Special Enrollment Periods For Medicare Part A And Part B

Some beneficiaries qualify for Special Enrollment Periods , in certain situations. If you qualify for an SEP, you can enroll in Medicare Part A or Part B during your SEP without having to pay a late-enrollment penalty. For example, if youre covered by a group health plan because you or your spouse is working, your SEP for Medicare Part A or Part B is either of the following:

- Anytime youre still covered by the group plan.

- During the eight months starting the month after employment ends or the group plan coverage ends, whichever happens first. For example, if your employment ends on March 15 and your group coverage continues until March 30, you have until November 15 to enroll in Medicare Part A and Part B.

If you qualify for an SEP, usually the late-enrollment penalty wont apply to you.

How Will I Know How Much My Medicare Part B Premium Will Be

The Social Security Administration or the Railroad Retirement Board, if that applies to you will tell you how much your Part B premium will be. Heres a table that may help you to know what to expect, particularly if your income is above a certain level.

If your income falls into one of four higher-income categories based on your 2019 tax return, in most cases youll pay more than the standard Medicare Part B premium. The amounts listed below reflect the Income Related Monthly Adjustment Amount, or IRMAA. To determine your Part B premium, the Social Security administration looks to your income tax returns from two years ago .

Here is a chart of Medicare Part B premiums for 2021, including IRMAA amounts, if applicable. Please note that your actual premium may be different depending on your individual circumstances.

| Your reported tax income in 2019 | Your 2021 Part B premium |

Medicare Part A Late Enrollment Penalties

The late enrollment penalty for Medicare Part A , is 10% of your monthly premium if you miss your Medicare enrollment deadline. This is applied no matter how long the delay is, and the penalty is added to your premium cost for twice the number of years you waited to enroll. For example, if you waited one year past your initial eligibility to enroll, then you have to pay the penalty for two years.

Also Check: Will Medicare Cover Cataract Surgery

Medicare Prescription Drug Plan Late

If you dont enroll in a Medicare Prescription Drug Plan during the Initial Enrollment Period for Part D, you may have to pay a late-enrollment penalty if you enroll in a Part D plan later. You wont have to pay this penalty if you:

- Enroll in the prescription drug plan when youre first eligible to do so, during the IEP for Part D.

- Make sure you have creditable coverage with your insurance plan. Your plan must tell you every year if your prescription drug coverage is creditable coverage. If you have a period of 63 or more days in a row without creditable coverage, you could pay a late-enrollment penalty.

- Qualify for Medicare Extra Help.

- Never enroll in a Medicare Prescription Drug Plan or a Medicare Advantage Prescription Drug plan.

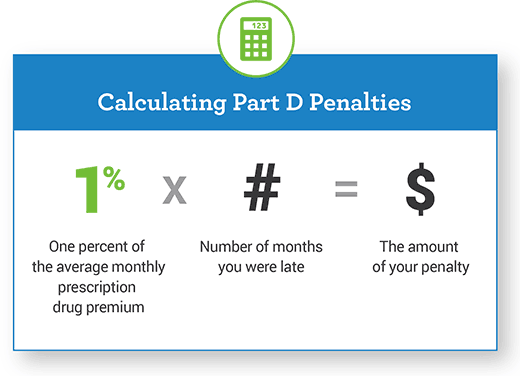

The late-enrollment penalty for Medicare Prescription Drug Plans depends on how long you go without creditable coverage. The late-enrollment penalty is calculated by multiplying 1% of the national base beneficiary premium by the number of months you were eligible, but did not apply, for a Medicare Prescription Drug Plan. This amount is rounded to the nearest 10 cents and added to your monthly prescription drug plan premium. The national base beneficiary premium may change each year, so the late-enrollment penalty may also change each year. Beneficiaries may have to pay the late-enrollment penalty the whole time theyre enrolled in a Medicare Prescription Drug Plan.

NEW TO MEDICARE?

What Is The Late Enrollment Penalty For Medicare Part B

Medicare Part B enrollment is complicated, and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties. Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. People who delay Part B because they were covered through their own or a spouses current job are exempt from this penalty, and can generally enroll in Part B without any delays.

However, people who delay Part B enrollment and didnt have current job-based health coverage can find themselves out of luck. They dont qualify for the Part B Special Enrollment Period and cant enroll in Part B until the next General Enrollment Period , which runs from January to March of each year, with Part B coverage beginning that July. The GEP for the current year may have passed by the time you discover you need Part B, potentially your Part B coverage effective date by an entire year.

Recommended Reading: When Can I Get My Medicare

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

89 percent of Medicare Advantage plans include prescription drug coverage in 2021 . More than half of all 2021 MA-PD plans charge no premium, other than the Medicare Part B premium.1

The average 2022 Medicare Advantage plan premium is $62.66 per month.2

Medicare Advantage plans are required to offer the same benefits as Original Medicare , and some Medicare Advantage plans may also offer additional benefits for things like routine dental and vision coverage, non-emergency transportation, caregiver support, allowances for over-the-counter items and more.

And according to Medicare expert John Barkett, Medicare Advantage monthly premiums dropped in 2020 by as much as 14 percent. Hear more about this in the video below.

How Much Is The Medicare Part B Penalty

The penalty for late enrollment in Part B is an additional 10% for each 12-month period that you delay it.

Lets say your Initial Enrollment Period ended September 30, 2010, for example. Then you enroll in Part B during the General Enrollment PeriodThis is when you can enroll in Medicare if you didnt sign up during your Initial Enrollment Period. The General Enrollment Period is January 1 March 31 every year. You may have to pay a penalty for late enrollment. Coverage takes effect on July 1. in March 2013. Your late enrollment penalty would be 20% of the Part B premium, or 2 x 10%. This is because you waited 30 months to sign up, and that time period included 2 full 12-month periods.

In most cases, you have to pay the penalty every month for as long as you have Part B. If youre under 65 and disabled, any Part B penalty ends once you turn 65 because youll have another Initial Enrollment Period based on your age.

Don’t Miss: Is Estring Covered By Medicare

Medicare Part B Late Enrollment Penalty Exception

You can delay enrollment into Part B if you have qualifying health insurance coverage from another source. Most of the time, this would be from a large employer group health plan. In this scenario, the employer plan is primary and Medicare is secondary. Many people delay Part B until they retire so that they dont have to pay for Part B while they are still working.

Be aware that for small employers with less than 20 employees, the rules are different. Medicare is primary in that scenario, so you need to enroll in Part A and B during your IEP.

Medicare Part B Late Enrollment Penalty

Home / FAQs / General Medicare / Medicare Part B Late Enrollment Penalty

If youre new to Medicare and dont sign up for Part B when youre first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when theyre first eligible. If you have to pay a penalty, youll continue paying it every month for as long as you have Part B.

Don’t Miss: Is Oral Surgery Covered By Medicare

What Are The Exceptions To The Medicare Part B Eligibility Rules

To get Medicare Part B coverage, its not necessary that you must be age 65 or above.

- You qualify for Part B coverage if you are under 65 and have received railroad retirement disability benefits or Social Security disability benefits for at least 24 months.

- People of any age who have ESRD or ALS are eligible for Medicare Part B.

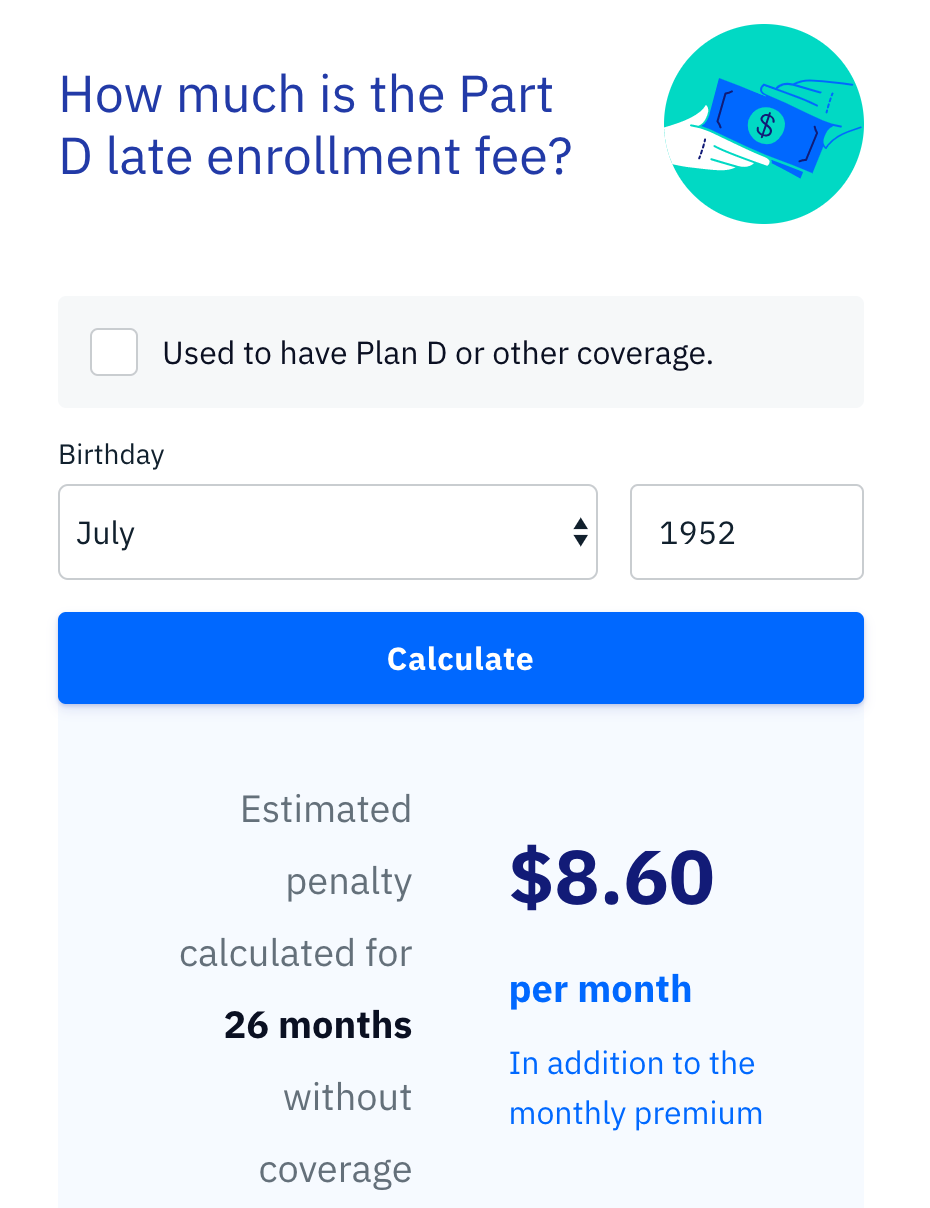

How Much Is The Lep For Part D

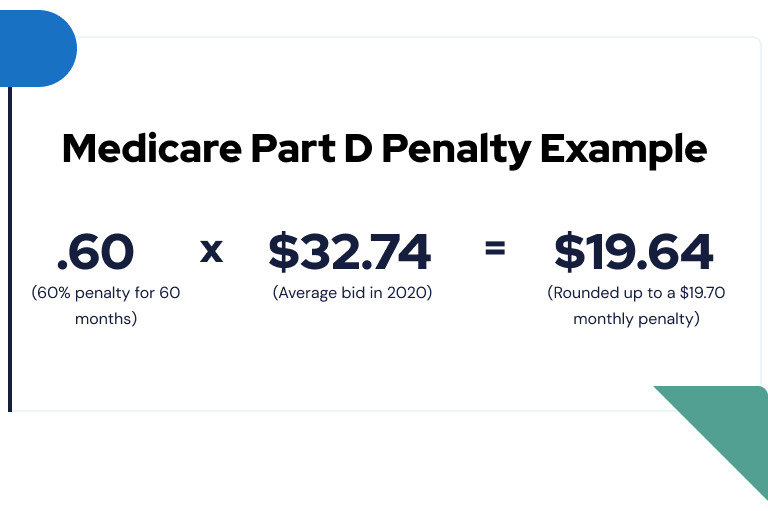

The Medicare Part D penalty is based on the number of months you went without PDP coverage. For each month without coverage, you will pay an additional premium of 1 percent of the current national base beneficiary premium. For 2021, the average Part D premium is $33.06 up slightly from the 2020 $32.741.

If you are assessed this penalty, you will pay it every month for as long as you have Medicare prescription coverage. Your Medicare Part D penalty will be rounded to the nearest $.10 and added to your Part D premium. Because the LEP is based on the current years national beneficiary premium, it may change or go up each year.

Recommended Reading: What Is The Coinsurance For Medicare Part B

B Deductibles And Copays

Medicare Part B comes with an annual deductible. In 2021, it is $203 .

After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare benefits. This assumes your doctor or other provider accepts Medicare assignment. In other words, your provider will accept the amount Medicare agrees to pay for the treatment or service. Some providers who charge more than the Medicare-assigned amount may bill patients for the difference. Always check with a new physician or other health care provider that they accept the amount Medicare pays.

What Is The Medicare Part D Late Enrollment Penalty

The late enrollment penalty for Medicare Part D is an extra amount added to your Part D monthly premium. Generally, the longer you wait to enroll in Part D past your Initial Enrollment Period, the greater your Part D penalty amount.

The penalty amount is calculated by multiplying 1% of the National Base Beneficiary Premium times the number of months you went without creditable prescription drug coverage. The months used in calculating the penalty must be full months that you went without creditable coverage.

The final penalty amount is always rounded to the nearest $.10 and then added to the cost of your Part D monthly premium.

Don’t Miss: How Much Does Medicare Pay For Hospice

Its Worth Asking Human Resources These Questions

If youre covered by a GHP and will be qualifying for Medicare soon, its worth your time to talk to Human Resources about transitioning to Medicare coverage. Heres what you should ask:

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He managed a Medicare technical assistance contract at the Medicare Rights Center in New York City and represented clients in Medicare claims and appeals. Josh also helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including an associate at Sachs Policy Group, where he worked with insurers, hospital, and technology clients.

How Can I Safely Delay Medicare Part B Enrollment

You must have coverage from a GHP through your or your spouses current job to safely delay signing up for Part B.* You also have to have been covered through an employer-sponsored GHP or Medicare Part B during the month you qualified for Medicare. If you meet these criteria, youll receive an 8-month long special enrollment period during which you can enroll in Part B without penalty.

The Medicare Part B SEP begins the sooner of when:

- You are no longer currently employed OR

- Your GHP ends even if you continue to be employed.

Note that coverage through Medicaid, a retiree plan, COBRA, or individual market coverage will never allow you to safely delay enrolling in Medicare Part B.

*Disabled Medicare beneficiaries under age 65 can also qualify for a Part B SEP if theyre covered through a non-spouse family members large group health plan .

Don’t Miss: What Is Medicare Insurance Plans

I Didnt Sign Up For Part B When I First Became Eligible But Want To Sign Up Now I Know There Is A Penalty For Late Enrollment Is There Any Way To Avoid The Penalty

Generally, no. In most cases, if you missed your Part B enrollment window, which runs from the three months before the month of your 65th birthday through the three months after the month of your 65th birthday, you will face a late enrollment penalty once you do enroll, which will be added to your premium costs for the remainder of your enrollment. The penalty equals 10% of the standard monthly premium for each 12-month period that you delayed enrollment.

If you did not enroll for Part B during your initial enrollment period, you may qualify for a Special Enrollment Period to sign up for Part B anytime as long as you or a spouse is working and youre covered by a group health plan through that employment. For people age 65 or over who have coverage through a group health plan, there is also an 8-month SEP which starts the month after the employment ends or the group health plan coverage ends. If you sign up during an SEP, the late enrollment penalty will not apply.

Medicare Part B Part D Irmaa Premium Brackets

September 14, 2021Keywords: AGI, health insurance, Medicare

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits arent included in the income for determining IRMAA.

* The last bracket on the far right isnt displayed in the chart.

Don’t Miss: Which Of The Following Is True Regarding Medicare Supplement Policies

How Does A Late Penalty Affect My Part D Premium

Once you join a Medicare Part D prescription drug plan, your plan provider will notify you if youve been assessed a late penalty. This Part D penalty applies for as long as you have a Medicare prescription drug plan.

The amount of the penalty is determined by how long you went without prescription drug coverage. The late penalty is 1% of the national base beneficiary premium times the number of full months you went without creditable drug coverage.

What Is Medicare Part B Coverage And What Does It Cover

Medicare Part B, along with Part A, constitutes what is known as original Medicare. It is estimated that in 2016, 67 percent of individuals using Medicare were enlisted in Original Medicare.

Part B protects a wide range of medically necessary outpatient services. A service is considered medically necessary if required to diagnose or treat a medical condition effectively.

Part B services include the following:

- emergency ambulance transportation

- long-term care

- complementary health services such as acupuncture and massage

- If you want prescription coverage, you can buy Part D plans. Medicare Part D programs are provided by private insurance organizations and cover most prescription drugs.

Furthermore, Medicare Part C programs include all benefits covered under traditional Medicare services and some additional services such as vision, dental, and even fitness plans. If you think youll need these medical services, consider a Part C program.

Don’t Miss: Does Medicare Pay For Private Duty Nursing

Paying Medicare Premiums In 2022

As youre learned in this article, not all Medicare premiums are alike. And neither are the ways in which they can be paid.

If a premium is owed for Medicare Part A, a monthly bill is typically sent to the beneficiary.

If you receive Social Security benefits, you can generally have your Part B, Medicare Advantage, Part D or Medicare Supplement Insurance premiums deducted directly from your Social Security check. Those who do not receive Social Security benefits are directly billed for their premiums.

Payment arrangements may include mailing a check, an electronic transfer from a bank account or charging a credit or debit card.

Youre Still Employed And Pass On Part B

If youre happy with the coverage your employer offers, you may think you dont need to enroll in Medicare. But individuals who work for a small employer should enroll in Part B because that will be their primary insurance coverage.

Employees of large companies do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

*The threshold for being considered a large employer is 100 employees when an individual qualifies for Medicare based on a disability.

Also Check: Is A Nursing Home Covered By Medicare