Traveling With Medicare Advantage Or Part D

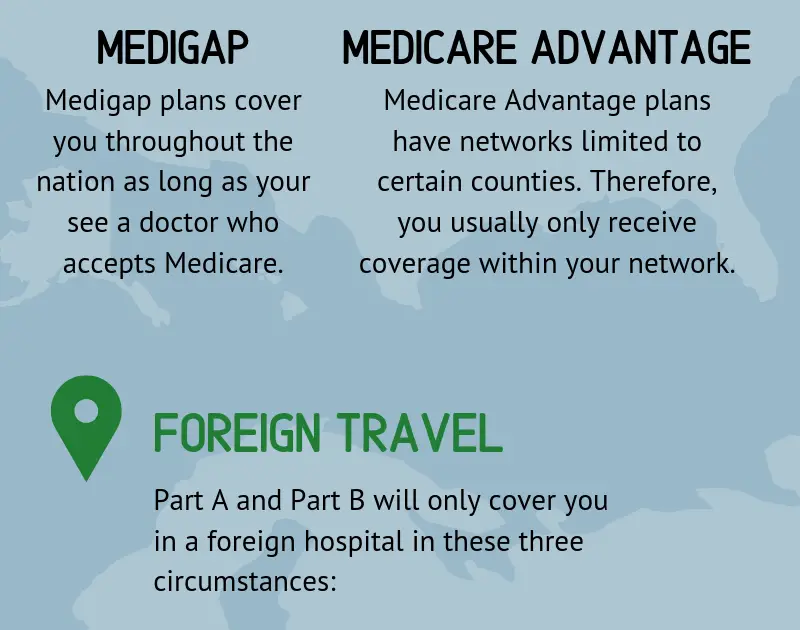

When it comes to Medicare Advantage or Part D plans, traveling can get tricky. Unlike Original Medicare, Medicare Advantage and Part D plans can be limited by the plans service area, and if you leave it, your plan may not cover you. Some Medicare Advantage plans may offer travel coverage , but the costs could vary depending on the plans rules about in-network versus out-of-network providers.

For Medicare Advantage and Part D plans, youll want to contact your plan provider to understand your options while traveling nationally or internationally.

If You Have Original Medicare

If you have Original Medicare and youre traveling within the 50 states, Washington, D.C., Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa or the Northern Mariana Islands, youre covered for care from any provider that accepts Medicare. Outside the U.S., Medicare typically doesn’t cover health care unless:

-

A medical emergency occurs in the U.S., but a foreign hospital is closer than the nearest U.S. hospital that can help.

-

A medical emergency occurs while youre traveling between Alaska and another U.S. state by way of Canada, and the Canadian hospital is closer than the nearest U.S. hospital that can help.

-

You live in the U.S., and a foreign hospital is closer than the nearest U.S. hospital that can help.

-

You receive medically necessary health care on a ship within territorial waters near the U.S.

Under all circumstances, Medicare drug plans wont cover prescription drugs purchased outside the U.S.

What Medigap Plans Are Available For Emergency Healthcare While Traveling

Medigap plans C, D, E, F, G, H, I, J, M, and N provide emergency healthcare while traveling. Of those, the six standard Medigap policies with foreign-travel emergency healthcare coverage are C, D, F, G, M, and N. To compare the plans with other benefit tradeoffs, see this chart from Medicare.gov.

Medigap policies E, H, I, and J offer foreign-travel emergency healthcare coverage but are closed to new buyers. Though no longer for sale, people who already have these policies can keep them.

Recommended Reading: Does Medicare Cover Outpatient Mental Health Services

How Do I Purchase Travel Medical Insurance

You can search for medical travel policies on insurance comparison sites like SquareMouth , InsureMyTrip or Travel Guard. Policies differ by state, and availability may change during or after the pandemic, so verify that the state you reside in offers travel medical insurance in light of coronavirus.

Some Types Of Medigap Plans Can Help Pay For Foreign Emergency Medical Care

While Original Medicare is limited in its coverage of emergency care received outside of the U.S. and U.S. territories, some Medicare Supplement Insurance plans provide coverage for emergency care received outside of the U.S.

These plans provide 80% coverage of the emergency care costs after you meet an annual deductible :

Recommended Reading: Will Medicare Pay For Drug Rehab

Things Every Beneficiary Should Know About Medicare Coverage And Cruise Ships

Did you know that your Medicare insurance wont typically cover routine health care you receive outside of the United States? This could have a potentially costly impact if you go on a cruise and need medical care while youre on your trip.

Here are five things you should know about how Medicare does and doesnt cover beneficiaries on a cruise.

What Should You Look For Before Purchasing A Travel Health Plan

A travel health insurance plan is meant to protect your health and your finances, so it’s important to research a plan before making a purchase. There are several things you should look for when choosing a travel health insurance plan:

- Emergency care: The plan you purchase should let you seek urgent care in the event of a medical emergency. It should cover services such as ambulance transport, ER visits and medically necessary inpatient hospital stays.

- Geographical coverage: Make sure the plan you choose covers the region or country you’re traveling to. If a single plan doesn’t cover all the countries on your itinerary, you may need to purchase multiple policies.

- Pre-existing conditions: Your travel health insurance plan should cover any treatment you may need for pre-existing conditions.

Direct payment to providers: Medical care can be expensive, and you may not have the means to pay out-of-pocket for treatment so make sure your plan offers direct payment to hospitals and other providers.

You May Like: Is The New Shingles Vaccine Covered By Medicare

Should I Have Medicare Coverage If I Retire Abroad

For coverage in your new country, youd need to purchase private health insurance or buy into the countrys public health plan, if that option is available. If youre willing and able to return to the United States for hospital care, youll still have access to Medicare Part A .

But youd need to purchase Medicare Part B in order to have outpatient coverage, and theres a 10% premium increase for each year that you were eligible for Part B but not enrolled . Advocacy groups have pushed for Medicare coverage to be portable for retirees who choose to live overseas, but so far, its not.

Will Medicare Advantage Provide Coverage For Extended Travel Abroad

Some Medicare Advantage plans keep people on a plan if they are traveling abroad for extended periods, but seniors traveling outside of their Medicare Advantage plans service area for over six months could face disenrollment. Even seniors traveling within the United States or its territories may be disenrolled unless they notify the plan of changing geographic locations.

Seniors who are disenrolled under these circumstances can join a different Part C plan during a special enrollment period. If they dont choose a new plan, they will be automatically enrolled in Original Medicare.

Recommended Reading: Does Medicare Cover Home Health Care After Surgery

Do You Need International Travel Health Insurance

Is travel insurance required mesuring Coverage? When you visit a foreign country, you will need a travel insurance plan. If you leave the U.S. within three months, most domestic medical insurance plans do not cover you. A sick person may not be covered if he or she is taken to the hospital by a reputable healthcare professional.

Does Medigap Cover You While Abroad

Most Medicare Supplement plans, include a foreign travel benefit check to see if yours does. Medicare Supplement plans C, D, E, F, G, H, I, J, M, and N that cover travel, pay for 80% of the cost of medically necessary emergency care outside of the U.S. and its territories.

Youll be responsible for a separate $250 deductible. The medical emergency must occur within 60 days of the start of your trip. So it wont work if you leave the country indefinitely. Plus, theres a $50,000 lifetime limit to the amount this benefit will payout.

Medigap policies are not a Medicare replacement. Theyre an additional benefit on top of your existing coverage under Original Medicare . And be aware that Medicare Part D prescription benefits also do not extend outside the U.S. and its territories.

Recommended Reading: Does Part B Medicare Cover Dental

How Can Medicare Advantage Plans Pay For Foreign Travel

Medicare Advantage plans must provide at least the same benefits as Original Medicare. Consequently, the same emergency care provisions under Medicare Parts A and B apply with Medicare Advantagealso called Medicare Part C, including coverage for:

- Allowable charges when the nearest hospital is in a foreign country

- Urgent care needed when traveling through Canada on a direct route to Alaska and a Canadian hospital is closer than a U.S. hospital

- Allowable charges for care received on a cruise ship in U.S. territorial waters if the vessel is more than six hours from a U.S. port.

Medicare Advantage can pay for additional international care expenses because it is managed by private carriers. However, the medical services covered depend on the plan, destination, length of travel and care needed during the trip. Some plans require paying upfront and getting reimbursed.

What To Do When No One Will Insure You

your health coverage is denied, the first call is to another provider-all insurers have different policies. Depending on your insurers, you may want to look at alternatives if they refuse to cover you: Join a state-licensed pooled pool Auto insurers in your state will be responsible for establishing a standardized risk pool.

Recommended Reading: Are Motorized Wheelchairs Covered By Medicare

Does Medicare Cover Dialysis Abroad

No, Medicare cannot be used to get any medical treatment as youre travelling internationally, including dialysis. The only time when Medicare could potentially cover dialysis is if t is an emergency and:

- You are in the US, but the nearest hospital that could offer you dialysis is a foreign hospital or

- You are in Canada, on your way back from Alaska, and the nearest hospital that could offer you dialysis is in Canada

Does Medicare Cover Overseas Travel

Original Medicare typically does not pay for emergency care when youre traveling outside the U.S. There are a few exceptions:

- If youre in the U.S. and have a medical emergency, but the nearest hospital capable of treating your condition is in a foreign country, Medicare may cover allowable charges.

- If youre traveling through Canada on a direct route to Alaska and you need emergency care, Medicare may pay for your treatment if a Canadian hospital is closer than a U.S. hospital.

- If youre on a cruise ship in U.S. territorial waters and you need health care services, Medicare may cover allowable charges if the ship is more than six hours from a U.S. port.

Keep in mind, if you do get covered health care services outside the U.S. under the circumstances mentioned above, your normal Part A and Part B deductibles apply, as well as any copayment or coinsurance amounts. In addition, although U.S. hospitals must submit a claim to Medicare on your behalf, this is not true of foreign hospitals. Youll need to get itemized bills from the hospital, doctors, ambulance service, and any other health care providers you see, and submit them yourself to Medicare upon your return.

Read Also: When Will I Get Medicare

Can I Use Medicare For Medical Treatment On A Cruise

Just as with trips to a foreign country, Medicare will not cover your medical expenses that occur during a cruise. But there is a very small window, starting from when the cruise starts, during which you have Medicare protection:

- The present doctor is authorized to provide medical care to you

- The ship is still in US waters, not international waters, and

- The ship is within 6 hours away from a US port, regardless of whether it is an emergency or not. If you are more than six hours away from the port, then Medicare will not cover your medical expenses.

Foreign Travel Under Medigap Plans C D F G M & N

Some Medicare beneficiaries dont like Medicare Advantage plans due to network restrictions or a favorite doctor who doesnt participate in that plan. These individuals might choose to stay on Original Medicare. If they choose one of the ten standard Medigap plans, like Plan F, that offer Foreign Travel benefits, they can travel without worry. The plan will pay up to 80% of your medical emergency costs after a $250 deductible.

This benefit has some limits though. It will only pay for emergencies during the first 60 days that you are out of the country. It is also limited to a lifetime benefit of $50,000 though, and that can add up quickly. If you plan to be out of the U.S. for an extended period, we generally recommend that you visit your travel agent to learn about some of the short-term medical plans that are designed to give you extra emergency benefits while on international travel.

Read Also: What Is Msp Qualified Medicare Beneficiaries

What Does Medigap Travel Insurance Cover

The insurance is limited to the costs of treatment in the first 60 days that travelers are outside of the country. Coverage pays 80% of the charges for most medically necessary emergency care. Medically necessary is defined case by case by Medicare, but this guide explains what is deemed unnecessary. Dont expect your Medigap plan to pay for nonemergency surgery. Instead, it will pay to get you in good-enough shape to fly back home.

Neither Medigap nor Medicare Part D pay for drugs outside of the U.S., but Medigap will probably pay 80% of the cost of drugs administered in a hospital if they are medically necessary.

Medigap pays for an ambulance ride to a foreign hospital. It also may pay to airlift you via plane or helicopter to the hospital. In a worst-case scenario, Medigap wont pay to fly your body home if you die.

Can Medicare Be Used Outside The United States

In addition to the United States, Medicare may be used in any U.S. territory. This includes:

- Guam

- The U.S. Virgin Islands

- The Northern Mariana Islands

Medicare Part B may also be used to cover medical services received on a ship if the vessel is located within the territorial waters adjoining land areas of the United States. However, if the ship would have to travel more than six hours to reach a U.S. port, Medicare wont pay for onboard medical services.

You May Like: How To Find A Medicare Doctor

Tip : Check With Your Medicare Plan Provider About Your Plans Coverage

There are a few different kinds of Medicare plans, in addition to Original Medicare . Original Medicare is government funded, and covers certain hospital and medical expenses, but not usually if youre outside of the country.

Medicare supplement insurance plans can be good plans for avid travelers. Medigap Plans C, D, F, G, M, and N provide emergency foreign travel health care coverage in some form. These plans typically cover 80% of health care costs, after you meet the $250 deductible.1

Some Medicare Advantage plans may cover you overseas. It depends on your specific plan, so contact your Medicare provider for more information. Also, be sure to bring a copy of your Medicare and health care insurance cards with you when you travel. That way, youll have that information at the ready if you need it.

Its always best to contact Medicare providers for more information on each plans coverage. That way, you can decide which option is right for you!

Can I Use Medicare Supplement Insurance In Another Country

Original Medicare wont typically cover health care or medical supplies you receive in a foreign country.

Certain Medicare Supplement Insurance plans do offer some coverage for foreign travel emergency health care.

Medigap Plans C, D, F, G, M and N each provide foreign travel emergency care coverage, which you should keep in mind as you travel overseas.

Also Check: How Does An Indemnity Plan Work With Medicare

What If I Have A Medigap Medicare Supplement Policy For Foreign Travel

Since Medicare does not cover 100% of your medical needs, a Medigap is a supplement policy which is purchased to fill in the gaps leftover from Medicare. Your Medigap policy will cover you for medical emergencies abroad if you have purchased a policy which includes travel health insurance.

These are known as plans C, D, E, F, G, H, I, J, M, and N, and can cover up to 80% of your medical bills abroad after you pay a $250 deductible. They also have a lifetime limit of $50,000.

However, to make sure, you have to contact your Medigap policy provider and ask them where you stand on medical travel insurance abroad and just how much coverage you need.

Remember that Medigap policies are not as comprehensive as actual travel insurance policies, which include higher limits, evacuation coverage, as well as coverage for trip cancellation or disruption.

If you do not have a Medigap policy, you can find plans on the official US website for Medicare after you enter your ZIP code .

Does Medicare Advantage Cover You While Abroad

Unlike Medigap coverage, Medicare Advantage plans are a government-approved alternative to Medicare offered by private health insurance companies. These plans differ in which added benefits they provide. Check with your Medicare Advantage provider to see if your plan includes health insurance for foreign travel .

If your Medicare Advantage plan does have travel insurance, make sure that it explicitly covers health issues such as preexisting conditions or medically necessary emergencies.Be mindful that Part C plans may not cover travel in every country or may even be limited in covering domestic travel emergencies. Part C plans operate in limited geographic areas. Your benefits will be equal to or better than Original Medicare, but they dont apply everywhere. If your Medicare Advantage plan becomes aware that youve lived away from your plans service area for 6 months or more, you may be automatically disenrolled.

Recommended Reading: Why Is My First Medicare Bill So High

Can I Use Medicare If I Retire Abroad

No, if you choose to spend your retirement outside the US, Medicare will not reimburse you for any medical expenses that you have abroad. Medicare only covers medical treatment within US states and territories .

If you are retiring abroad, then you will likely have to obtain private expat health insurance within the country you are in or enroll in a government health insurance plan. This, of course, changes depending on which country youre retiring to.

But you can still keep Medicare, which will cover your expenses if you return to the US.

Travel Medical Insurance Faq

For the most part, your U.S.-based medical insurance provider will not cover your medical treatment when youre abroad. If you want peace of mind while youre on a trip away from your home country, a travel medical insurance plan is your best bet.

Anytime before your trip begins.

Generally, the emergency medical insurance coverage on credit cards offers fewer protections and lower limits than a stand-alone policy. For example, the Chase Sapphire Reserve® offers emergency medical coverage up to $2,500 with a $50 deductible. The policies we looked at above offered medical coverage from $50,000 to $2,000,000. If you want a higher limit, you may want to purchase a travel medical insurance policy.

It depends on the type of coverage youre looking for. Generally, if youre only concerned with emergency medical benefits and dont need trip cancellation, trip delay, rental car coverage or any of the other benefits provided by a comprehensive travel insurance plan, a medical plan should be enough for you. There is no one-size-fits-all answer, and your particular circumstances determine which policy is most suitable.

Read Also: Do You Need A Medicare Supplement