing the IRMAA decision.

If you’re new to Medicare, you may be charged the standard Part B premium in the beginning, with the IRMAA determination coming once SSA receives your MAGI information from the IRS. Once you receive your Initial Determination Notice, you have 10 days to contact Social Security if you believe the determination was made in error.

You may appeal the IRMAA decision if you’ve experienced a permanent income reduction in the past 2 years. This is very common for Medicare beneficiaries who retired recently.

Visit SSA.gov for more information about IRMAA.

Also Check: Does Medicare Pay For Catheters

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

These Part B costs can add up quickly, which is why many beneficiaries search for a way to lower or be reimbursed for these expenses. The good news is they have options that can help maximize their savings while on Medicare.

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

Read on to learn about Part B savings options that you may be able to take advantage of.

Medicare Advantage Premiums In 2022

The CMS estimates that the average Medicare Advantage premium of $21 for 2021 is the lowest in 14 years. The agency figured monthly premiums dropped an average of nearly 8.7 percent from $23 in 2020.

CMS projected that 24.4 million people were enrolled in the plans in 2020. At the same time, plan choices, benefits and Medicare Advantage enrollment have all increased.

There were 3,550 Medicare Advantage plans available in 2021 and because these vary based on location, the average Medicare beneficiary had access to 33 Medicare Advantage plans, the most ever according to the Kaiser Family Foundation.

For the most part, plans with cheaper premiums may offer far fewer benefits than those with more expensive premiums. Be sure to compare plans to get the coverage you want or need at a price you can afford.

Don’t Leave Your Health to Chance

You May Like: Does Medicare Pay For Contact Lenses

Medicare Part B Premium In 2022

The Medicare Part B standard premium went up in 2022 to $170.10 from $148.50 a month in 2021. The CMS cited rising prices for doctor administered medications as the driving force behind the hike. People with higher incomes may have to pay higher prices.

Medicare Part B uses a complex formula to determine the amount of your monthly premium. The cost is based on your modified adjusted gross income. Thats adjusted gross income plus any tax-exempt interest reported on your most recent tax return.

The formula also takes into account whether you filed an individual tax return, a joint return or you were married but filed separately.

2022 Medicare Part B Premiums

| Filed an Individual Tax Return | Filed a Joint Tax Return | Medicare Part B Premium for 2022 |

|---|---|---|

| $91,000 or less |

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Recommended Reading: Will Medicare Pay For A Hospital Bed At Home

How Are My Medicare Premiums Calculated

Q. My modified adjusted gross income was based on my 2020 tax returns when both my husband and I were working. I retired and reached full retirement age in January 2022. My husband passed away that same month. At this point, I have no income. I applied for Medicare A and B and based on my MAGI the amount is $374.20 $170.10 for standard plus $170.10 for Income-Related Monthly Adjustment Amount . I have an appointment to explain why it should be reduced due to my husbands death. I was told I will need to tell them what my estimated adjusted gross income will be in 2022. When I calculate this, what is considered income?

Widow

A. Were sorry to hear about your husbands death.

Lets cover how this all works.

For the uninitiated, Income-Related Monthly Adjustment Amount is an additional amount some people pay for Medicare if their income is above a certain level.

Medicare Part A is free except that you paid into it over your entire working career, said Bernie Kiely, a certified financial planner and certified public accountant with Kiely Capital Management in Morristown.

Medicare Part A covers the hospital bed, nursing care and bad food, he said. Medicare Part B covers medical procedures and doctors care.

He said everyone pays a monthly premium for Medicare Part B.

So whats considered income? Kiely said you need to do is look at your 1040 income tax return.

Email your questions to .

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Recommended Reading: Is Medicare Accepted In Puerto Rico

Does The Medicare Part B Premium Change Every Year Based On Income

Medicare premiums are calculated based on MAGI, which is your modified adjusted gross income. If your MAGI from two years prior is $91,000 or less when filing individually, or under $182,000 when filing jointly, then youll only need to pay the standard Part B premium of $170.10. If youre a higher-income earner, youll see an increase between $68-$368.20 per month, depending on your income bracket.

What Will Medicare Part B Cost

Medicare Part B requires a monthly premium,4 which will be automatically deducted from any benefit youre receiving from Social Security, the Railroad Retirement Board or the Office of Personnel Management. Otherwise, youll get a bill.

Youll generally pay a standard premium amount unless your modified adjusted gross income is over a certain amount. For this calculation, Medicare uses your IRS tax return from two years prior to identify whether youre a higher-income beneficiary. If you are, youll pay an income-related monthly adjustment amount . Heres how it works.

If your yearly income in 2020 was:

| File taxes as an individual | File taxes as married filing jointly | File taxes as married, filing separately | Youll pay each month in 2022* |

|---|---|---|---|

| $91,000 or less | |||

| $578.30 |

In addition to your monthly premiums, Medicare Part B has a deductible of $233 in 2022. Once you hit your deductible during the year, youll usually be responsible for 20% of Medicare charges for all Part B services .

Although the costs above are standard, if you dont enroll in Part B when youre first eligible and you didnt have a valid reason to delay enrollment your premium may go up 10% for each 12-month period you couldve had it .5 In most cases, youll pay this late enrollment penalty for as long as you have Part B, so dont miss your window.

You May Like: How To Apply For Medicare Advantage

What Doesnt Medicare Part B Cover

Original Medicare Part B doesnt cover everything.2 Some things that arent covered by Medicare include:

- Long-term care .

- Most dental care.

- Acupuncture .

- Hearing aids and exams for fitting them.

- Routine foot care.

If youre wondering whether a test or service is covered by Medicare, you can check here.

Cms Announces 2022 Medicare Part B Premiums

Today, the Centers for Medicare & Medicaid Services released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts. Most people with Medicare will see a 5.9 percent cost-of-living adjustment in their 2022 Social Security benefitsthe largest COLA in 30 years. This significant COLA increase will more than cover the increase in the Medicare Part B monthly premium.

Most people with Medicare will see a significant net increase in Social Security benefits. For example, a retired worker who currently receives $1,565 per month from Social Security can expect to receive a net increase of $70.40 more per month after the Medicare Part B premium is deducted.

CMS is committed to ensuring high quality care and affordable coverage for those who rely on Medicare today, while protecting Medicares sustainability for future generations,” said CMS Administrator Chiquita Brooks-LaSure. The increase in the Part B premium for 2022 is continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program. The Biden-Harris Administration is working to make drug prices more affordable and equitable for all Americans, and to advance drug pricing reform through competition, innovation, and transparency.

Don’t Miss: Does Medicare Offer Gym Memberships

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Recommended Reading: Is Medicare Medicaid The Same

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARAâs archives.gov.

Legal Status

When Will Your Benefits Start

If youre automatically enrolled, your benefits will start the first day of the month you turn 65. You can apply for benefits if youre at least 64 years and 9 months old, do not currently have any Medicare coverage, and arent receiving any Social security retirement, disability or survivors benefits.9

You can also sign up for Medicare by phone by calling 800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. Or you can visit your local Social Security office.

If you must enroll for Medicare Part B, your coverage start date depends on when you sign up:

| If you sign up for Part B in this month: | Your coverage starts: |

|---|---|

| During first three months of initial enrollment period | The first day of the month you turn 65, or if your birthday is the first day of the month, benefits start on the first day of the prior month |

| The month you turn 65 | 1 month after you sign up |

| 1 month after you turn 65 | 2 months after you sign up |

| 2 months after you turn 65 | 3 months after you sign up |

| 3 months after you turn 65 | 3 months after you sign up |

You dont have to enroll in Medicare annually, but each year youll have the chance to review your coverage and change plans if desired. You can make changes between October 15 and December 7.11 This is especially important if you know your medical needs may change, so put an annual reminder in your calendar in October to go over your options.

Don’t Miss: Does Medicare Pay For Cancer Drugs

B Deductibles In Previous Years

The Part B deductible has generally increased over time, although there have been some years when it stayed the same or even decreased. The increase for 2022 is the largest year-over-year dollar increase in the programs history. Heres an historical summary of Part deductibles over the last several years :

- 2005: $110