Medicare Enrollment 2022 Important Dates You Shouldnt Miss

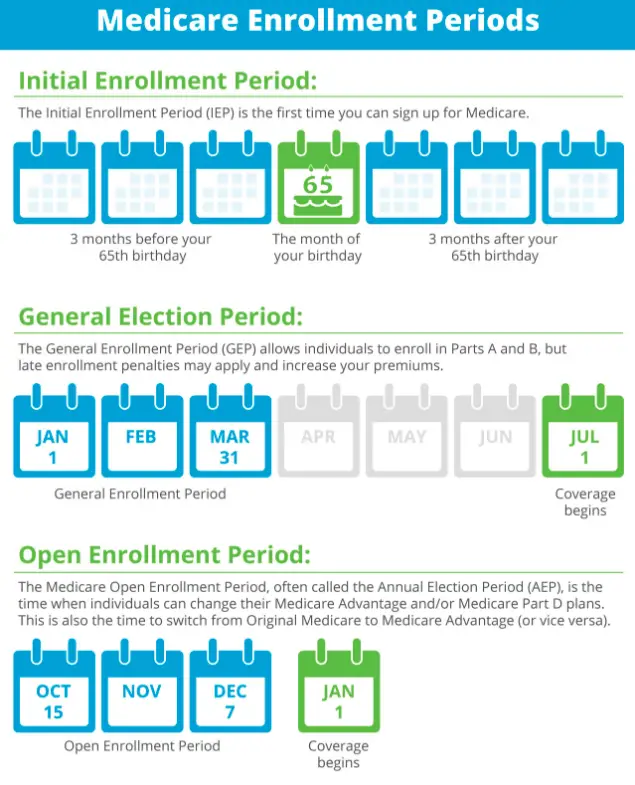

When you first become eligible for Medicare , you will automatically be enrolled in original Medicare Part A and Part B if you are receiving benefits from Social Security or the Railroad Retirement Board . You have an Initial Enrollment Period of seven months to add additional Medicare health care coverage with an Advantage plan, or Supplemental Insurance and/or a Prescription Drug plan.

Medicare enrollment or changes to plans you are already enrolled in are limited to specific times.

Important dates to enroll in, switch or cancel a Medicare plan for 2022 are:

Visit www.medicare.gov to get detailed and current information about your Medicare eligibility and enrollment options, or call 1-800-MEDICARE or TTY 1-877-486-2048.

Annual Enrollment Period For Medicare

The Annual Enrollment Period for Medicare occurs each year from October 15 to December 7. This Annual Enrollment Period allows Original Medicare enrollees to make several changes to their coverage.

These changes include:

- Switching from Original Medicare to Medicare Advantage

- Go from Medicare Advantage to Original Medicare

- Switch from one Medicare Advantage plan to another

- Enroll, change or drop your Medicare Part D prescription plan

Suppose you use the Annual Enrollment Period to return to Original Medicare from Medicare Advantage. In this case, you can then enroll in a Medicare Supplement plan to alleviate your Original Medicare out-of-pocket costs. This plan will begin on January 1 of the following year.However, you will need to pass medical underwriting to enroll in the Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What Happens If You Miss Your Medigap Open Enrollment Period

If you miss your initial open enrollment period, you generally have to wait until the annual Medicare open enrollment period to request coverage. However, if you have a guaranteed issue right as explained above, you can work with a private insurance provider outside your initial open enrollment period to enroll in coverage that suits your needs.

Read Also: Where Do I Apply For Medicare Benefits

When Is The Medicare Open Enrollment Period

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

The Good Brigade / Getty Images

Medicare is a government health insurance program for people 65 and older, as well as for people with certain disabilities and end-stage renal disease. Most people are eligible to enroll in Original Medicare , Part D, and Medicare Advantage plans during their initial enrollment period when they turn 65. Open enrollment is the time to do so if you want to make changes to your existing coverage or add Part D drug coverage.

Does Medicare Supplement Have Open Enrollment

You can change your Medicare Supplement policy anytime, but the best time to change your plan is during a guaranteed issue period.

Medicare Supplement plans don’t have the same dedicated enrollment periods for changing coverage. Even though youâre allowed to change to a new plan at any time, youâll get the best rates and can’t be denied coverage if you change plans during a guaranteed issue period. If you aren’t protected by a guaranteed issue period, we recommend you carefully consider the potential outcomes of changing coverage.

- Making changes without a guaranteed issue period

For most people, changing your Medigap plan will mean your application will go through the medical underwriting process. This includes reviewing your medical history and assessing risk factors. As a result, you could have to pay more for a policy or could be denied coverage for a pre-existing condition.

For example, without guaranteed issue rights, an application for Humana Medigap can be denied on the spot for conditions such as heart disease, dementia or uncontrolled diabetes.

- Making changes with a guaranteed issue period

If you change your Medigap plan during a guaranteed issue period, the insurance company wonât consider your age or medical condition. Making changes during a guaranteed issue period gives you better protection from high prices, and it gives you more freedom to select the coverage you want.

What changes to Medigap can you make?

Federally protected guaranteed issue periods:

Also Check: What Do You Need To Sign Up For Medicare

Special Enrollment Period For Original Medicare

The good news: Outside the main enrollment windows, you can enroll in, change to, or leave a Medicare Advantage or prescription drug plan during a Medicare Special Enrollment Period .

The not-so-great news: Lets just get this out of the way. Special enrollment periods may be even more challenging to navigate than regular enrollment periods. Not all Medicare recipients will ever be qualified for a Special Enrollment Period, and those who are, must provide evidence of their eligibility.

A Special Enrollment Period happens when Original Medicare enrollment is postponed after being initially eligible. The most common reason for postponing Original Medicare coverage is if you or your spouse are actively employed and have health insurance coverage through the employer. You can delay your enrollment in Medicare until you or your spouse retires. Upon retirement, you will be granted an SEP to enroll in Original Medicare. The Special Enrollment Period lasts for eight months after your employer group coverage expires.

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

Read Also: Will Medicare Pay For Handicap Bathroom

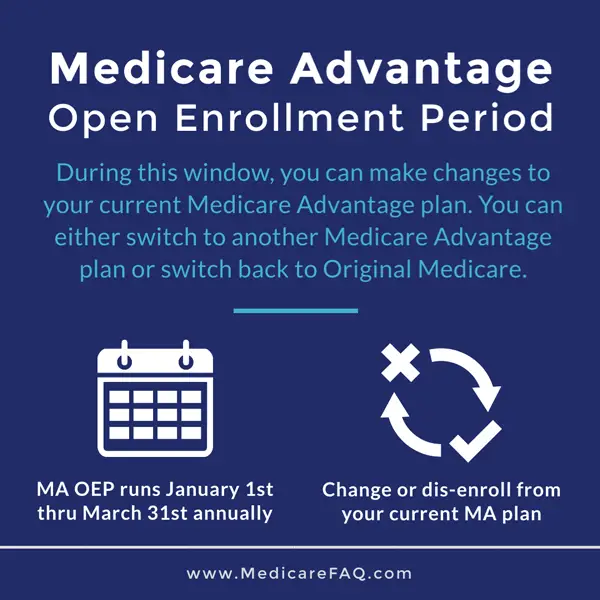

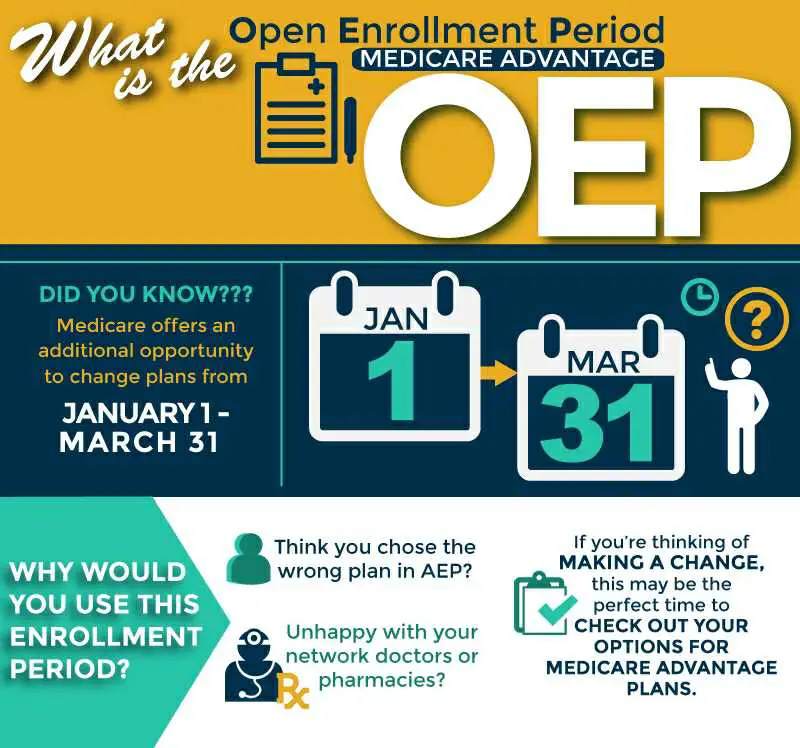

What Changes Are Off Limits With The New Medicare Advantage Open Enrollment Period

Not all 2022 Medicare Advantage plans will have the new benefits, and there may be benefit caps and other rules that apply for those that do. For example, plans may limit the non-medical transportation to 20 trips a year and require you to use certain providers before benefits apply.

During the new Open Enrollment Period for Medicare Advantage, you generally cannot:

- Sign up for a Medicare Advantage plan when youâre not already enrolled in one. In other words, you can switch plans, but not get one for the first time.

- Sign up for a stand-alone Medicare Part D prescription drug plan . But suppose youâre losing this type of coverage by dropping a Medicare Advantage prescription drug plan . You might be able to sign up for a PDP in these cases.

- Switch from one stand-alone Medicare Part D prescription drug plan to another.

The Medicare Advantage Open Enrollment Period doesnât apply to other types of Medicare health plans, such as Medicare Savings Accounts, Medicare Cost plans, or the PACE program .

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Initial Enrollment Period For Those On Medicare Before 65

If you receive Medicare benefits before age 65 due to a disability, you will receive a second Initial Enrollment Period. This will happen when you turn 65. This is known as the Initial Enrollment Period 2.

For example, if you become eligible for Medicare at age 57 due to 24 months on disability, you will be able to enroll again at age 65 with no late enrollment penalties.

During the Initial Enrollment Period 2, you can sign up for a Medicare Advantage or Medicare Supplement plan, and a Medicare Part D plan. The Initial Enrollment Period 2 runs for the same seven-month period as the Initial Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: What Percentage Does Medicare Part A Cover

Medicare Supplement Open Enrollment

Medicare supplement plans, also known as Medigap, do not have specific enrollment periods. You can buy a Medigap plan during the 6-month period that starts the first day of the month when you turn 65. You need to be enrolled in Medicare Part B to apply for a Medicare supplement plan.

For people who are new to Medicare, you may be eligible for guaranteed issue rights, which means that an insurance provider cannot refuse to sell you a Medigap policy. This is the best time to enroll in a Medigap plan since you are guaranteed coverage.

You may also apply for a Medigap policy if you choose to drop your Medicare Advantage plan and return to Original Medicare.

Medicare Open Enrollment 2023

Well, the Medicare open enrollment period for 2023 is upon us!

And if youve got a Medicare Advantage plan or a Medigap plan, a Part D drug plan, or a combination of a couple of those, youll learn what you can change and when you need to do it by so you dont get yourself into trouble this year.

The Medicare open enrollment period is a designated period of time that Medicare allows people to make certain changes.

This runs from October 15 through December 7.

Now, this period is technically called the Medicare Annual election period, or AEP. Most people simply call it the enrollment period, so well go with that

Most of the changes that take place during this time will go into effect the following January 1.

Read Also: Can I Buy Private Health Insurance Instead Of Medicare

What To Do If You Miss Medicare Open Enrollment

If you are planning to change your Medicare plan, it is important to remember when the open enrollment period ends. The Medicare open enrollment period runs from the 15th of October to December 7th each year. This means that if you do not make changes to your plan by the 7th of December, your existing plan will remain in effect the following year.

In some special cases, you may be able to qualify for special enrollment. Special enrollment allows people who were unable to switch their plans during the open enrollment period to do so outside of the annual enrollment period.

Some of the cases that may qualify for special enrollment include:

· You moved to an area that is not covered by your existing Medicare plan.

· You moved to or out of a long-term care facility or skilled nursing home.

· You are no longer eligible for Medicaid.

· Your Medicare plan is no longer Medicare-approved.

Whats The Difference Between Medicare Annual Enrollment Vs Initial Enrollment Vs Open Enrollment

- The Medicare Open Enrollment Period is for current Medicare beneficiaries who are looking to make changes to their Medicare plan. This includes changing plans, switching to Medicare advantage, or enrolling in a drug plan. For Original Medicare, Open Enrollment is also commonly referred to as Annual Enrollment.

- Medicare Initial Enrollment is for individuals who are turning 65 and enrolling in Medicare for the first time. Open Enrollment starts the first day of the month that you turn 65, and lasts for 6 months.

- There is also a period from January 1st to March 31st, called the Medicare Advantage Open Enrollment Period, in which people who already have a Medicare Advantage plan can switch plans or switch back to original Medicare.

You May Like: What Is A Medicare Set Aside In Personal Injury

Enrollments And Changes You Can Make During The Annual Open Enrollment Period

Open enrollment is an annual opportunity for Medicare beneficiaries to reevaluate their current plan benefits rather than enrolling for the first time.

You should weigh changes in coverage and out-of-pocket costs including Medicare deductibles, coinsurance, copayments and premiums.

Enroll or Switch During the Annual Medicare Open Enrollment Period

What Can I Do During The Medicare Annual Enrollment Period

From October 15th to December 7th each year, all Medicare beneficiaries have the opportunity to:

- Switch from Original Medicare to Medicare Advantage

- Switch from Medicare Advantage back to Original Medicare

- Join, drop, or switch Medicare Prescription Drug Plans

- Switch to a different Medicare Advantage plan from your current insurer, or to a plan from a different insurer.

- Switch to the new Medicare MSA Plan, the only Medicare Advantage that comes with a tax-advantaged savings account

You May Like: Does Medicare Cover Foreign Travel Emergencies

What Plan Changes Can I Make During The Medicare Open Enrollment Period

During the Medicare open enrollment period, you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

What Changes Can You Make During The Medicare Enrollment Period

During the annual Medicare enrollment period, there are a few different types of changes that can be made. First and foremost, this is the time of year that you can change your Medicare Part D plan. It is very important that you evaluate/re-evaluate your Part D coverage at least every few years, if not every year.

Part D plans change every year. Not only do they change premiums, but they also update their formularies, change pharmacy networks or preferred pharmacy arrangements, deductibles and co-pays change, and more! There are many variables to consider with Part D, and it is the most important part of Medicare to evaluate annually.

The suggested method of comparing Part D plans is to use Medicare.gov and the Medicare Plan Finder. The plan finder gets updated with 2020 plans on or around October 1. After that date, you can run a comparison, using your medications, dosages, adn preferred pharmacies. The Medicare Plan Finder will rank the plans in order of lowest overall annual cost to you, which takes into account the premiums, deductibles and co-pays for all the different plans. Any Part D changes you make between October 15 and December 7 will take effect 1/1/2021.

Also Check: Where To Apply For Medicare Part D

Special Enrollment Period For Parts A And B

Some people with health care coverage through their job or union, or through their spouse’s job or union, wait to sign up for Medicare Part A and/or Part B . If you or your spouse are actively working for an employer with more than 20 employees when you turn 65, you can get a Special Enrollment Period to sign up for Parts A and/or B:

- Any time you’re still covered by the employer or union group health plan through you or your spouses current employment or

- During the eight months following the month the employer or union group health plan coverage ends, or when the employment ends .

If you delay enrolling even longer, you may have to wait for coverage and you may pay a lifetime late enrollment penalty surcharge on your Medicare premiums.

If you’re under age 65, and eligible for Medicare because you’re disabled and working , the SEP rules also apply to you as long as the employer has more than 100 employees.

Are There Enrollment Periods For Medicare Supplement Plans

Your Medicare Supplement Open Enrollment Period begins the 1st day of the month your Medicare Part B becomes effective. This is a six-month enrollment period that grants you guaranteed issue rights for any Medicare Supplement plan you wish to enroll in. However, many carriers allow you to enroll in a Medicare Supplement plan up to six-months before your Medicare Part B start date.

A Medicare Supplement plan is essential for Medicare enrollees who wish to pay as little out-of-pocket costs as possible for their healthcare coverage. Medicare Supplement plans cover the costs that Medicare Part A and Part B leave behind, eliminating the high expenses associated with Medicare coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Enrolling in Medigap during a guaranteed-issue period is important. Especially if you have pre-existing conditions that could result in denial of your policy in the future.If you miss your Medicare Supplement Open Enrollment Period, you can still apply for Medigap coverage throughout the year. However, there is a chance the application can be denied due to underwriting.

Don’t Miss: Is Enbrel Covered By Medicare

At What Age Do You Qualify For Medicare Enrollment

Most people qualify for Medicare at age 65. You can enroll during your initial enrollment period, which is three months prior to the month you turn 65, your birth month, plus the three months after, for a total of seven months. Youll be automatically enrolled in Original Medicare when you turn 65 if you’re receiving Social Security benefits.

Lets Find Your Medicare Plan

Phew! You made it. Now you know all about Medicare Enrollment Periods, right? Its not at all still a bit confusingright?

Here at Healthpilot, we understand that interpreting all the different parts of Medicare can be complex, and adding these different timeframes and deadlines is downright stressful.

Want a better way? We can do the hard work for you. Simply answer a few questions, then we analyze all the information to recommend the best plan for you at the right time, always on time, because you can enroll with us too, in minutes, securely online.

Best of all, once youre a Healthpilot customer, we do this for you every year for the rest of your life. No need to memorize enrollment periods when you have Healthpilot on your side.

Recommended Reading: Does Medicare Cover Dermatologist Check Ups