What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

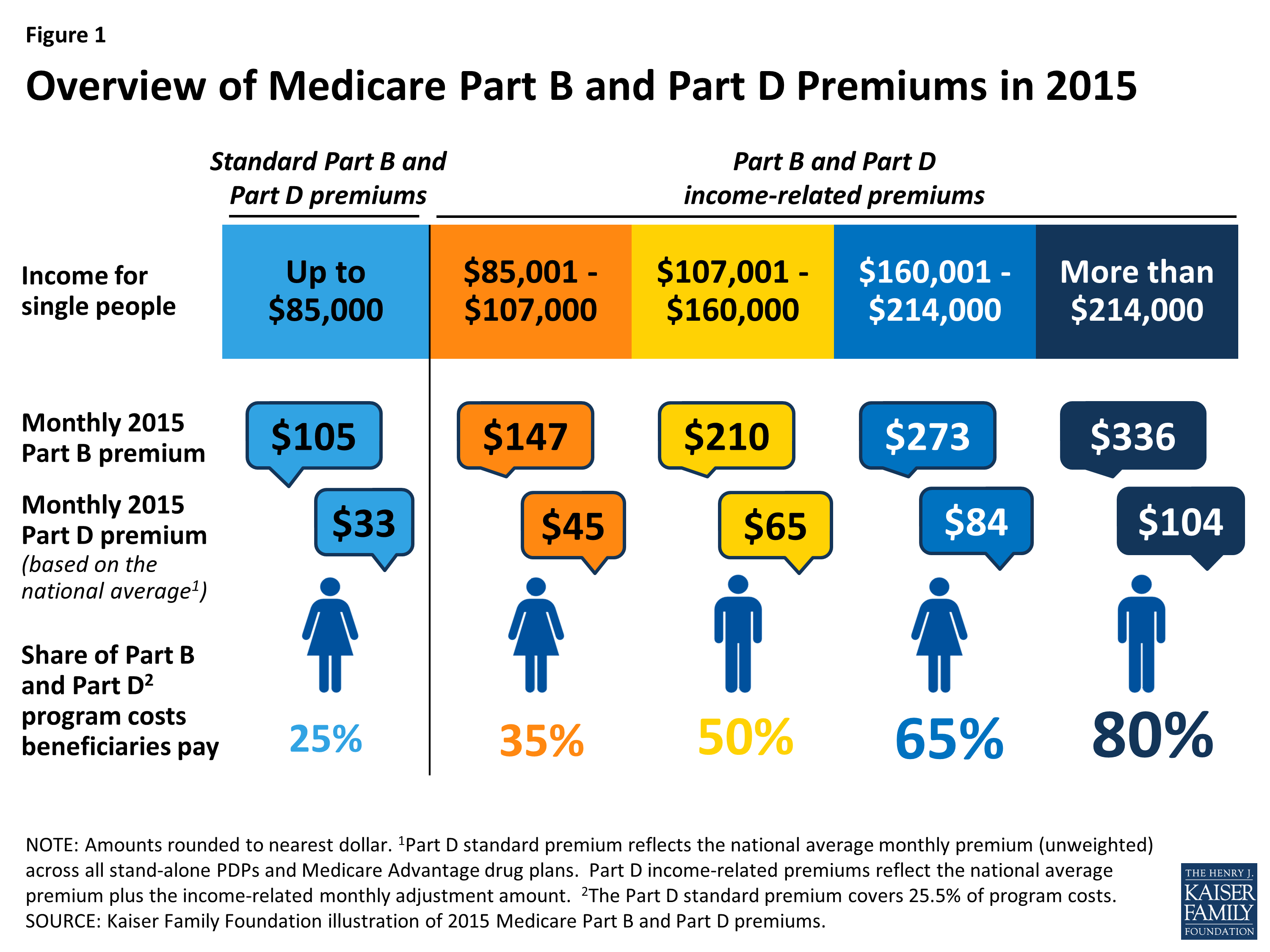

How Much Does Medicare Part B Cost

The out-of-pocket costs for Part B include a premium, deductible, and coinsurance. Part B will cover 80% of your medical expenses once youve met the annual deductible. You must pay the monthly premium for Part B. Most beneficiaries will pay the standard monthly premium. Those in a higher income bracket will pay more.

In 2022, the Part B premium is $170.10 a month. If you receive Social Security, Railroad Retirement Board, or Office of Personnel Management benefit payments, your Part B premium will be deducted from your monthly check. Part B has an annual deductible of $233. This deductible can slightly increase each year.

If you dont receive Social Security, you could get a monthly bill from Medicare. They have an online payment option called Easy Pay for those with a MyMedicare account.

Is There A Limit On Out

There is no out-of-pocket spending limit with Original Medicare .

Medicare Advantage plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses.

While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2022. Some plans may set lower maximum out-of-pocket limits.

Medicare Advantage plans are offered by private insurance companies. When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

Most Medicare Advantage plans provide prescription drug coverage, which is not typically covered by Original Medicare.

Some Part C plans also offer other benefits that Original Medicare doesnt cover, which may include:

- Routine hearing, dental and vision coverage

- Non-emergency transportation to approved locations

- Over-the-counter medication allowances

- Health and wellness programs, such as SilverSneakers

Depending on where you live, you may be able to find $0 premium Medicare Advantage plans.

You May Like: How To Get Motorized Wheelchair Through Medicare

Whats A Qualifying Hospital Stay

Another important rule: You must have had a qualifying hospital stay, meaning you were formally admitted as an inpatient to the hospital for at least three consecutive days. You cannot have been in observation status.

In both cases you are lying in a hospital bed, eating hospital food and being attended to by hospital doctors and nurses. But time spent under observation does not count toward the three-day requirement for Medicare coverage in a skilled nursing facility.

When you enter the hospital, ask if you are being officially admitted or for observation. If the latter, you may want to appeal to your doctor to see if you can be switched to inpatient status. Two more things to note about the three-day rule:

- Medicare Advantage plans, which match the coverage of original Medicare and often provide additional benefits, often dont have those same restrictions for enrollees. Check with your plan provider on terms for skilled nursing care.

- Skilled nursing facilities are the only places that have to abide by the rule. If youre discharged from the hospital to another kind of facility for ongoing care, such as a rehabilitation hospital, Medicare provides coverage under different rules.

If you qualify for short-term coverage in a skilled nursing facility, Medicare pays 100 percent of the cost meals, nursing care, room, etc. for the first 20 days. For days 21 through 100, you bear the cost of a daily copay, which was $170.50 in 2019.

What Is Medicare Reimbursement For Inpatient Costs

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible. Medicare reimbursement covers you for up to 90 days per benefit period, but you have a daily coinsurance amount for days 61 through 90.

Medicare reimbursement also allows for an additional 60 âlifetime reserve daysâ after the 90th day in each benefit period. You pay a daily coinsurance amount for each lifetime reserve day as an inpatient.

There is generally no Medicare reimbursement once youâve exhausted your lifetime reserve days you may pay 100% of the charges. Medicare reimbursement is also not available for long-term care or custodial care in a nursing facility.

You may have more than one Medicare Part A deductible in a calendar year. Medicare Part A deductibles are based on benefit periods which are tied to the specific illness or injury requiring inpatient care.

You May Like: Does Medicare Cover The Cost Of Cataract Surgery

What Is Unique About Medicare Advantage When It Comes To Hospital Coverage

Medicare Advantage plans protect you with an annual out-of-pocket maximum a dollar amount specific to your plan that defines the most money you will have to pay out of your pocket for the plan year for healthcare. Original Medicare doesnt have an out-of-pocket maximum, although if you have Parts A and B, you can add one of the two standard Medigap plans that include an out-of-pocket max.

While Medicare Part A coverage is standard across the board, Medicare Advantage plans that replace Original Medicare come in all shapes and sizes. Some Medicare Advantage plans, for example, provide coverage for all hospital visits, regardless of their length or whether theyre considered to be inpatient or outpatient.

If you are looking for a specific level of coverage from a Medicare Advantage plan, a GoHealth licensed insurance agent can locate the right plan for your situation.

Why Is Medicare Part C Separate

Medicare Advantage plans are not separate from Medicare. Medicare Advantage is private insurance required to meet all of Medicares regulations. You have Medicare rights and protections, even though private insurance companies manage your benefits. Medicare Advantage plans can offer additional benefits like Part D, vision, dental, and hearing.

Are you eligible for cost-saving Medicare subsidies?

Also Check: Is Shingrix Vaccine Covered By Medicare

Cost Differences Between Part A And Part B

Medicare Part A is free for most Americans age 65 or older, though people who haven’t worked or paid Medicare taxes for at least 10 years will pay a large monthly Part A premium. Most people don’t get Part B for free whether they’ve reached their 65th birthday or not, but the cost is much lower and depends on your income.

Other Items And Procedures Not Covered By Medicare

It is virtually impossible to keep track of everything Medicare may or may not cover. However, there are certain criteria that must be met.

For example, the physician has to agree to accept Medicare payments. Doctors are not required to accept the government programs.

According to the Kaiser Family Foundation, close to 90 percent of the U.S. Doctors accept Medicare patients. However, approximately 80 percent are accepting new patients and the remainder does not accept new Medicare patients.

Virtually all family doctors accept Medicare. However, only 55 percent of psychiatrists in the nation accept Medicare patients, according to a story in the New York Times referencing a study published in the Journal for the American Medical Association .

Don’t Miss: Do I Have To Use Medicare When I Turn 65

A Premiums Deductibles & Coinsurance

The chart below lists the Part A premiums, deductibles and coinsurance for inpatient hospital and skilled nursing facility care for Original fee-for-service Medicare. For a comprehensive list of Part A and B costs, see our summary chart, Medicare Benefits & Cost-Sharing for 2022

Part A Hospital Insurance Premiums, Deductibles & Coinsurance

| If You Have |

|---|

Find A $0 Premium Medicare Advantage Plan Today

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: Does Medicare Pay For Cataract Surgery With Astigmatism

What Do Part A And Part B Not Cover

There are some services and items that Medicare Part A and Part B dont cover. If you need any of these services, youll be responsible for paying the costs yourself unless you have additional insurance or a different Medicare health plan that covers them. Some services Medicare doesnt cover include the following:

- Acupuncture

- Most prescription drugs

- Routine foot care

If you require any of these services, you may want to consider switching to a Medicare Advantage Plan that offers additional coverage beyond Original Medicare, which is a common term for Part A and Part B combined. Or, consider adding Part D prescription drug coverage.

Learn more about Original Medicare versus Medicare Advantage.

Do Medicare Benefits Run Out

If you are admitted for inpatient care at a hospital or another inpatient facility, your MedicarePart A benefits will help pay for some of your hospital costs.

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs.

- For the first 60 days of a qualified inpatient hospital stay, you dont have to pay any Part A coinsurance. You are responsible for paying your Part A deductible, however. In 2022, the Medicare Part A deductible is $1,556 per benefit period.

- During days 61-90, you must pay a $389 per day coinsurance cost after you meet your Part A deductible.

- Beginning on day 91 of your stay, you will begin using your Medicare lifetime reserve days. Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $778 per day in 2022.

You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year. If you have a hospital stay that lasts longer than 90 days after your lifetime reserve days are exhausted, you will be responsible for all costs beginning on day 91.

Also Check: Does Medicare Plan F Cover International Travel

What Will You Pay Under Medicare Part B

Your Medicare Part B Costs:

- Part B Premium for most people*: You pay $170.10 a month

- Yearly Deductible: You pay $233

- Most doctor services : You pay 20% of the cost of the visit

- Clinical Lab Services: You pay $0

- Durable Medical Equipment: You pay 20%

- Preventive Care: You pay $0

- Part B Copayment: Depends on service

- Home Health Services**: $0

*Those with higher incomes pay an increased premium.

**Although Home Health Services are completely covered at no cost to you, if you need durable medical equipment you will need to pay 20% of the cost.

What Does Medicare Part B Cost

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 and increases with income.3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier.

The annual deductible for Part B is $198 in 2020 .4 Once this is paid, youll only pay your coinsurance payments, which are 20% of covered expenses.

Some low-income and disabled people may be eligible for help paying Part B premiums through their state’s Medicare Savings Program . Those eligible for free Medicare Part B may qualify for free or lowered deductibles and coinsurance as well.

If you con’t qualify for an MSP, consider purchasing a Medicare Supplement plan to help cover the costs of both Parts A and B.

Learn more about Medicare costs.

You May Like: When Is Open Enrollment For Medicare Supplement Plans

What Is Medicare Part B

Part B helps cover medically-necessary services like doctors’ services, outpatient care, home health services, and other medical services. Part B also covers some preventive services. Check your Medicare card to find out if you have Part B.

How Much Does Part B Cost?If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

How Do I Get Part B?Some people automatically get Part B. Learn how and when you can sign up for Part B.

What Does Part B Cover?To find out if Part B covers something specific, visit Your Medicare Coverage. Part B covers two types of services:

Medically-necessary services â Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services â Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

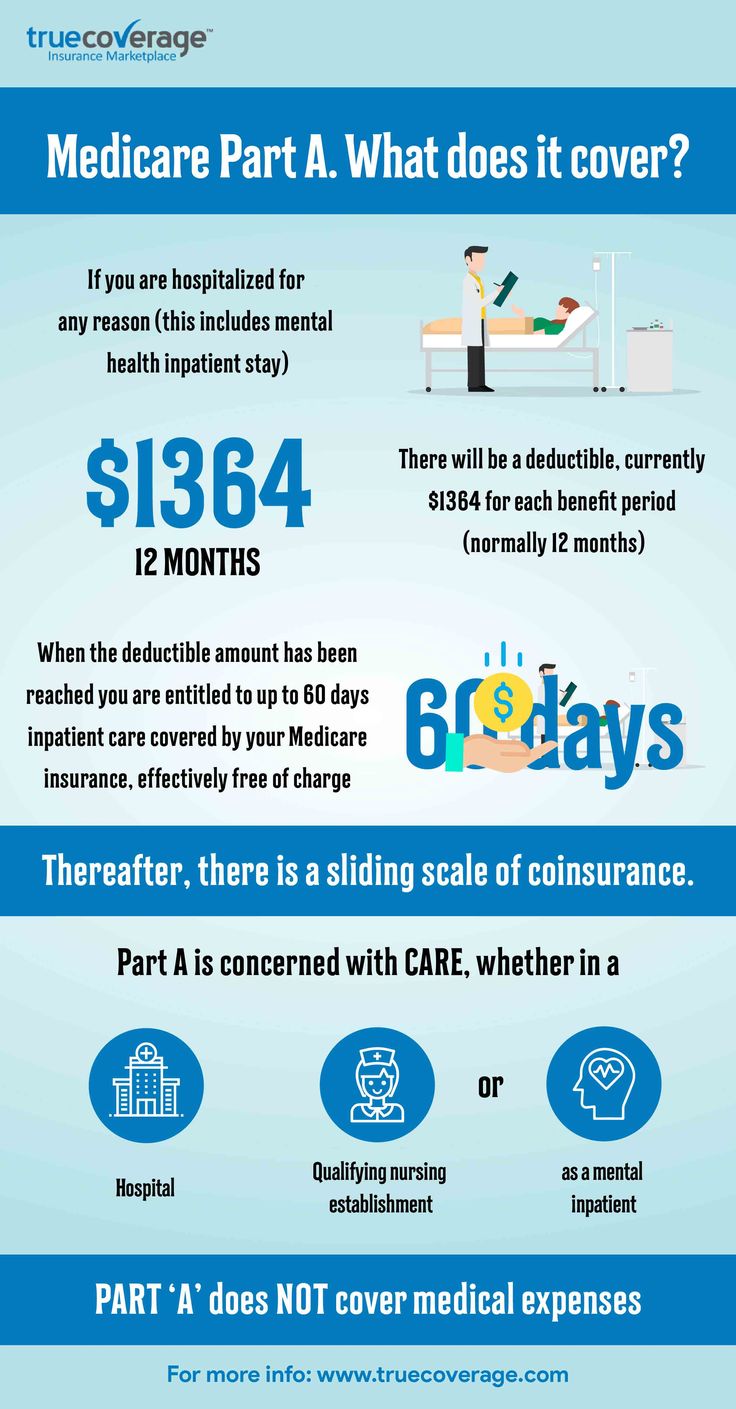

What Is Medicare Part A

Part A is the hospital insurance portion of Medicare. Most people become eligible for Medicare once they turn 65, and they may be automatically enrolled if they receive Social Security benefits. Otherwise, you have a limited window of time during which to sign up for Part A without having to pay a penalty. This is referred to as the initial enrollment period. It lasts for a total of seven months .

You won’t pay a premium for Part A if you already receive Social Security retirement benefits or you’re eligible for them.

You could have a coverage gap if you wait to sign up for Medicare until the month you turn 65 or later.

Also Check: What Is The Medicare G Plan

Medicare Part B Medical Coverage

What it helps cover:

What it costs:

- Most 2021 Medicare members must pay a monthly premium of $148.50.

- If you don’t enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

- The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Other Part B costs:

- There is a $203 annual deductible for Medicare Part B in 2021. After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy.

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Medicare Doesn’t Cover Long

One of the largest potential expenses in retirement is the cost of long-term care. The median cost of a private room in a nursing home was roughly $105,800 in 2020, according to the Genworth Cost of Care Study a room in an assisted-living facility cost $51,600, and 44 hours per week of care from a home health aide cost $54,900.

Medicare provides coverage for some skilled nursing services but not for custodial care, such as help with bathing, dressing and other activities of daily living. But you can buy long-term-care insurance or a combination long-term-care and life insurance policy to cover these costs.

You May Like: Are Legal Residents Eligible For Medicare

In General Part A Covers:

Medicare Parts A and B coverage details

| Services | You pay in 2022 | ||

|---|---|---|---|

|

HospitalizationSemi-private room and board, general nursing and other hospital services and supplies |

First 60 days |

||

|

91st to 150th day (60 reserve days may be used only once |

All but $778/day |

||

|

All costs |

|||

|

Skilled nursing facility careSemi-private room and board, skilled nursing and rehabilitative services and other services and supplies |

First 20 days |

||

|

All costs |

|||

|

Home health carePart-time or intermittent skilled care, home health aide services, durable medical equipment and supplies and other servicesNote: Doctor must order care and a Medicare-certified home health agency must provide it |

Unlimited, as long as you meet Medicare requirements for home health care benefits |

100% of approved amount 80% of approved amount for durable medical equipment |

Nothing for services 20% of approved amount for durable medical equipment |

|

Hospice carePain relief, symptom management and support services for the terminally ill – meaning you have a life expectancy of six months or less |

For as long as doctor certifies need |

All but limited costs for outpatient drugs and inpatient respite care |

Limited cost sharing for outpatient drugs and inpatient respite care |

|

Blood*When furnished by a hospital or skilled nursing facility during a covered stay |

Unlimited during a benefit period if medically necessary |

All but first three pints per calendar year |

For first three pints |

1 – Neither Medicare or Medigap insurance pay for most nursing home care .