Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

Getty/AARP

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Medicare Advantage Versus Medicare Supplement: How To Choose

Heres what you need to know about the benefits and disadvantages of each program.

Everyday Health may earn a portion of revenue from purchases of featured products.Everyday Health

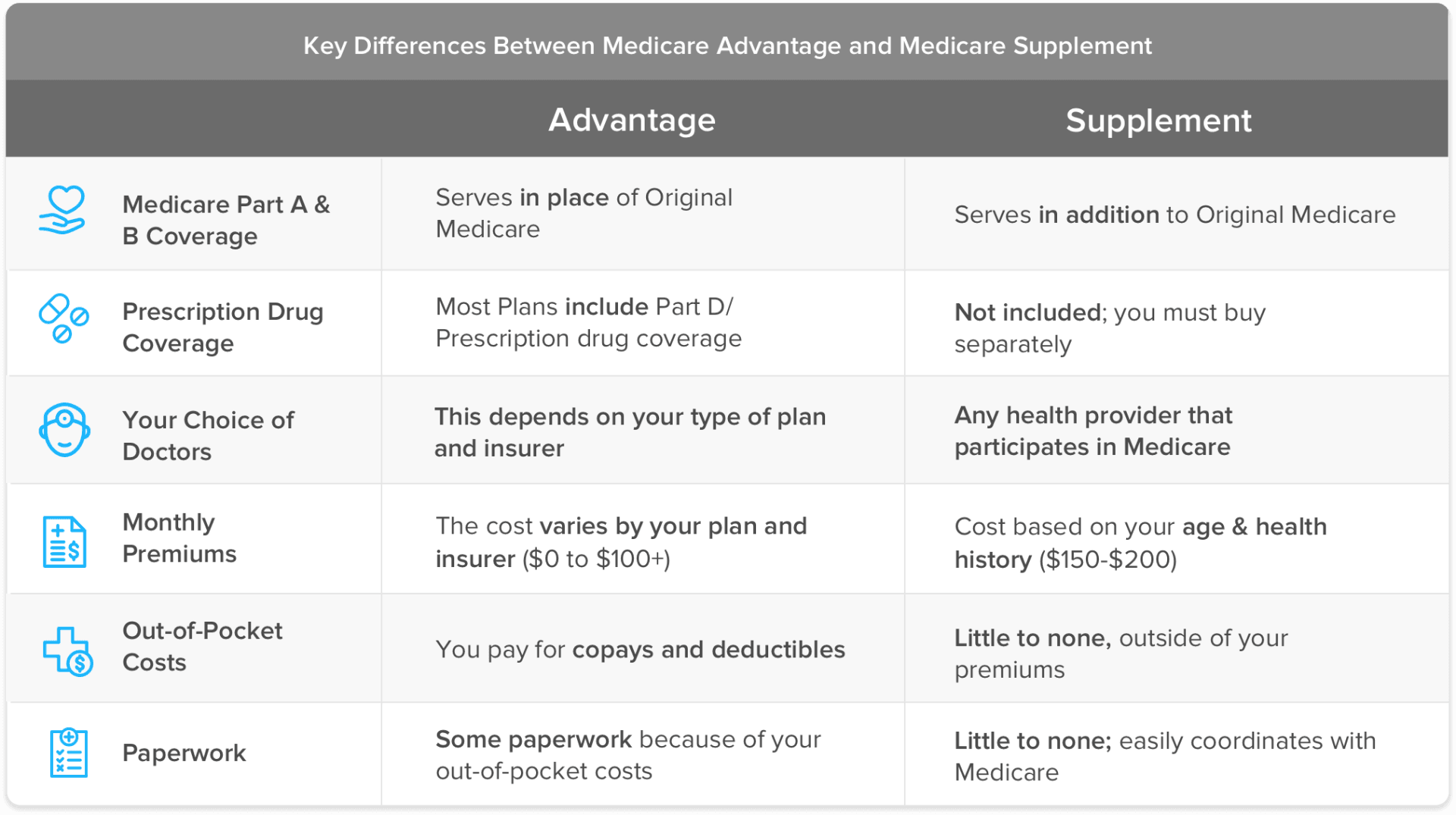

Medicare Supplement insurance and Medicare Advantage are the two pillars of private Medicare insurance. It can be difficult to choose between them.

Medicare Supplement insurance is offered by private insurance companies. These policies, which are also known as Medigap, fill in some of the gaps in Original Medicare . Medigap will pay some or all of the amounts that you would normally pay out of pocket.

Medicare Advantage, also called Part C, is an alternative to Original Medicare. When you enroll in Medicare Advantage, you leave the Original Medicare system. Part C plans are also offered by private insurance companies.

Medicare Advantage plans usually require you to pay copays and coinsurance for the services you receive, just like Original Medicare. But Medicare Advantage plans have a fixed cap on spending each year. Many Medicare Advantage plans also include prescription drug coverage.

Read Also: How To Apply For Medicare Through Social Security

Is Medicare Advantage Or Medigap Coverage Your Best Choice

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your particular health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you have to choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your particular wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

How Do I Enroll In A Medicare Advantage Plan

Before enrolling in a Medicare Advantage plan, a person may want to check the details of various plans in their area.

Enrollment can be done online or via a paper enrollment form. A person can also offering the plan, or call Medicare at 1-800-633-4227. The company may ask for confirmation of the date when someone got original Medicare.

There are several enrollment periods when a person can get a Medicare Advantage plan.

Don’t Miss: Is Fehb Better Than Medicare

How Much Does A Medicare Supplement Plan Cost

The estimated average monthly premium for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Just like Medicare Advantage plans, its good to shop around65-year-olds stand to save an average of $840 a year with Medicare Supplement Plan G or $648 a year with Plan N if they enroll in the lowest-cost option available in their areas, according to a price comparison analysis by eHealth, Inc.

We continue looking at how private plans and Medicare can be more efficient, effective and equitable for people, says Jacobson. The good story here is in the data. Weve seen pretty consistently that inequities are much smaller in Medicare than any other source of coverage.

| Medicare Advantage vs. Medicare Supplement: Which Is Right For You? | |

|---|---|

| Medicare Advantage | Medicare Supplement |

|

|

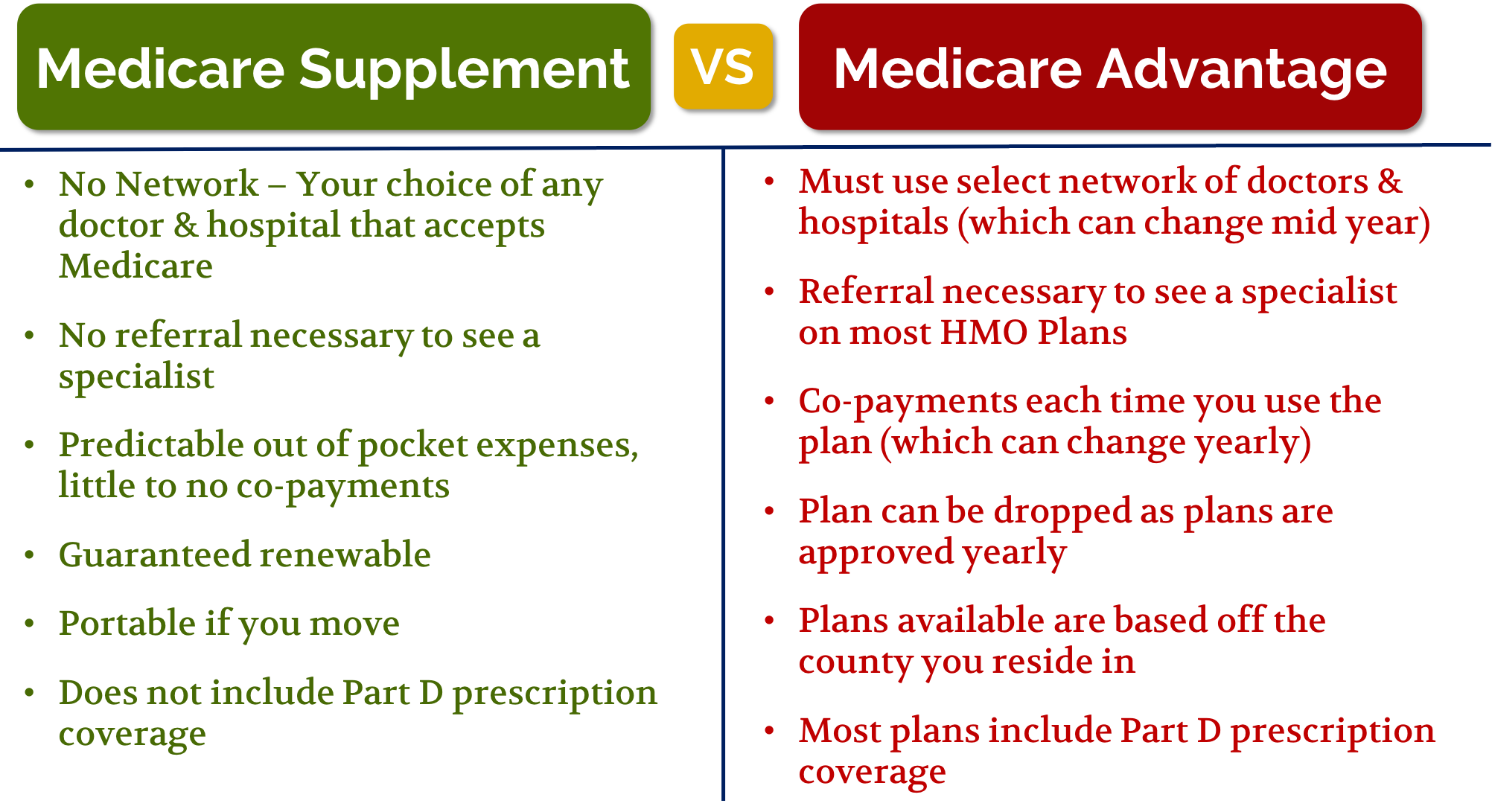

Key Difference #: Provider Networks

Provider networks are common in health insurance. You may be familiar with PPO or HMO policies. Both require you to seek healthcare within the network. These apply to Medicare Advantage plans as well. There are several types of Medicare Advantage plans, with HMOs and PPOs being the most popular. If you enroll in one of these plans and get care outside the network, you’ll have higher coinsurance amounts. You may even be responsible for the entire expense.

Medicare supplement plans do not require the use of provider networks. As long as your provider or facility accepts Medicare, they will also accept your Medicare supplement, regardless of which insurance company your plan is with.

Read Also: What Medications Are Covered By Medicare

Find Cheap Medicare Plans In Your Area

Both Medicare Advantage and Medicare Supplement allow you to fill the gaps in coverage that are found in original Medicare. However, Advantage and Supplement plans will vary depending on costs, coverage and the provider network . Therefore, you’ll need to compare these policies to choose the ideal combination of Medicare policies for your situation.

Medicare Supplement Vs Medicare Advantage: The Pros And Cons Of Each

You may have encountered these buzzwords in television commercials, email blasts, or the piles of mail youve likely received from insurance agencies, but what do they mean? What is the difference between a Medicare Advantage Plan and a Medicare Supplement? Which is the best option for you?

First off, it is important to address that regardless of which option you choose, you need to for original Medicare first. As long as youve determined that you shouldnt delay part B , you should sign up for both within the 7-month period starting 3 months before your 65th birthday month.

Medicare Supplement, or medigap insurance as it is aptly nicknamed, fills in some of the gaps of what original Medicare does not cover. However, Medicare is still the primary payer of your claims.

On the other hand, Medicare Advantage is an alternative it replaces original Medicare as the primary payer of your claims and is offered through subsidized private insurance companies that have contracted with Medicare.

This difference makes a big difference when considering the benefits and detriments of each optionin dollar signs, security, and convenience. Because of this, lets consider the pros and cons of each carefully.

Also Check: Is Medicare Plan F Still Available

Comparing Medicare Advantage Vs Medicare Supplement Plans

Lets look at Medicare Advantage vs. Medigap. In short, the difference between Medicare Advantage and Medicare Supplement plans is that one can supply health benefits while the other can supply financial coverage.

Medicare Supplement Insurance is a policy thats added to Original Medicare, Part A and Part B, to provide additional financial coverage. Medicare Advantage is a private plan option that may provide you with other health benefits that Original Medicare does not cover .

You cannot have both Medicare Advantage and Medigap at the same time.

A given plan type has the same benefits regardless of the insurance company that provides the policy, or the state in which you reside. This is not true of Medicare Advantage plans, however, because coverage details may vary by plan.

Excluding prescription drug coverage, any standard Medigap plan with Part A and B will have more benefits than a standard Medicare Advantage plan. However, as mentioned above, some Medicare Advantage plans offer benefits beyond those found in Part A and Part B.

Some Medicare Advantage plans offer prescription drug coverage . With a Medigap plan, in contrast, you would need to enroll in a separate prescription drug plan. When comparing plan options, consider your costs for drug coverage. In some cases, Medigap with a stand-alone prescription drug plan has lower total costs than a Medicare Advantage plan with drug coverage. In other cases, the reverse might be true.

How Do I Choose Between Medicare Supplement Insurance And A Medicare Advantage Plan

In 2021, over 26 million Medicare beneficiaries are enrolled in a Medicare Advantage plan.1

A similar number of Medicare beneficiaries are enrolled in a Medicare Supplement Insurance plan.2 However, Medicare enrollment is growing overall, as is Medicare Advantage plan enrollment.

With the two types of insurance being nearly equally popular among Medicare beneficiaries, how do you choose which type of coverage is right for you?

Here are a few factors you can consider when deciding.

Read Also: What Are All The Medicare Parts

What Plan Is More Affordable

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits tooâsuch as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

With Medicare Supplement plans, you pay a premium to a private insurer to bridge your gaps in Original Medicare coverage. There are 10 standardized levels of Medicare Supplement, Plans A-N, each with their own level of coverage. However, the pricing and specific private insurers offering these plans will vary according to your region.

Additionally, with Medicare Supplement plans, the more gap coverage you want, the higher monthly premium you pay. Some expenses not typically covered by Medicare Supplement include vision, dental, and long-term care. If you want prescription drug coverage, you must join Medicare Part D.

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Read Also: Will Medicare Pay For Liposuction

Medicare Advantage Vs Medicare Supplement: The Basics

Medicare Supplement insurance plans go alongside Original Medicare and help pay for out-of-pocket costs not typically covered by Original Medicare. Since Original Medicare has no out-of-pocket maximum, a Medicare Supplement plan could give you a safety net against high medical costs if you face a serious health setback.

Neither Original Medicare nor Medicare Supplement insurance plans typically cover the prescription drugs you take at home. If you want coverage for most prescription drugs, you will generally need to combine Original Medicare and a Medicare Supplement insurance plan with a stand-alone Medicare Part D prescription drug plan.

You coverage with a Medicare Supplement insurance plan and a stand-alone Medicare Part D prescription drug plan could look like this:

Medicare medical and hospital insurance + Medicare Supplement + stand-alone Medicare Part D prescription drug coverage = comprehensive Medicare coverage

This combination of insurance is quite comprehensive. You still may have some out-of-pocket Medicare costs. You generally pay separate premiums for Medicare Part B, Medicare Supplement insurance, and Medicare prescription drug coverage.

You coverage with a Medicare Advantage plans could look like this:

Medicare medical and hospital insurance + Medicare prescription drug coverage = comprehensive Medicare coverage

What Are Medicare Advantage Plans

If you have a Medicare Advantage plan, youre still enrolled in the Medicare program in fact, you must sign up for Medicare Part A and Part B to be eligible for a Medicare Advantage plan. The Medicare Advantage plan administers your benefits to you. Depending on the plan, Medicare Advantage can offer additional benefits beyond your Part A and Part B benefits, such as routine dental, vision, and hearing services, and even prescription drug coverage.

There are many different types of Medicare Advantage plans, described below:

- Health Maintenance Organizations require you to use health-care providers in a designated plan network and may require referrals from a primary care physician in order to see a specialist.

- Preferred Provider Organizations recommend the use of preferred health-care providers in an established network, and these plans are likely to cover more of your medical costs if you stay inside that network. You dont need a referral to see a specialist.

- Private Fee-for-Service plans determine how much they will pay health-care providers, and how much the beneficiary is responsible to cover out-of-pocket.

- Medical Savings Account plans deposit money into a health-care checking account that you use to pay for health-care costs before the deductible is met.

- Special Needs Plans are tailored health insurance plans designed for beneficiaries with certain health conditions.

Also Check: Does Medicare Require A Referral To See A Podiatrist

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

How Frequently Do You Visit The Doctor

Advantage Plans often require copays and sometimes even deductibles. So for example, if you see your doctor twice a month and you have a copay of $40 per visit, that equates to $80 per month, which can add up quickly. However, if you do not see the doctor frequently, a Medicare Advantage could save you money. Supplement Plans do not require any out-of-pocket expenses such as copays. So if you visit your doctor often or plan on having any upcoming surgeries, this might be the better option for you.

You May Like: Does Medicare Pay Anything On Dental

Pros To Medicare Advantage Vs Medigap

Medicare Advantage

First, lets go over the benefits of Advantage plans. Part C plans look like an all-in-one option. Most policies are $0 a month. Many Part C plan options include Part D, dental, vision, and more. At first glance, Part C seems like a dream come true. Also, many Medicare Advantage plans include over the counter medications.

Medicare Supplements

Now, we can take a look at the perks of Medigap. Supplement policies give you the freedom to choose any doctor in America that accepts Medicare assignment. Youll never need a referral with a Medigap plan. Further, Medigap covers foreign travel emergencies, extra days in the hospital, and the coinsurances youd otherwise pay. When a severe condition develops, or emergency takes place, Medigap is the safety net you want.