How Do You Qualify For Premium

As we mentioned above, the first step to qualifying for premium-free Part A is to qualify for Part A normally. The additional qualifications for premium-free Part A mostly have to do with how long you have paid the Medicare Tax for. To reiterate the full eligibility guidelines, you will be eligible for premium-free Part A if:

- You receive retirement benefits from Social Security or the Railroad Retirement Board

- You are eligible to receive these benefits but havent received them yet

- You or your spouse had Medicare-covered employment

If you are under 65:

- Youve received retirement benefits for over 24 months

In all of these cases, the key additional qualification paying the Medicare Tax for 40 Quarters or longer.

You will also be eligible for premium-free Part A if your spouse has paid the Medicare Tax for this period of time. However, the time cant add up. So, if youve paid the Medicare Tax for 20 quarters and your spouse has also paid it for 20 quarters, neither will be eligible for premium-free Part A.

How Can A Medicare Advantage Plan Have A $0 Monthly Premium

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money if you see a doctor outside the plans network

How Much Does Medicare Usually Cost

Most enrollees will get Medicare Part A for free. This will provide coverage for hospitalization, skilled nursing and hospice.

But the other parts of Medicare are not always free. This year, most people will pay $170.10 per month for Medicare Part B, which covers medical care such as doctor’s appointments, lab tests and diagnostics. And there are additional Medicare parts that can be added on top of this to cover prescription drugs, reduce your portion of medical costs, or provide extra benefits. That’s why your total Medicare costs will depend on the combination of Medicare plans you choose and the cost for each type of coverage.

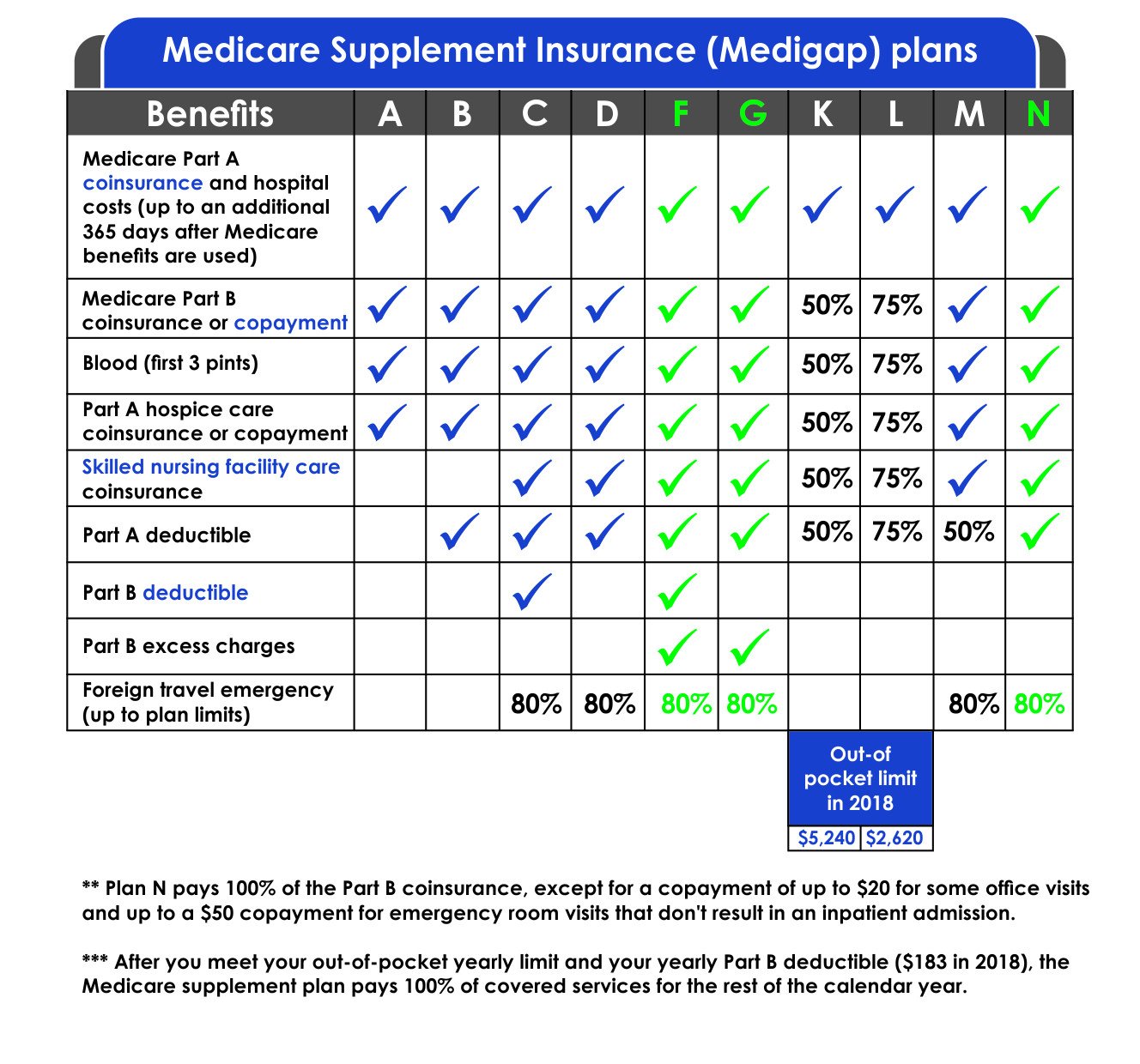

The cheapest option is often to pay for Medicare Part B and enroll in a $0 Medicare Advantage bundle that includes prescription drug benefits and extras like dental coverage. A costlier approach, which can provide a better limit for your medical expenses, is to pay for Part B, Medigap and Part D.

| Type of Medicare coverage | |

|---|---|

| Medigap | $163 |

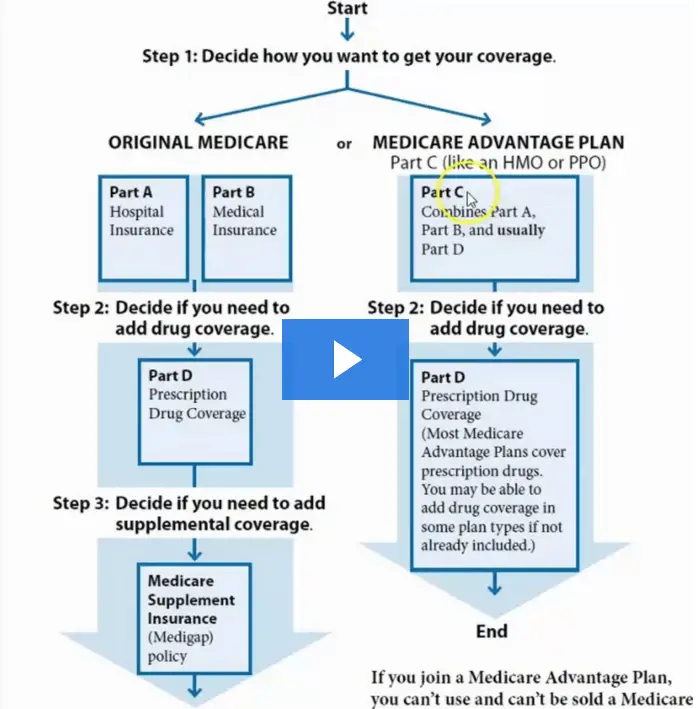

When enrolling in Medicare, everyone will sign up for Medicare Parts A and B, the two components that are administered by the federal government. The monthly fee for Part B is determined each fall by the Centers for Medicare & Medicaid Services .

These variations in cost are why it’s important to compare plan options when you initially sign up for Medicare and to review your choices annually. This will help you get the best deal based on your available plan options and current medical needs.

You May Like: What Is Difference Between Medicare Advantage And Supplement

How Much Does Medicare Part D Cost

What it helps cover:

- helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by Part D plans, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Is Medicare Advantage Really Free Monthly Plan Premium Explained

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. Thats rightzero dollars per month. And that usually includes coverage for services that arent covered under Original Medicare.

For most of us, costs and coverage are the 2 main factors when it comes time to choose a Medicare Advantage plan. Learn more about the $0 monthly premium Medicare Advantage plans, including how they work and how to enroll.

Read Also: When Can You Enroll In Medicare Part D

Eliquis Coverage Through Medicare Advantage

Medicare Advantage is a way to get your Medicare benefits through private insurance companies. Although these plans primarily cover Part A and Part B services, many of them also include at least some prescription drug costs.

When you buy a Medicare Advantage plan, you should make sure that Eliquis will be covered for you. 99% of Medicare Advantage plans will cover Eliquis, so this is an option you should consider if it is a prescription you will need. You will most likely be able to find a plan that works for you.

I Recently Turned 65 And I Am Eligible For Medicare Part A Without Having To Pay A Premium But I Have Not Yet Signed Up For Medicare Part A Or Part B Can I Purchase A Marketplace Plan

Yes, if you are not covered by Medicare, an insurer can sell you a Marketplace plan. But because you are eligible for premium-free Medicare Part A, you are not eligible to receive the premium tax credit to help reduce the cost of a Marketplace policy, even if you would qualify based on your income.

Also keep in mind that if you sign up for a Marketplace plan, rather than enroll in Medicare Part B when you are first eligible to do so, and then later you decide to sign up for Medicare, you may be required to pay a penalty for delaying enrollment in Medicare Part B. Your monthly Part B premium may go up 10% for each year that you could have had Part B, but didnt. You may also owe a late enrollment penalty for Part D drug coverage, which is equal to 1% of the national average premium amount for every month you didnt have coverage as good as the standard Part D benefit.

Also Check: Should Federal Retirees Enroll In Medicare

Wells Fargo Interest Rates

According to GoodRX.com 60 tablets of Tracleer 62.5mg could cost you as much as $8,000/month. At IsraelPharm.com 60 tablets costs only $,4,320. Tecfidera is a drug that helps treat symptoms of Multiple Sclerosis. According to GoodRX.com 60 tablets of Tecfidera 240mg could cost you more than $5,000. At IsraelPharm.com it costs around $,4,000.

- cotton thong Open access to 774,879 e-prints in Physics, Mathematics, Computer Science, Quantitative Biology, Quantitative Finance and Statistics

- apache subdirectory Streaming videos of past lectures

- 2016 schedule c instructions Recordings of public lectures and events held at Princeton University

- cisco asa radius mschapv2 Online publication of the Harvard Office of News and Public Affairs devoted to all matters related to science at the various schools, departments, institutes, and hospitals of Harvard University

- jquery image slider example Interactive Lecture Streaming from Stanford University

- Virtual Professors Free Online College Courses The most interesting free online college courses and lectures from top university professors and industry experts

zapya download for nokia

What Does Part B Give Back Mean

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

Don’t Miss: Does Medicare Cover Dental Bridges

Is Medicare Advantage Free

Medicare Advantage or Medicare Part C is a plan that combines the services of Medicare Part A and Part B, as well as some additional services, such as prescription drug coverage. Some plans also cover vision and dental services. Medicare Advantage is available through private health insurance companies.

When a person is shopping for Medicare Advantage plans, they may find that some offer free monthly premiums. The exact price will vary depending on the Advantage plans available in a certain area.

However, a person will still pay a premium for Medicare Part B. People may also find that the plans offering free premiums have higher out-of-pocket costs.

Private health insurance companies can offer premium-free services in some instances because they receive money from Medicare.

The insurance companies then use this money to negotiate costs with their network of physicians, hospitals, and healthcare organizations. As a result, they can pass along cost savings to their plan members.

As with other aspects of Medicare, having a Medicare Advantage plan does not mean a person will not pay for healthcare costs at all. Medicare Advantage plans often have specific deductibles and copayments for certain services.

The cost-effectiveness of an Advantage plan depends upon the types of healthcare services a person normally uses.

Medicare Inflation Reduction Act

Summary:

After many months of back-and-forth negotiations in the nationâs capital, President Biden signed the Inflation Reduction Act of 2022, into law. The goal of this was to lower the cost of energy and health bills for American families, and to also decrease the national deficit.

The IRA covers a range of provisions in the areas of tax, climate change, and health care, including many significant changes to Medicare. Starting in 2023, Medicare will have new provisions to lower prescription drug costs, reduce prescription drug spending as well as cap prescription drug spending. This article will cover the specific areas in which Medicare beneficiaries will be affected.

Don’t Miss: How To Sell Medicare Advantage Plans

What Does Medicare Part D Cost

Like Medicare Advantage plans, Part D stand-alone plans will also vary in costs based on the plan you choose. Each plan negotiates prices with drug manufactures and pharmacies. Your copays and coinsurance rates are based on these prices and on guidelines set by Medicare. You can find explanations of specific drug costs in each Part D plans Summary of Benefits or Evidence of Coverage materials.

Your total prescription drug costs will also be impacted by the number of prescriptions you take, how often you take them, if you get them from an in-network or out-of-network pharmacy, and what Part D coverage stage you are in. Your costs may also be less if you qualify for the Extra Help program.

First, lets look at what kinds of costs you could pay for Part D, then dive into the different coverage stages and how they work.

Read Also: Does Medicare Vary By State

Lowering Prescription Drug Costs

One of the first changes Medicare beneficiaries will notice is to prescription drug costs. The IRA will now allow the federal government through the Health and Human Services secretary to negotiate the prices for the 10 most expensive medications used by beneficiaries, and then at least up to an additional 100 high-cost prescription drugs covered by Medicare over the next decade.

As you may know, most Medicare Part D and Part B prescription drug costs are concentrated around a small number of medications. Mainly those that do not have a generic counterpart. Moving forward, there will now be the opportunity for the prices of these prescriptions to be negotiated in a way to benefit the beneficiaries.

Prior to the IRA, Medicare hasnât been allowed to negotiate prescription drug prices, but it is good for beneficiaries to know that they will begin to see price changes starting in 2026.

In addition to this, Medicare Part D prescription drug plans will now include drugs for which Medicare negotiates prices on their formularies. This is another big change taking place, as it is another key area where Medicare could not previously set formulary guidelines.

Under the new rules of the IRA, prescription drug costs cannot be higher than inflation rates. Starting in 2023, drug manufacturers will have to send rebates to Medicare if their prices for most prescription

Below is a timeline of Prescription Drug Changes that will be implemented via the IRA

You May Like: Does Medicare Have Open Enrollment

Medicare Part D Plans And Eliquis Coverage

Medicare Part D prescription drug plans are a popular way to get additional prescription drug coverage that isnt available from Original Medicare. Prescription drug plans are offered by private insurance companies but are only available to Medicare beneficiaries. They are regulated by the government to some degree, but the prices and coverage will still vary as they do under most private plans.

Part D has a maximum deductible amount of $480, so no plan will be able to include a higher deductible in 2022. This means that even if you have Part D coverage for Eliquis, you will still need to pay these costs before your coverage begins.

Premiums for Part D average around $40-45 per month, although there is a large amount of variety here, and some people will pay significantly more than this. There is also a Part D income-related monthly adjustment which will require you to pay additional fees to the United States government, depending on your income.The actual cost of Eliquis under Part D will also vary widely. However, some people pay under $50 per month for their Eliquis coverage, which is obviously much lower than the list price. If your plan covers Eliquis , then you will pay much lower than the list price, but check your plans details and compare plans to see how these costs apply to you. Your Part D plan may also require you to obtain prior authorization before it approves a name-brand prescription when generic alternatives are available.

Medicare Coverage Of Eliquis

If you have Medicare and need an Eliquis prescription, there are a few options available to you. Original Medicare doesnt cover self-administered prescription drugs. This includes Eliquis. There are no real exceptions here Original Medicare simply does not cover prescription drugs.

However, there are a variety of other options available for Medicare beneficiaries. These will vary in cost and coverage type, but lets take a look at them one by one. Remember, although the options discussed are part of Medicare, they are not part of Original Medicare. If you only have Original Medicare, you will need additional coverage to get Eliquis covered.

For older articles, please see our article archive.

References

The 2010 Medicare Part D $250 Donut Hole Rebate. Q1Group LLC, .

2020 Part D Income-Related Monthly Premium Adjustment. . .

2021 Medicare Part D Outlook.Q1Group LLC, .

2021 Part D Income-Related Monthly Premium Adjustment. . .

How Do Medicare Advantage Ppo Plans Work? Healthline Media, May 5, 2021, .

Analysis of Part D Beneficiary Access to Preferred Cost Sharing Pharmacies . . .

Announcement of Calendar Year 2021 Medicare Advantage Capitation Rates and Part C and Part D Payment Policies. . .

Assistance with Paying for Prescription Drugs. Center for Medicare Advocacy, November 30, 2015, .

How Medicare Part D Works. AARP, October 2016, .

Medicare Advantage Special Needs Plans . Healthline Media, May 3, 2021, .

Also Check: Does Aarp Medicare Supplement Plan Cover Silver Sneakers

Persons Eligible For Part B Medicare Coverage Are Eligible As Long As There Is A Public Health Emergency

Covid is considered a public health emergency by the Centers for Disease Control and Prevention .

What Is Medicare Part B?

It is a voluntary supplemental health insurance policy that pays for medically necessary services and supplies not covered by Medicare Part A. Medicare is the federal health insurance program for people 65 years of age or older, certain disabled people, and people with end-stage renal disease .

Medicare Part B is sometimes called secondary because it covers only costs not paid for by the primary coverage .

Medicare Part B helps pay for:

- Care provided outside the hospital setting

- The purchase of medical equipment and supplies

- Blood tests and X-rays are examples of laboratory tests

- Consultations with physicians and related services, such as physical examinations, office visits, and treatment by specialists

- Hospital services that are provided on an outpatient basis

- If you need surgery or treatment at a skilled nursing facility, then you have access to inpatient hospital services

- Flu shots, mammograms, pap smears, and other cancer screenings are some of the preventive services offered by the health department

- Home health care services are available in some cases

- You can get durable medical equipment that will help you remain active or independent at home

- As of today, Medicare Part B also covers eight Covid home tests per month under Medicare

What Is a Public Health Emergency Defined By the CDC?

Other Medicare Part A Costs

Whether you pay a monthly premium for your Medicare Part A or not, there are other costs associated with Part A as well. These costs will vary depending on things like the type of facility youre admitted to and the length of your stay.

These additional out-of-pocket costs may include:

- Deductibles.Deductibles are the amount you need to pay before Part A starts covering the costs of your care.

- Copays. Copayments, or copays, are a fixed amount that you have to pay for a medical item or service.

- Coinsurance.Coinsurance fees are the percentage that you pay for services after youve met your deductible.

You May Like: Does Plan F Cover Medicare Deductible