What Is Original Medicare

Original Medicare is a health insurance plan provided by the federal government to those 65 years and older, younger people with disabilities, and those with End-Stage Renal Disease . Traditional Medicare plans are broken into two Parts: Medicare Part A and Medicare Part B .

Medicare Part A consists of medical care someone would receive during an inpatient stay while Medicare Part B coverage includes medical services that would be considered outpatient.

Neither Medicare Part A nor Medicare Part B includes coverage for prescription drugs. This is known as Medicare Part D, which must be enrolled in separately if someone is enrolled in Original Medicare.

Why Medicare Advantage Plans Are Bad By David W Bynon Book Review

Medicare has been one of the leading healthcare plans for people in the US. Most particularly, it has been beneficial for those 65 years old and above, some people with certain disabilities as well. While the plan can potentially cover a lot when it comes to healthcare costs, there are a few issues with Medicare in general.

The biggest problem that people often have with Medicare is that to get full coverage, people will have to spend a lot on annual premiums. Understandably, not everyone can afford to pay for such high premiums, so they alter the package to meet their needs foregoing some coverage along the way.

As an answer to the problem, the federal government has launched Medicare Advantage. This is a new package that promises to bundle all of the coverage in Medicare at a more affordable price. From the offset, this seems like a good idea, but there are those that disagree.

MedicareWire.com founder Andrew Bynons book titled Why Medicare Advantage Plans are Bad details Medicare Advantage to its very core. Its a good way to help people understand the upsides and downsides of Medicare Advantage. How do the book and the authors take on the plane fare?

How To Choose The Right Medicare Advantage Plan

You can choose to enroll in a Medicare Advantage plan if you’re not satisfied with what Original Medicare offers. Medicare Advantage plans can add coverage, and some even pay for a portion of your Part B premium. But you may be limited to network providers, depending on the plan. Consider your preferences and needs when deciding which to choose.

You May Like: When Can I Enroll In A Medicare Supplement Plan

If Youre 65 Or Older:

If you apply for Medigap coverage after your open enrollment period, theres no guarantee an insurance company will sell you a policy. Insurers can:

- Request your medical history as part of the conditions of issuing you a plan

- Refuse to sell you a policy

- Make you wait for coverage to start

- Charge you more

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

Read Also: Is Trump Trying To Get Rid Of Medicare

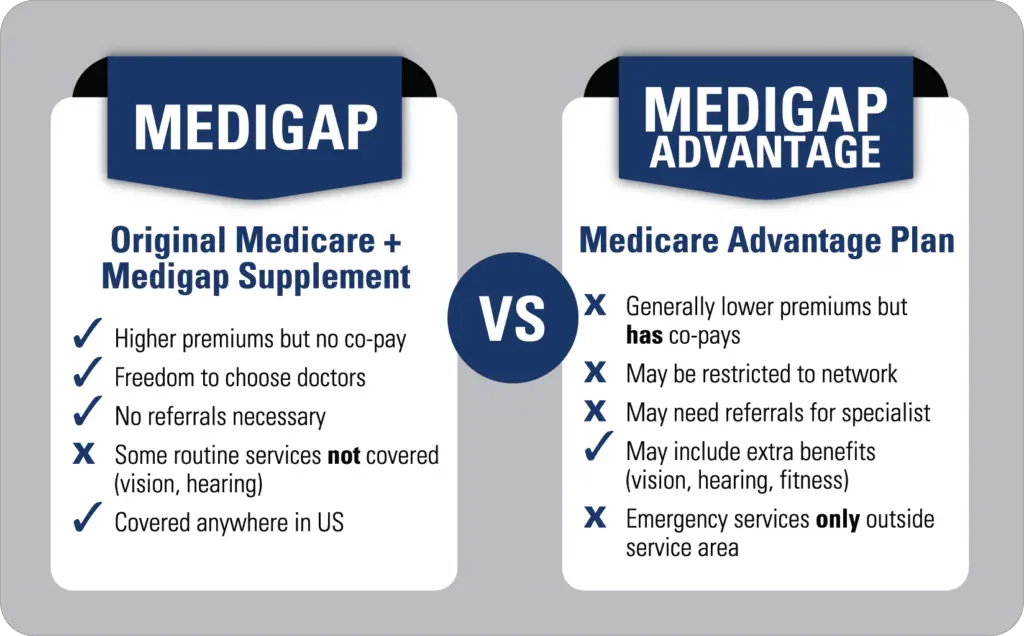

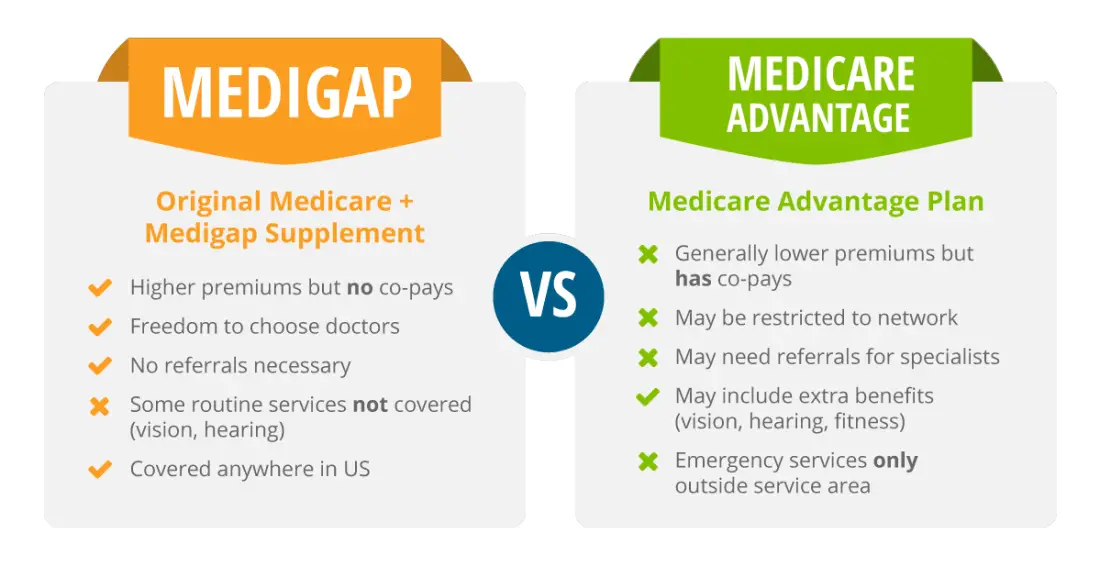

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

Both Original Medicare and Medicare Advantage plans offer Part A, B and D coverage, but the way they deliver these coverages differs. Understanding the differences can help you choose the right plan for your needs.

For instance, Original Medicare grants you access to physicians across the country, meaning youre not limited by a network. Additionally, you dont need to provide a referral to see a specialist.

However, it also requires you to pay 20% of your Medicare-approved amount after your deductible, referred to as coinsurance. There is also no yearly limit on your out-of-pocket costs, meaning you may have to pay more in coinsurance and deductibles if you visit the doctor frequently. Depending on your expenses, your coinsurance under Original Medicare may be more than what youd pay under a Medicare Advantage plan. Supplemental coverage is often recommended along with an Original Medicare plan to help offset these costs.

Original Medicare Pros and Cons

PROS

- Original Medicare can be used anywhere in the U.S.

- Referrals generally are not needed to see a specialist

- Offers widespread coverage for those over 65, regardless of medical history

CONS

- No out-of-pocket maximum to limit health care costs

- Must purchase Part A, B and D coverage separately

- No coverage for dental, vision or hearing

Medicare Advantage Vs Medicare Supplement

Medicare supplementplans help a person cover some of the healthcare expenses that traditionalMedicare does not include. Some people also refer to these plans as Medigap.

As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Plans in Wisconsin, Minnesota, and Massachusetts are also different from the traditional Medigap plans.

Medicare supplementplans can help cover several costs, including:

- copayments for parts A and B

- up to 3 pints of donated blood

- coinsurance for skilled nursing facilities

- yearly out-of-pocket expenses

Peoplewith concerns about steep out-of-pocket expenses may choose a Medigap plan. Asa general rule, a person cannot have a Medicare Advantage plan and a Medigap plan at the same time.

Read Also: Is Pae Covered By Medicare

Medicare Advantage Vs Medicare: Which One Should You Get

Whether it makes sense for you to get Medicare Advantage or Original Medicare can depend on what type of health coverage you need and what you want to pay for it. If you dont need extras like vision care or dental care, then you might prefer to go with Original Medicare. You may avoid paying a Part A premium and youll know what your Part B premiums will be each year, based on your income.

You may also prefer the convenience of being able to visit any doctor or healthcare provider that accepts Medicare, rather than having to visit in-network doctors. And not having to get a referral to see a specialist may be a plus if you develop an ongoing health condition.

On the other hand, Medicare Advantage plans can offer more comprehensive coverage. Costs may be lower as well. If you choose a Medicare Advantage plan, youre not locked into that plan. You could change to a new Medicare Advantage plan if the one you have falls short of your expectations or needs. Talking to a financial advisor or Medicare enrollment specialist can help you get answers to your Medicare questions.

What Does Medicare Advantage Cover

Many Medicare Advantage plans provide Part A, Part B, and Part D coverage in addition to other benefits such as coverage for dental, vision, and hearing.

When patients select a Medicare Advantage plan, they must also decide on a plan type. Plan types include Health Maintenance Organization plans , Preferred Provider Organization plans , Special Needs Plans , and more. Each type of Medicare Advantage plan has different requirements and provides unique coverage options. To learn more about Medicare Advantage plan types, visit this source.

Note: To learn more about Medicare as a whole, visit this source.

You May Like: What Age Can I Take Medicare

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

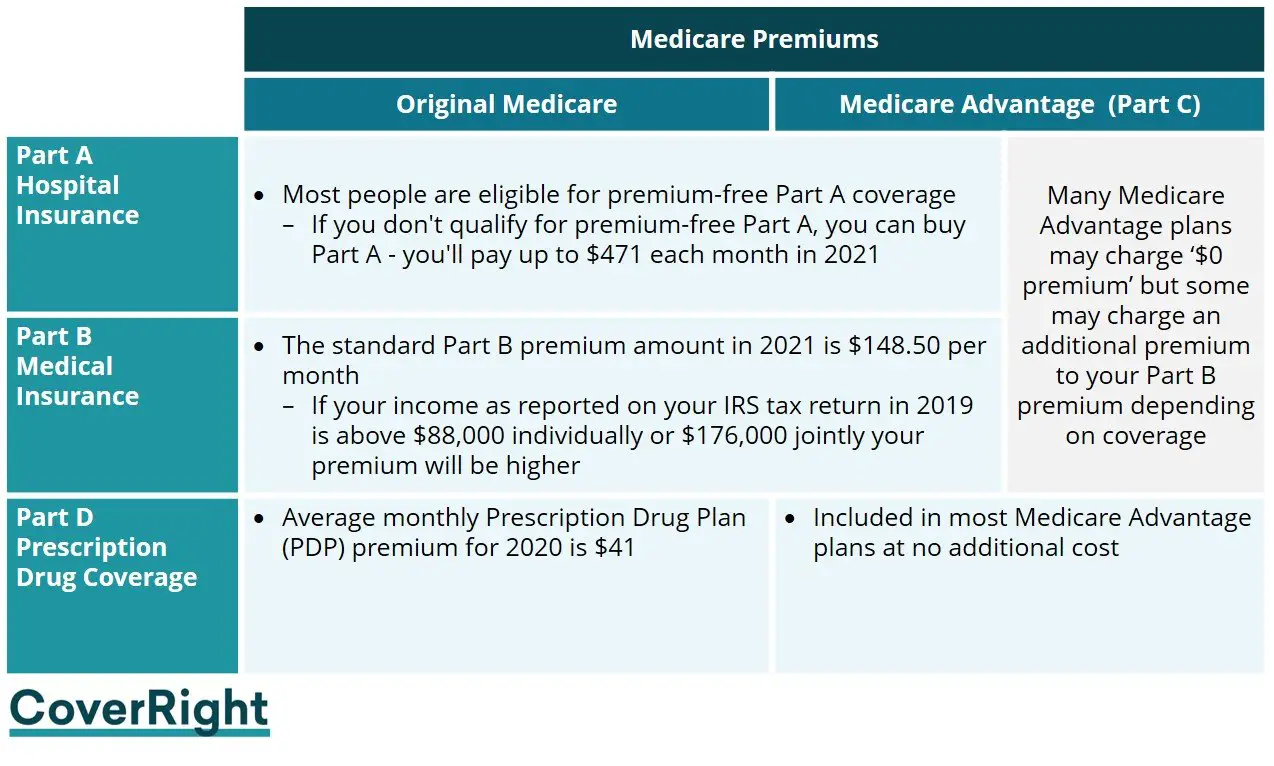

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

Learn About Medicare Supplement Plans Available Where You Live

TTY 711, 24/7

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look.

2 AHIP. . State of Medigap: Trends in Enrollment and Demographics. Retrieved from https://www.ahip.org/wp-content/uploads/AHIP_State_of_Medigap-2020.pdf.

3 MedicareAdvantage.com’s The Best States for Medicare report. .

4 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

You May Like: Which Medicare Plan Covers Hearing Aids

Pros Of Medicare Advantage Plans

Medicare Advantage plans combine all the benefits of an Original Medicare plan under one policy. While youll still have to pay for Part B premiums, these come at a reduced cost, which can make a Medicare Advantage plan more affordable overall.

Additionally, Medicare Advantage plans limit your out-of-pocket expenses. For instance, if youre visiting a primary care physician with a Medicare Advantage plan, your copay may only reach as high as $10 before your policy pays for everything. Conversely, Original Medicare, which has a coinsurance of 20%, will require you to pay money out-of-pocket before coverage kicks in.

Medicare Advantage plans may also include additional medical benefits, such as coverage for vision, hearing and dental services.

What Is A Medicare Advantage Plan

Medicare Advantage is also called Medicare Part C. With Medicare Advantage, youll get your Medicare Part A and Medicare Part B through a private company and not through Original Medicare. Medicare Advantage plans also often provide coverage for Medicare Part D, prescription drugs, which Original Medicare usually doesnt cover. In addition, Medicare Advantage plans often offer extra benefits not generally covered by Original Medicare, such as vision, hearing, and sometimes dental. You must continue to pay your Medicare Part B premium.

Medicare beneficiaries with end-stage renal disease usually cannot enroll in Medicare Advantage.

Learn more about Medicare Advantage.

You May Like: How Do You Sign Up For Medicare Part B Online

Consider Premiumsand Your Other Costs

To see how a Medicare Advantage Plan cherry-picks its patients, carefully review the copays in the summary of benefits for every plan you are considering. To give you an example of the types of copays you may find, here are some details of in-network services from a popular Humana Medicare Advantage Plan in Florida:

- Hospital stay$175 per day for the first 10 days

- Ambulance$300

- Diabetes suppliesup to 20% copay

- Diagnostic radiologyup to $125 copay

- Lab servicesup to $100 copay

- Outpatient x-raysup to $100 copay

- Renal dialysisup to 20% copay

As this non-exhaustive list of copays demonstrates, out-of-pocket costs will quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Why Should I Enroll In A Medicare Supplement Insurance Plan

When you use Medicare Part A or Part B benefits, youll often be left with some out-of-pocket expenses like deductibles, coinsurance or copayments. This is known as cost sharing.

Thats where Medicare Supplement Insurance comes into play. As the name implies, this type of plan is used alongside your Original Medicare coverage.

Here are a few examples of how a Medigap plan can work:

Also Check: What Is My Deductible For Medicare

Is Medicare Advantage Better Than Original Medicare

There is not one universal right or wrong answer when it comes to choosing Original Medicare vs. Medicare Advantage.

If you want the freedom to travel and seek health care from any doctor or provider who accepts Medicare, and if you want the opportunity for more predictable health care spending with the help of a Medigap plan, Original Medicare may be the right choice for you.

If you want to enjoy extra benefits such as dental, vision and drug coverage under one easy plan that also covers your hospital and medical benefits, if you want added protection against potentially high surprise medical bills, or if you want a plan that can offer customized coverage for a specific health condition, then a Medicare Advantage plan may better suit your needs.

Private Health Insurance Coverage

Bare minimum private health insurance covers preventative care visits. But it can be customized to include additional coverage at additional cost.

You can choose an all-in-one coverage plan covering hospitalization, medical visits, prescription drug, dental, vision and other types of benefits. Or you can choose different add-ons to get only the ones you need.

And unlike Medicare, private health insurance usually allows you to extend your coverage for other family members.

You May Like: How To Apply For Medicare Through Spouse

They Can Be Expensive

Medicare Advantage plans all come with monthly premiums. Some of them have $0-premiums, but the average monthly premium in 2019 is $28. Some people may think, free, when they hear $0 premium, but thats not necessarily the case. Even if you enroll in a MA plan, you may still be responsible for paying your Medicare Part B premium and other costs, like copayments.

Along with monthly premiums, MA plans can come with high out-of-pocket maximums. An out-of-pocket limit is designed to protect you. Once you reach your limit, the insurance company pays for your covered services. However, some plans out-of-pocket limits can be as high as $6700.

The out-of-pocket limit resets at the beginning of the year, but you could end up paying $13,400 if you have two major procedures within a few months.

For example, if you have hip replacement surgery in November, you might reach the $6700 limit just from that. Then,after your out-of-pocket maximum resets in January, you need knee replacement surgery. You would owe another $6700, just a few months later. You would then be covered for the rest of the year, but that total of $13,400 within a few months can certainly hurt.

Wider Range Of Services

Medicare Advantage plans are permitted to provide more benefits to members than Original Medicare. More than 80% of plans provide some dental, vision, hearing or fitness benefits. Additional eligible services may include transportation to medical appointments, meal delivery, nutrition counseling, cooking classes, in-home support, telemedicine, acupuncture and chiropractic care.

Read Also: Does Medicare Advantage Cover Chiropractic Care

Medicare Advantage Enrollment Periods

Enrollment periods for Medicare Advantage plans are similar to those for Original Medicare. The MA enrollment periods include initial enrollment, general enrollment, and fall open enrollment.

-

Initial Enrollment Period: When a patients IEP is enacted for Original Medicare, they can also sign up for Medicare Part C.

-

General Enrollment Period: General enrollment for Original Medicare is January 1st – March 31st meanwhile, general enrollment for MA is April 1st – June 31st. The general enrollment period should be used to register new patients for Medicare plans.

-

Fall Open Enrollment Period: From October 15th through December 7th, patients have the option to change their Medicare coverage plan. During this time, they can switch to a different MA plan or switch from Original Medicare to an MA plan. The fall enrollment period should only be used to make changes to Medicare plans.

Cost Of Medicare Vs Medicare Advantage

Medicare members pay standard rates for services, regardless of where they live. While Medicare Part A is usually covered for free by the government, Part B costs $104.90 per month or more if the individuals annual income is greater than $82,000. Benefits kick in after a deductible of $140 per year. In addition to the premium and deductible, there is coinsurance of 20%, i.e., members must pay 20% of medical costs for all services covered by Parts A and B, such as extended hospital stays. Home health care services and hospice care are covered for free. Part D, which covers prescription costs and is bought through a private insurer, varies in cost from plan to plan, but according to the federal government, the average cost in 2014 is just under $33 per month.

Along with the costs associated with traditional Medicare, Medicare Advantage members usually pay a monthly premium for prescription drug coverage. As of 2014, premiums tend to range from $30-$65. This can be less than the cost of traditional Medicare, plus a Part D plan, plus Medigap coverage, but costs vary from plan to plan. Medicare Advantage plans have set copays with doctors but may have higher copayments for expensive care, such as hospitalization or chemotherapy.

Also Check: What Urgent Care Takes Medicare

What Are The Pros And Cons Of Medicare Advantage Vs Original Medicare

Compared to Medicare Advantage plans, an Original Medicare plan can be used anywhere in the U.S. This is best for those who travel frequently or want access to a wide range of providers. However, Original Medicare comes with a coinsurance of 20%, which can lead to high out-of-pocket costs if your approved Medicare amount is significant.

On the other hand, Medicare Advantage plans have out-of-pocket limits that can ensure you spend only a certain amount before your coverage kicks in.

About the Author

Nathan Paulus is the director of content marketing at MoneyGeek. Nathan has been creating content for nearly 10 years and is particularly engaged in personal finance, investing, and property management. He holds a B.A. in English from the University of St. Thomas Houston.