Healthmarkets Helps With Medicare Advantage And Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

Then, use FitScore® to help you find and apply for a Medicare Advantage plan that fits your needs. You can compare plans and choose plans that include your current providers. We can also help you find a Medigap plan that supplements your Original Medicare.

47036-HM-0221

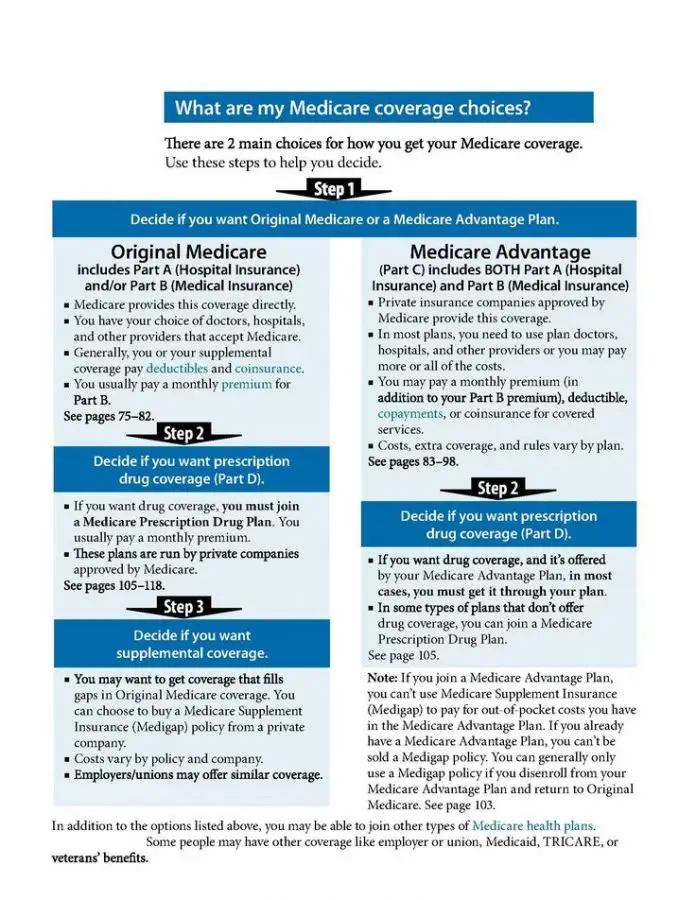

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

- Inpatient hospital services. These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

- Outpatient medical services . These benefits include coverage for preventive, diagnostic, and treatment services for health conditions.

Original Medicare generally doesnt cover prescription drugs, dental, vision or hearing services, or additional healthcare needs.

However, for people who have enrolled in original Medicare, there are add-ons such as Medicare Part D prescription drug coverage and Medicare supplement plans that can offer additional coverage.

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

Read Also: Do I Need Health Insurance With Medicare

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patients situation worsens, it might be difficult or expensive to switch plans.

What Does Medicare Cover

The two main parts of Medicare are Part A and Part B. Part A is hospital coverage for inpatient services, and Part B is your doctors coverage for outpatient services. Part A is premium-free for most beneficiaries, and Part B comes with a standard monthly premium. If youre in a higher income bracket, your premium will be higher than the standard premium. This is known as income-related monthly adjustment amount, or IRMAA.

Medicare Part A and Part B come with cost-sharing in the form of deductibles, copays, and coinsurance, and this is where Medicare Advantage and Medigap come into play. These options can cover most if not all of your cost-sharing.

Read Also: Does Medicare Cover Lasik Eye Surgery

Enrolling In Medicare Advantage

Your initial coverage election period begins three months before your 65th birthday and ends either the last day of the month before your Part B becomes effective or the last day of your IEP.

Outside of your ICEP, you have two additional annual enrollment windows.

- Annual enrollment period

- Medicare Advantage open enrollment period

What Is The Difference Between Plan G And Plan G With A High Deductible

The difference between a regular Plan G plan and a High Deductible Plan G plan is the deductible amount and coverage timing. With a standard Supplement Plan G, youre covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium. With a high-deductible Plan G, your coverage begins once you pay your $2,490 deductible, which then covers all future out-of-pocket costs.

Determining which one is best for you depends on your situation and if you need the coverage Plan G provides immediately or if it makes more sense to pay the lower premiums until that higher deductible is met.

You May Like: When Can I Change My Medicare Prescription Drug Plan

What Is The Difference Between A Medicare Supplement Plan And Medicare Advantage

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

A Medicare Supplement plan cannot be used to cover costs from an Advantage plan in fact, its illegal for anyone to try to sell you a Medicare Supplement policy while you’re enrolled in an Advantage plan unless you’re switching back to Original Medicare. If youre unhappy with your Advantage plan and switch back to a Medicare Original Plan , you then become eligible for Medicare Supplement insurance.

Can You Switch Between Medicare Advantage And Medigap

If you originally sign up for Medicare Advantage and decide it isnt right for you, you can switch to Medigap supplemental coverage. You can also switch from Medigap to a Medicare Advantage plan.

However, you have to follow certain rules and there may be some problems if you decide to switch down the line.

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicares open enrollment period, which runs from October 15 through December 7 each year.

You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan. When you first qualify for Medicare, insurers are required to sell you a Medigap policy. But after that initial enrollment, theres no guarantee that they will sell you one.

Insurers can also charge you more for a Medigap policy if you have serious medical problems when you decide to switch from a Medicare Advantage plan.

A handful of states protect your ability to switch back to Original Medicare with Medigap coverage.

States That Allow You to Switch Year-Round

- New York

Don’t Miss: How Do You Get Credentialed With Medicare

Your Choice Depends On Your Lifestyle And Needs

With all the many options for Medicare, figuring out what coverage you do need can be confusing. Beyond the basic coverage, there are two major options you’ll want to look into: Medigap and Medicare Advantage.

If you want to save money on your health insurance but make sure you’re covered, learning the basics will help you decide which coverage is best. Let’s compare Medicare Advantage and Medigap to see which is right for you.

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

But if you have chronic conditions or severe health needs, you may want to think twice about Medicare Advantage because of the requirements for pre-authorization and staying in-network, says Melinda Caughill, co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance to financial advisers and individuals.

If you need to see multiple specialists, and you have to get referrals for each appointment or fight to overturn denials, it can be really challenging, Caughill says.

Steven Feld, 65, a retiree in South Pasadena, Fla., struggled to get coverage for an injection to treat his arthritic knee. The treatment, a prefilled injection administered in a doctors office, is deemed a medical device by the FDA, so the plan twice denied the coverage. When I was on my employers group plan, there was no problem getting the injection covered, says Feld, who joined his Medicare Advantage plan in May.

Read Also: Is Unitedhealthcare Dual Complete A Medicare Plan

Determine If You Would Like A Regular Or A High

As you might have guessed, a high-deductible Plan G comes with a higher out-of-pocket payment than regular Plan G, but with lower monthly premiums. Its important to do your homework the trade-off is that with a high-deductible Plan G, there is a potential to have to pay an additional amount before receiving the benefits. Youll need to determine the best choice for your budget, and if paying a higher monthly premium is worth it to you, to not have to pay out-of-pocket costs throughout the year.

How To Find The Best Medigap Or Medicare Advantage Plan

When trying to find the best price for Medigap coverage or a Medicare Advantage plan, you may want to shop with independent brokers and non-captive agents. If you call an insurer directly, it will not be able to offer you more than one option for each plan because the insurance company can only speak for its own plans.

An independent broker or agent may represent a large number of companies, so they will be able to compare many options and give you advice. Agents and brokers are regulated by the government and by codes of ethics They will not charge you fees. Instead, they are paid a commission by the insurance company they refer you to.

Get the advice of a licensed Medicare health insurance professional before making any final decisions. It won’t cost you a thing, and it may save you money in the long run.

You May Like: When Does Permission To Contact Expire Medicare

Find Out What Medicare Supplement Plan G Plans Are Available In Your Area

Not every provider offers every Supplement plan, and not every provider has plans available in every location. Most Supplementary Medical Insuranceproviders will ask for your ZIP code when you’re preparing your personalized estimate, which will let you know immediately if the provider covers your area.

Just because a plan covers your state doesnt mean it covers your area, so make sure you enter your ZIP code correctly to see the plans available in your county.

Choosing Medicare Advantage And Enrollment

A person may be eligible for a Medicare Advantage plan if they are enrolled in original Medicare and are living in the service area of the plan they wish to join.

Medicare Advantage plans work in different ways, so it is advisable for people to compare all the available plans in their area. They can do this using Medicares find-a-plan tool.

After deciding on a specific plan, a person can enroll by doing one of the following:

- enrolling through the companys website

- completing a paper enrollment form and then mailing it to the private insurer

There are three opportunities for a person to switch from Medicare Advantage to Medigap.

- During the initial enrollment period : This 7-month period begins the month before a person reaches 65 years of age.

- During the Medicare Advantage OEP: This OEP runs from each year. Between these dates, a person can drop their Medicare Advantage plan, return to original Medicare, or enroll in a Medigap plan.

- Shortly after enrolling: When a person first becomes eligible for Medicare and enrolls in a Medicare Advantage plan, they have 3 months in which they can switch back to original Medicare and enroll with Medigap.

Recommended Reading: Should I Get Medicare Part C

What Are Medicare Advantage Cons

While Medigap policy coverage is nationwide, many Medicare Advantage plans have provider networks confined to a regional or local geographic area. Depending on where you live, you may have to travel a distance to see providers in your Medicare Advantage plans network.

If your Medicare Advantage plan is an HMO, you will need a referral from your primary care doctor for most services, including seeing specialists, unless its an emergency. If you see providers outside the network without the HMOs authorization and its not an emergency, the plan will not cover the cost.

If your Medicare Advantage plan is a PPO, you may see providers outside the network but your copay is higher than if you used an in-network provider.

Medicare Advantage plans typically have copays for most services, whereas Medigap policies cover coinsurance and copays in Original Medicare. Be assured, there is a maximum out-of-pocket amount in Medicare Advantage plans if your total payments for copays, coinsurance, and deductible reach the maximum out-of-pocket amount, the Medicare Advantage plan will cover 100% of covered services for the remainder of the year.

What Are The Differences Between Medicare Advantage And Medigap

Within Medicare Advantage and Medigap, there will be differences in coverage, cost and the provider networks. These will vary greatly and thus are important to recognize before you decide on a plan that will be right for your health situation. Below is an overview of the main differences between Advantage and Supplement coverage.

| Medicare Advantage | |

|---|---|

| In-network deductibles that depend on the plan | Any that participate in Medicare |

Recommended Reading: Does Medicare Pay For Prostate Cancer Treatment

Medigap Vs Medicare Advantage: What Is The Difference

All you need to know

Medicare Parts A and B provide people in retirement with good basic coverage of their healthcare costs, but they pay just 80 percent of the costs for doctors and hospitals.

Meanwhile, the individual is expected to cover the rest of the bill, but this amount can be huge in the event you are facing a serious health issue, while the regular Medicare does not cover prescription drugs, hearing aids, eyeglasses, and dental care.

For those who are hoping to cover those gaps, there are two options as you can either get the Medigap supplemental insurance policies or the Medicare Advantage Plans.

Current And Future Health

Its important to consider not only your current health, but also your future health. You cant predict what your future health will be, but being proactive and planning for all scenarios will protect you from emptying your retirement savings and provide peace of mind.

If your family has a history of medical issues, then its in your best interest to enroll in a plan that gives you the most benefits now. Otherwise, you could be denied coverage if you wait to enroll after youre diagnosed with a chronic condition or serious illness.

Recommended Reading: Which Is Better Medicare Supplement Or Medicare Advantage

Start With This Informational Video

Understand that this is a lengthy video, we like to joke around by recommending to grab some popcorn and enjoy at your own pace. When watching this video, write down any additional questions that come along. Then, hop on the phone with one of us to knock em out one by one. We have found this to be an extremely effective way to make sure you are educating yourself to make this choice when transitioning to Medicare.

Once you have made the decision that you need to sign up for Medicare part A and Part B, it is time to decide how you fill the financial holes present in original Medicare. It is important to note that this discussion will not include retiree coverage from a former employer, the government, or through military service. If you do not plan on receiving retiree benefits, you will have to turn to the private market to find the best plan to fit your healthcare needs. This Article will help you learn how each product type works, MedigapVs.Medicare Advantage.

There are two main ways to receive additional coverage when you are Medicare eligible. The first is Medigap . The second option is Medicare Advantage .

Medigap plans are offered by private insurance companies as secondary insurance to fill in the gaps that are left by original Medicare . To learn even more details about Medigap plans, watch this video.

Medicare Vs Medicare Advantage: How To Choose

Original Medicare comes in two parts: Part A and Part B. Part A covers a portion of hospitalization expenses, and Part B applies to doctor bills and other medical expenses, such as lab tests and some preventive screenings.

But some individuals may find better value in Medicare Advantage plans. Such plans are run by private insurance companies regulated by the government, and they must offer coverage that’s comparable to Original Medicare parts A and B. Most Medicare Advantage plans also include prescription drug coverage, called Part D, which is also available to beneficiaries who keep Original Medicare. With Original Medicare, patients are able to see any provider in the country that accepts Medicare with no restrictions.

Medicare Advantage Plans

Some Medicare Advantage plans have a $0 monthly premium, while others come with a higher monthly premium. You must continue to pay your Part B premium, which is $148.50 per month for most beneficiaries in 2021. Medicare Advantage plans are similar to individual health insurance policies you may have received through your employer or signed up for on your own through the individual insurance market, in that they have different monthly premiums, provider networks, copays, coinsurance and out-of-pocket limits. The trade-off for a lower plan premium could include higher copays or coinsurance, smaller provider networks, more restrictions on use of services, higher out-of-pocket limits or less generous coverage of prescription drugs.

Read Also: What Is The Monthly Charge For Medicare