Medicare Eligibility And Enrollment

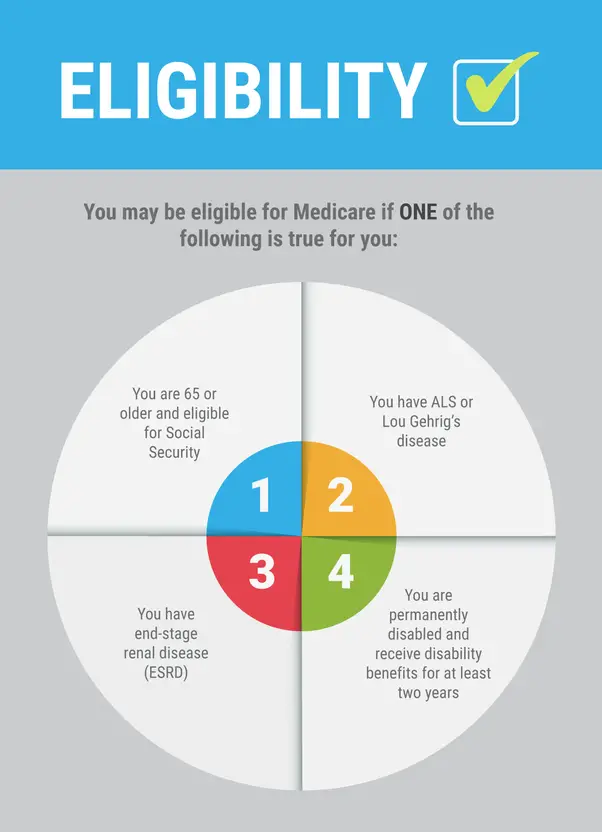

Who can get Medicare? Basically,three groups are eligible:

You might assume that signing up for a big government program like Medicare would be confusing. But it’s usually easy. Most people are signed up automatically for Original Medicare .

Medicare Eligibility For End

You may be eligible for ESRD Medicare if you have been diagnosed with renal failure and you meet the following criteria:

- Are you on dialysis or have you undergone a kidney transplant?

Additionally,

- You are eligible for SSDI.

- You qualify for Railroad Retirement benefits.

- Alternatively, you, a spouse, or a parent have paid Medicare taxes for a period of time that meets the Social Security Administrations requirements.

If you are under the age of 65 and have ESRD, the date on which you begin receiving Medicare benefits is determined by your unique circumstances, including when you register for Medicare, whether you receive dialysis at home or in a facility, and if you obtain a kidney transplant. If you qualify for ESRD Medicare, you may enroll in Parts A and B concurrently. Part A is retroactive for up to 12 months but cannot begin prior to the month in which you become eligible for ESRD Medicare.

If you are a railroad employee who has ESRD, you must contact Social Security, not the Railroad Retirement Board, to determine your Medicare eligibility.

Am I Eligible For Medicare Part B

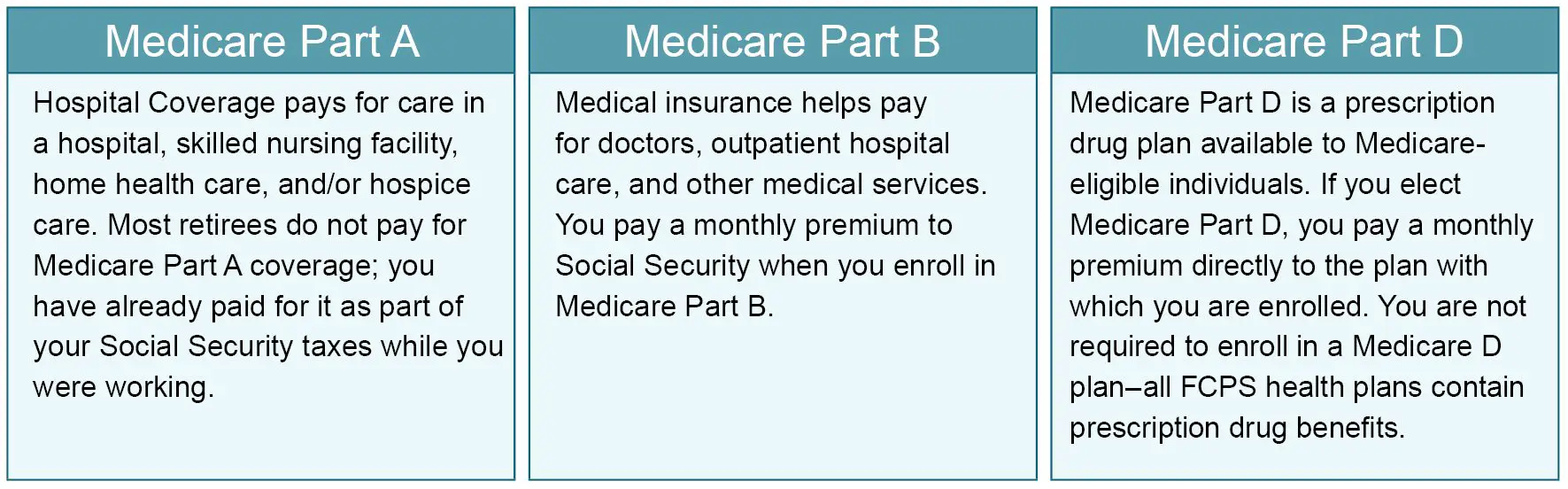

When you receive notification that youre eligible for Medicare Part A, youll also be notified that youre eligible for Part B coverage, which is optional and has a premium for all enrollees.

Part B costs $148.50/month for most enrollees in 2021, although Part B costs more if your income is more than $88,000 . For 2022, the standard Part B premium is projected to be $158.50/month, and the high-income threshold is projected to increase to $91,000 for a single individual and $182,000 for a couple.

Its important to enroll in both Part A and Part B. You have an enrollment window that runs for seven months . And while you can enroll in the three months following your 65th birthday, its best to enroll in Part B early, or you could have gaps in health coverage. If you wait too long, you could end up locked out of Part B and have to wait until the next general Medicare enrollment period.

If you dont enroll during your initial window, you wont lose eligibility for Part B, but you will be penalized with an increased premium when you eventually enroll, which climbs 10% for each year that youre eligible but dont enroll in Part B . The General Enrollment Period for Medicare A and B runs from January 1 to March 31 each year, for coverage effective July 1 with an increased premium if the late enrollment penalty applies.

You May Like: When Does Medicare Coverage Start

Enroll When Youre Eligible

If you dont get Part B when you first become entitled, your monthly premium will go up for each month when you should have received Part B but didnt.

Youll also have to pay this tax any time you pay your premiums. As you go without Part B coverage for a more extended period, the penalty increases.

Your monthly premium will rise if youre allowed to buy Part A but chose not to do so when you first became eligible for Medicare. As you didnt sign up, youll be paying the higher price for twice as many years.

This consequence only suggests that when you turn 65, getting Medicare can also be a great way of saving money after retirement. So, why wait to pay higher premiums if you can have it at a lower price the first time you become eligible?

Am I Eligible For Medicare If Ive Never Worked

The short answer is yes, you are still eligible when you reach age 65 even if you have never worked. However, you will be required to pay a premium for Part A and B. If you have never worked, you will not receive Part A premium-free. You can also qualify if your spouse has met the work requirements for premium-free coverage. Another way to qualify is if your spouse had Medicare-covered government employment.

If you have never worked, then you cannot qualify for Social Security disability benefits, so that option would not qualify you for Medicare either. Kidney failure or ALS can still qualify you for Medicare even if you have never worked and you are under 65 years old.

Don’t Miss: How To Change Medicare Direct Deposit

Medicare Part B Premiums

For Part B coverage, you will pay a premium every year. A lot of people will pay the standard premium sum. In 2021, the standard premium is $148.50. Nonetheless, in the event that you make more than the preset income limits, you will pay more for your premium. The additional premium sum is known as an income-related monthly adjustment amount . The Social Security Administration decides your IRMAA depending on the gross income on your tax return. Medicare utilizes your tax return from 2 years ago. For instance, when you apply for Medicare coverage for 2021, the IRS will give Medicare with your pay from your 2019 tax return. You might pay more based on your income. In 2021, higher premium sums start when people make more than $88,000 each year, and it goes up from that point. You will get an IRMAA letter via the mail from SSA if it is determined, you need to pay a higher premium.

How Social Security Helps Pay For Medicare

In addition to automatically enrolling you in Medicare, if you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will be automatically deducted from your monthly benefit payment.

If you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . Bills can be paid for by check or money order, a credit or debit card, or through online bill pay services.

In conclusion, as youre starting to think about Medicare and retirement, do some research and make sure you understand how your Social Security benefits can or will play a role.

Recommended Reading: What Age Is For Medicare

Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own different premiums. The national base beneficiary premium sum for Medicare Part D in 2021 is $33.06, however costs can vary. Your Part D Premium will rely upon the plan you pick. Similar to your Part B coverage, you will pay an increased expense on the off chance that you make more than the preset pay level. In 2021, if your pay is more than $88,000 each year, you will pay an IRMAA of $12.30 every month on top of the expense of your Part D premium. IRMAA sums go up from that point at higher levels of pay. This implies that in the event that you make $95,000 each year, and you select a Part D plan with a monthly premium of $36, your complete monthly cost will really be $48.30.

You can get Medicare coverage regardless of your income. Keep in mind that:

- When you hit specific income levels, you will be required to pay higher premium costs.

- If your pay is more than $88,000, you will get an IRMAA and pay extra expenses for Part B and Part D coverage.

- You can request for an IRMAA if your circumstances change.

- If you are in a lower income bracket, you can get assistance in paying for Medicare.

- You can enroll through your stateâs Medicaid office for special programs and Medicare assistance.

There are various brackets for married couples who file taxes separately. If you file in this manner, you will pay the following amounts for Part B:

Retirees And Those Still Working

If you paid into a retirement system that didnt withhold Social Security or Medicare premiums, youre probably still eligible for Medicareeither through your retirement system or through your spouse. To receive full Medicare coverage at 65, you must have earned enough credits to be eligible for Social Security.

Each $1,470 you earn annually equals one credit, but you can only earn a maximum of four credits each year. You will receive full benefits at retirement if you have earned 40 credits10 years of work if you earned at least $5,880 in each of those years.

If you continue to work beyond age 65, things get a bit more complicated. You will have to file for Medicare, but you may be able to keep your companys health insurance policy as your primary insurer. Or, your company-sponsored insurance plan might force you to make Medicare primary, or other conditions may apply to you.

Theres a lot to consider that makes it prudent to talk to a person knowledgeable in Medicare about your specific choices. This could be your Human Resources department or a Medicare representative.

If you continue to work beyond 65, theres a lot to consider that makes it prudent to talk to a Medicare expert about your choices.

Also Check: What Does Medicare Extra Help Pay For

How Can I Appeal For An Irmaa

You can request for your IRMAA if you think that it is wrong or if you have had a significant change in life circumstances. You will be required to get in touch with Social Security to request a reconsideration. You can request an appeal if:

- the information sent by the IRS was incorrect or old

- you amended your tax return and think that the SSA received the wrong version

You can also request an appeal if you have had a significant change to your financial circumstances, including:

- death of a spouse

- loss of income from another source

- loss or reduction of pension

- retiring or losing your job

- working fewer hours

For instance, if you started work in 2019 and made $120,000, but you retired in 2020 and are currently only making $65,000 from benefits, you could request your IRMAA. You can fill out the Medicare Income-Related Monthly Adjustment Amount â Life-Changing Event form and give supporting documentation about changes in your income.

Medicare Savings Program Eligibility

The Medicare Savings Program helps with some out-of-pocket expenses, such as Part A and Part B. One of these programs can help you pay for your premiums, deductibles, copayments as well as coinsurances associated with Medicare.

Medicare Savings Programs has 4 Types:

- SLMB Specified Low-Income Medicare Beneficiary Program

- QI Qualifying Individual Program

- QDWI Qualified Disabled and Working Individuals Program.

Aside from the QDWI Program, all these programs will help pay for your Part B premiums.

Medicare Savings Program eligibility automatically qualifies you for Extra Help. The Extra Help program helps you cover the costs of prescriptions.

However, if you are eligible for Extra Help, that does not mean you also qualify for the Medicare Savings Program.

Medicare Eligibility Verification

When you go to the doctor, the billing department will verify your Medicare eligibility. The billing department will need your full name, Medicare number, gender, and date of birth.

So, when you arrive at the doctors and they request identification, be ready!

Also Check: What Does Bcbs Medicare Supplement Cover

You May Like: Does Medicare Cover Dementia Care Facilities

What Is Not Covered By Medicare

Medicare does not cover a range of costs like:

- private patient costs in hospital

- extras services like dental and physiotherapy

- medical aids like glasses or hearing aids

You may choose to take out private health insurance to help with these costs. Private health insurance may cover some of your costs for things like glasses, or hearing or mobility aids. You may also be eligible for free or low-cost medical aids under the Medical Aids Subsidy Scheme.

You Have Lou Gehrigs Disease

If you have amyotrophic lateral sclerosis , youll be eligible for Medicare and automatically enrolled in Medicare Part A and Part B on the first day of the month that you start receiving disability benefits. Unlike other disabilities, you dont have to wait 24 months to be eligible for Medicare benefits.

Don’t Miss: Is A Sleep Study Covered By Medicare

If Youre Younger Than 65 Years Old

If youre younger than 65 years old, you might still be eligible for Medicare under the circumstances below:

- If youre diagnosed with Lou Gehrigs disease or Amyotrophic Lateral Sclerosis

Youll be eligible for Medicare from the first day of the month you start collecting disability payments. Also, youll be automatically enrolled to Medicare Parts A and B, unlike most conditions that require two years of waiting.

- If youre permanently disabled and collecting medical coverage for, at least, two years

If youve been receiving disability payments from the Railroad Retirement Board or Social Security Disability Insurance for, at least, two years, youre eligible for Medicare. Youre automatically enrolled to Medicare Part A and Part B on the first day of your 25th month of disability coverage.

- If you have end-stage renal failure and need dialysis or a kidney transplant

To be eligible for Medicare, you must either be eligible for or currently receiving Social Security or Railroad Retirement Board benefits or have worked long enough for Social Security, the Railroad Retirement Board, or the government.

What Services Does The Partnership Provide

- Medicare and Medicaid information and education

- Help with original Medicare eligibility, enrollment, benefits, complaints, rights and appeals

- Explain Medicare Supplemental insurance policy benefits and comparisons

- Explain Medicare Advantage and provide comparisons and help with enrollment and disenrollment

- Explain Medicare Prescription Drug coverage, help compare plans and search for other prescription help

- Information about long-term care insurance

The partnership also helps with the following programs. Benefit Counselors are specially trained to help you understand all the fine print to find and apply to a plan that works for you. They advocate for you with these programs and help you get the services you need.

Read Also: Who Is Eligible For Medicare Extra Help

Who Qualifies For Early Medicare

A person can be eligible for Medicare insurance when they are 65 years old if they have one of the following conditions:

- a disability that a doctor can confirm in writing

- ESRD

- ALS

In these situations, an individual may be able to get Medicare Part A without paying a premium. Part A covers in-hospital treatment and long-term skilled nursing care. They may also be able to get Medicare Part B, which pays for medical treatment and consultations, such as doctorâs visits and physical therapy sessions. Nevertheless, they will have to pay a monthly premium unless they receive help from their stateâs insurance assistance program.

Difference Between Medicare And Medicaid

A distinction between Medicare and Medicaid is that the former is a government-sponsored health insurance program and the latter is not. Medicaid is a federally financed and administered program that works in conjunction with states to provide health insurance to those with low financial resources.

Depending on the state, Medicaid can be made available to people who earn less than a particular amount but meet other requirements , or it can be made available to everyone who earns less than a certain amount. Its important to remember that, unlike Medicaid, Medicare eligibility is not based on income. In addition, persons who are eligible for both Medicare and Medicaid are referred to as dual-eligibles because they qualify for both programs.

Everyone who has Medicare is issued an Original Medicare card, which is colored red, white, and blue. If you choose to obtain your coverage through Original Medicare, you will be required to present this card whenever you seek medical attention or services. In the event that you elect to receive your Medicare benefits through a Medicare Advantage Plan, you will continue to get an Original Medicare card, but you will be required to provide your Medicare Advantage Plan card while receiving services. No matter how you obtain your Medicare health coverage, only your Medicare number should be shared with your doctors and other healthcare providers.

Also Check: Is Mutual Of Omaha A Good Medicare Supplement Company

Are Medicare Supplement Insurance Plans Part Of My Medicare Benefits

Medicare Supplement Insurance Plans are private insurance plans you can buy to supplement your Medicare benefits under Medicare Part A and Part B. These plans only work with Original Medicare and cant be used for prescription drugs or with Medicare Advantage plans.

Depending on the plan you choose, it pays some or all of your coinsurance and copayment amounts under Part A and Part B, and your Part A deductible. Depending on when you are first eligible for Medicare you may not be able to get a plan covering your Part B deductible.

Although Medicare Supplement Insurance Plans arent a mandatory part of your Medicare benefits, you do have guaranteed issue rights to buy a plan during your Medigap Open Enrollment Period. This is the six-month period that begins the month you are both age 65 or over and enrolled in Part B. During that time, you can buy any plan sold in your state and you cant be charged a higher premium based on your health status.

If you dont buy during your Medigap Open Enrollment Period, you may have to pass medical underwriting and the insurance company can refuse to sell you a plan.

To find a Medicare Advantage, Medicare prescription drug plan, or Medicare Supplement Insurance Plan in your area, enter your ZIP code on this page.

Find Plans in your area instantly!

Medicare Eligibility For Those 65+

When you reach the age of 65, you become eligible for Medicare if you meet the following criteria:

- Social Security retirement cash benefits are available to those who receive or qualify for them.

- Alternatively, you now reside in the United States and are one of the following:

- A citizen of the United States,

- or a permanent resident of the United States who has been in the United States for a continuous period of five years previous to applying

If you are currently receiving Social Security retirement benefits or Railroad Retirement benefits at the age of 65, the method by which you enroll will be determined by this factor. Additionally, there are scenarios in which someone may become Medicare-eligible at age 65 but may choose to defer enrollment in Medicare without incurring any future fines, such as if the individual receives qualifying health insurance via his or her workplace.

The amount of money you have to pay toward your Medicare coverage is determined by your job history . Everyone is required to pay a monthly payment for their medical insurance coverage . The majority of Medicare beneficiaries do not have to pay a premium for their hospital insurance .

Also Check: How To Get Replacement Medicare Id Card