What Is The Medicare Open Enrollment Period

The Medicare Annual Enrollment Period can feel like a chaotic time for many of those on Medicare. Many worry that they may enroll into the wrong plan or not realize the changes happening to their current plan. Its all too easy to misunderstand the rules or forget to check whether a certain doctor is in the network. Those enrolled in Medicare Advantage plans sometimes find themselves stuck in a plan that they do not like, due to mistakes like these. The Medicare Open Enrollment Period is designed specifically to help Medicare beneficiaries in these situations.

Can I Make Changes Outside Of The Open Enrollment Period What Is A Qualifying Life Event

Typically, once youve made your benefit elections, you have to wait to make changes until the next open enrollment period. Not always, though. You may have heard the term, qualifying life events. These are life events that let you make changes to your benefits outside of the open enrollment period.

Enrolling In Medicare Part D

The first opportunity for Medicare Part D sign up is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65, or during the seven-month period beginning three months before your 25th month of disability.

In both of these cases whether youre turning 65 or are eligible for Medicare because of a disability you likely have the option of selecting a Medicare Advantage plan that includes Part D prescription drug coverage, and using that in place of Medicare A, B, and D

If you enroll in Medicare during the , you can enroll in a Medicare Advantage plan between April 1 and June 30. But if you already had premium-free Medicare Part A and youre just using the General Enrollment Period to sign up for Part B, youll have to wait until the fall open enrollment period to sign up for a stand-alone Part D plan. This is because Part D can be purchased when you have Part A or Part B, whereas Medicare Advantage requires you to have both. So if youve already had premium-free Part A, you were eligible for Part D as of when your Part A coverage took effect. But your eligibility for Medicare Advantage would only begin when youre enrolled in both Part A and Part B.

If youre enrolled in a Medicare Advantage plan and use the Medicare Advantage open enrollment period to switch to Original Medicare, youll also have the option to sign up for a Part D plan to supplement your Original Medicare coverage.

Read Also: Do You Have Dental With Medicare

Initial Coverage Election Period

Another Medicare enrollment period is the Initial Coverage Election Period. The ICEP is your first opportunity to choose a Medicare Advantage plan instead of Original Medicare.

During the ICEP, you can also sign up for prescription drug coverage.

If you enroll in Part B when you turn 65, your ICEP is the same as your IEP. When you join later, your ICEP is the three months before your Part B coverage takes effect.

- If youre newly eligible for Medicare because you turned 65, you can sign up for a Medicare Advantage Plan or Prescription Plan.

- When on Medicare because of a disability, you can select a Medicare Advantage Plan or Medicare Drug Plan. Medicare coverage begins 24 months after SS or RRB disability benefits.

- If youre already eligible for Medicare because of a disability and you turned 65, you can sign up for a Medicare Advantage Plan or a Prescription Drug Plan.

- You can also switch from your current Medicare Advantage or Prescription Drug Plan to another plan.

- Additionally, you can drop a Medicare Advantage or Prescription Drug Plan altogether. If you sign up for a Medicare Advantage Plan during this time, you can drop that plan during the next 12 months and return to Original Medicare.

The Most Important Elements Of Medicare Advantage Coverage

Now that you have a clear grasp of the key forces impacting Medicare Advantage plan coverage and pricing for 2022, lets dig into exactly which plan details should be prioritized when looking at your current options.

We often get caught up in the frills and the glitter, but the substantive parts of a plan are the hospital network, the physician network and the prescription drug formularies, says Rich. Thats what you should make your selection on because thats where the morbidity, or the costs of claims, is highest. Thats where you want to make sure youre covered.

In fact, hospital care, physician care and prescription drugs collectively accounted for more than 60% of U.S. national health expenditures in 2019. If the majority of resources are invested in these areas, its only logical to consider how robust that coverage is and how much it could support you over the course of a year.

Once youve evaluated the big three areas, consider the less risky benefits, advises Rich. For seniors, dental and vision coverage is very important, so I would look at those and the networks of those plans, he says. After that, look at transportation and meal benefits for outpatient surgery, as well as over-the-counter benefits. Some have hearing aid benefits, too, but I put things like that in a third tier because, in terms of cost, its just so much lower.

You May Like: Will Medicare Cover Lasik Surgery

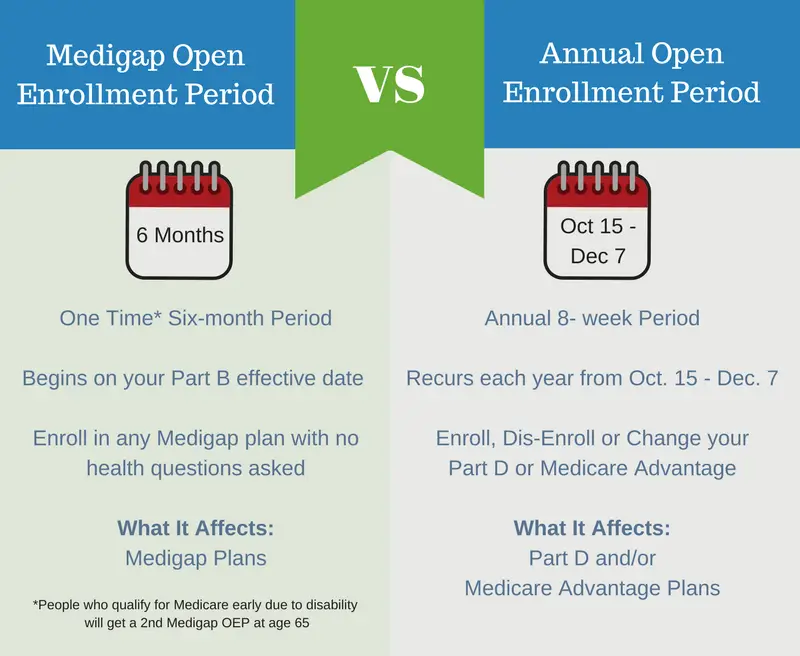

Enrolling In A Medicare Supplement

During your initial Medigap enrollment period you cant be denied Medigap coverage or be charged more for the coverage because of your medical history.

But after that window ends, Medigap insurers in most states can use medical underwriting to determine your premiums and eligibility for coverage.

If youre under 65 and eligible for Medicare because of a disability, there are 33 states that provide some sort of guaranteed issue period during which you can purchase a Medigap plan. But in the majority of those states, the carriers can charge additional premiums for people under 65. You can click on a state on this map to see how Medigap plans are regulated in the state.

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area.

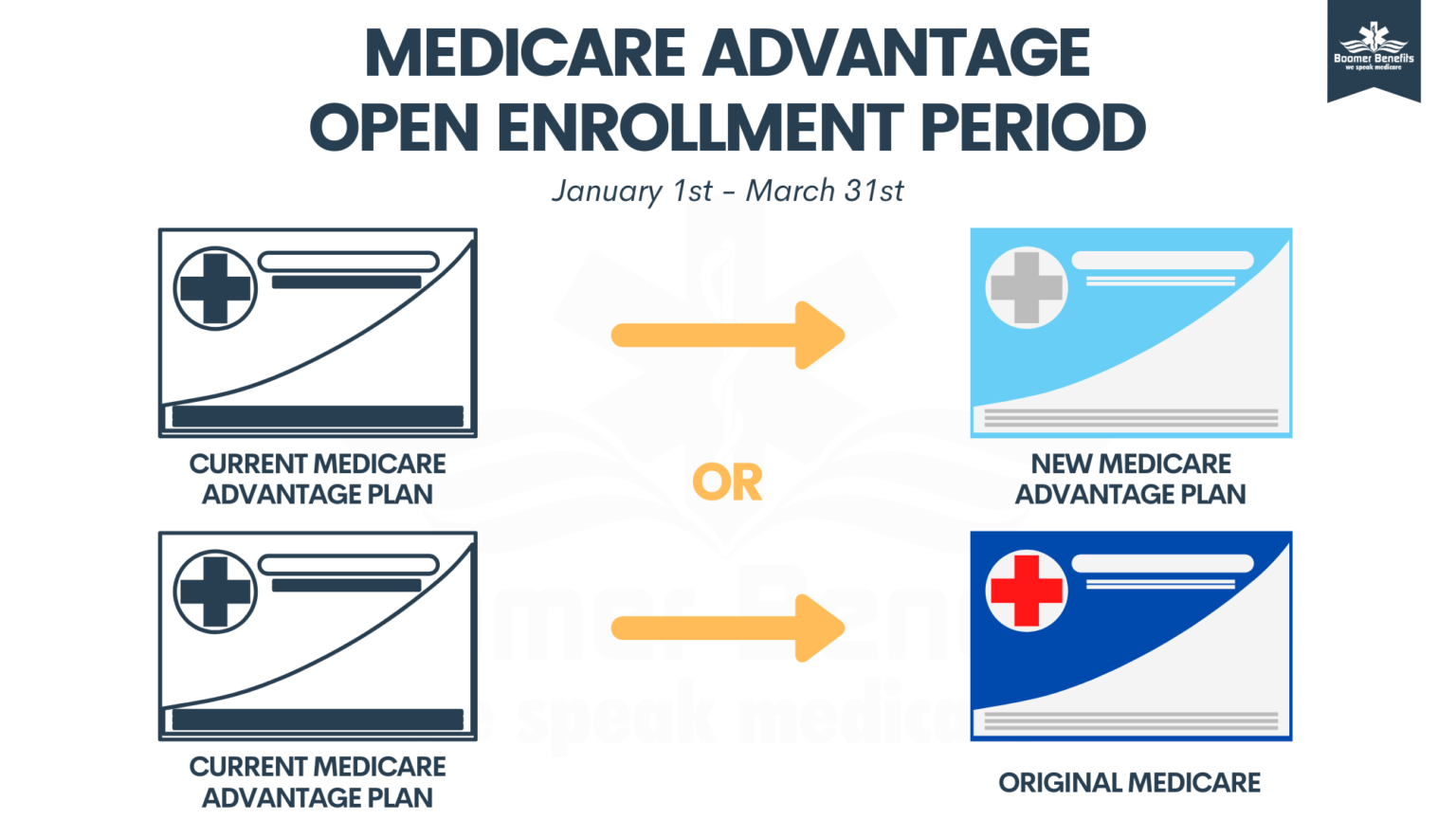

Medicare Advantage Open Enrollment Period

The Open Enrollment Period is for Medicare Beneficiaries who need to make a change but may have missed the Annual Enrollment Period or who have enrolled into a plan that they do not like. It can be easy to make the mistake of not checking to see if your doctors are in-network or if all your prescriptions are covered under the plan.

The Open Enrollment Period begins January 1st and March 31st of each year. This is a time where a Medicare beneficiary already enrolled in a Medicare Advantage plan can make a one-time change to their Medicare.

Don’t Miss: Do You Have To Enroll In Medicare

Can Eligible Beneficiaries Use Their Oep Election More Than Once

âNo. The election can only be used once, and the first application received by CareValue is the application that will be processed and will determine the AOR. Additional applications received after that will be rejected.

This weekâs topic of the week is Service Inquiry. When you need help on an existing member or a new application, service inquiry is the way to go. You can even direct Humana to reach out to your member to help resolve. View the post for more information, including an FAQ sheet and service inquiry job aid from Humana.

How Can I Use The Medicare Oep

The Medicare OEP allows those who are enrolled in a Medicare Advantage Plan to make a one-time change. During the Medicare OEP you can:

- Switch from one Medicare Advantage plan to another

- Disenroll from a Medicare Advantage plan to return to Original Medicare. You have the option to enroll into a Part D drug plan

The Medicare OEP does not, however, allow a beneficiary to change from one Part D plan to another. Also, once you make a change, you will be locked into your plan choice until the end of the year. The only way to change after this would be if you have a Special Election Period .

You May Like: Is Medicare Solutions A Legitimate Company

How To Sign Up For And Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Is There An Open Enrollment Period For Medicaid

Medicaid, a federal program, was designed to help people with limited income get access to health coverage. There is no open enrollment period for Medicaid programs, including the Childrens Health Insurance Program .

In some states, Medicaid covers all low-income adults below a certain income level. In all states, Medicaid provides health coverage to:

- Low-income families and children

Read Also: What Benefits Do You Get With Medicare

When Is Medicare Enrollment

Turning 65 or retiring in the near future? It could be time to choose your Medicare coverage. There are a number of different Medicare enrollment periods. One key Medicare enrollment period for changing your coverage is called the Annual Enrollment Period . This happens from October 15 to December 7 every year. During AEP, you can join, switch or drop a plan. If you dont make any changes during AEP, your current plan will automatically renew the next year.

Can I Change My Medicare Advantage Plan If I Dont Like It

If your current Medicare Advantage plan is not working for you, you have options and may be able to change your plan depending on the time of year. There are only a few times a year when you can change your Medicare plan.

The Medicare Advantage Open Enrollment Period is from January 1 to March 31 every year and is designed for people who are dissatisfied with their current MA coverage.

During the MA OEP, you can change to another Medicare Advantage plan or switch back to Original Medicare. For more about Medicare Advantage Open Enrollment Period, weâve got you covered with a previous blog all about it!

Another option is to utilize the 5-Star Special Enrollment Period . From December 8th to November 30th, you have the option to switch to a 5-Star Medicare Advantage plan. You can only make this switch one time during your SEP.

Please reach out to our office if you’re interested in the 5-Star SEP. You first need access to a 5-Star plan in your county. Some counties do not have any 5-Star plans. You also want to make sure the plan coverage and network is a good fit before making any changes â even if you hate your current plan.

Also Check: How To Decide Between Medicare Advantage And Medigap

What Is The Medicare Advantage Open Enrollment Period

One of the many perks of switching to a Medicare Advantage plan is that, for MA enrollees, there is a bonus enrollment period just for them. It is fittingly called the Medicare Advantage Open Enrollment Period.

Today, weâre going to explore what that means and what the differences are between this enrollment period and the Annual Open Enrollment Period in the fall.

Why No Single Plan Is The Best Plan

Even with this guidance, its virtually impossible for anyone to identify one plan as the absolute best in the bunch across the board, according to both Parker and Rich. It comes down to your specific needs and how well a plan can balance them.

And its really not until the end of this annual enrollment period that we will have a good handle on the changes in premiums, deductibles and benefits and whether the plans are better or worse than they were in 2021, adds Rich.

With that said, its certainly possible to find a plan right now that meets the majority of your coverage needs by shopping the marketplace.

Recommended Reading: Does Medicare Cover Inspire Sleep

Let The Medicare Helpline Help You Better Understand The Medicare Advantage Open Enrollment Period

Our licensed insurance agents can provide side-by-side coverage comparisons to make it easier for you to decide which Medicare plan is right for you. Dont miss out on the benefits you deserveget started by entering your zip below.

Privacy Policy | Terms of Service

The Medicare Helpline is a licensed and certified representative of a Medicare Advantage organization and a stand-alone prescription drug plan with a Medicare contract. Enrollment in any plan depends on contract renewal. By completing the contact form above or calling the number listed above, you will be directed to a licensed sales agent who can answer your questions and provide information about Medicare Advantage, Part D or Medicare supplement insurance plans. Availability of carriers and products are dependent on your resident zip code.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

1https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/find-your-level-of-extra-help-part-d

MULTIPLAN_SQMHL2022_M

What Is The Open Enrollment Period

The Open Enrollment Period are for Medicare Beneficiaries who are already enrolled in a Medicare Advantage plan, they can make a limited one-time plan change to:

Also Check: What Age Do You Draw Medicare

Understanding Medicare Open Enrollment Period

Medicare enrollment periods are extremely important understanding them can have significant impact on your health coverage and costs. The Medicare Advantage Open Enrollment Period is a new period in 2019, and itâs easier to understand it in context of the other Medicare enrollment periods. Hereâs a simple guide to the major enrollment periods:

Initial Enrollment Period â The seven-month period surrounding an individualâs 65th birthday, during which they are eligible to sign up for Original Medicare, Medicare Advantage plans, and Medicare Supplement plans. Learn more

Annual Enrollment Period â A yearly enrollment period that usually runs from October 15 – December 7. Individuals can join or switch Medicare plans. Learn more

Open Enrollment Period â This period is new for 2019. From January 1 – March 31, individuals can make one change between Medicare Advantage plans or swap from a Medicare Advantage plan to Original Medicare only.

Special Enrollment Period â An enrollment period dependent on specific conditions, such as losing health coverage or being affected by a declared emergency like a hurricane or earthquake. Learn more

Fall Medicare Open Enrollment Part D Prescription Drug Plans

If youre enrolled in Original Medicare , you can enroll in a stand-alone Medicare Part D Prescription Drug Plan during the Fall Medicare Open Enrollment period, which is the same time period described above . You need to live within the service area of the plan. You can make other coverage changes during the Fall Medicare Open Enrollment Period, such as:

- Switch from one Medicare Part D Prescription Drug plan to another.

- Drop your Medicare prescription drug coverage completely.

If you decide to drop your Medicare prescription drug coverage, be aware that if you go without this coverage for 63 days in a row or longer, you could face a Medicare Part D late-enrollment penalty if you decide to enroll again at a later date.

Recommended Reading: How To Apply For Medicare In Illinois

Who Should Pay Attention

Roughly 63.3 million people get their health coverage through Medicare. The majority of them 55.1 million are age 65 or older, while the remainder are individuals with permanent disabilities.

Fall enrollment is different from your initial enrollment window, which starts three months before the month of your 65th birthday and ends three months after it. That’s when you generally must sign up for Part A and Part B unless you meet an exception such as having acceptable coverage elsewhere. You also can sign up for an Advantage Plan or a Part D prescription drug plan during your initial enrollment period.

Nevertheless, fall open enrollment touches most beneficiaries in one way or another due to the coverage they select. For instance, 26.7 million choose to get their Parts A and B benefits delivered through Advantage Plans, which are likely to include Part D.

The remainder stick with original Medicare and often pair it with a standalone Part D plan. Some also get a Medicare supplemental plan , which is offered by private insurers.

Altogether, 48.5 million beneficiaries have prescription drug coverage through either an Advantage Plan or a standalone Part D plan.