Buyers Guide: How To Choose Medicare Supplement Insurance

Finding the right Medicare Supplement Insurance provider can be an overwhelming task. There are many different companies offering a wide selection of supplement plans, along with other additional policies. In this buyers guide, well walk you through a few simple steps that can help you determine if you need Medicare Supplement Insurance and help you find the company thats right for you.

Step 1: Determine your Eligibility and if Medicare Supplement Insurance is Right for You

To be eligible for a Medicare Supplement plan, youll need to have Original Medicare, which is Parts A and B. If you have Medicare Advantage you cannot purchase these plans unless you are switching to Original Medicare.

A supplemental insurance plan may be right for you if you wish to add additional coverage that can protect you from unexpected medical expenses in the future. While this means youll need to budget for an additional monthly premium, it also means expenses like copayments and deductibles will be covered. Since medical expenses can put a significant strain on your budget, especially if they arent planned for, this coverage can provide peace of mind over all of the gaps in Medicare coverage.

Step 2: Understand Your Needs

Once you know that Medicare Supplement Insurance is for you, your next step is to understand your coverage needs. This will depend on several factors, including your current health and financial situation.

Step 3: Consider Additional Services and Benefits

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

- No. States Available: Enter zip code to find out

- Providers In Network: Not disclosed

The company offers multiple plans, a comprehensive website that is user-friendly, and customer discounts.

-

Comparison charts for different plans

-

Customer reviews on the plan information page

-

Multi-step process to pay online

-

No app for Medicare Supplement insurance

In business since 1909, Mutual of Omaha offers high quality, in-depth information through the company website. The website is simple, uncluttered, and includes a comparison checklist showing who each plan is best for, with the option to include further coverage . Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company.

However, the company only offers three plans . To get price estimates, you need to include information on your gender, date of birth, and ZIP code. You can contact them online or over the phone for a personalized quote, but the company does not offer a mobile app for its Medigap customers. Mutual of Omaha is ranked by AM Best at A++ for financial health.

Best Discounts For Multiple Policyholders: Cigna

Cigna

-

Fewer plan options than some other companies

-

No pricing listed on the site without providing personal information

Cigna offers the best premium discounts for healthy policyholders as well as households with multiple policies through Cigna, including a 7% household discount and a 5% discount for online sign-up that remains in effect for the life of the policy . While Cigna offers fewer plans than some of its competitors its easy-to-use website has information clearly separated into categories, with an itemized breakdown of each plan when you click on “details” in the plan comparison chart. This allows for easy comparisons while avoiding presenting too much information at once. Cigna also offers a short educational video to explain “the basics of Medicare Supplement insurance.”

Cigna has been in business since 1792, making it one of the oldest companies we reviewed, and the company’s financial strength is currently an A according to AM Best. If youre willing to answer some detailed health history questions, you can see personalized quotes on the website, or you can contact them by phone.

Don’t Miss: When Do You Get Medicare When On Disability

How Much Do The Best Medicare Part D Plans Cost

According to MyMedicareMatters.org, the national average monthly premium for a Part D plan is $33.19. However, the cost varies depending on the plan you choose and the area where you live. In addition, to really determine the best plan for you, you need to consider the cost of the drugs you take plus the deductible and premium.

You shouldnt necessarily choose a plan based on the lowest available premium without first determining how the plan affects your annual drug costs, as its important to remember that Part D plans usually dont begin to cover prescription drug costs until youve paid the out-of-pocket deductible. So, if a low premium plan has a high deductible, it can potentially cost you more per year than a higher premium.

To find the most affordable plan, you need to start by making a list of the prescriptions you take and the monthly cost without insurance. Then calculate the annual cost of the drugs.

This might require consulting with your pharmacy or past receipts. Once you know how much your drugs cost, you can choose a plan with a deductible and a monthly premium that costs you the least.

Its also critical to consider the co-pay tier categorizations of the drugs you take. Medicare Part D plans will always emphasize or encourage you to take the tier 1 generic drugs, and most cover these at a much lower co-pay. But if you have some drugs that are only available on the tier 4 speciality designation, you could end up with a higher co-pay.

Silverscript Medicare Prescription Drug Plans

There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan.

All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

For example, someone with a few generics would find the Plus plan to be more insurance than necessary.

On the contrary, a person with many brand name drugs could find the Plus plan is more suitable than the Choice policy.

SilverScript Network Pharmacies

The preferred pharmacies with SiverScript vary depending on which policy you have. For those with the Choice plan, there are fewer options.

For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores.

Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

CVS Caremark Mail Order pharmacy is an option with your plan, so if you want to skip driving to the pharmacy, you can!

SilverScript Reviews

Both plans offer $0 copays for preferred generics at preferred pharmacies during the initial coverage phase.

SilverScript is one of the largest Part D insurers. They have 24/7 customer service, online tools, and medication programs to keep you on track.

The only downside I can think of, they only offer two plans. Many of the other top companies have at least three options.

You May Like: What Is Centers For Medicare And Medicaid Services

Why Choose A Medicare Supplement Plan

All of these companies also offer Medicare Advantage plans. Buying Medicare insurance isnt an easy decision, and understanding the difference between Medigap and Medicare Advantage plans before you choose one or the other is a good idea.

Medicare Supplement insurance plans work with Original Medicare, Part A, and Part B. They pay costs that Original Medicare doesnt.

Medicare Advantage is different. It replaces original Medicare and might be similar to the health insurance you had before you enrolled in Medicare. Because you are no longer in the federal system, the plans have differences. Reading and asking questions about those differences before you sign up is important.

Cost of supplemental plans vary

While the basic benefits are the same for every Medicare Supplement policy, costs vary widely, and some companies offer additional benefits that might make choosing their plans attractive to you.

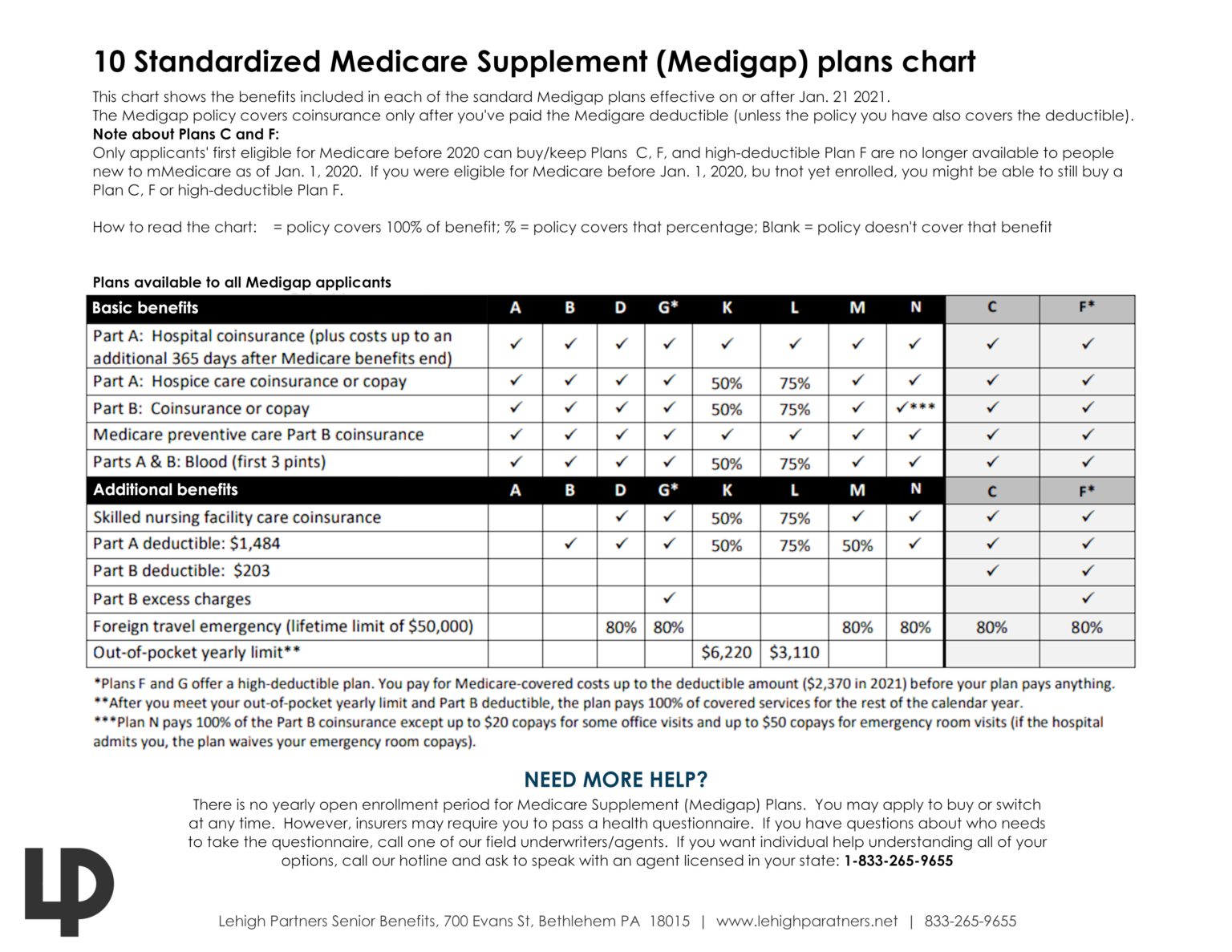

Plans C1 F1 And G: Higher Benefit Level Higher Premium

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

1 You may only apply for plans C and F if you were first eligible for Medicare before 2020.

Also Check: Does Medicare Cover Inspire Sleep

How To Shop And Compare Medicare Supplement Plan G

When you sign up for Medicare, or during Open Enrollment, you must first decide if you want to be on Original Medicare or Medicare Advantage. Original Medicare has a nationwide network of providers but has fixed benefits. Medicare Advantage plans are based on a local network of providers but can offer additional benefits. If you sign up for Original Medicare, you are eligible for a Medicare Supplement Plan.

Medicare Supplement Plans In Wisconsin

Wisconsin standardizes its Medicare Supplement Insurance very differently. For one thing, there is only one major Medigap policy available, the Basic plan.

This plan covers basic benefits:

-

Part A coinsurance for inpatient hospital services

-

Part B coinsurance for outpatient medical services

-

First three pints of blood

-

Part A coinsurance or copayment for hospice care

It also covers coinsurance for stays in skilled nursing home facilities under Part A, as well as 175 days per lifetime in inpatient mental health care, and 40 visits/year for home health care .

Beneficiaries can add riders to their policy to make it fit their needs better. The riders available are:

-

100% Part A deductible

Also Check: Does Medicare Pay For Naturopathic Doctors

Medicare Supplement Plan K

Medicare Supplement Plan K covers services similar to other Medicare Supplement insurance policies, but instead of paying all your costs, the plan pays a percentage. If you have a serious illness or injury, you have the protection of an out-of-pocket annual limit. Once you reach this cap on your out-of-pocket costs, the plan pays 100% of Medicare-approved costs for the rest of the year. This plan is a good option if you prefer a lower premium but still want a fair amount of coverage for a wide variety of services.

In general, Plan K offers a lower monthly premium than Plan L, but offers higher coinsurance amounts and a higher annual out-of-pocket limit.

Most Coverage Pre 202: Medicare Supplement Plan F

Plan F is notable as being the Medigap plan that offers the most coverage. Plan F covers every single fee category that Medigap plans can cover, including all Original Medicare deductibles and coinsurance payments, as well as Part B excess charges. Because Plan F was very popular, it was offered by most companies that offered Medigap plans. This further lowered the price, making Plan F even more desirable.

However, there are some new restrictions on Plan F. If you turned 65 or are enrolled in Medicare Part A after January 1st, 2020, you wont be able to purchase Plan F. Aside from Plan C, Plan F is the only Medigap plan that covers the Part B deductible.

Agent Tip

Plans F and C are no longer available to folks who turned 65 or started Medicare Part A AFTER January 1st, 2020.

If you already have Plan F or are eligible to buy it, it will still be available to you with no restrictions. These new restrictions apply only to those who turned 65 or enrolled in Medicare Part A after the start of 2020. So, even if youve had Medicare for years and are just getting a Medigap plan now, youll still be able to buy Plan F.

Don’t Miss: What Is Uhc Medicare Advantage

What Are The Best Medicare Supplement Plans For 2022

All Medigap plan options are completely standardized throughout the country. This means that Aetna Plan G and Cigna Plan G will offer the exact same coverage. However, not all companies offer the same plans in each state. In addition to this, some plans are no longer available for people who became eligible for Medicare past a specific date, such as Plans F and C.

When you enroll in Medicare Part B, youll enter your Medigap open enrollment period. Medigap plans can usually choose to not sell you a plan based on your pre-existing conditions. However, if you choose a plan during this period, they must sell it to you, regardless of your health.

For now, every Medigap plan is still available to people who became eligible before 2020. Still, its always good to make sure you understand your coverage options before you shop around.

Have Medicare questions? Our licensed agents are ready to help! Call us at today!

Aarp By United Healthcare

Most Experience Working with Seniors

AARP is a special interest group that has served seniors since 1958. The company was founded with the goal of keeping aging Americans informed, empowered, and independent. Through various programs and services, it works to make the world more accessible and enjoyable for seniors across the country.

AARP is not an insurance company itself, but it does frequently team up with insurance providers to bring seniors affordable and accessible insurance solutions. To provide Medicare Supplement plans, it has teamed up with United Healthcare, an experienced nationwide health insurance company.

| Number of States Covered |

|---|

| Enrollment discount, household discount |

Coverage

AARP offers plans A, B, C, F, G, K, L, and N. Plans are available in all 50 states, but the plans that are available will vary by location. Customers only need to enter their zip code to see an estimate for a Medicare Supplement plan with AARP. The website will then display all of the plans available in your area. The premium estimates displayed assume that you are turning 65 and do not use tobacco products. So your actual premium may vary depending on your age and habits. Alternatively, customers can contact an agent to discuss their options over the phone.

Customers will also have the option to purchase Medicare Part D directly through United Healthcare when they sign up for a Medicare Supplement plan if they wish to have coverage for prescription medications.

Sample Pricing:

Read Also: How Is Medicare Part B Penalty Calculated

Silverscript: Best Medicare Part D Plan For 24/7 Advice

Reasons to avoid

SilverScript is a Medicare Part D plan specialist, and this, together with being part of the CVS family of companies, puts it in good stead to assist potential customers with their initial enquiries.

Although the company only offers two plans , the plans are different enough to appeal to most customers, and is why we have featured it in our best Medicare Part D plans guide.

SilverScript should appeal to those with basic, low-level medical requirements, through to those who take regular multiple medications. The 24/7 customer service and a range of online tools to help with medication organization is also a good benefit to customers.

Medicare Supplement Plan N

Now, coming in to close second is Medicare Supplement Plan N, which I happen to love.

Its a great plan, and it has lower premiums than Plan G.

Now, you dont get the same coverage with lower premiums.

There are a few additional out-of-pocket expenses that you could get with Plan N.

So lets talk about what some of those out-of-pocket expenses could be.

Plan N, its very similar to Plan G.

You pay the Part B deductible and then you get your coverage from Medicare and then the plan.

But with a Plan N, if you visit the doctor after you meet that deductible, you could get up to a $20 co-pay.

Now, it could be less than that, or it could be no co-pay, but it just depends on how they code it.

Another expense with Plan N is if you visit the emergency room and youre not admitted, they will charge you a $50 co-pay.

Thats just to keep people out of the emergency room for small things.

One more thing with Plan N, it doesnt cover whats called Part B Excess Charges.

Dont let that worry you. Nobody really ever gets these, although you could if you see a doctors that doesnt accept Medicare assignments.

All that means is if your doctor doesnt take the assigned rates for Medicare, they could charge a little extra and you would have to pay a percentage of that.

In the 13 years, Ive been in business, none of my clients have ever seen a Part B Excess Charge and Plan N with its lower premiums than Plan G makes for a great option.

You May Like: How To Apply For Medicare Without Claiming Social Security

Most Comprehensive For New Enrollees: Plan G

Plan G is the most comprehensive plan aside from Plan F. The only difference between these plans is that Plan G doesnt cover the Part B deductible, which comes out to only $233 per year. For this reason, Plan G is expected to become the new most popular plan, as Plan F is slowly phased out.

In a practical sense, Plan G is unlikely to differ from Plan F in any significant way. Because the Part B deductible is so low, the overall financial impact of these plans should be very similar for most. Because Plan G is growing in popularity, more companies will likely offer it as time goes on. As this happens, the price will go down, making Plan G even more affordable.

When Should I Choose Plan N

Plan N is suitable for people who want an affordable premium, and are okay with paying small copays. These will usually come out to $20, with premiums tending to hover around $100 per month. Depending on your area and pricing structure, this could vary, so always make sure to double-check. However, if this is what youre after, Plan N is a good choice for you, as premiums will be lower than they are for Plan D.

Have questions? Call us at , our licensed agents are ready to help!

Recommended Reading: Will Medicare Cover Life Alert

Why Should I Compare Medicare Supplement Plans

Comparison shopping is important because two different insurance companies could charge you a different price for a plan with the same benefits.

For example, every Plan G policy provides the same benefits, but two insurers may charge you very different prices for a Plan G policy.

Comparing plan prices from multiple insurance carriers helps ensure that you get a competitive rate for the plan you want.

Medicare beneficiaries can enroll in any available Medigap plan, regardless of its popularity. Despite this, is it helpful to review the options and reasons why hundreds of thousands or even millions of people choose one plan over another.