What Is The Best Medicare Advantage Plan

If youve read this far, youre probably wondering which Medicare Advantage plan is the best. Is it Humana, AARP, Aetna, Blue Cross Blue Shield, Cigna, Wellcare, or Kaiser?

Its easy to answer the question, What is the best Medicare supplement insurance plan? Its Plan F. It offers the most coverage.

We wish the answer was as clear-cut with Medicare Advantage, but its not. Heres why.

When you combine all of the standard Medicare Advantage plans, employer plans, and Special Needs Plans, there are literally over 70,000 plan options. Its a truly staggering number.

The good news is that all of those plans are organized across nearly 2,800 U.S. counties. Why? Because most plans use local provider networks, making county boundaries the most logical way to organize private health insurance.

To find the best private health plan for you, use our Plan Finder tool. It will show you all of the plans in your area, their 5-star rating, premiums, copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., and extra benefits, too. If you have both Medicare and Medicaid, use the SNP Plan Finder. Plus, every plan page has a free PDF document you can download with basic cost and coverage information.

Drug Coverage In Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage . You can join a separate Medicare Prescription Drug Plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- Youre in a Medicare Advantage HMO or PPO.

- You join a separate Medicare Prescription Drug Plan.

Investments In Rx Coverage

Access to affordable prescription drugs continues to rank high on the list of central expectations of our members, said Noel. From everyday medications to lifesaving drugs like insulin, our 2022 plans are designed to cover what people tell us they need.

Most standard plans include prescription drug coverage and access to more than 67,000 network pharmacies, with offerings that deliver cost savings, price predictability and transparency, including:

Read Also: Does Medicare Cover Oxygen At Home

Aarp Medicarerx Saver Plus

If you need coverage for prescriptions that are most commonly used, youll benefit from the AARP MedicareRx Saver Plus prescription drug plan. Benefits include:

- A $400 annual deductible

- Most generic and many commonly used brand-name drugs are included

- Co-pays are as low as $1 when filled at a Preferred Retail Network pharmacy

Home delivery includes $0 co-pay for a 90-day supply of Tier 1 and Tier 2 medications. A $0 co-pay is applicable for Tier 1 and Tier 2 medications during the initial coverage phase and may not apply during coverage gap. It does not apply at the catastrophic stage.

Complaints And Customer Service

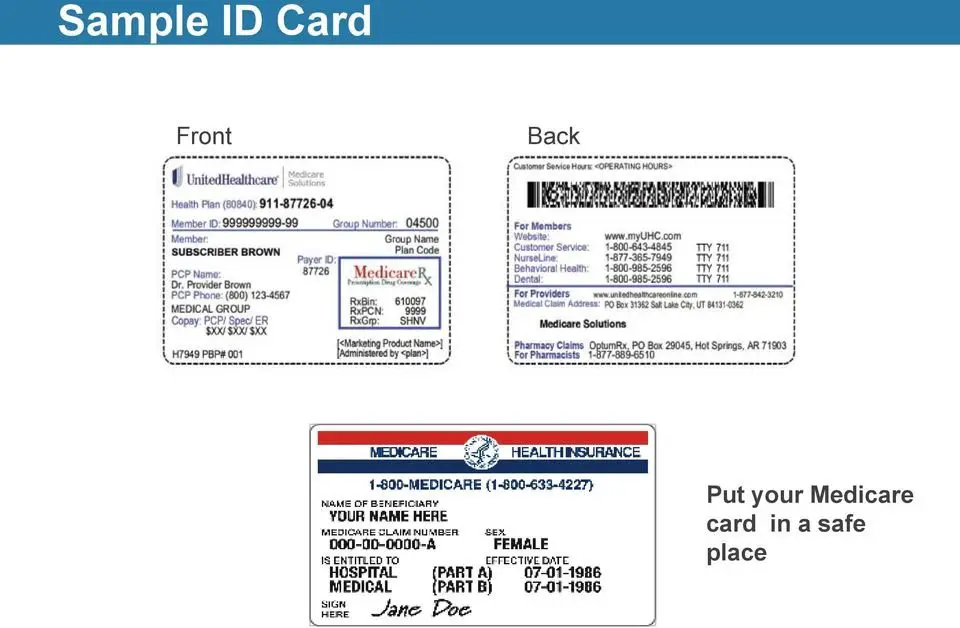

Overall, Consumers Advocate ranks UnitedHealthcare 4.5 out of 5 stars for customer service. The member website is easy to navigate and you can handle most issues online, such as requesting new cards, changing your address, and checking the status of a claim. Online chat and phone representatives are available from 8 a.m. to 8 p.m. seven days a week.

AARP UnitedHealthcare has an average number of complaints on third-party consumer review sites. The Better Business Bureau gives UnitedHealthcare an A+ rating.

Read Also: Does Kelsey Seybold Accept Medicare

Unitedhealthcare Medicare Advantage Plans Review

Fact checked Reviewed by: Leron Moore, Medicare consultant –

Quick UnitedHealthcare Medicare Advantage Plans review: UnitedHealthcare offers a broad variety of services to its customers, but in some cases, out-of-pocket costs may be higher than expected.

As the largest health insurance company based in the United States, UnitedHealthcare offers trustworthy services to 35 states. The company has a wide selection of options designed to fit a variety of customers’ needs, making it relatively easy to find a good Medicare Advantage Plan. In recent years, UnitedHealthcare has focused on plans with $0 copays and low monthly premiums. It’s a good idea to familiarize yourself with all of the options offered by UnitedHealthcare before you make a purchasing decision.

Unitedhealthcare Connected Benefit Disclaimer

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays and restrictions may apply. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

You can get this document for free in other formats, such as large print, braille, or audio. Call , TTY 711, 8 a.m. – 8 p.m., local time, Monday – Friday . The call is free.

You can call Member Services and ask us to make a note in our system that you would like materials in Spanish, large print, braille, or audio now and in the future.

Language Line is available for all in-network providers.

Puede obtener este documento de forma gratuita en otros formatos, como letra de imprenta grande, braille o audio. Llame al , TTY 711, de 08:00 a. m. a 08:00 p. m., hora local, de lunes a viernes correo de voz disponible las 24 horas del día,/los 7 días de la semana). La llamada es gratuita.

Puede llamar a Servicios para Miembros y pedirnos que registremos en nuestro sistema que le gustaría recibir documentos en español, en letra de imprenta grande, braille o audio, ahora y en el futuro.

Los servicios Language Line están disponibles para todos los proveedores dentro de la red.

You May Like: Does Medicare Pay For Maintenance Chiropractic Care

Who Recommends Aarp Unitedhealthcare

AARP is a nonprofit organization that has a reputation for being an advocate for members over 50 as they age. AARP has partnered with UnitedHealthcare for the past 23 years and lent their name to UnitedHealthcare’s Medicare Advantage plans, which is a significant endorsement of the value provided by the carrier.

Other key endorsements include:

-

“A” rating for financial strength from A. M. Best, which assesses the company’s ability to meet the financial needs of its policyholders

-

Collaboration with the American Medical Association to help underserved populations gain better access to healthcare services

-

Chosen as a 2020 Military Friendly Employer for the eighth consecutive year

-

Recognized as a Top 100 Most Valuable Global Brand, ranking number 86 on the 2020 list by Kantar BrandZ

What Are United Healthcare Medicare Advantage Plan Options

UnitedHealthcare offers several Medicare Advantage Plans, including both Preferred Provider Organization and Health Maintenance Organization options. While monthly premiums and annual maximum out-of-pocket costs vary from plan to plan, HMOs tend to be the least expensive. However, HMOs require you to find service within the network. Conversely, PPOs come with higher annual maximums and allow you to choose any participating provider, although in-network providers are less expensive.

All of UnitedHealthcares plans come with a $0 annual medical deductible, $0 copays for primary care office visits, and free telehealth services.

Compare these five UnitedHealthcare Medicare Advantage Plan options:

| UnitedHealthcare Medicare Advantage Plans |

|---|

*Based on pricing in Chicago, IL

Recommended Reading: How To Sign Up For Medicare And Tricare For Life

United Healthcare Medicare Ppo Plans

Unlike HMO plans, PPOs allow enrollees to receive care out of network at a higher cost. Many of United Healthcares PPOs offer drug coverage, hearing coverage, in-home monitoring, caregiving support, vision coverage, video doctor visits, and access to a nursing hotline.

AARP MedicareAdvantage Choice includes preventative and comprehensive dental coverage. It also includes hearing benefits, vision benefits, and a fitness membership through Renew Active.

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

Recommended Reading: How To Enroll In Original Medicare

Medicare Annual Election Period

The Medicare Advantage Annual Election Period , also called Medicare Open EnrollmentIn health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits. Health plan enrollment is ordinarily subject to restrictions…., is the period when beneficiaries can enroll in a Medicare Advantage plan, switch plans, add prescription drug coverage, or disenroll from a Medicare Advantage plan and return to Original Medicare. It occurs every Fall from October 15 to December 7. Youll know its coming up when you start seeing Medicare commercials on TV.

Reason : Plan Benefits Costs And Providers Change Every Year

This is true. Under the rules set out by the Centers for Medicare and Medicaid ServicesThe Centers for Medicare & Medicaid Services is the U.S. Federal agency that runs the Medicare, Medicaid, and Childrens Health Insurance Programs…. , insurers may change the benefits and costs in their plans. They are also allowed to change their provider networks.

This is the primary reason Medicare Advantage members should compare plans every year. Unfortunately, most enrollees dont.

Also Check: What’s The Eligibility For Medicare

Pros And Cons Of Aarp Unitedhealthcare Medicare Advantage

|

Pros |

|

|

There is a good selection of plans in most areas, including a flexible HMO-POS plan. |

In some areas, customer service gets below average marks. |

|

There is a large national provider network. |

Although there are many 4 and 4.5 star plans, the average Medicare star rating is 3.9. |

|

The $0 premium and $0 deductible plans are available in most areas. |

PPO plan premiums are slightly higher than average in some areas. |

|

Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership. |

Aarp Unitedhealthcare And Expanded Medicare Advantage Benefits

In 2018, the Centers for Medicare and Medicaid Services approved a list of new supplemental benefits for Medicare Advantage plans. These benefits are designed to help people age safely at home.

UnitedHealthcare was one of the first insurers to add some of these new benefits to their Medicare Advantage plans. Many AARP Medicare Advantage plans include one or more of these optional supplemental benefits at no additional cost:

- Nonmedical transportation

- Allowance for over-the-counter medications and devices

- Personal emergency response system

In addition, most AARP UnitedHealthcare Medicare Advantage plans include the new insulin savings program which caps copays for insulin at $35 in all four stages of prescription drug coverage.

You May Like: What Is The Cost Of Medicare Supplement Plan F

How Does Aarp Unitedhealthcare Medicare Advantage Insurance Work

A Medicare Advantage plan, also known as Medicare Part C, is an alternative way to receive your Medicare benefits. Instead of receiving your benefits through Part A and Part B from the federal government, you may choose an Advantage plan from a government-approved private insurance company.

Many people choose Advantage plans because they often include extra benefits yet still offer low or $0 premiums. Unlike Medicare Parts A and B, the plan may restrict you to a local network of providers, but for many beneficiaries this trade-off makes sense.

You may choose to enroll in an Advantage plan when you’re first eligible for Medicare, or switch from Original Medicare or another Advantage plan during the yearly Open Enrollment Period.

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the advantages and disadvantages of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for you and your situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

MA Plan ProsLearn more in this article.

Also Check: Do I Need Health Insurance With Medicare

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area. Learn about these factors and how to get cost details.

How Does Pricing Work With Aarp Unitedhealthcare And Can I Get Any Discounts

Many of the AARP UnitedHealthcare Medicare Advantage plans are offered with a low or $0 monthly premium. You are still required to pay the Part B monthly premium of $148.50, which is required no matter which Advantage plan you choose.

You also may be responsible for certain copays or deductibles, but with many AARP UnitedHealthcare plans, you will have low or $0 costs for these as well.

You may receive various discounts or incentives for participation in fitness or wellness activities, as well as discounts on hearing and vision services.

Recommended Reading: What Is A Medicare Special Needs Plan

Pros And Cons Of Medicare Advantage Plans Vs Original Medicare

In addition to the fact that Medicare Advantage plan insurance carriers are generally obligated to sell you a plan, they also bundle additional benefits, such as vision, dental, hearing, and a prescription drug plan . These are valuable benefits that Original Medicare does not cover. For healthy people, these extras make a Medicare Advantage plan a very good deal.

Many of the extra benefits that some insurance plans offer look very enticing, but they often come with limits or high out-of-pocket costs. For example, a plan may have excellent healthcare benefits and a poor Part D plan .

Also, it is important to understand that the extra benefits, including Part D prescriptions, are not included in the plans maximum out-of-pocket limit. So, lets say you use the plans dental coverage and pay $1,500 in copays for restoration work, that $1,500 is not included in your MOOP, nor are your Part D medications. This is why so many people feel that traditional Medicare, plus a supplement plan, dental plan, and a stand-alone Medicare Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan are the best way to go.

American Disabilities Act Notice

In accordance with the requirements of the federal Americans with Disabilities Act of 1990 and Section 504 of the Rehabilitation Act of 1973 , UnitedHealthcare Insurance Company provides full and equal access to covered services and does not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs, or activities.

Read Also: What Is The Annual Deductible For Medicare

When A Medicare Advantage Plan Fails For Three Straight Years To Meet The 85% Threshold Cms Must Suspend Them From Accepting New Enrollees For The Next Contract Year

Four Medicare Advantage plans affiliated with UnitedHealthcare and Anthem, Inc. have been barred from enrolling new members until 2023 after failing to meet the 85% medical loss ratio threshold for paying benefits, the Centers for Medicare & Medicaid Services says.

The medical loss ratio, mandated by the Social Security Act, is applicable to all Medicare Advantage plans. When an MA plan fails for three straight years to meet that 85% threshold, CMS must suspend them from accepting new enrollees for the next contract year.

The UHC plans affected by the suspensions are: UHC of the Midwest , with a footprint in Missouri, Kansas, Nebraska, Iowa UHC of New Mexico and UHC of Arkansas . The enrollment suspensions affected about 80,000 of UHC’s 7.5 million Medicare Advantage enrollees, the Minnetonka, Minnesota-based payer confirmed.

In a statement to the media, UHC said it “spends at least 85% of the premiums we take in on care for the people we serve.”

“In a few markets, we were not able to do that because so many of our members deferred going to get care due to COVID-19. As a result, we cant enroll any new members in a few local plans until 2023 when we expect care patterns to be at more normal levels,” the payer said.

Existing members will not be affected by the suspension, UHC said, adding that it would “continue to offer alternative plan options for people who want to choose a new UnitedHealthcare plan in these select markets.”

What Unitedhealthcare Medicare Advantage Plans Are Available

There are several different UHC Medicare Advantage plans to choose from, but not every plan option is available in every location. Each private insurance company contracted with Medicare decides which plans to offer in each state, and plan options and monthly premiums vary by location. Depending on where you live, the following UnitedHealthcare Medicare Advantage plans may be available:

UnitedHealthcare Medicare Advantage

Health Maintenance Organization plans may be more affordable than other options because private insurance companies like UnitedHealthcare negotiate with a network of providers to treat plan members at reduced rates. Here are some features of HMOs you should know before selecting this plan:

- You are expected to get your health care from in-network providers, or your plan may not cover you. However, if you need emergency care or urgent care services and you use non-network providers, youll still be covered.

- Youll need to choose a primary care doctor to oversee your medical care most of the time, referrals are needed to see a specialist. Its important to follow all plan rules, such as getting a referral or prior authorization, or you may have to pay the full cost of your care.

- Most HMO plans include coverage for prescription drugs listed in their formulary, or list of covered medications. The HMO plan may change its formulary at any time, but youll be notified if needed.

UnitedHealthcare Medicare Advantage

Common features of a PPO include:

You May Like: Can You Only Have Medicare Part B