Cigna Medicare Supplement Plan Options

There are 10 universal Medigap policies known as plans A, B, C, D, F, G, K, L, M, and N, including standardized benefits and copay reductions. Plans C and F are only available to existing Medicare enrollees who became eligible for Medicare before 2020. New beneficiaries can sign up for a Medigap plan without restrictions during their seven-month initial enrollment period. Otherwise, insurers can base eligibility on your medical history.

Cigna Health Insurance offers five Medicare Supplement plans in most geographic areas. For Plans A, G, and N, there are up to six different options available, including: a Standard plan, a Standard plan with 6% HHD, a Standard plan with 15% HHD, Standard II, Standard II , and Standard II .

With the exception of Plan F, youre responsible for paying your $233 Part B deductible for medical services and diagnostics. Medigap policies can reduce or eliminate your Part A hospital deductible, which can save you up to $1,556 per benefit period. Some plans may pick up excess charges beyond Medicare-approved amounts, and they can limit your out-of-pocket expenses.

Learn more about some of the Cigna Medicare Supplement plans that may be available in your area :

| Plan name |

*Based on pricing in Denver, CO for a 65 year old woman, no tobacco useRates are based on medical eligibility

Choose A Regular Or High

If you would like a Medicare Supplement Plan and choose Plan G, decide if you would like a Regular or a High-Deductible Plan G. High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible, which was set at $2,490 for 2021. These plans will have lower monthly premiums than a regular plan. You will need to decide if paying more in monthly payments makes more sense financially than paying higher costs when you need care.

Cigna Medigap Options In Minnesota And Wisconsin

Minnesota and Wisconsin have developed their own Medicare supplement plans, which are structured differently than Medigap plans in other states. In both states, Cigna uses “attained age” rating, meaning your premium is based on your current age and may go up as you get older.

In Minnesota, Cigna offers four plans: Basic, Extended, High Deductible and Copay. Premiums range from $63 per month for the High Deductible plan to $248 per month for the Extended plan. With the Basic plan, you can purchase optional riders to cover the Medicare Part A deductible, Medicare Part B excess charges or preventive care not otherwise covered by Medicare.

In Wisconsin, Cigna offers only the Basic Medicare Supplement plan with optional riders similar to those available in Minnesota.

Read Also: How Do I Cancel Medicare Part A

Medigap Plan G Review

Medicare Plan G offers broad benefits for Medicare beneficiaries who want additional help paying for out-of-pocket medical expenses. Here is a quick recap of Medigap Plan G:

- For beneficiaries who have frequent emergency room and doctors office visits, Medicare Plan G is an excellent option because it covers copayments and coinsurance relating to those medical expenses.

- Benefits are standard for Plan G regardless of which insurance company offers the Medigap policy, but you need to compare carriers to find the best rates.

- Beneficiaries who can afford to pay the Part B deductible can get a significantly lower premium while still getting extensive benefits coverage.

- Medicare Plan G might not be available in all states.

- You must keep on paying your Medicare Part B premium to remain qualified for Medicare Plan G.

- Because beneficiaries typically do not change Medigap plans, it is critical that you carefully compare plan options before enrolling.

Who Is Eligible For Medicare Supplement Insurance

If you are age 65 or older and enrolled in Original Medicare Part B, you may be eligible to apply for Medicare Supplement Insurance. You can apply for a Medicare Supplement plan at any time throughout the calendar year, but during your 6-month open enrollment period, you can buy any policy offered in your state and you are guaranteed coverage even if you have pre-existing health conditions.

- If you are retiring at 65 and applying for Medicare Part B, your open enrollment period lasts for 6 months starting the first day your Part B coverage begins.

- If you are not retiring until later and still getting medical coverage under your employers insurance, then your open enrollment starts when you do retire and sign up for Part B coverage.

Medicare Supplement plans are also available to you if youre younger than age 65 and eligible for Medicare due to disability.

Learn more about Medicare Supplement Enrollment and Eligibility

Read Also: What’s The Medicare Deductible

What Is Covered By Medicare Plan G

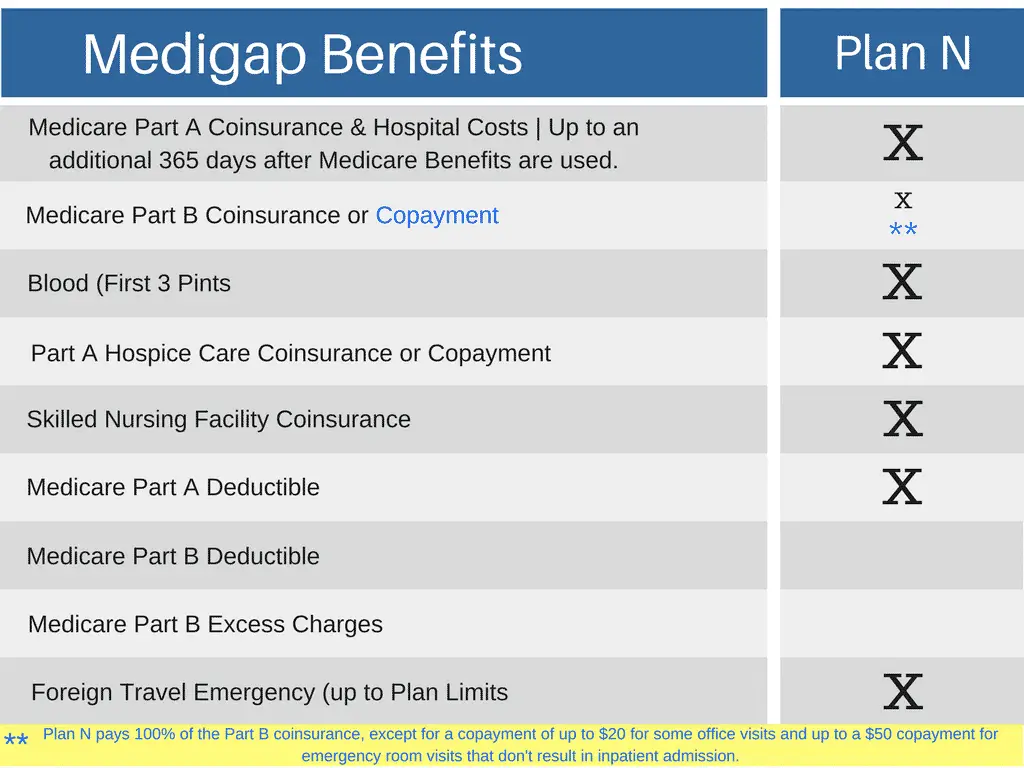

Medigap Plan G pays for most of the out-of-pocket medical expenses that you are responsible for after Original Medicare pays its portion. It pays the full cost of the following benefits:

- Medicare Part A hospital coinsurance and hospital costs up to one year after you use up your Medicare benefits

- Medicare Part B coinsurance

- Medicare Part A hospice care copayment and coinsurance

- Medicare Part A annual deductible

- Medicare Part B excess charges

- First 3 pints of blood

- Foreign travel emergency coverage up to plan limits

- Coinsurance for skilled nursing facility care

Coverage Under Cigna Medicare Supplement Plan G

Cignas most popular Medicare supplement plan, Part G, offers many of the same coverage options as Plan F, the Cadillac of Medicare Supplement insurance plans. A Medicare enrollee can choose the right plan without breaking the bank with Plan G, which is more affordable.

Plans G and F cover many of the same things, with the exception of the Medicare Part B deductible, which Plan G does not cover.

In addition to paying for your first 60 days of hospitalization, Plan G pays for your Medicare Part A deductible. You are insured for the extra $371 per day up to your 90th day. In addition, you are insured for the extra $742 per day on your 91st day and every day afterward.

If you have been in a hospital for at least three days and are in a Medicare-approved facility, a Cigna Medicare Supplement Plan G will cover many of the costs of skilled nursing facility care. As well as hospice care, it covers your first three pints of blood a year.

Part B covers the following:

- Part A hospital coinsurance

Part B does NOT cover the following:

- Part B deductible

Also Check: What Is A Medicare Advantage Medical Savings Account

Medicare Medical Serviceswhat Plan G Pays

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physicians services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an excess charge. Medicare puts a 15% limit on the extra amount a doctor can charge.

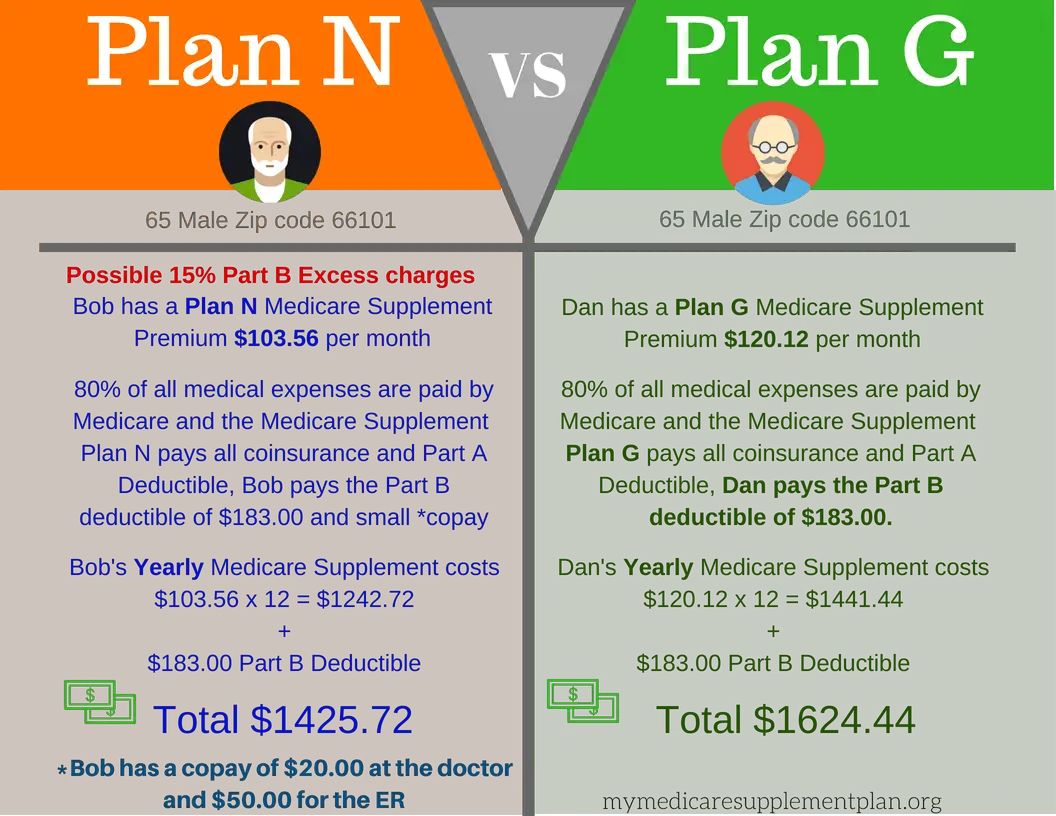

Medicare Plan N Vs Plan G

When compared to Medicare supplement Plan N, Plan G provides more comprehensive coverage. While Plan G pays for expenses related to Medicare Part B excess charges, Plan N does not. This difference would be paid for you out of pocket if you had Plan N. However, the rates for Plan N are less than Plan G. For 2022, Plan N costs between $102 and $302 per month about 18% less than Plan G. One thing they have in common: neither Plan N nor Plan G cover the Medicare Part B Deductible.

Also Check: What Medicare Supplement Plans Cover Hearing Aids

What Does Medicare Supplement Plan G Cover

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2022 is $233.

In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible. However, the premiums for Plan G tend to be considerably less than that of Plan F. Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option.

Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F. This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

What Is The Typical Cost Of A Medicare Supplement Plan G

Costs for Medicare Supplement Plans vary widely depending on your age, gender, and where you live. Chronic medical conditions are taken into account, including whether or not you smoke and if you sign up after the one-time Medigap Open Enrollment Period that starts when you first enroll in Medicare Part B and ends six months later.

Plan G costs were reviewed across four regions of the United States in 2020. Based on ages 65 to 75 years old, gender, smoking status, and cost summaries from Medicares Find a Plan search engine, Part G costs ranged $189 to $432 on the east coast , $104 to $479 in the midwest , $88 to $417 in the south , and $115 to $308 on the west coast . Costs could be higher or lower based on specific regional data.

Recommended Reading: How Old To Get Medicare Part B

Cigna Medicare Supplement Prices

We know the price is important. Cigna is very competitive across the country. We also understand that you may want to view rates without speaking to an agent first. We have implemented a live quote comparison tool on our website.

To view instant quotes from Cigna and all of its subsidiaries for Plans F, G and N simply fill out our online form and view instant rates here.

Please note: We do our best to keep the rates updated and accurate but we cannot guarantee accuracy without speaking to you on the phone. We can ensure all applicable discounts are applied and confirm policy effective dates, which affect the premium cost. Call us at for a free rate comparison.

What Is Included In Medicare Supplemental Plan G

Medicare Plan G covers almost everything Original Medicare does not. It doesnt extend the scope of care, just the amount of coverage included. Plan G coverage includes excess charges leftover from the 80% that Original Medicare does not cover, including Part A and Part B copays and Part As deductible. The other big difference: Plan G does not cover the Part B deductible, which needs to be met. However, that payment does count toward the Plan G deductible as well.

The Plan B deductible for 2022 is $233, so youll have to pay at least this much, but that means you can subtract that amount from your expected Plan G deductible as well.

Also Check: When Do Medicare Benefits Kick In

Is Medigap Plan G Right For You

Medigap Plan G might be a good fit if youre new to Medicare as of 2020 and you want the most comprehensive Medigap coverage available.

However, its also usually the most expensive Medigap coverage and costs can continue to increase each year.

Tips for how to shop for a Medigap plan

- Use Medicare.govs tool to find and compare Medigap policies. Consider your current monthly insurance costs, how much you can afford to pay, and if you have medical conditions that may increase your healthcare costs in the future.

- Contact your State Health Insurance Assistance Program . Ask for a rate-shopping comparison guide.

- Contact insurance companies recommended by friends or family . Ask for a quote for Medigap policies. Ask if they offer discounts you may qualify for .

- Contact your State Insurance Department. Ask for a list of complaint records against insurance companies, if available. This can help you weed out companies that may be problematic to their beneficiaries.

When And Where To Buy Medigap Plan G

You can purchase a Medigap Plan G supplement policy through private health insurance companies such as Aetna and UnitedHealthcare. However, not all insurance providers offer Plan G. Therefore, you should research which insurance companies offer a plan that fits your needs and compare quotes so you get your best rate possible.

Starting three months before you turn 65, you have seven months to enroll in Medicare and Plan G, if you choose. You can also sign up for or make changes to your Medicare insurance during open enrollment season, which runs from Oct. 15 to Dec. 7 each year.

Also Check: What Is Medicare Catastrophic Coverage

How We Chose The Best Medicare Supplement Plan G Companies

When we set out to select the five best Medicare Supplement Plan G providers, the first thing we looked at was geographical coverage. We made sure that the plans we mention here cover at least 40 states to allow for the most possible coverage for as many people as possible. From there, we determined the five best plans by studying pricing, ease of website use and application, educational information, extra benefits, and more.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE 24 hours a day/7 days a week to get information on all of your options.

How Does Medicare Work

Signing up for Medicare:When you turn 65 you must choose either to sign up for Original Medicare or a Medicare Advantage Plan through a private insurer.3

- You are eligible to sign up during the 3 months before the month in which you turn 65, during your birthday month, and through the 3 months that follow your birthday month. So you have 7 months in which to sign up for Medicare.

If you have End Stage Renal Disease or a chronic condition or disability for which you receive Social Security benefits, you would be eligible for Medicare, regardless of age.

Medicare annual open enrollment:Medicare Open Enrollment usually runs from October 15 to December 7, each year. During that time you can decide if you want to make any changes to your current Medicare coverage.

For example, if you signed up for Original Medicare when you turned 65, you may decide you want to try a Medicare Advantage plan instead, or vice versa.

Signing up* for a Medicare Supplement Insurance policy :If you are 65 or older and have signed up for Original Medicare then you may be eligible for a Medicare Supplement plan. These plans are not part of the federal governments Medicare program and are sold exclusively through private insurers.

Open Enrollment is a 6-month period when you can buy any Medicare Supplement policy sold in your state, even if you have pre-existing health conditions. This period automatically starts on the first day of the month that you meet both of the following 2 criteria:

Also Check: Where Do I Send My Medicare Payment

Check Plan Pricing And Coverage

Cost is often a determining factor in many purchases. Different providers may have different costs for the same care, while some may go above and beyond the basic level of care required by law.

The federal government mandates all Medicare Supplement Plan G coverage. All plans will cover the same basics: nursing home care, extended hospital care, blood transfusions, etc. Some providers may offer more, but the cost may be higher with those plans.

Gaps In Original Medicare Part B

With Part B, you can expect to pay these costs:

- Part B deductible

- Part B coinsurance

- Part B excess charges

For 2020, you pay the first $198 of Part B services before Medicare begins sharing the cost with you.After youve met the deductible, Medicare will pay 80% of the rest of your Part B expenses.

Part B covers you for the following:

- Doctors and therapy visits

- Lab work and other diagnostic testing

- Medical equipment like bottled oxygen

- Outpatient surgeries like arthroscopic joint surgery

- Some cancer treatments like chemotherapy

Once youve met the deductible, youll pay 20% of the cost for every Part B service or procedure you undergo. You may also have to pay up to 15% for excess charges. These charges are on top of the 20% coinsurance.

Its important to keep in mind theres no cap on the total you can spend in a year. Unlike traditional private health insurance, Medicare doesnt have an annual out-of-pocket maximum protection. Also, Original Medicare doesnt cover you outside the United States.

Also Check: Does Affordable Dentures Accept Medicare

Which Cigna Medigap Plan Is Right For Me

Below are some of the most common concerns and priorities to help you decide which plan works best for you.

You’re looking for a little extra protection beyond Original Medicare.

Medigap Plan A, the Medigap plan with the lowest level of coverage, will pay for some of the basic costs not covered by Original Medicare. With Plan A, you’ll still pay your Medigap Part A and Part B deductibles. Medigap Plan A will then cover the remaining costs for both hospital and medical expenses, including copays and coinsurance associated with hospice care.

Quick Tip: Medicare Supplement insurance plans A, F, and G provide benefits at higher premiums with limited out-of-pocket costs. Plan N is a cost-sharing plan offering similar benefits at lower premiums with greater out-of-pocket costs.

You’re a world traveler and need the extra assurance abroad.

Plans N, G, F, and High Deductible F cover foreign travel emergencies. They cover 80 percent of medically necessary emergency care received outside of the U.S., as long as the care started during the first 60 days of your trip. There is also a $250 deductible each year, and this coverage can’t exceed the lifetime maximum of $50,000.

You find that some predictable out-of-pocket costs are a good trade-off for a lower monthly premium.

You prefer the most coverage available.

Plan F boasts the lowest out-of-pocket costs for Medicare-covered services, as it pays the Medicare Part B calendar year deductible, which most other standardized plans do not.