Medicare Supplement High Deductible Plan F

Get A Free Medicare Quote

Medicare Supplement High Deductible Plan F is a version of the standard Plan F. High Deductible Plan F is a popular option for healthy beneficiaries that watch how they spend their money.

These plans are a popular option because of low premiums and an affordable cap on the maximum you can spend. More and more Medicare beneficiaries are leaning toward the High Deductible Plan F if theyre eligible.

Medicare Part A Deductible

Medicare Part A requires a deductible to be met at the beginning of each benefit period. A benefit period begins when you are admitted as an inpatient and ends when you have gone 60 consecutive days without inpatient care.

Aflac Plan F like all Medicare Plan F options from Aflac or any other insurance company covers the Part A deductible in full for each benefit period, even if you experience multiple benefit periods in a single year.

Medicare Supplement Insurance: High Deductible Plan F

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

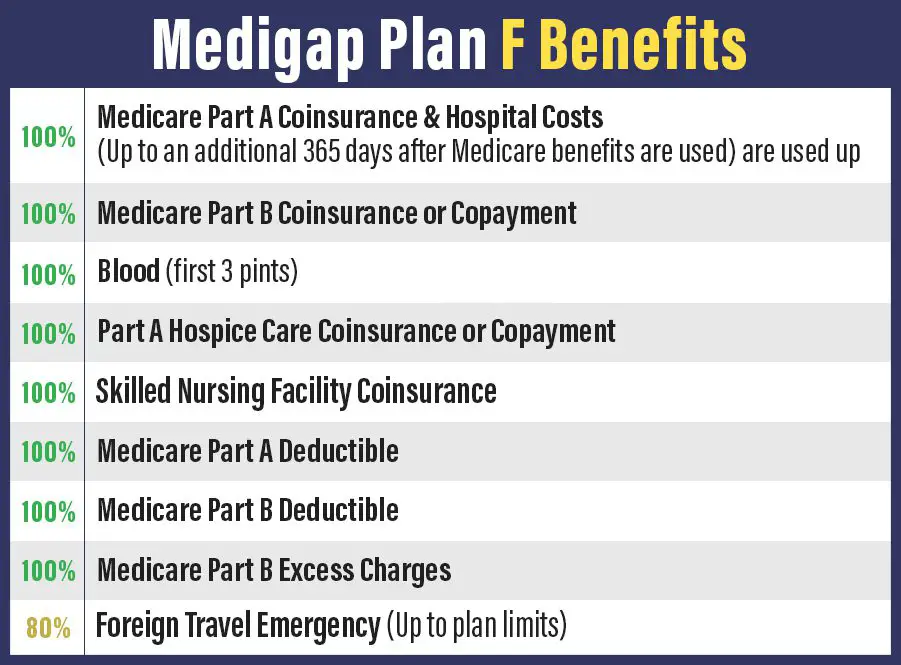

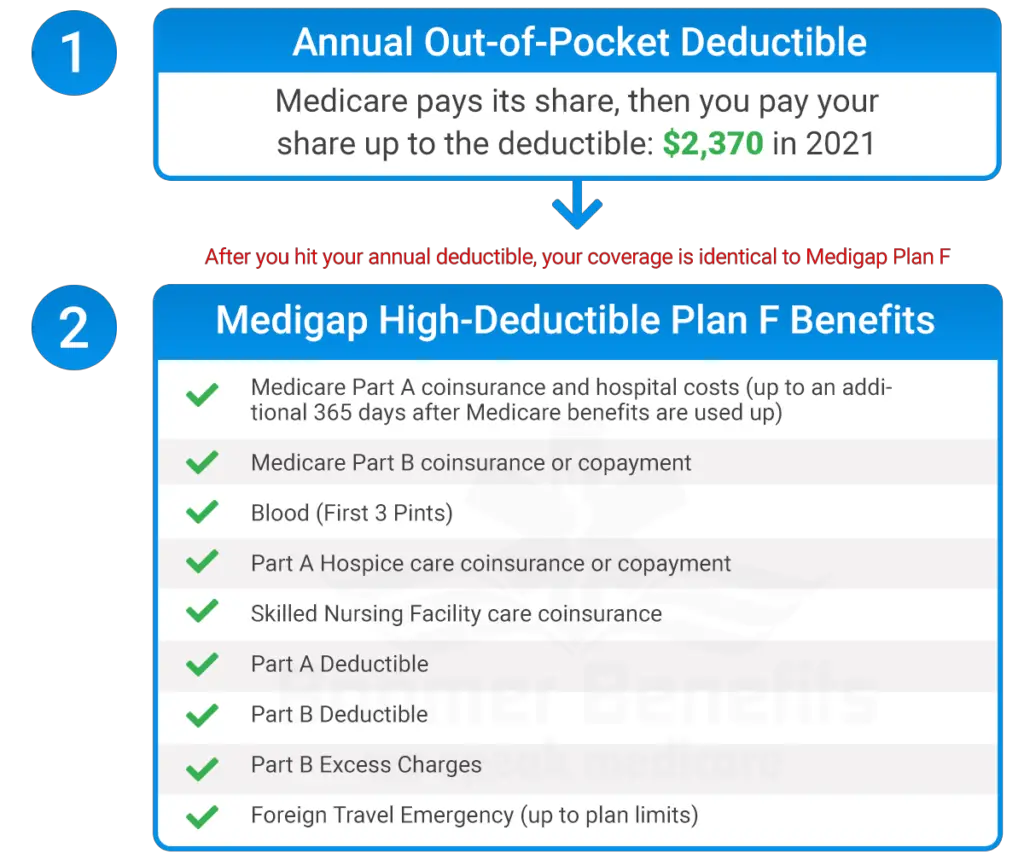

Medigap Plan F is the most comprehensive Medicare Supplement Insurance plan, providing at least partial coverage for all nine benefit areas. High deductible Plan F provides the same level of coverage as the standard Plan F with potentially lower monthly premiums. The tradeoff for these lower monthly premiums is a high deductible.

In 2021, the standardized deductible amount for high deductible Plan F is $2,370. Once youve paid that, your policys coverage will kick in.

Important: Medigap Plan F and High-Deductible Plan F are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020.

Also Check: How Does Medicare D Work

What Doesnt Medicare Supplement Plan F Cover

Medicare Plan F wont cover any services not covered under Original Medicare.

Most notably, Medicare Plan F wont cover costs associated with preventative care, like routine doctor visits or prescription drugs. Instead, you need Part D prescription drug coverage to help with prescription costs.

Medicare supplemental insurance, including Plan F, will also not cover the following:

Medicare Plan N Vs Plans F And G

A person considering Plan N may wonder how it compares with plans F and G.

Plan F is the most comprehensive Medigap plan, but it is no longer available to new enrollees who became eligible for Medicare before .

If an individual is looking for a plan with extensive coverage, Plan G is the second most comprehensive option.

Recommended Reading: How To Get Replacement Medicare Id Card

Recommended Reading: Must I Sign Up For Medicare At 65

How To Compare Plan F And High

Lets imagine your total Medicare-approved Part B expenses for the year amount to $1,250, and you dont have any inpatient services at all. If you have a high-deductible Plan F, this Medigap policy isnt going to pay anything towards your costs that year, because youre not going to reach the out-of-pocket maximum on the HDPF.

Instead, youre going to pay the $198 Part B deductible, and then 20% of the remaining $1,052 in Part B charges, which works out to be $210.40. So youll pay a total of $408.40 in out-of-pocket costs: The $198 deductible plus $210.40 in coinsurance charges, in addition to the HDPF premiums.

Your HDPF only kicks in and starts to pay your bills once your out-of-pocket costs reach $2,340 in 2020. Since youre not going to even come close to that, youll pay all of your out-of-pocket costs on your own. And youll also pay the HDPF premiums. These vary by area, but the average is going to be about $40 to $60 per month, so lets say the annual premium for HDPF is $600.

In this scenario, if you have HDPF, your total costs for out-of-pocket expenses plus premiums would amount to around $1,000 for the year (roughly $600 in premiums, plus a little more than $400 in out-of-pocket costs.

Now lets say your high expense year turns into something chronic, and you start meeting your HDPF deductible each year. Youd be adding on another $2,940 in total expenses each year, versus the premiums-only expense that youd have with regular Plan F.

Aarp Medicare Supplement Plan K

Looking for more basic Medicare Supplement coverage at a lower cost? Plan K might be the right choice for you. Plan K offers partial coverage for many of the costs youd pay out of pocket. This includes:

- 100% of your coinsurance payments for inpatient hospital care

- 50% of your Part B coinsurance or copayments

- 50% of up to 3 pints of blood

- 50% of your Part A hospice care coinsurance or copayment

- 50% of your coinsurance for care provided in a skilled nursing facility

- 50% of your Part A deductible

An Additional Benefit of Plan K

Plan K is one of only two Medicare Supplement plans that includes an annual out-of-pocket limit. In 2020, this limit is set at $5,880. Once youve spent this amount, your plan will cover 100% of your Medicare costs for the remainder of the year.

Also Check: What Is The Best Medicare Supplement Plan In New York

Are All Medigap Plan F The Same

Due to standardization, all Plan F policies have the exact same benefits regardless of the carrier you enroll with. No carrier can change the benefits covered by this plan. However, in some circumstances, you may be eligible for perks for being enrolled with certain carriers such as gym memberships or discounts on eyeglasses or hearing aids. However, these additional perks must be given to all policyholders from the same carrier regardless of the plan they enroll in.

What Is A High

High-deductible Plan F differs from standard Plan F in that it has an annual deductible.

High-deductible Megiap Plan F has the same benefits as the standard Plan F policy, but you must meet a deductible before you can access its health benefits.

For 2022, the annual deductible for the high-deductible Plan F is set at $2,490. If you want to switch from a high-deductible plan back to the standard Plan F, you may need to undergo a medical exam for underwriting.

A high-deductible Medicare Plan F policy could be useful if you are healthier and do not think you’ll need many medical services. However, you should carefully evaluate your own medical situation before committing to the high-deductible plan, as you would be responsible for the entire $2,490 if you incurred a large medical cost.

For example, say you needed to get a colonoscopy, which can cost up to $3,500. Under a standard Medigap Plan F, the first 80% of that bill would be paid for by Medicare Part B. The remaining 20% would be covered by Plan F. You would end up paying nothing in medical expenses under this scenario, but you would pay the monthly premium. Based on the lowest average premium of $161, your Plan F would cost at least $1,932 per year.

You May Like: What Does Medicare Part B

Is There An Alternative To Medicare Supplement Plan F

Suppose you are interested in enrolling in Medicare Supplement Plan F but find that the premium rates are more than you want to spend. In that case, High Deductible Plan F is a potential alternative for you to consider. If you are comfortable reaching the higher deductible before receiving full coverage for this plan, the lower premium could be worth it.

Medicare Supplement High Deductible Plan F provides the same excellent Plan F benefits at a lower premium rate by eliminating first-dollar coverage. Once you meet the deductible, you receive 100% coverage from the high-deductible version.

Get A Free Quote

Find the most affordable Medicare Plan in your area

For those who missed eligibility for Plan F, Plan G could be a great alternative if you wish to have comprehensive coverage with a low deductible and a lower monthly premium. Plan G may be a plan to consider. The chart below compares the top three plans in 2022.

So Is Plan F Worth The Price

For some, its easier to budget a set amount of cash per month for a Plan F premium and the peace-of-mind of having no other out-of-pocket healthcare expenses. The need to pay $183 before a Medigap plan takes over can create a strain on a tight budget.

However, the yearly savings of a Plan G over a Plan F may be enough to warrant paying the Part B deductible . Even so, a Plan G member will still come out ahead by the end of the year.

Don’t Miss: Does Medicare Pay For Ensure

Your Medigap Plan N Costs

Medicare Supplement Plan N offers identical basic benefits like the more popular Plan G, but you agree to pay a share of a few things that you wouldnt pay on Plan G. First, you agree to pay the small annual Part B deductible . You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay.

Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows. This is called an excess charge. Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time.

However, you can avoid this by simply asking your providers up front if they accept Medicare assignment. If they do, you need not worry about excess charges. Another option is to compare Medicare Plan N v Plan G. People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

About Medicare Supplement Plan F

Medicare Supplement Plan F, administered by Premera Blue Cross, allows the use of any Medicare contracted physician or hospital nationwide. The plan is designed to supplement your Medicare coverage by reducing your out-of-pocket expenses and providing additional benefits. It pays some Medicare deductibles and coinsurances, but primarily supplements only those services covered by Medicare.

There is no prescription drug coverage with this plan so a Part D prescription drug plan is also needed unless you have other creditable drug coverage .

In Medicare Supplement Plan F, benefits such as vision, hearing exams, and routine physical exams may have limited coverage or may not be covered at all.

If you select Medicare Supplement Plan F, any eligible family members who are not entitled to Medicare will be enrolled in UMP Classic.

Medicare Supplement Plan F does not include prescription drug coverage. If you select this plan, you may have to enroll in Medicare Part D to get your prescriptions, unless you have other creditable prescription drug coverage.

Note: The PEBB Program does not offer the high-deductible Plan F shown in the Outline of Medicare Supplement Coverage.

You May Like: How To Determine Medicare Eligibility

Medicare Supplement Plan F

If you are new to Medicare or shopping for a Medigap plan, Medicare Supplement Plan F may suit your needs. Plan F is the most comprehensive Medigap plan available for qualifying Medicare beneficiaries.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Specifically, this plan covers 100% of your Medicare cost-sharing and leaves you with no out-of-pocket expenses for Medicare-covered services. Below we help you understand when Medigap Plan F is the best choice for you and whether youre eligible.

What Is Medicare Supplement Insurance

Medicare Supplement Insurance is sold by private insurance companies.

While the costs of each type of Medigap plan may vary depending on where and by whom it is sold, all of the benefits remain standardized by the federal government. For example, Plan N purchased in New York will include the same coverage as a Plan N purchased in California, though the monthly premiums will vary for the two plans.

Medicare Supplement Insurance is accepted by any doctor or provider who accepts Medicare.

You can use the chart below to compare the different types of standardized Medicare Supplement plans.

Medicare Supplement Insurance Plans 2021

| Medicare Supplement Benefits |

Also Check: What Does Bcbs Medicare Supplement Cover

You May Like: Can Someone On Ssi Get Medicare

Medigap F Cost Example

Gracie applies for a Plan F Medigap and the insurance company approves her. The following year she sees an orthopedic specialist about problems with her knee. Medicare pays 80% of the cost of this visit to her specialist. Plan F covers the other 20% owed under Part B. Gracie owes nothing.

The specialist sends her to an imaging facility to have an MRI done on her knee. Medicare pays 80% of the cost of her MRI. Medicare F pays the other 20%. Gracie pays absolutely nothing.

The results of the MRI show serious problems. Her orthopedic specialist tells Gracie that she is a candidate for a total knee replacement. She undergoes surgery at her local hospital and is in the hospital a couple of days. Gracie also has a home health care nurse come out to her home several times in the weeks following her surgery.

The total cost for Gracies surgery, hospital stay and follow-up care is $70,000. Medicare pays its share of the bills and sends the remainder of about $14,000 to Gracies Supplemental insurance carrier. The carrier pays the entire bill, and Gracie owes absolutely nothing for any of these Part A and Part B services. Her only out-of-pocket spending would be for medications.

That means the cost of Medicare Supplement Plan F is really only the premiums that you pay for the plan itself. Medicare Supplement Plan F rates will vary by insurance company, but you can rest assured there is no back-end spending.

Whats The Difference Between Medicare Plan F And Plan G

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you’re getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.1

This much coverage means that Plan F may come with a higher premium. However, choosing a high-deductible option for Plan F could help keep your premium down. If youre currently enrolled in the Plan F high-deductible option for 2022, you are required to pay for Medicare-covered costs up to the deductible amount of $2,490 before your Medigap plan begins to cover any expenses.1

You May Like: Can You Switch Back To Medicare From Medicare Advantage

What Do Medicare Plan F And Plan G Cover

Medicare Plan F and Plan G are similar and offer the same basic coverage benefits, which include:1

- Part A coinsurance and hospital costs.

- Part B coinsurance or copayment.

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Up to 80% of medical emergency costs during foreign travel.

- No out-of-pocket limit.

Is Medigap Plan F The Best Deal

The Medigap F Plan, regardless of the end of the 2020 plan, may not be the best deal for your situation anyway. As always, you should look at the rates for your specific postal code, as rates vary considerably from one geographic area to another. But often other plans will have more financial sense. For example, the only difference between the Medigap G and F plans is the deductible coverage under Health Insurance Part B, which is $198/year . In other words, the only cost to pay for a G plan is $198/year.

Generally, premium savings in G compared to F are $240 per year to $500 per year. Therefore, it would certainly make financial sense to save 240-$500/year in exchange for a payment of 198$/year.callout8 For more information about Medigap Plan F or a list of companies and rates for your region, do not hesitate to contact us or call us at .

Our site also contains more specific information about the plans, which you can review here:

Don’t Miss: What Does Original Medicare Mean

Mutual Of Omaha Has You Covered

Since 1909, weve existed as a Mutual company serving for the benefit and protection of our customers. Which means we dont answer to Wall Street, we answer to you.

Medicare Supplement insurance is offered to protect our customers health and wallets. Its a great option to add to your existing Medicare Part A and B plans, as Medicare supplement insurance helps cover some out-of-pocket costs that Part A and Part B may leave you with. These include expenses like copays, coinsurance, and deductibles. Medicare Supplement plans also make traveling – even internationally – easy, while being a steady monthly bill you can budget for. Check out Medicare Supplement Insurance Basics for the information you need to make the decision thats right for you.

Medicare Supplement Plan N Eligibility And Enrollment

Like other Medigap plans, youre eligible to enroll in Plan N if:

- You are enrolled in both Medicare Part A and Part B

- There is a Plan N available in your service area.

The best time to enroll in Medigap Plan N is during your Medigap Open Enrollment Period, which is the six-month period that automatically starts on the first day of the month that you are both 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed-issue right to enroll in any Medigap plan available in your service area, regardless of any pre-existing conditions* or disabilities you may have. Insurance companies arent allowed to reject you based on your medical status or charge you more if you have health problems. After your Medigap Open Enrollment Period is over, you may have more difficulty enrolling in a Medicare Supplement plan if you have health problems. Insurance companies are also allowed to use medical underwriting after this period and may charge you higher premiums based on your health status. You may also be denied coverage entirely due to your health status.

Do you have questions about Medigap Plan N and whether it may work for your situation? Feel free to use our eHealth plan finder tool to compare Plan N or other Medigap options in your location just enter your zip code into the tool on this page to get started. If you need immediate assistance, contact eHealth to speak with a licensed insurance agent and get answers to your Medicare questions.

New To Medicare?

Don’t Miss: Is Skyrizi Covered By Medicare